by Daniel J. Loewy, AllianceBernstein

As the new year begins to unfold, the environment for risk assets is still benign: the global economy is strong, monetary policy is accommodative, and volatility is low and steady. At this point, we don’t see excesses developing that could change that.

Global Growth Is Improving

The global economy appears to be hitting its stride, and the impressive performance is broad-based. During 2017, the Purchasing Managers’ Index, a gauge of the manufacturing sector’s overall health, signaled expansion in at least 75% of a sample of 12 large developed and emerging economies (Display).

Monetary policy is providing support, too: even though the Fed is starting to shrink the size of its balance sheet, monetary policy is still accommodative globally. And yields are low, but so is inflation.

Some investors worry that the flatter shape of the US yield curve today may point to slower growth, but in our view, the shape is more likely a result of quantitative-easing dynamics than a signal of recession. The economic cycle may be maturing, but it isn’t coming to an end.

As for US tax reform, we don’t have grand visions of what the new rules will do. But they should be incrementally positive, given the sound macro backdrop. Our bigger concern? A possible pickup in inflation, with tax reform likely to add to the pressure. If policymakers are forced to tighten financial conditions faster than markets expect, we could see a technically driven market sell-off.

The Portfolio Perspective: Equity Risk Is Attractive

Multi-asset strategies integrate a broad, diverse tool kit, including stocks and bonds, diversifying exposures such as real estate and global credit, and factor exposures—investments that thrive in different environments. Those allocations also have to be adjusted as market conditions evolve.

Today, the environment for taking equity risk remains attractive. In addition to the improved economic landscape, earnings growth is robust and labor costs are contained, which support corporate margins. Earnings growth will likely decelerate in 2018, but we still think mid- to high-single-digit percentages are likely.

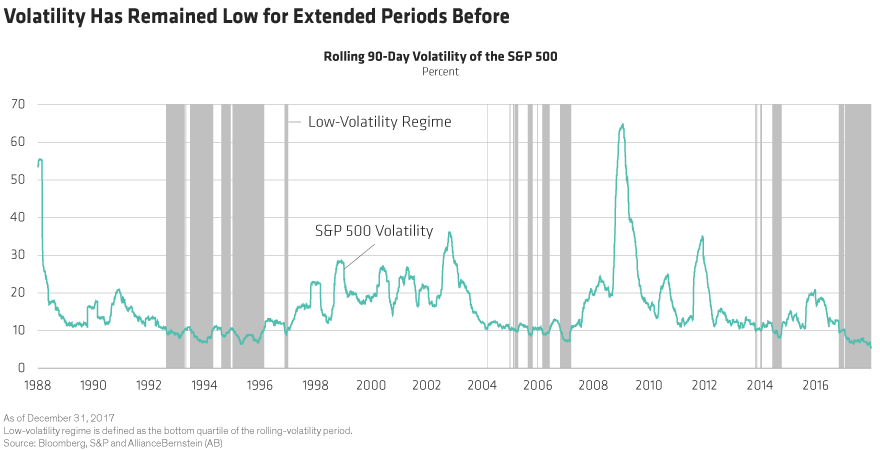

The positive growth/policy combination should keep volatility low in the near term—a factor that should also help stocks. Extended periods of low volatility may seem uncommon, but history shows that they’re not (Display). And at the moment, we don’t see catalysts that could alter that picture.

Regionally, we still see opportunities in US equities, but strong economic growth and tightening labor markets make it likely that we’ll see more interest-rate hikes than the market expects. And US equity valuations are high. That’s not a recipe for outperformance. We see more potential in Europe and Japan right now, where monetary policy is easier and valuations are more attractive.

We also see more potential in equities relative to credit markets right now—although credit offers select opportunities. High-yield bond spreads are very low today; in an environment with solid earnings growth and tight spreads, we think equities should offer better relative upside. In terms of interest-rate exposure, we think it makes sense to consider modestly reduced duration, because there’s risk of more hawkish Fed policy.

Little Sign of Excesses Building Up Right Now

We don’t yet see evidence of overextensions—at least in the private sector—that could change the encouraging investing backdrop. The consumer is in strong shape. Firms have been prudent with capital spending and have been buying back stock, which is shareholder-friendly. We don’t see much overcapacity, and there’s little fundamental evidence that economic growth will slow.

The world’s capital markets have been remarkably placid for quite a while, and this trend seems likely to continue from our vantage point. However, we think it makes sense to include protection against possible volatility spikes—and to continue to adjust portfolio exposures dynamically as 2018 progresses. Portfolio construction doesn’t stand still.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein