by Blaine Rollins, CFA, 361 Capital

Four years ago, I wrote a Weekly Research Briefing focused on the death of volatility. It was fairly easy to write given the certainty of Janet Yellen’s communication for the Fed to be the backstop for any errant items in the economy or global marketplace. Anytime the market caught a whiff of fear in the air, the Fed would be there with loving words and of course, lots of QE. Equity and risk asset prices seemed protected and so volatility across the board was collapsing. I still remember the below tweet that I used in the memo along with a great photo of a casket going into a hearse.

Both the piece and the picture were not well received by my readers. The picture got a negative reader response for being insensitive (which was not my intent at all, but I thought it quickly conveyed the message). And then the message was not well liked by readers in the hedge fund and alternative asset category because no one wanted to be reminded of a return to the days of only higher prices and no risk. I remember being on summer vacation with the family and wishing that I would have just left my laptop back at the office. In looking back though, it all played out with the Fed keeping their implied promise to protect the U.S. markets, and being very easy with their initial interest rate increases once the economy began to recover in full. As a result, the markets did move mostly in one direction (and that has been higher.)

But this month, the markets changed. No longer is the Fed able to protect market prices. In fact, some would say that the Fed had better become a bit more aggressive toward the markets or else not have enough power to fight future inflation battles. And while the U.S. economy is ripping higher, causing the uptick in inflated prices, our government is spending too much requiring added supplies of debt to be sold into the market. Bottom line is that inflation is rising, interest rates are rising and market disruptions are happening. The short volatility strategies were the first most aggressive strategy to become wiped out. What might be the next one?

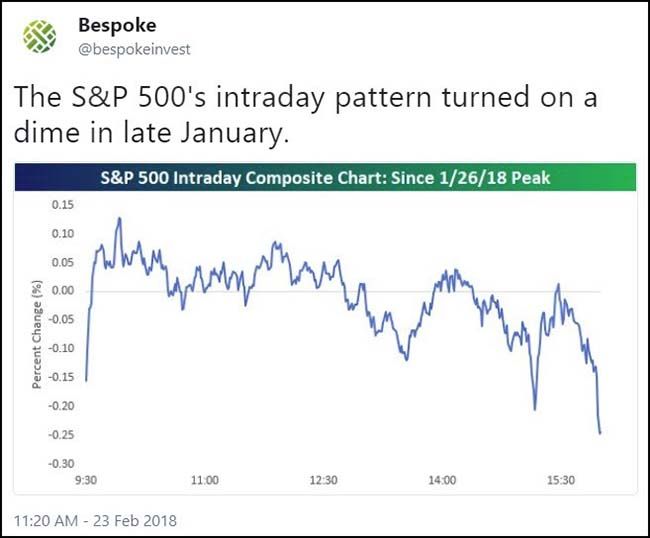

Yes, bond prices have had a big price decline in 2018 and they probably should have a relief bounce. But do you really want to be long bonds when that next string of strong inflation data points rolls out? For the last year, equities seemed to be bought into the close. I assumed that this was the sign of a bull market maybe caused by the flows into passive ETF shops that needed to buy into day end. Since the VIX spike at the beginning of this month though, we have seen stocks sell off into the close. This change in buying pattern could also be signaling a change in the market. Something feels different about the market and I will be watching closely as we retest the January/February highs and lows. Maybe the risk-off move 3 weeks ago is a future warning sign about the U.S. economy. Credit quality remains good right now so a recession hit would still seem to be 18-24 months away. But if we remember back to the market flinches in the Q1 of 2007, we would also have said that credit quality was good back then… just before two heavily leveraged asset backed security funds got into trouble. I am not drawing a line between today and 2007, but I do want everyone to keep their antennae up because I don’t think the investing climate gets easier from here.

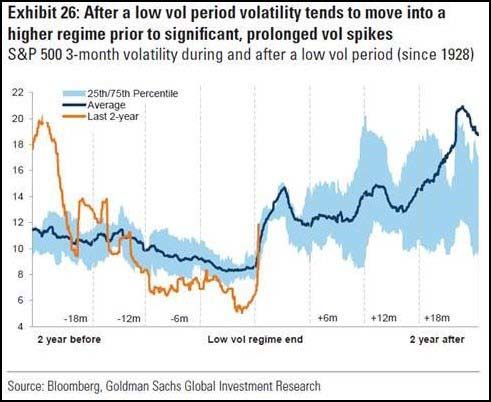

As Goldman Sachs charts below, higher volatility environments tend to stick around a prolonged spike in volatility…

(@DriehausCapital)

Some ink from Eric Peters on the change in the markets…

“Hard to pinpoint why this happened,” said Roadrunner, the market’s biggest equity volatility trader. “But this kind of move usually reflects something below the surface.” Poorly designed VIX exchange-traded products are the fall guys. “Could it have simply been too much leverage and complacency? Doubt it.” VIX finished the week at 16.5, back below where it started the morning of Feb 5th. “I struggle to believe rising interest rates are the big problem – too obvious, too many people are focused on them,” said Roadrunner, darting a glance left, right, up. “Maybe it’s a recession early next year. The market sees things first. And if so, then this was just the tremor that takes us to a new volatility regime.”

(Eric Peters/Wknd Notes)

If Ray Dalio gives a 70% chance to a recession within 21 months, then we had better begin to protect our portfolios…

Dalio said the U.S. economy is not currently in a bubble. But he reasoned that it might not take long to get there and then to move on to a “bust” phase.

”I think we are in a pre-bubble stage that could go into a bubble stage … The probability of a recession prior to the next presidential election would be relatively high, maybe 70 percent, Dalio said during an appearance at the Harvard Kennedy School’s Institute of Politics.

(Reuters)

We knew it was coming, but now we are all stressing over it…

@Schuldensuehner: US’s projected twin deficits will be the largest outside of a recession, JPM says.

Even the White House insider is worried…

“I am troubled by the deficit; and troubled by the national debt, and I think we need a three-year program to deal with it,” David Malpass, the Treasury’s undersecretary for international affairs, said Wednesday during an interview with Maria Bartiromo on Fox Business Network. “It’s a very challenging environment.”

When the economy is good, it should be time to pay down our debts, not increase them…

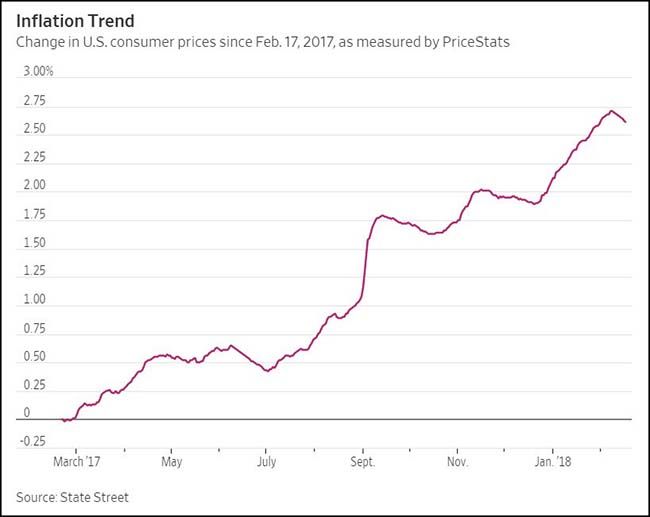

If Government inflation stats are not dynamic enough for you, check this series out…

Investors on the edge of their seats about inflation’s next move don’t have to wait until mid-March to find out how prices changed this month.

PriceStats, a Cambridge, Mass., firm that tracks prices of millions of items sold online, produces a measure of U.S. consumer prices daily. And its latest figures show prices have crept higher so far in February, underscoring that inflation pressures are building.

PriceStats was born out of the Massachusetts Institute of Technology’s Billions Prices Project, one of the most widely cited measures high-frequency inflation data. PriceStats data is distributed to through a partnership with financial services firm State Street Corp.

(WSJ)

Most companies now buying and selling much higher prices…

Um, no you can’t. The markets worry about everything…

“You can have wage inflation and not necessarily have inflation concerns in general.” Treasury Secretary Steven Mnuchin

Thirty-eight years later, the U.S. inflation rate is again heading higher while our Hockey Team is still winning Gold medals…

@darrenrovell: Newspaper on doorsteps on this day in 1980. Top story? Inflation. #2? Miracle On Ice!

Warren Buffett doesn’t want you to consider bonds as lower risk in a portfolio…

“It is a terrible mistake for investors with long-term horizons — among them, pension funds, college endowments and savings-minded individuals — to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks,” Buffett wrote. “Often, high-grade bonds in an investment portfolio increase its risk.”

The Fed minutes this week suggests they are prepping the markets…

“In their discussion of the economic situation and the outlook, meeting participants agreed that information received since the FOMC met in December indicated that the labor market continued to strengthen and that economic activity expanded at a solid rate.”

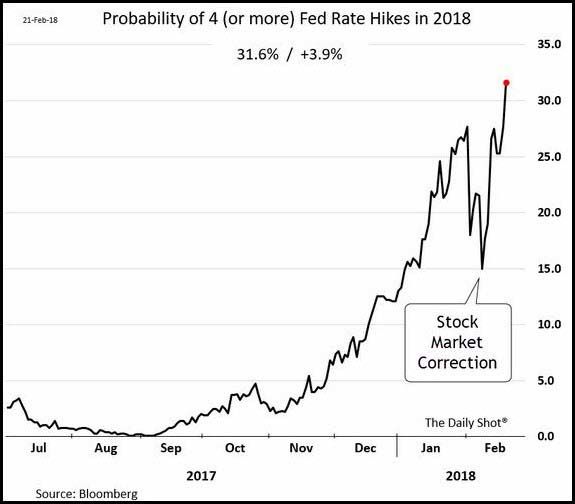

After the Fed minutes were released, the market began to look at the possibility of four rate hikes for 2018…

We will find out this week whether or not the new Fed head, Jerome Powell, wants three or four as he speaks to Congress.

(WSJ/Daily Shot)

Nowhere to run, nowhere to hide for a Bond investor in 2018…

Looking back to the markets at the beginning of 2007…

The U.S. job market was healthy and stock prices were trending higher but there were some bumpy days in the market during the first quarter. Then credit spreads began to get wobbly. At the end of the 2nd quarter, two asset backed funds with $20b in assets became insolvent. And one year later, Bear Stearns was out of capital and forced to merge with J.P. Morgan. It is still surprising how quickly it turned.

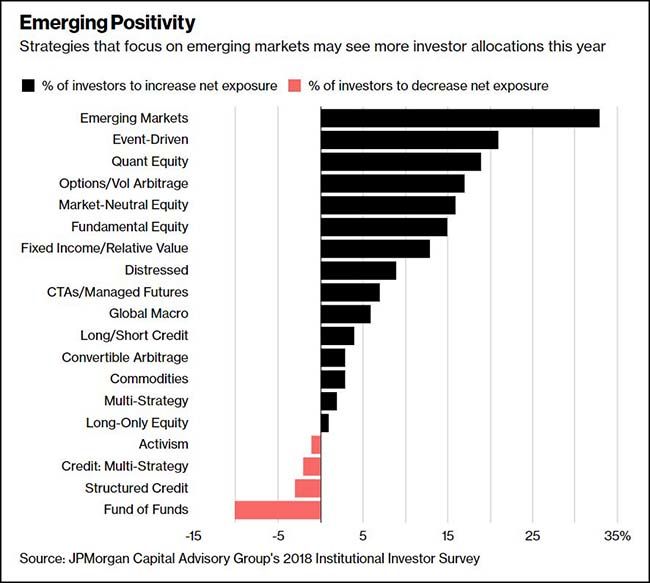

Even before the February volatility, investors were increasing their appetite for hedge fund return streams…

Sentiment toward hedge funds has officially turned around.

Data provider Preqin tracks the proportion of investors planning to increase or decrease their exposure to hedge funds. Since about December 2014, that metric has shown trouble: More clients were planning to flee the sector than join it.

Now, that’s shifted. New data show that 27% of investors plan to boost their allocation in 2018—the biggest proportion since December 2013. And 46% plan to maintain what they’ve got…

“The hedge fund industry is now experiencing a renaissance,” said Amy Bensted, Preqin’s head of hedge fund products. “This may be largely due to an expected correction in equity markets. Half of investors now feel that the long bullish phase of recent years is close to ending—a sentiment seemingly confirmed by rising volatility in recent weeks. In these circumstances, hedge funds provide a valuable opportunity for portfolio diversification and downside risk protection.”

(Barron’s)

J.P. Morgan breaks down which hedge fund strategies are seeing interest going into 2018…

The Bull doesn’t yet see a Bear, but it smells one…

Merrill Lynch now counts 13 triggered signals out of 19 that typically precede a bear market. Still not triggered are: Tightening credit conditions, Low quality outperforming, Low P/E outperforming, Sell side equity optimism, Lower PM cash levels and an Inverted yield curve.

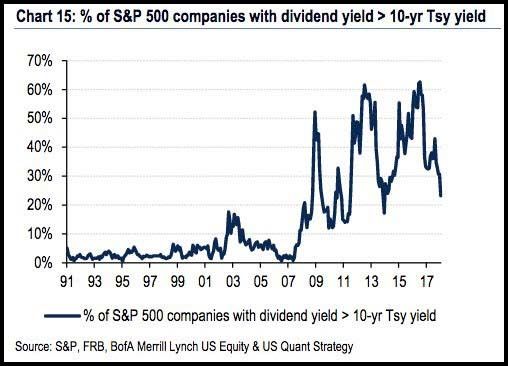

Another chart to give you discomfort in paying up for stocks right now…

(@bySamRo)

Here is that new intra-day trading pattern which has emerged since the February volatility spike…

Also in the Berkshire Hathaway letter is a jab at CEOs for overpaying for acquisitions…

In his annual letter to Berkshire shareholders, Buffett said finding things to buy at a “sensible purchase price” has become a challenge and is a major reason Berkshire is awash with $116 billion of low-yielding cash and government bonds.

Buffett said a “purchasing frenzy” binge by deal-hungry chief executives employing cheap debt has made that task difficult. Berkshire typically pays all cash for acquisitions.

(Reuters)

Private equity funds are also to blame for Berkshire not being able to deploy his cash hoard…

Hugh MacArthur, head of global private equity for Bain, said he expected this year to be similar to 2017 if market conditions remain broadly the same. “There has been a continuous piling in of money into private equity funds. We’ve got an all-time high of [cash ready to be deployed] of $1.7tn, nearly 60 per cent higher than at its peak in 2007,” he said. “Companies are under pressure to invest and this is potentially causing private equity to be less scared or less mindful of those macro factors.”

And a shot across the bow of consensus thought that private equity investing is a superior strategy right now…

In 2007, private equity debt levels reached 5.2x ebitda. Today, they are at 5.8x ebitda, and they have been above 5.2x every year since 2013. The 2007 vintage deals did not end well for investors. Today’s higher-priced and more leveraged deals could end even worse.

These levels of leverage leave companies with no margin of safety. Most companies’ cash flows are too volatile and unpredictable to sustain high debt levels for long. In addition, the recent tax reform caps interest deductibility at 30 percent of ebitda, which for most firms translates to about 5x ebitda of debt. This will be particularly problematic for highly leveraged firms, especially in any downturn when ebitda declines. Those that are lucky enough to grow will be fine, but companies with large interest payments and looming debt maturities cannot invest for growth.

The history of financial markets echoes with a warning: beware markets where investors are not only bullish but also borrowers. Yet there is always a logic behind each bubble, a set of ideas that form the foundation of the consensus thinking.

And there are three premises that underlie the private equity boom. First, the experts believe that PE firms make money by improving the companies they buy. Second, the experts believe that PE is less volatile and less risky than public equity. Third, the experts believe that PE will significantly outperform every other investment. There is near complete consensus on these three points among academics, investors, and PE firms.

Private equity assets today exceed $2 trillion, and PE firms have $700 billion of dry powder capital just sitting there, waiting to be invested. The market is so flooded with investors and valuations are so high that even the truest believers have not found a way to invest it. There is a huge amount of money betting that this consensus is right, and the voices arguing that the consensus is wrong are marginal relative to the chorus of those who agree.

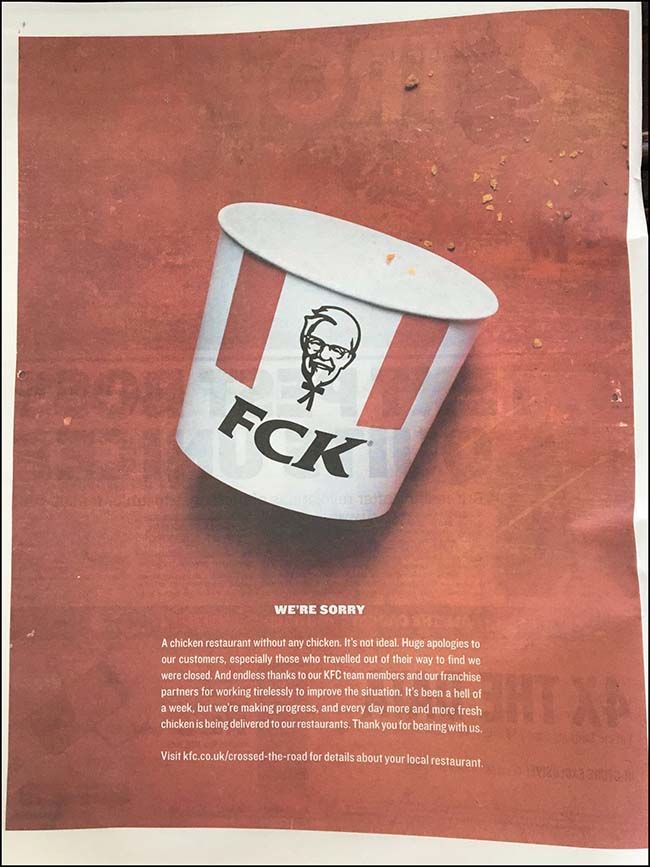

I have a new movie script for Michael Bay…

In the United Kingdom, the KFC restaurants ran out of chicken last week…

The fault was a logistical nightmare caused by a move to a single distribution center. Their marketing department saw an opportunity in the crisis.

(@AndrewBloch)

The NFL had better start investing in longevity drug research trials…

NFL TV viewership is clearly facing significant viewership challenges. 2017 regular season ratings declined for a second consecutive year, by 8% yoy, bringing the cumulative 2-year decline to 17%. This is actually worse than the 15% decline in non-sports broadcast programming, in a departure from the historical pattern of NFL outperformance.

(Goldman Sachs)

Congrats to all Olympians. Especially the Norwegians.

This is by far my favorite Olympics article…

“We always want to win,” said Fredrik Aukland, a TV sports commentator in Norway. “But modesty is a big part of the culture here. And Norwegians don’t go out much.”

Unless it’s Constitution Day, ostentatious displays of all kinds are frowned upon in Norway, especially when it comes to wealth, a notable feature in one of the world’s richest countries. Nobody expects a parade for returning athletes, even though they are bringing home 14 medals in cross-country, six in biathlon, five in ski jumping, seven in Alpine skiing and four in speedskating.

The haul is sure to revive pangs of concern that have shadowed Norway’s streak of victories in recent years — that the country may dominate some winter sports so thoroughly that it is ruining them.

That anxiety is strongest in cross-country skiing, which is adored with a fervor that stretches back centuries. Norwegians fear lopsided results can demolish enthusiasm for a sport in countries that are getting demolished.

(NY Times)

Classes resume this week at Marjory Stoneman Douglas High School…

And our thoughts will be with all of the students, teachers and faculty. #NeverAgain

Copyright © 361 Capital