by Richard Turnill, Blackrock

Richard lays out our views for the second quarter–including three refreshed investment themes.

Global stocks have had a strong start of the year. Will the rally be sustainable? We see a repeat as unlikely and a narrower path for risk assets to grind higher against the background of growth slowdown–a key theme in our latest investment outlook. The global economy must remain strong enough to calm recession fears but weak enough to keep policymakers on hold, we believe. We are moderately pro-risk, with a penchant to re-balance toward quality.

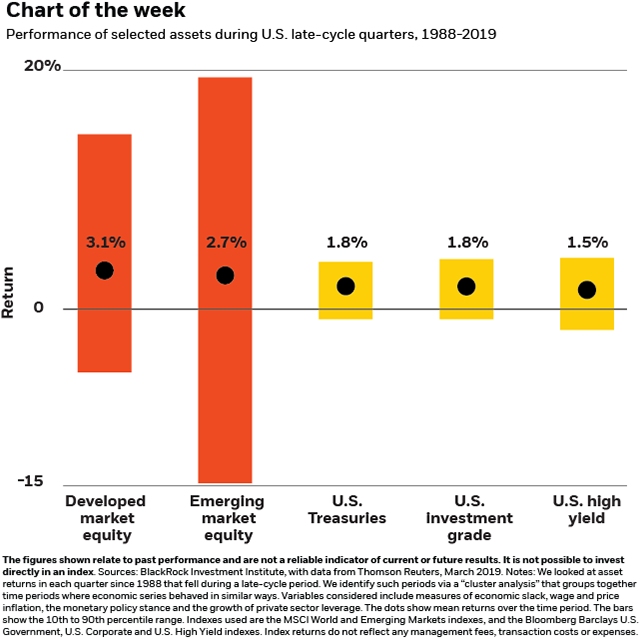

We see further deceleration in both economic and earnings growth ahead. Yet we are also increasingly confident that the global economy can remain in late-cycle throughout 2019. How do markets typically fare during late-cycle periods? Global equities produced quarterly returns above the full-cycle historical average, edging out fixed income, according to our analysis. Yet there was wide dispersion and pronounced downside around these averages, particularly in emerging market equities. Within fixed income, U.S. Treasuries modestly outperformed riskier credit sectors. See the chart above.

A new theme and a Chinese rebound

We introduce a new investment theme this quarter: patient policymakers. It reflects the Federal Reserve’s dovish pivot—and a similar emphasis on patience among other developed market central banks. China has moved to easier credit and fiscal policies, but with greater caution than in the 2015-2016 downturn. The supportive stance of global policymakers should underpin both equities and bonds. Yet the strength of the year-to-date rally across markets looks fragile and hard to replicate, and we believe market expectations of U.S. monetary policy are now overly dovish. This is where our third theme, balancing risk and reward, takes on new importance. Signs of a more pronounced growth slowdown or new trade disputes have the potential to stoke uncertainty. A rapid rise in asset valuations and plunge in volatility point to creeping market complacency, but fund flows and market positioning are far from euphoric. These crosscurrents lead us to favor a selective approach to risk-taking in the second quarter. We see quality assets, including U.S. Treasuries, as an important source of portfolio resilience.

China plays a pivotal role in our views on the global economy, markets and geopolitics. We are increasingly confident that Chinese growth is likely to reaccelerate from the second quarter onward, thanks to easing fiscal and monetary policies. Improving Chinese activity should benefit global growth, especially in Asia and Europe, and could also boost global capex. We see potential for a U.S.-China trade deal to address the bilateral trade gap and market access, but caution that U.S.-China tensions, particularly over tech dominance, are likely here to stay. A potential flare-up between the U.S. and Europe over U.S. auto tariffs also merits concern.

Bottom line

We remain modestly overweight stocks versus bonds, but favor trimming exposures that have notched particularly strong returns so far this year. Our preferred regions remain the U.S. and emerging markets. We favor quality equities in sectors that can sustain earnings growth even in a slowing economic environment, such as selected health care and tech firms. In bonds, we focus on income, including emerging market debt, but also see an important role for U.S. Treasuries as portfolio shock absorbers.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0419U-801318