by John Lynch, Chief Investment Strategist, LPL Financial

KEY TAKEAWAYS

- We expect roughly flat earnings for the first quarter, putting the seven-quarter streak of growth in jeopardy.

- The picture seems quite a bit better when looking beyond the first quarter, which we see as a trough in growth.

- We expect enough economic growth ahead to drive record profits in 2019, supported by fiscal stimulus, robust manufacturing output, healthy labor markets, and a U.S.-China trade deal.

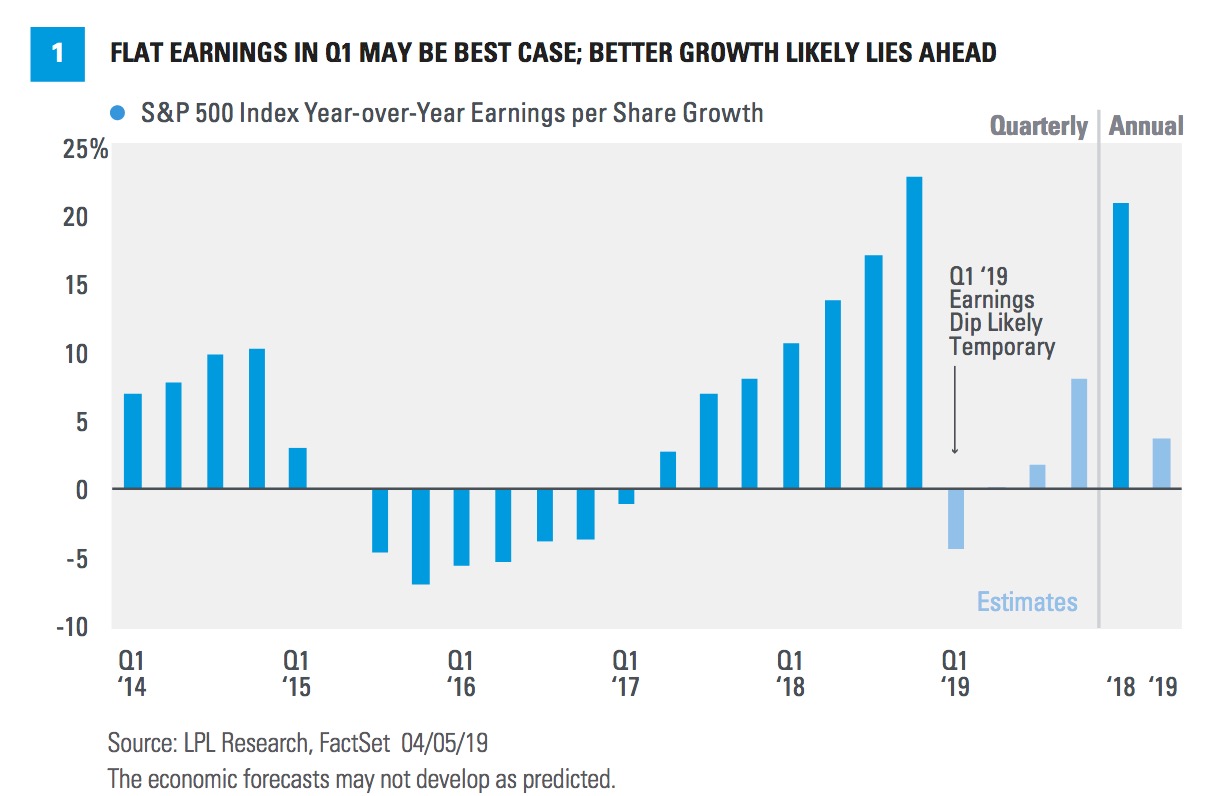

First quarter earnings season kicks off this week and the bar seems low. Consensus estimates for first quarter earnings season are calling for a slight year-over-year decline in S&P 500 Index earnings amid the economic soft patch at the start of the year. Marking the one-year anniversary of the tax reform earnings boost, in the first quarter of 2018, has made the annual comparison more difficult, as shown in Figure 1. We expect roughly flat earnings for the quarter, but the streak of seven straight quarters of earnings growth could come to an end. Here we preview the upcoming earnings season, highlight some key themes, and share some thoughts on the 2019 corporate profit outlook.

All estimates indicated are FactSet consensus estimates.

Key Themes for Q1

Here are some of the key themes for first quarter earnings season:

- The low bar is likely to be cleared. Quarterly earnings almost always beat quarter-end consensus estimates—this quarter will likely be the 40th in a row. However, given the headwinds of weaker global growth and trade uncertainty, which led to above-average cuts to estimates, the typical 3–5% upside surprise may not be a slam dunk in the minds of some market watchers. We believe companies took advantage of the many excuses available to them to guide expectations down. The 7% cut to first quarter estimates since the start of the year, the biggest cut since the first quarter of 2016, may have put the bar too low.

- All about margins. With the financial media’s focus on falling earnings, you might be surprised to hear that S&P 500 revenue is expected to increase 5% year over year in the first quarter based on consensus estimates from FactSet. That means the potential earnings decline is being driven by concerns about shrinking profit margins. Some small drags—such as currency, commodity prices, tax adjustments, etc.—may lead to modest margin contraction. But stable wage growth, productivity gains, and still-low interest costs should help limit the amount of margin contraction and support positive earnings surprises.

- Is trade now a positive earnings catalyst? There are a number of reasons why the U.S. economy hit a soft patch to start the year, and tariffs and trade uncertainty are certainly on that list. Recent progress in trade talks may lead to an agreement as soon as this month, potentially eliminating a drag on business and consumer confidence. More business confidence could spur business investment and help boost productivity, keys to extending the business cycle and growing earnings. Some U.S. tariffs on Chinese goods may be pulled back, offering a potential positive earnings catalyst.

- The oil earnings boost is gone. During the middle two quarters of 2018, oil prices averaged 38% year-over-year increases, which boosted the annual growth of the energy sector significantly. In fact, earnings for the S&P 500 Energy Sector Index more than doubled last year. Even in the fourth quarter of 2018, average oil prices rose 8% year over year. In the first quarter of 2019, oil prices averaged $54.90, 11% below the $61.45 average in the year-ago quarter. Energy sector earnings are expected to fall nearly 20% versus the year-ago quarter. Because of its bigger weight in the index, the technology sector’s expected 10.6% drop in earnings is a bigger contributor to the overall decline.

- U.S. dollar drag. The average price of the U.S. Dollar Index in the first quarter was 7% above year-ago levels. As a result, currency may cut 1–2 percentage points out of S&P 500 earnings for the quarter (roughly 40% of S&P 500 companies’ profits come from outside the U.S.). Even if the dollar stays where it is now, the drag would continue for at least the next couple of quarters. While the dollar is a drag now, we expect its latest rally to reverse and potentially contribute to earnings growth later this year.

Outlook for 2019 profits

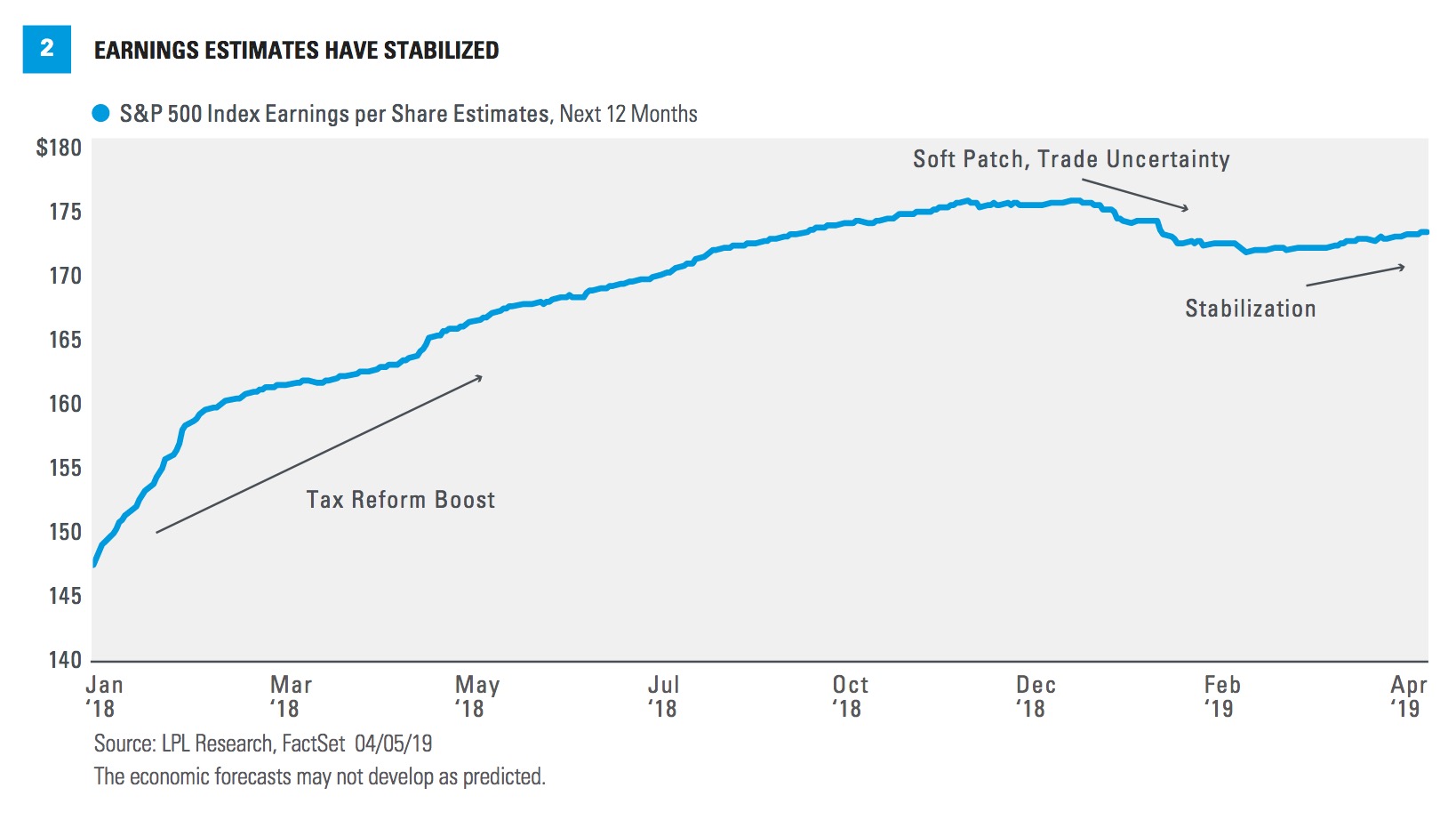

Beyond the first quarter, the earnings picture looks quite a bit better. We expect the S&P 500 to generate mid-single-digit earnings growth in 2019 and see the first quarter as a trough in growth. Though economic growth is likely to slow from last year’s pace, we see enough growth ahead to drive another year of record profits, supported by fiscal stimulus, robust manufacturing output, healthy labor markets, and resolution of the U.S.-China trade dispute. Our forecast for S&P 500 earnings per share in 2019 remains $172.50, representing a little over 6% growth.

Our estimate is above Wall Street’s consensus estimate, which now stands between $168 and $169 per share, representing a 4% increase. We believe analysts have been overly pessimistic in bringing consensus estimates down from roughly $177 (a 10% increase) in November 2018.

We acknowledge the risks, including slower global growth, trade conflicts, and potential margin pressures from higher wages. While we can’t dismiss these risks, we see them as manageable for corporate America at this point.

In summary, we think Wall Street’s earnings estimates for this year are a bit too low. If some of these positive catalysts do not play out as we expect, however, we could see a number closer to $170 than our $172.50 number.

CONCLUSION

First quarter earnings will be weak. Flat may be the best-case scenario. But looking forward is more important than looking backward. When we do that, we see several reasons for encouragement. The fundamentals of the U.S. economy are in good shape, supported by fiscal stimulus. A U.S.-China trade deal may be coming soon and could lead to an increase in business investment. Finally, we think consensus estimates for 2019 may have come down too much and are encouraged by recent stabilization in estimates that could be a prelude to positive revisions to earnings estimates in coming quarters.

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in this material may not develop as predicted.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

DEFINITIONS

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P Energy Index is comprised of energy companies that primarily develop and produce crude oil and natural gas, and provide drilling and other energy-related services.

The U.S. Dollar Index (DXY) indicates the general international value of the U.S. dollar. The DXY Index does this by averaging the exchange rates between the US dollar and six major world currencies.

Copyright © LPL Financial