by Christopher Nikolich, Fixed Income, AllianceBernstein

With market returns expected to be lower going forward, target-date funds that invest in passively managed underlying components are at risk of underdelivering. We think diversifying beyond traditional asset classes and tapping alpha opportunities with a multi-manager structure can increase the chances of success.

The Challenges of a Lower-Beta Environment

Expected returns for traditional beta sources are challenged today. Projected global equity performance is running roughly 3% below normal levels, and sovereign bond returns are about 4% below normal. Bonds have historically helped diversify equity risk, but yields are low and have little room to fall. As a result, traditional bonds are likely to be less effective than usual in protecting downside.

These conditions pose major headwinds to target-date funds as they work to provide the growth participants need. Target-date funds that invest only in traditional asset classes, such as large-cap equities and core bonds through indices, face limitations in their glide path designs. This can make it a struggle for target-date funds to meet participants’ needs in anything but a high-return, low-risk market environment. And in terms of environments, that ship has likely sailed for now.

A lower-beta landscape challenges a popular line of thinking that says investing in funds with the lowest fees will ensure compliance with plan sponsors’ fiduciary responsibilities. Low fees aren’t the end all and be all. For one thing, focusing too much on fees could cause sponsors to overlook other factors in retirement investing that also have fiduciary implications.

Diversifiers Can Help Cushion Downside in Rough Markets

One such factor is sound portfolio structure. More diversified asset-class exposure and more robust glide path construction are even more critical in times like these. Diversifiers such as long/short equities, unconstrained bonds and market-neutral strategies can provide additional sources of uncorrelated—or less correlated—returns versus traditional stocks and bonds, and they may help reduce overall portfolio risk, including the potential for losses.

For example, when the US bond market declined by more than 3% in the period surrounding the US presidential election of 2016, fixed-income diversifiers generated a positive return that helped offset the bond sell-off. More recently, when global equity markets fell by more than 5% in early 2018, equity diversifiers fell by only half as much, moderating losses.*

Tapping Alpha Opportunities in More Fertile Markets

Active management comes with a higher price tag, but it also offers the potential for outperformance.

A target-date fund that blends active and passive strategies—as opposed to one that uses passive only—offers the potential to generate alpha in less efficient markets while still managing costs. Of course, no active manager wins all the time, so a multi-manager approach provides access to best-in-breed strategies across all asset classes. This may reduce manager-concentration risk and provide more consistent returns.

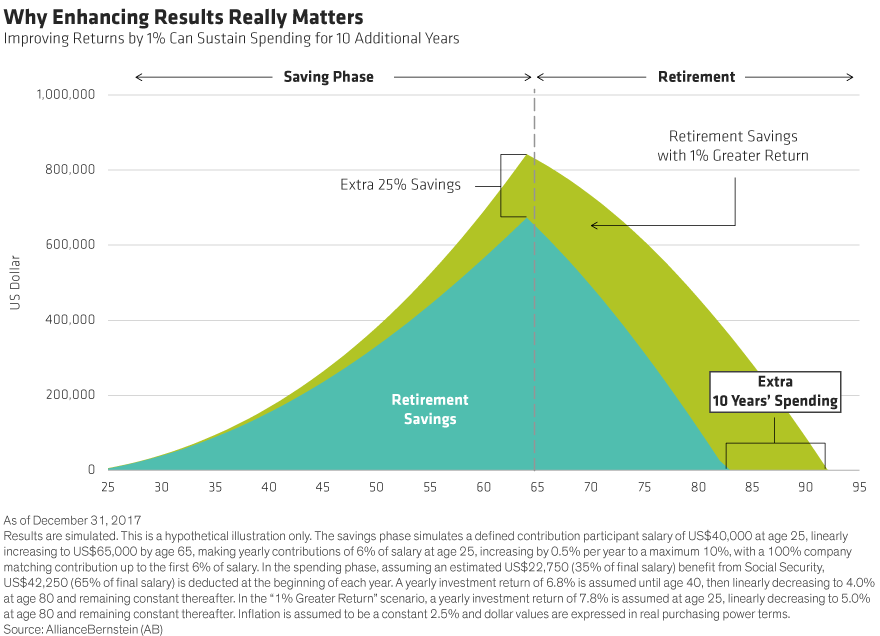

Increased diversification in a target-date fund’s glide path, paired with the use of multiple managers—including active—may help enhance returns and manage overall risk. In a less favorable environment like the one we’re seeing today, this approach can also help cushion participants’ losses in down markets. Improving annualized returns by just 1% over the long run can sustain a participant’s retirement spending for 10 extra years (Display).

In a lower-beta environment, plan sponsors will continue to face challenges—including finding the mix of investment options and glide path diversification that’s best positioned to achieve participants’ outcomes. As we see it, passive alone is not the answer in this market, and it doesn’t make sense to look away from the potential of including actively managed and diversifying components in target-date funds.

*The US bond market is represented by the Bloomberg Barclays US Aggregate Bond Index, October 2016–December 2016. Global equity markets are represented by the MSCI World Net Return USD, August 2015—February 2016. Fixed-income and equity diversifiers are representative of a blended allocation of select funds within a fully diversified target-date portfolio.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the AllianceBernstein blog

Copyright © AllianceBernstein