by Frank Holmes, CIO, CEO, U.S. Global Investors

Another day, another banking scandal.

Last week the European Commission announced that it’s fining five big banks for rigging the international foreign exchange (forex) market. As many as 11 world currencies—including the euro, British pound, Japanese yen and U.S. dollar—were allegedly manipulated by traders working at Barclays, the Royal Bank of Scotland (RBS), Citigroup, JPMorgan and Japan’s MUFG Bank.

Altogether, the fines come out to a whopping 1.07 billion euros ($1.2 billion).

According to the press release dated May 16, the infringements took place between December 2007 and January 2013. Traders working on behalf of the offending banks secretly shared sensitive trading information. This enabled the traders—who were direct competitors—to “make informed market decisions on whether to sell or buy the currencies they had in their portfolios and when.”

Financial services is already the least trusted sector among seven others worldwide, according to the 2019 Edelman Trust Barometer. News of the coordinated forex rigging—which follows other high-profile scandals such as the Libor scandal, Wells Fargo fake account scandal, gold fixing scandal (which I’ll get to later), among many more—is unlikely to improve public sentiment.

As I’ve said before, I believe that strong distrust in traditional financial services, especially among millennials, greatly contributed to early bitcoin adoption. With bitcoin, there’s no third-party risk. Transactions are peer-to-peer. Users of the digital coin find this sort of freedom very attractive, and because it’s built on top of blockchain technology, price manipulation is much more difficult to pull off.

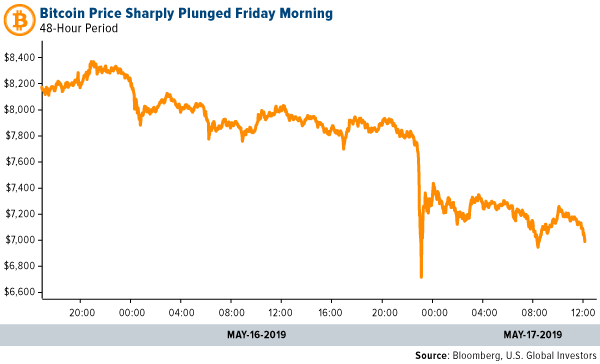

That’s not to say that bitcoin hasn’t been, or isn’t still being, manipulated. There are those who argue that the cryptocurrency’s meteoric rise to nearly $20,000 in late 2017 was at least in part due to coordinated price manipulation. And early Friday morning, its price dramatically lost as much as $1,702, its worst intraday drop since January 2018, after breaching $8,300 on Thursday.

click to enlarge

Bitcoin Seen as a Threat to Global Fiat Currencies

None of this should come as a surprise to anyone who’s been paying attention, of course. I’ve seen and heard the aggressive stance bankers have taken against bitcoin and other cryptocurrencies, as I’m sure you have.

Quite simply, banks don’t want the competition. If you recall, JPMorgan CEO Jamie Dimon called people who buy bitcoin “stupid” and said he’d fire any trader caught trading it. (And then in an amazing about-face, his bank announced in February the rollout of its own digital coin, the “JPM Coin.”)

Quite simply, banks don’t want the competition. If you recall, JPMorgan CEO Jamie Dimon called people who buy bitcoin “stupid” and said he’d fire any trader caught trading it. (And then in an amazing about-face, his bank announced in February the rollout of its own digital coin, the “JPM Coin.”)

Also consider the comments made by Agustín Carstens, general manager of the Bank of International Settlements (BIS). The BIS, in case you’re unfamiliar, is often called the “central bank of central banks.” That’s because it provides banking services to as many as 60 financial institutions from all over the world, including heavyweights such as the Federal Reserve, Bank of England (BoE), European Central Bank (ECB) and Bank of Japan (BoJ). Its influence on global monetary and financial policy, in other words, is monolithic.

Ever since bitcoin hit $4,000 or so, General Manager Carstens has been on a global PR campaign to stop its momentum—because, again, it’s seen as a threat to sovereign currencies. As recently as November of last year, he laid out 10 reasons why central banks should discourage the use of digital coins.

Among them: “Cryptocurrencies are highly conducive to illegal activities.”

Anyone else see the irony? Fiat currencies are still very much used to conduct illegal activities, despite the enactment of anti-money laundering (AML) and know your customer (KYC) laws. In November 2017, Jennifer Fowler, deputy assistant secretary for the Office of Terrorist Financing and Financial Crimes (TFFC), testified before the Senate Judiciary Committee that the U.S. dollar “continues to be a popular and persistent method of illicit commerce and money laundering,” and that, although virtual currencies are also used, “the volume is small compared to the volume of illicit activity through traditional financial services.”

The BIS doesn’t stop at bitcoin, though. It’s also put gold in its crosshairs.

Gold Suppression: It’s Not a Question of IF but to WHAT EXTENT

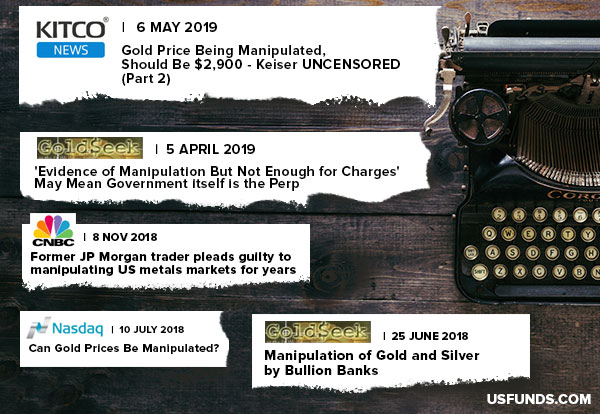

First of all, let me say that gold price suppression (“fixing,” “rigging,” “manipulating” or however else you want to think about it) is not just a conspiracy theory. It’s a well-documented phenomenon, with real actors and real ramifications. In 2014, Barclays was fined nearly $44 million for failing to prevent traders from manipulating the London gold “fix.” Late last year, a former JPMorgan trader pleaded guilty to manipulating the U.S. metals markets. Remember the gold futures “flash crash” of 2014?

The best people to speak to about this subject are the folks at the Gold Anti-Trust Action Committee, or GATA. For 20 years now, Chris Powell and others at GATA have made it their mission to expose collusion by international financial institutions to control the price and supply of gold.

The best people to speak to about this subject are the folks at the Gold Anti-Trust Action Committee, or GATA. For 20 years now, Chris Powell and others at GATA have made it their mission to expose collusion by international financial institutions to control the price and supply of gold.

Last week I had the chance to sit down with Chris, GATA’s secretary/treasurer. I asked him how institutions manage to manipulate the price of gold on such a global scale.

“It’s done largely in the futures markets,” Chris told me. “It’s also done in the London over-the-counter (OTC) market. The mechanisms are gold swaps and leases between central banks and bullion banks, and through the sale of futures contracts.”

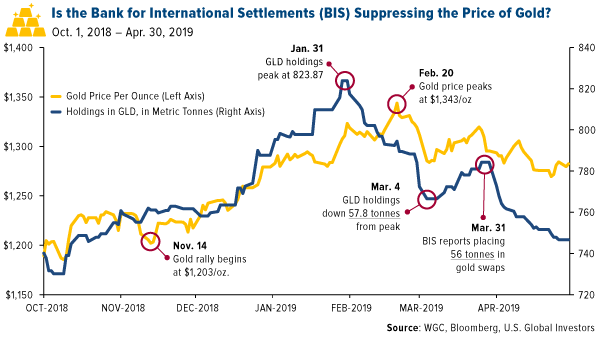

GATA’s Robert Lambourne reported on this in March of this year. As you can see in the chart below, gold rallied between November 2018 and February, when it peaked at around $1,343 an ounce. Ordinarily, you could expect inventory in the bullion-backed SPDR Gold Shares ETF (GLD) to continue to climb at least until then. But that’s not at all what happened. Three weeks before the price of gold peaked, the holdings in the GLD curiously began to fall, and by March 4, the ETF had lost approximately 57.8 metric tonnes. And because the GLD is the largest gold ETF in the world—its value stands at $30.2 billion, as of this week—such selling will naturally impact the price of gold. Sure enough, the yellow metal soon fell below $1,300. What gives?

click to enlarge

The answer to that question may lie in the BIS’ monthly statement of account for February. According to Robert’s reporting, the BIS was still actively trading gold swaps, which it uses to gain access to the metal held by commercial banks. Specifically, the bank placed as much as 56 metric tonnes of gold swaps into the market in February.

If you ask me, that amount is remarkably close to the 57.8 tonnes that fled the GLD in the first quarter of this year.

Hard to believe? This is only scratching the surface. I’ll let Chris Powell be the one to elaborate, but it will have to wait until a Frank Talk later this week. Trust me when I say this is an interview you don’t want to miss! Make sure you’re subscribed to Frank Talk so you can be one of the first to read it.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2019.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors