by Richard Turnill, Blackrock

Richard explains our latest tools for assessing climate-related risks to investment portfolios.

Hurricanes. Floods. Wildfires. Heat waves. Extreme weather events–and climate-related risks–are increasingly becoming talk on the street. But until recently it has been difficult to pinpoint what such risks mean to investment portfolios. Good news: Advances in data and climate science now allow us to assess the climate-related financial risks–down to a localized level.

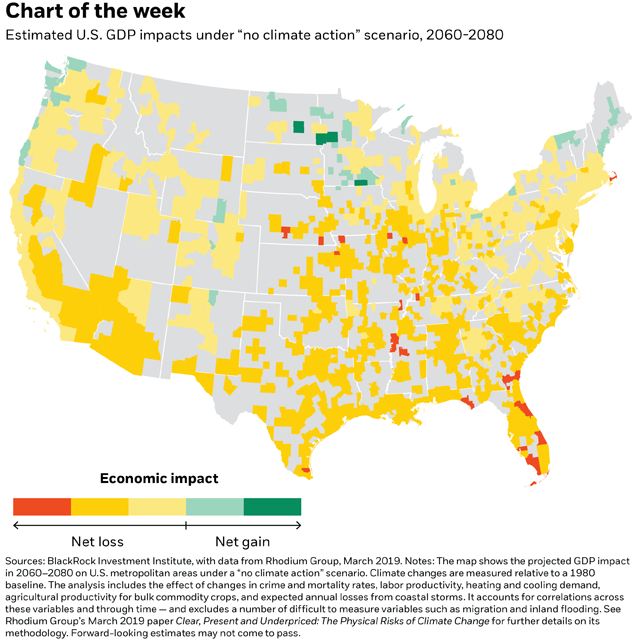

We now can analyze the overall economic impact of climate-related risks on a region in the U.S. Researchers across BlackRock have used data from Rhodium Group to estimate potential direct financial damages, as well as indirect effects such as the impact of rising average temperatures on crop yields or labor productivity. The heat map shows projected changes in regional economic activity under a “no climate action” scenario assuming ongoing use of fossil fuels. The risks are asymmetric: Some 58% of U.S. metro areas would see likely gross domestic product (GDP) losses of 1% or more by 2080, with less than 1% set to enjoy gains of similar magnitude, we estimate. The biggest likely losers: Arizona, the Gulf Coast region and coastal Florida.

Investing implications

The potential losses from a changing climate are not baked in, as suggested by our recent publication Getting physical. Decisive actions to curb carbon emissions could mitigate the damage. But the vulnerabilities revealed in our evolving research, led by BlackRock’s Sustainable Investing and Global Fixed Income teams, can help investors get a better handle on physical climate risks. The risks are especially relevant for physical assets with long lifespans. It is why BlackRock’s research first focused on three sectors with long-dated assets that can be located with precision: U.S. municipal bonds, commercial mortgage-backed securities (CMBS) and electric utilities.

Our early findings suggest investors must rethink their assessment of vulnerabilities. Climate-related risks already threaten portfolios today, and are set to grow, we find. Take the potential impact on the creditworthiness of U.S. municipal bond issuers: A rising share of issuance in the $3.8 trillion market is set to come from regions facing climate-related economic losses, BlackRock’s research shows. Within a decade, more than 15% of the current S&P National Municipal Bond Index by market value would come from U.S. regions suffering likely average annualized losses from climate change of up to 0.5% to 1% of GDP, we estimate. Climate risk is also a growing concern for CMBS owners. To illustrate, we overlaid Rhodium’s hurricane modeling onto the roughly 60,000 commercial properties in BlackRock’s proprietary CMBS database. The median risk of one of these properties being hit by a Category 4 or 5 hurricane has risen by 137% since 1980, we found. Lastly, we assessed the exposure to climate risk of 269 publicly listed U.S. utilities based on the location of their plants, property and equipment. A key conclusion: Vulnerability to weather events is under-priced in U.S. utility equities. This leaves owners of such securities exposed to temporary price and volatility shocks.

The key takeaway

Climate change is increasingly a risk that investors cannot afford to ignore. Integrating insights on climate-related risks is important for investors in all asset classes and regions, and can help enhance portfolio resilience, we believe. We plan to extend our analysis across global markets, asset classes and sectors as data availability improves–from the early focus on U.S. assets.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.b

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

807183