by Richard Turnill, Global Chief Investment Strategist, Blackrock

2019 is off to a bumpy start, and the volatility is likely to persist. Against this backdrop, Richard shares three ideas for building portfolio resilience.

Late-2018 volatility looks likely to persist for both stock and bond markets, reflecting greater risk as 2019 gets underway.

We expect a slowdown in global growth and corporate earnings this year, though not an end to the ongoing expansion. Yet markets are still vulnerable to earnings- and growth-related fears. Uncertainty around U.S.-China trade frictions, a possible pause in Federal Reserve rate hikes and European political risks are also likely to cause bouts of investor anxiety as key March dates near.

Our base case is for low, positive returns for fixed income and equities in the year ahead, with stocks modestly outperforming bonds. Cheaper asset valuations heading into 2019 lower the bar for positive performance, but rising risks argue for caution. Against this backdrop, we advocate that investors build more resilience into their portfolios, as we write in our 2019 Global investment outlook. Here are three ideas for how to potentially do that.

1. Think barbell.

Building resilient portfolios is about more than just dialing down risk. Overly defensive positioning can undermine investors’ long-term goals. The positive correlation between equity and bond returns in 2018 can be explained, at least in part, by rising uncertainty and tighter financial conditions, we believe. These risks look more priced into assets now and we expect growth to reassert itself as a driver of returns. This suggests to us that bonds should be more effective as offsets to equity risk in 2019—and calls for a bar-belled approach: exposures to government debt as a portfolio buffer, coupled with high-conviction allocations to assets that offer attractive risk/return prospects. See point #3 below.

2. Consider allocations to quality bonds.

We see U.S. government bonds as a key source of income and portfolio ballast. Rising rates have made shorter-term U.S. bonds an attractive source of income. Short-term Treasuries now offer almost as much yield as the 10-year Treasury. That’s with one-fifth the duration risk, we calculate. We prefer short- to medium-term U.S. government bonds, but we are also warming up to longer-term debt as an offset to equity risk. U.S. government bonds overall can potentially help cushion portfolios amid late-cycle selloffs and risk-off events. Consider December’s market performance, when U.S. stocks posted their worst month since February 2009, while 10-year Treasury yields fell to the lowest levels since early 2018 (as prices rallied).

In addition, we see the Fed likely pausing its quarterly pace of rate hikes to assess the effects of slowing economic growth and tightening financial conditions, potentially creating a relatively benign environment for Treasuries. Our base case calls for two Fed rate increases in 2019, one in each half with a pause in March looking increasingly likely.

3. Target risk taking.

We advocate targeted risk-taking in assets where the risk/reward looks most appealing. We still prefer equities over bonds, although with reduced conviction amid rising risks. This underpins our preference for quality companies with free cash flow, sustainable growth and clean balance sheets. Quality has historically outperformed other equity style factors in economic slowdowns, our analysis shows. One sector where we find these quality characteristics: health care. The sector also shows low sensitivity to global growth, which historically has provided resilience in late cycle. Our view is supported by positive demographic and innovation trends, and a strong earnings outlook among defensive sectors. We favor pharmaceuticals, managed care and medical technology.

The U.S. remains a favored region. Valuations are high but we find prospects for earnings growth stronger than in other regions. We also see emerging market (EM) equities as good candidates for the other end of the barbell. Lowered EM valuations open an attractive entry point amid a solid earnings outlook and China’s focus on economic stabilization.

What to avoid? Assets with more downside than upside potential. We see many credit and European assets falling into this category. European stocks are an underweight given political risks and a fragile economy vulnerable to the effects of any recession; financials would be most at risk. Europe’s equity market is also heavy on lower-quality, cyclical companies that tend to lag in late cycle.

Bottom line

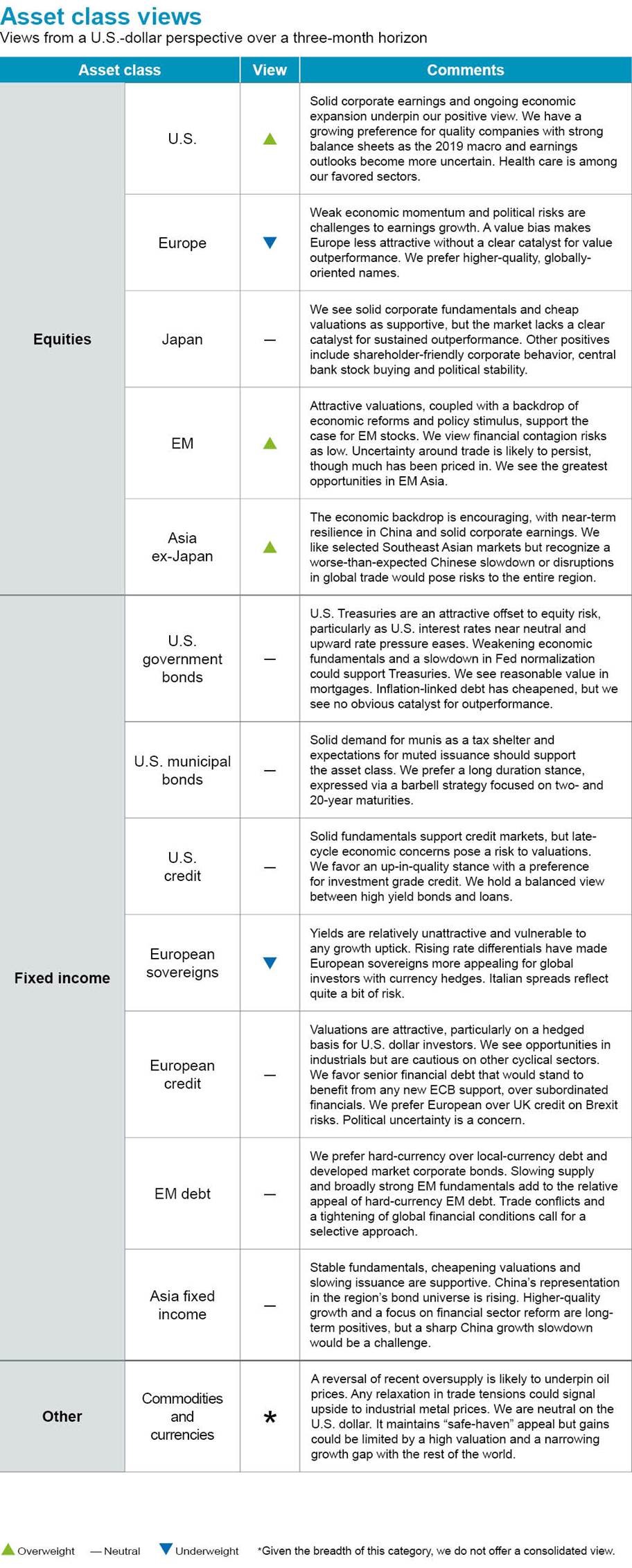

Increasing uncertainty points to the need for quality assets in portfolios—but also potential for upside should market fears ebb in 2019. Read more in our full 2019 Global investment outlook and find our asset class views in the table below.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog

Copyright © Blackrock