by Mark Spina, Russell Investments

It’s the beginning of the year and markets have been volatile. You’re thinking about client reviews and outlooks, and the fee discussions that may come along with those meetings. As you prepare to step into that conversation, remember one thing: Your job is to help your clients stay focused on the outcome.

Our global market outlook for 2019 makes it a safe bet that we won’t be experiencing the same kind of bull markets some of your clients may have come to expect, based on returns for the past 10 years. But that’s why we believe a long-term, outcome-oriented approach is more vital than ever for advisors.

It’s time to arm yourself with the right strategies. With 2019 still in its early days, here are the top five actions we believe outcome-oriented advisors should do this year.

1. Rephrase the question – A typical conversation with a client can go like this: “Markets look a bit dodgy this year. Should I be in more gold, more cash, or more bonds?” Maybe you’ve even trained your clients to embrace model portfolios, so they ask, “Should I move from a growth model to a balanced model?” Either way, this is your chance to shift the question. A financial plan should never be led by product or asset class. The guiding question should always be: “What outcome are you trying to achieve?” Defining the outcome—or reminding your clients of the already-defined outcome—changes the conversation.

Tim Halverson, one of our regional directors, says it this way: “When I work with our premier advisors, one thing I notice is that they always start their conversations with the outcome and back into the solutions. Getting to retirement, paying for college, or creating a sustainable income are outcomes that investors really understand. Only when they come to a clear understanding of that outcome, is a solution then proposed.” Tim also reminds us that the financial plan is a very important part of the goal-oriented process: “When clients are worrying about the outcome, get them back to the plan.”

2. Track your value-adds – If your client is saving today for a goal that is decades away, how do you show the value you delivered in the short-term? That’s where the temptation to focus on near-horizon performance benchmarks comes in, but we believe such a short-term focus can bump a long-term strategy off-track. Instead, look at the tangible, meaningful milestones you delivered for your specific client over the last 12 months. Perhaps you established a trust for them. Or maybe you helped to ensure their estate plan reflected all of their investment holdings. Did you establish clear beneficiaries for their IRA? Or did you hit a funding milestone on a 529 plan? Maybe you coached them into increasing their contributions toward retirement savings. It doesn’t hurt to document and it can help set up the next step in the strategy.

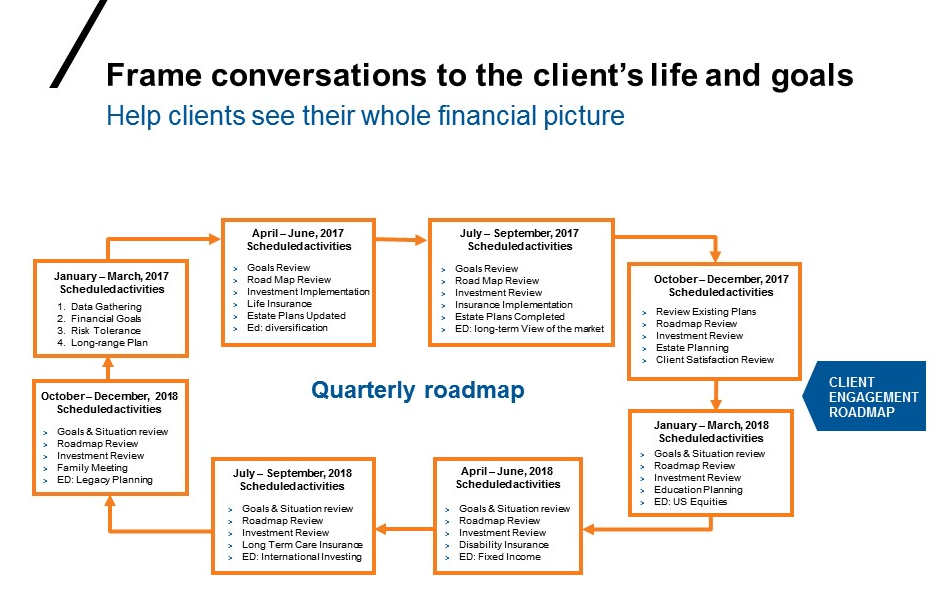

3. Map your engagement – One of your biggest challenges as a financial professional is to help your clients stay focused and on course. Despite your best efforts, clients sometimes struggle to remember your valuable guidance. No matter how strong the message, clients can be easily frustrated and diverted. Some may be inclined to make emotional, sometimes rash, decisions based upon what is happening at the moment, losing sight of where they have been or where it is they desire to go. A solution to this common problem is to provide them with a Client Engagement Road Map. The Client Engagement Road Map positions you as the coordinator of your clients' multi-faceted financial affairs. Helping your client articulate and then document their goals and objectives is a critical function. Ask your Russell Investments representative for access to this easy-to-use tool.

4. Measure client satisfaction –When it comes to delivering on investor outcomes, how are you measuring your clients’ satisfaction? More and more of our premier advisors are forming formal client advisory boards, where they check in with that board in a structured fashion to see how they’re delivering against their promise. This may seem like a daunting task, but it’s simpler than it sounds. We recommend five members and five steps: (1) Select five of your best clients, who generate revenue and share your investing values. (2) Set the stage for your meetings, with clear expectations, a welcoming social setting, and a twice-a-year schedule. (3) Make the most of your meetings, with advance notice, a clear agenda, and no more than five questions—that create answers you can act upon. (4) Follow up on the meetings, by thanking each board member in writing, summarizing your findings, and providing a high-level plan on how you’ll respond to the findings. And finally, (5) act on their words. Demonstrate that you’ve listened by implementing changes according to your findings, so that your practice is aligned with the needs of your top clients. And your response to those conversations may be among your best opportunities to exceed your clients’ expectations and build deeper commitments.

5. Set outcomes for yourself – An outcome-oriented approach is not just for investing. We recommend the same approach for yourself and your practice. If a focus on delivering outcomes is part of your offer, then your personal and professional goals should reflect that. Make sure your goals are specific, attainable and measurable. A meaningful goal, for example, could be, “I want to shift 30% more of my clients away from a benchmark-measured approach to an outcome-focused approach, by using more model portfolios.” Other goals could include AUM milestones, or referral generation, but your goals should all be pointing toward the long-term outcome you desire for your practice. Where do you want to be in five, 10, or even 20 years? What are you doing now to reach your own outcome? Digging deep into your own long-term goals will help you in your own mind shift.

The bottom line

As you prepare for client conversations this year, remember your job is to help your clients stay focused on the outcome. Using the top 5 actions outlined above can help you achieve this. We believe the more you live and breathe an outcome-oriented philosophy, the more your clients and your practice will benefit.

Copyright © Russell Investments