by Alfred Lee, CFA, DMS

Vice President & Investment Strategist, BMO ETFs & Global Structured Investments

BMO Asset Management Inc.

alfred.lee [at] bmo.com

The start of a new year has always been a good time for investors to consider a tactical reallocation to their portfolios to better reflect the current economic and market outlook. In this special Monthly Strategy Report, we take a holistic view of portfolio construction and strategy, utilizing a top-down approach to express our views on asset allocation and the sectors within each of equities, fixed income, commodities and currencies that we believe present attractive opportunities.

Asset Allocation Themes

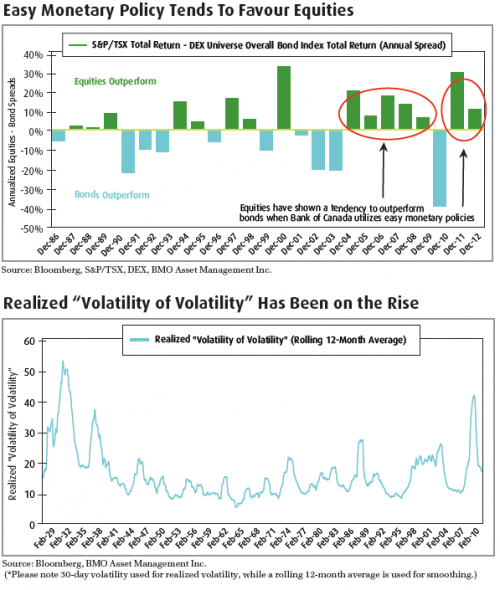

- Overweight Equities Relative to Bonds. Easy monetary policies in the developed nations, particularly the U.S., will likely continue to drive risk assets higher in 2011, albeit with continued volatility. As the correlation of risk assets across the world remain high, U.S. economic policy will be the harbinger in setting the tone for global investor risk appetite. The U.S. Federal Reserve (Fed) has made it clear that they will utilize tools such as quantitative easing1 (QE) to reflate asset prices, if and when needed. Furthermore, the Fed is likely to maintain interest rates at historic lows well into 2011, forcing its global counterparts to carefully consider raising lending rates to keep currency cross-rates and thus exports at competitive levels. Consequently, the traditional government debt of developed markets is likely to remain low-yielding, enticing investors to move into equities with the improving health of the private sector in the U.S. To compensate for lower yielding bonds, investors will likely have to take on higher expected risk in their fixed income allocation, while offsetting this risk with lower expected risk in their equity allocation.

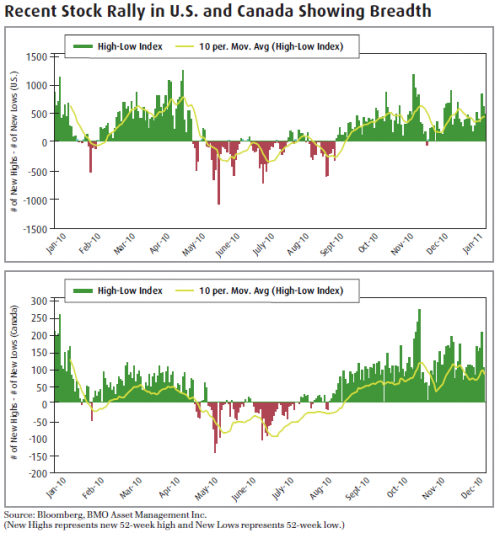

- Be Prepared For Sudden Upside Volatility In Equities. Although we wouldn’t be surprised to see equity market volatility, tracked by the S&P/CBOE Implied Volatility Index (“VIX”), end the year slightly lower, we also wouldn’t be surprised to see sudden upside shocks in volatility. Despite the impressive equity market recovery that is now nearing its two-year anniversary, the behavioural element in asset pricing remains a sizable factor. Historically, during periods where recent realized volatility has been high, implied volatility has had a tendency to be more sensitive to negative headlines and has priced-in a higher probability of tail risk2. With the 2008 financial crisis still relatively fresh on everyone’s mind, this is understandable. The unresolved European sovereign debt issues, concerns of U.S. municipal bond defaults and the imbalance between surplus and deficit nations may trigger “crisis déjà-vu”. This fear may also lead to sudden increases in the gap between implied volatility and realized volatility, or what is known as “volatility risk premium.”

Additionally, market ecology has changed dramatically in the last decade. Long-term investors such as mutual funds and institutional pooled funds are still the largest holders of issued equity. However, day-to-day trading is dominated by computer-based algorithms all chasing similar signals. That, coupled with increasing fragmentation in stock exchanges, could potentially lead to incidents where liquidity suddenly becomes a concern. We believe, however, that the long-term valuation of stocks is still largely driven by fundamentals. Therefore we envision long-term VIX to be driven slightly lower with the gradual improvement in global macroeconomics but see volatility shocks over the near-term as a result of behaviour and market ecology factors. In other words, the VIX can end the year lower but “the volatility of volatility” (the derivative of volatility or “volatility squared”) may be high in getting there. This further stresses the importance of using limit orders and stop-limit orders when executing trades.

Equity Themes

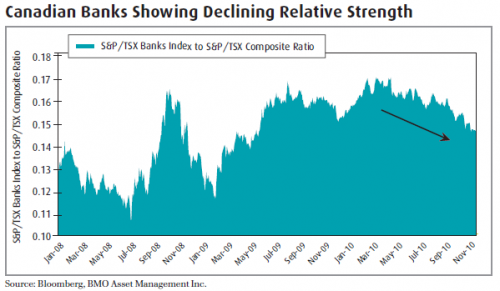

Since Fed Chairman Ben Bernanke signalled to the market on August 27, 2010 that he was willing to initiate a second round of quantitative easing (QE2), equities around the globe have experienced a sizable rally. Some investors have questioned the legitimacy of the rally given the uncertainty that remains in developed economies. While the Canadian economy has proven to be one of the most resilient of the G10 nations, there remains uncertainty in the U.S. As we noted, there is a sizable gap between the health of the private sector and that of the public sector south of the border. The recent rise in equity prices is backed by both improving fundamentals and investor sentiment. A closer look at the High-Low Differential Index, a measure of market breadth, shows that the recent upswing of the stock market is not driven by the divergence of the price action of a few particular or pocket of companies, but rather a healthy rally across a number of stocks and sectors.

- U.S. Equities to Outperform. Although many of the headlines about the U.S. remain focused on the uncertainty in its public sector, the improvements in its private sector are often overlooked. Non-financial corporate balance sheets in the U.S. show strong cash balances which indicate a higher probability of stock buy-backs, dividend increases and/or merger and acquisition (M&A) activity. Moreover, the rally in equities since March 2009 has made it extremely unbearable for retail investors to watch from the sidelines. Early indications of statistics tracked by the Investment Company Institute (ICI) are showing that equity mutual funds have seen their first positive net inflows since December 2007, suggesting retail money is finally warming up to stocks. As retail investors reallocate their portfolios from cash, the home-bias effect will be evident as we seldom see the typical investor move directly into less familiar territory such as emerging market equities, bypassing equities in developed markets. From a technical standpoint, the S&P 500 Composite Index moved into a “golden-cross” in late October last year where its 50-day moving average crossed above its 200-day moving average, historically a bullish indicator for U.S. equities.

Lastly, the third year of the U.S. presidential cycle has historically, on average, been favourable for equities and increased investor optimism will increase the chances of an Obama re-election. Investors should keep an eye not only on whether the net income of U.S. companies can continue to surprise on the upside but whether increasing bottom lines are the result of rising revenues or further cost-cutting, the latter of which is both unsustainable and eventually capacity limiting.

Potential Investment Opportunities:

- BMO U.S. Equity Hedged to CAD Index ETF (ZUE)

- BMO Dow Jones Industrial Average Hedged to CAD Index ETF (ZDJ)

- BMO Nasdaq 100 Equity Hedged to CAD (ZQQ)

- Long-term Story For Emerging Markets Equities Still Intact. While we have been extremely bullish on emerging markets equities coming out of the recovery, developing nations will likely be focused on taming inflation in the front half of 2011. This along with low yielding bonds is an additional reason why we would not be surprised to see U.S. equities outperform in 2011. The central banks of both China and India have raised interest rates a number of times in 2008, a clear indication that key emerging markets are for the time being focused on preventing their boom from turning into a bust. In the short-term, investors should consider paring back emerging market equity allocations in favour of Canadian and U.S. equities. Over the long-term however, we remain bullish on emerging market equities as the rebalancing of economic power continues to move towards select developing nations, most notably China. Perhaps in the second half of the year, long-term investors that want to initiate positions in emerging market equities should use technical indicators such as MACD3 and RSI4 to look for possible entry points.

Potential Investment Opportunities:

Put the following on radar as year progresses:

- BMO Emerging Market Equity Index ETF (ZEM)

- BMO China Equity Hedged to CAD Index ETF (ZCH)

- BMO India Equity Hedged to CAD Index ETF (ZID)

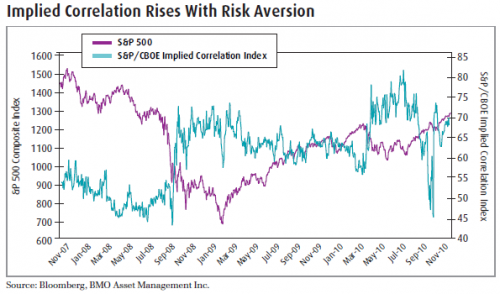

- Canadian Banks Continue to Look for Acquisitions. The recent wave of acquisitions by Canadian banks that was experienced in late 2010 could be a sign of things to come this year as “the Big Six” on a whole are on the lookout for bargains to complement their business lines. Canadian banks which are amongst the world’s best capitalized are in an enviable position, as the financial crisis has left many of their global peers targets for acquisition at attractive valuations. Given the capital outlay that these acquisitions would require, we could see a decline in tier one capital ratios throughout the year. Henceforth, Canadian banks could potentially see limited upside gains.

Although short-term capital gains for Canadian banks may be capped, we do believe these acquisitions will strengthen their businesses and provide geographical diversification over the long-term. For those investors that are willing to give up some short-term upside potential and build core portfolio positions for the longer-term, Canadian banks may be of consideration. Their declining relative strength relative to the broader market, may present some buying opportunities throughout the year.

Potential Investment Opportunities:

- BMO S&P/TSX Equal Weight Banks Index ETF (ZEB)

- Increase Dividends to Negate Equity Market Volatility. As we mentioned in 2010, high dividend equities are an efficient way to play this market. This low-beta and high yielding equity segment will be crucial to partially offset the higher-beta component in a portfolio’s fixed income allocation. With the near extinction of income trusts, the remaining higher yielding equities and REITs will be in demand to meet the dividend shortfall in portfolios.

Potential Investment Opportunities:

- BMO Equal Weight Utilities Index ETF (ZUT)

- BMO Equal Weight REIT Index ETF (ZRE)

- Mergers and Acquisitions Activity is Back. For the larger national U.S. financial institutions, the return of mergers and acquisitions activity may mean increased business for investment banking. The outlook for regional banks may be more mixed as two opposing forces are at work. Those regional banks with stronger balance sheets may make attractive acquisition targets which will counteract those regional banks exposed to high mortgage defaults. Using technical indicators to gauge when to get into this trade may be of benefit.

Potential Investment Opportunities:

- BMO Equal Weight U.S. Banks Hedged to CAD Index ETF (ZUB)

Fixed Income & Credit Themes

As the developed nations slowly continue to work their way out of sluggish economic conditions, low interest rate policies will remain. Thus, achieving higher yields in a fixed income portfolio would require investors to venture further out the risk spectrum. Our fixed income allocation is thus designed to achieve two purposes; allocations to bonds that provide portfolio stability and allocations to higher-yielding bonds. Keep in mind however, that some of the yield oriented fixed income will behave more like a high-beta asset class with a higher correlation to the equity portion of a portfolio. Therefore, when budgeting risk across asset classes, allocation to these areas should be both limited and monitored.

a) Portfolio Stability Segment: As we have stated in the past, a well diversified portfolio of equities no longer provides the necessary downside protection to insulate a portfolio from macroeconomic or market behavioural risk. Although the S&P CBOE Implied Correlation Index (ICI) has fallen significantly to as low as 46.86% in late November, the ICI index is highly correlated to the VIX Index, showing that increased market nervousness causes intra-market equity correlations to rise. We believe this relationship is exacerbated by the new market ecology in which much of the daily trading is driven by computer algorithms using an increasing amount of leverage. Equity sell-offs thus trigger margin calls, leading to further sell signals causing a mass exodus of investors, akin to everyone running for the exit simultaneously.

- Low Volatility Fixed Income. Although low yielding and low duration fixed income securities of high credit quality may not make for interesting cocktail party banter, we believe portfolio stability is important in a market environment where volatility can suddenly escalate. For this portion of a fixed income allocation, the purpose is solely to provide a negative correlation to other parts of the portfolio and offset paper losses of higher-beta plays, should market shocks arise. From a total portfolio construction perspective, low volatility fixed income should help investors increase portfolio efficiency by attaining better risk-adjusted returns and Sharpe-ratios. Very often investors focus too much on returns without any consideration to how much risk each asset class adds to a portfolio. As a result, of disregarding risk, investors can often find themselves in crowded trades where many assets in their portfolios react similarly to macro-economic shocks and deleveraging.

Potential Investment Opportunities:

- BMO Short Federal Bond Index ETF (ZFS)

- BMO Short Provincial Bond Index ETF (ZPS)

b) Yield-Oriented Segment:

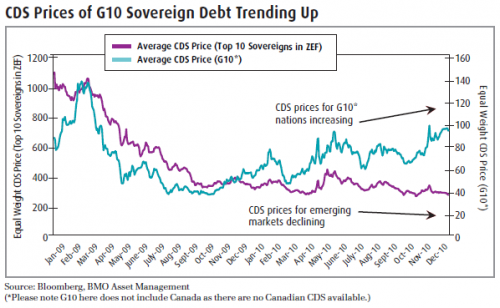

- Emerging Market Debt. Monetary tightening in the economies of the stronger emerging market players is expected to continue well into 2011. This means that key interest rates of some central banks may be on the rise, placing downward pressure on existing sovereign debt issues. However, new net issuance of sovereign credit is expected to decline in Emerging Asia and Latin America, the geographical areas in which tighter monetary policy is expected. We believe with this decreased supply of new issues coupled with increased demand from foreign investors searching for higher yields, the sovereign debt of emerging markets with strong GDP will continue to remain an attractive area. Unlike the U.S. situation where the private sector is more attractive than the public sector, we believe the reverse is true for emerging markets, given its current general focus on reigning in its equity boom. In addition, given the possibility of upside credit re-rating of emerging market sovereign debt on the back of declining credit default swap (CDS)5 prices and improving fundamentals of the stronger developing nations, we continue to like this area. As an example, on January 16, 2010, Indonesia’s credit rating was upgraded by Moody’s Investors Service based on “economic resilience” and an improving debt position.

Potential Investment Opportunities:

- BMO Emerging Market Debt Hedged To C$ (ZEF)

- U.S. High Yield Corporate Debt (Junk Bonds) The junk bond trade was a popular one coming out

of the crisis as we saw massive spread compression at play. Much of the low hanging fruit however is gone at this point, so the trade is now more of a yield play. For investors looking to time their entry points, they may want to initiate a position in junk bonds at points where the VIX Index is temporarily elevated, since credit spreads and market nervousness tend to be positively correlated.

Potential Investment Opportunities:

- BMO High Yield U.S. Corporate Bond Hedged

to CAD Index (ZHY)

Commodity Themes

Three main themes will likely move commodity prices higher this year. First, commodities will continue to be utilized as a hedge against fiat money in a world lacking a sound major currency. Second, the industrialization of Asian-Pacific and Latin American countries will continue to place a need on commodities, despite monetary tightening. Lastly, independent demand-supply imbalances of each individual commodity will play a role in pricing. We believe this last factor will play an increasingly important role as the year progresses, as QE2 moves further into the rear view, commodity differentiation will become increasingly important.

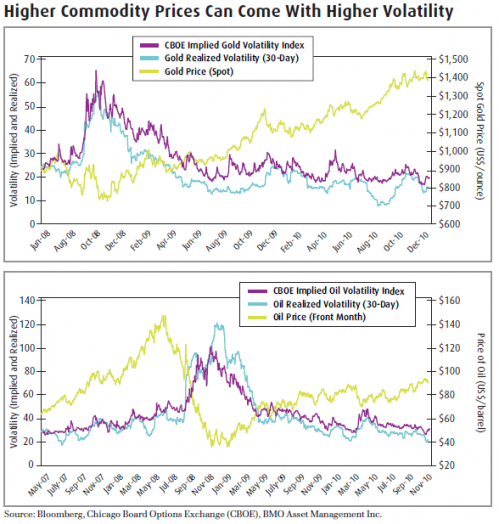

Commodities are highly sensitive to market sentiment and as we are anticipating sudden upward volatility shocks and changing sentiment, we expect commodity volatility to follow suit. The trading ranges of most commodities could increase, reflected through wider Bollinger bandwidths6. Although, higher commodity prices have come with lower implied and realized volatility post-crisis, higher commodity prices in 2011 could come with higher volatility similar to its pre-Lehman behaviour.

- Long Agricultural Commodities The world is getting smaller, perhaps not literally, but it may certainly feel like it. Global population is set to hit seven billion people at the turn of 2011-2012. More importantly is the location of this population growth; areas of rising income. This trend will continue to place upward pressure on soft commodity prices. The recent flood in Queensland, Australia and dry spells in Argentina and Northern Brazil could further exacerbate demand-supply imbalances in commodities such as wheat, soybeans and corn.

- Small-Cap Commodity companies will continue to be M&A targets As we mentioned in our U.S. equity commentary, merger and acquisition activity is on the rise. Much of that deal flow has been in North American small cap commodity companies. We were correct in being very bullish on junior commodity companies since the beginning of 2010 and we continue to like this theme. Strong cash balances has made it easy for companies to acquire junior commodity companies, while low interest rates and strong junk bond demand has made cash readily accessible. Moreover, the reflation trade has benefitted both small-caps and commodities in particular. Progressive stop orders or the use of a constant dollar exposure on the upside are recommended with this trade to protect profits that may arise.

Potential Investment Opportunities:

- BMO Junior Gold Index ETF (ZJG)

- BMO Junior Oil Index ETF (ZJO)

- BMO Junior Gas Index ETF (ZJN)

- Copper Supply Constraints Expected The International Copper Study Group (ICSG) is forecasting a deficit of approximately 400,000 tonnes in the red metal in 2011. This outlook is based on improving economic activity and operational constraints and cutbacks that limited mine production in 2010. We have also noticed that copper inventory levels at the London Metals Exchange (LME) are down significantly from its 2010 peak

Potential Investment Opportunities:

- BMO S&P/TSX Equal Weight Global Base Metals Hedged to CAD (ZMT)

Currency Themes

While country balance sheets and fundamentals will play a part in currency valuations, carry-trades will continue to explain a significant portion of the movement in currency cross-rates. Funding currencies such as the U.S. dollar and Japanese yen have shown a tendency to rise with risk-aversion, while currencies such as the Canadian and Australian dollar are more correlated with the market’s appetite for risk. The currency themes we mentioned last year are still in play. One factor we expect to be more pronounced in 2011 is the tug-of-war between increasing interest rate differentials and talks of currency intervention. As we previously mentioned, we would not be surprised to see sudden upside shocks in the VIX Index and as such, see funding currencies rally at those times. As we correctly forecasted last year, we continue to expect currency volatility to remain erratic and therefore currency-hedged products should be utilized not as a directional view on the Canadian currency but to reduce portfolio volatility attributed to currency.

In summary, we believe equity markets will further improve in 2011, but we stress that investors should keep risk in check as strong “risk-on” rallies will encourage investor greed only to be interrupted by “risk-off” corrections. With low yielding bonds forcing investors to allocate assets to higher beta fixed income which reacts to positive and negative headlines in the opposite direction to traditional fixed income, risk controls are an essential element to any portfolio. Additionally, as global economic conditions improve, intra-market correlation can loosen, making sector allocation more important in adding alpha to a portfolio.

Footnotes

1 Quantitative easing (QE): A government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

2 Tail Risk: A form of risk that arises when the possibility that an investment will move more than three standard deviations from the mean is greater than what is shown by a normal distribution.

3 Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line”, is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

4 Relative Strength Index (RSI): A technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset.

5 Credit Default Swap (CDS): The buyer of a credit swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the product. By doing this, the risk of default is transferred from the holder of the fixed income security to the seller of the swap.

6 Bollinger BandWidth is an indicator that is a measure of a security’s realized volatility. A Bollinger Band is typically set at two standard deviations above and below a moving average. Therefore, the wider the Bollinger Bandwidth, the higher the realized volatility of a security.

Download [PDF]

Copyright (c) BMO ETFs