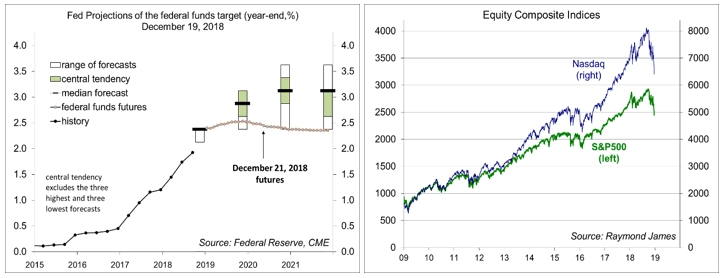

The Federal Open Market Committee raise short-term interest rates for the fourth time in 2018 and signaled more to come in 2019, albeit most likely at a slower pace. Market participants overly focus on what the Fed will do instead of why the Fed will do what it does.

In his post-FOMC press conference, Fed Chairman Powell noted that in September, many FOMC participants had expected that economic conditions would likely call for about three more rate increases in 2019, adding that “we have brought that down a bit and now think it is more likely that the economy will grow in a way that will call for two interest rate increases over the course of next year.” Powell’s characterization here contributes to the common misperception of the dot plot. The dots are the expectations of individual officials, which vary. There is no "consensus” – there is only the median forecast. The dots differ because some officials believe that the economy will be stronger than others.

Fed officials generally lowered their expectations for GDP growth in 2019 (to 2.3% from September 2.5%). That’s the median. Growth estimates of the 17 senior Fed officials (the five Fed governors and twelve district bank presidents) ranged from 2.0% to 2.7% (vs. 2.1-2.8% in September). The central tendency forecast, which excludes the three highest and three lowest forecasts, was 2.3-2.5% (vas. 2.4-2.7% in September). That's not a big change.

One of the surprising developments in recent weeks is that the Fed is much more optimistic than the market. The federal funds futures market is pricing in less than a 50% chance of a rate increase next year. Recent economic figures have remained consistent with moderately strong growth in the near term. But investors are focused more on the downside risks to the outlook. A recession could begin by the end of next year or in 2020, but that is not the base-case scenario.

The stock market is a leading economic indicator (it's one of ten components of the Conference Board's LEI), but it’s imperfect. The standard joke is that the stock market has predicted nine of the last five recessions (the better dig is that economists haven’t predicted any of them). Powell said that “we do focus on a broad range of financial indicators, and really, we don't obsess about any particular one. “He recognizes that "the Treasury market has come in some,” and “that’s consistent with a risk off feeling in the stock market as well,” but “we don't know whether that will persist.”

The Fed is not here to ease your pain. Many officials likely felt that the stock market (as well as other sectors) was overvalued in the summer. The Fed does not see the market decline as being driven by a sharp deterioration in the economic outlook. If that's the case, the correction should make valuations more compelling. The Fed could be wrong, but there’s little indication of that in the recent economic data. Of course, there are a number of downside risks heading into 2019.

Stock market participants have been anticipating a bounce for some time. January will be very important.

*****

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.