by Jennifer DeLong, AllianceBernstein

Target-date funds played a big part in helping defined contribution (DC) plan participants stay invested through February’s market turmoil. And history does repeat: in the severe 2008–09 financial crisis, these funds kept many participants positioned to take part in a lengthy bull market.

Keeping Investors on Course in February’s Sell-Off

In early February of this year, equity markets suddenly tumbled and volatility reawakened.

It was the first big disruption in a while, and some—albeit a small overall percentage of—worried investors quickly made changes to their 401(k) allocations. Trading was higher than average, but was almost exclusively limited to individual equity funds, as investors tried to reduce exposure.

But the percentage of overall assets in motion was actually very low. This means that target-date funds were a big factor in helping participants stay the course and avoid overreacting emotionally. In other words, these funds reinforced a much better, disciplined approach to long-term retirement investing.

The Global Financial Crisis: A History Lesson

This reinforcement likely paid big benefits for many participants in an earlier and much more disruptive period—the financial crisis of 2008–2009.

Even with markets reeling and the US economy moving into recession, industry statistics show that DC plan participants for the most part stayed fully invested, with only a small percentage of them changing their equity allocations.

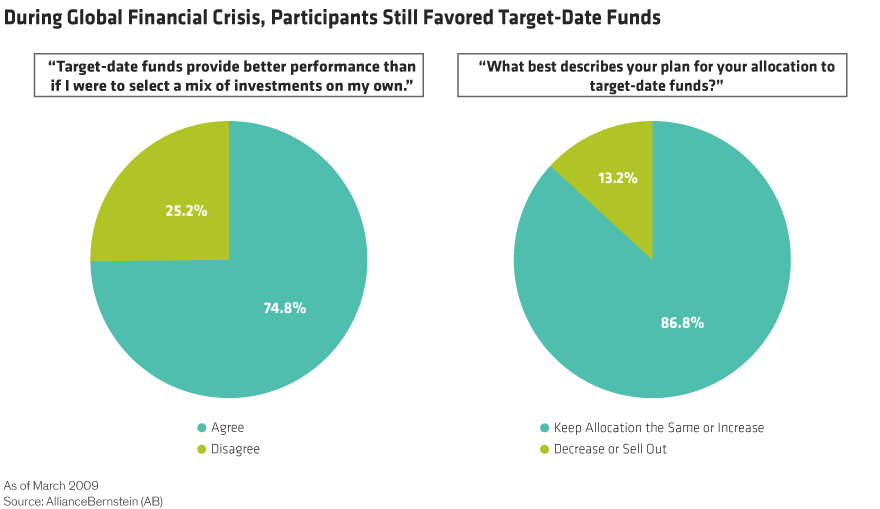

AllianceBernstein’s research backed up the commitment to target-date funds. We’ve been surveying DC plan participants for more than a decade, and when we reached out to them shortly after the financial crisis, most target-date-fund investors still favored these solutions (Display).

In those anxious times, about three-quarters of the surveyed target-date-fund participants agreed that “target-date funds provide better performance than if I were to select a mix of investments on my own.” These participants also showed strong confidence in the future of target-date funds: more than 85% said they would either keep the same amount invested in target-date funds or invest more.

It’s clear that target-date funds’ ability to keep participants invested—and confidence in these solutions—contributed to helping many investors weather the storm of that historic crisis. And it would be a powerful lesson: investors who stayed the course were likely much better positioned to take part in the incredible bull-market returns over the ensuing years.

Reinforcing Long-Term Investing Principles

What’s given target-date funds staying power in both the recent (although brief) market correction and the painful experience of the financial crisis a decade ago? One reason is that participants in default options tend to stay put. When those options are target-date funds, inertia keeps investors in a diversified retirement solution.

But the other reason target-date funds remain so popular is that their very construction—coupled with sound plan design—reflects the foundational principles of long-term investing. Those principles are often repeated, but they’re worth reinforcing with plan participants:

Contribute consistently. Making periodic contributions to a retirement plan smooths out the price participants pay for investments. It’s similar to dollar-cost averaging, a system that works by investing the same amount at specified intervals over an extended period.

Choose an appropriate risk profile. As participants move closer to retirement, the glide path reduces equity exposure and shifts to more conservative investments. This approach keeps participants’ risk profile appropriate for their age. Incorporating risk reduction and diversifying allocations help reduce volatility.

Rebalance systematically. Participants who choose individual funds need to rebalance their allocations periodically. In a market downturn, emotions can weigh heavily on these decisions. Target-date funds rebalance dynamically, so they take the emotion out of the equation.

Make time an ally. Staying invested for the long term not only takes emotion out of the game—helping participants endure the market’s ups and downs—but gives assets the time they need to grow and compound. Retirement investing is a marathon, not a sprint.

Challenging markets can trigger emotions that work against long-term outcomes. Staying calm and focused now can make the difference when it really matters—the retirement years. Markets may not be as robust in the years ahead, so it seems clear to us that target-date funds will be called on to play their critical role again. We think they’ll be up to the task.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein