by Ryan Detrick, LPL Research

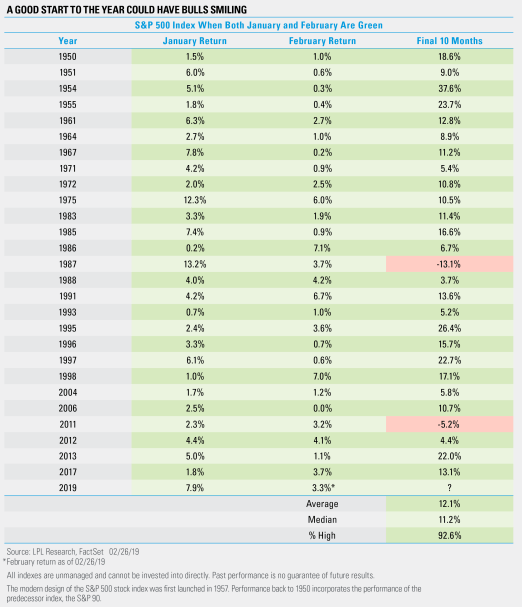

After gaining 7.8% in January, the S&P 500 Index has added another 3.3% so far in February for a grand total year-to-date return of 11.4%. With two days to go, currently this is the best first two months of the year since 1987.

As we noted in Five Key Questions, this rally could be extended near term, but we continue to believe eventual new highs are more likely in the second half of this year. Here’s the catch—to see stocks up in both January and February could be a good sign for eventual gains in the rest of the year.

“Think about it like this: Since 1950, the S&P 500 has kicked off the year higher each of the first two months 27 times,” explained LPL Senior Market Strategist Ryan Detrick. “And incredibly, the final 10 months finished higher 25 of those times!”

As our LPL Chart of the Day shows, the final 10 months gained a very impressive 12.1% on average when each of the first two months started the year in the green, well above the average final 10-month return of 7.6%. In other words, strength to kick off a year can potentially equal continued gains.

Copyright © LPL Research