The big theme running through world markets this week is the continued divergence of US markets and the North American economy from the rest of the world. China sensitive markets remain under pressure as the prospects of another escalation of their trade war continue to increase. The US has threatened tariffs on another $200 billion of Chinese imports while China has threatened retaliation including potentially bringing in the World Trade Organization.

In addition to this, emerging markets continue to struggle with Venezuela’s crisis moving into the spotlight, adding to the woes of Turkey, Argentina, South Africa and others.

Investors who only look at North American markets have seen US indices at or near new highs may get the impression that everything is fine but overseas, European indices have been regaining their footing after a summer correction and in Asia, the Hang Seng is flirting with an official bear market designation of a 20% drop off the high.

At this point, capital looking for a haven still appears to be mainly flowing into the US, propping up US stocks, boosting the US Dollar and keeping US treasury yields in check. Commodity prices (except for oil) and other currencies remain under pressure. Even traditional havens like Gold and the Yen have been unable to keep pace with the US. It’s an interconnected world, and I’m torn between “eventually something has to give” and “the market can remain irrational longer than you think”.

In this issue of Equity Leaders Weekly, we compare the performance of emerging markets relative to the US market. We also take our monthly look at capital rotation between groups within the US stock market through the Sector Scopes feature of SIA Charts.

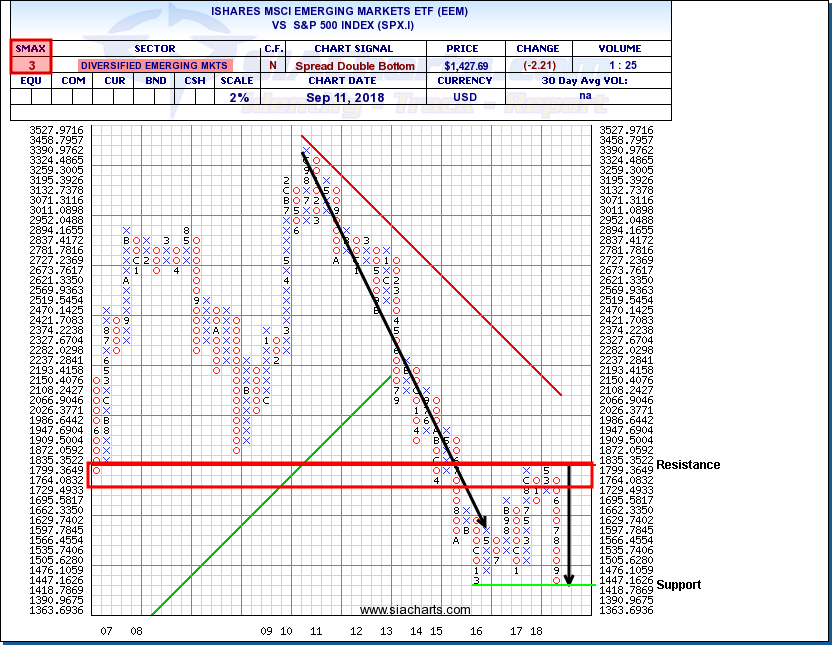

iShares Emerging Markets ETF (EEM) vs S&P 500 Index (SPX.I)

The relationship between the highly developed US stock market and emerging markets stocks can be seen as a measure of investors’ willingness or need to take on risk. For much of this decade, the Fed (easy money) propelled advance in US stocks had kept capital at home for the most part. Between the spring of 2016 and the spring of 2018, it had appeared that capital was starting to once again be open to seeking opportunities in emerging markets.

Over the course of the summer, however, the door has slammed shut on emerging market investments once again. US markets regained their footing and large cap US indices advanced to retest prior highs or break out to new highs. US gains appear to have been propelled at least somewhat by capital moving to the US and out of the China-led emerging markets selloff.

The ratio between emerging markets and US stocks has now dropped toward its lowest point in a decade, retesting its early 2016 low. While it is possible that emerging markets could continue to underperform, the ratio reaching an extreme level indicates a growing risk of a snap reversal. In that case, a sharp correction in US indices of say 10% in a month or a big short-covering rebound in emerging markets indices could happen without derailing the underlying US bull market trend.

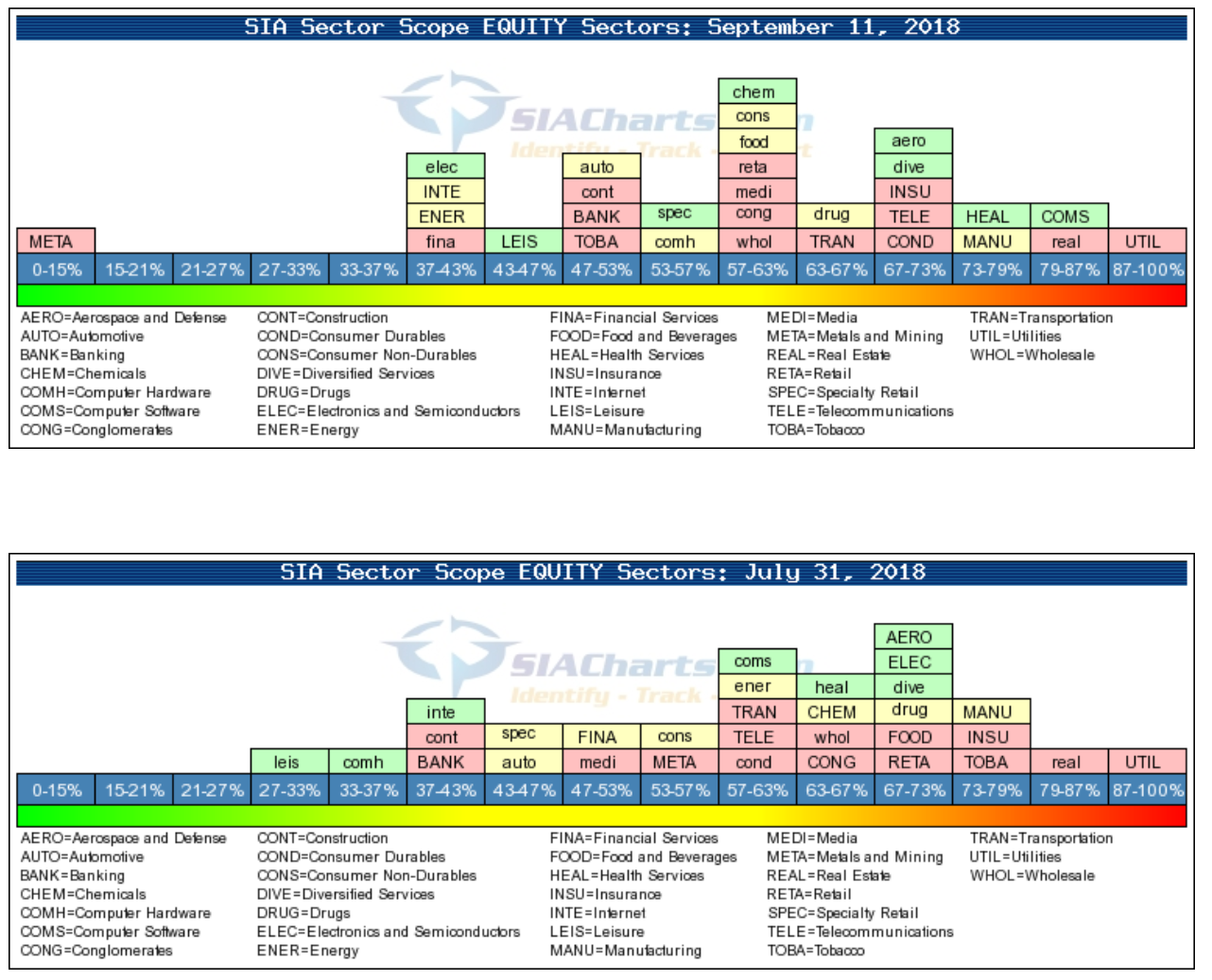

Sector Scopes Monthly Update

Sector Scopes reports, which can be found in the Markets section of the SIA Charts website, compares the Bullish Percent (percentage of stocks in a group on a Point and Figure bullish signal) of 31 sectors within the North American market. Not only does this provide a daily snapshot of which sectors are more or less popular and which may be overextended. Comparing Sector Scopes for different dates provides insight into capital flows over time.

Comparing the Sector Scopes reports from July 31st and this week shows a general but not extreme shift of most groups rightward which is to be expected in a rising market environment. The right side of the table is weighted toward sectors focused primarily on the US domestic economy including Real Estate, Utilities and Health Services.

On the other hand, falling commodity prices have hit resource stocks hard, sending Metals and Energy toward the left side. Technology groups have been mixed over the last month or so. Electronics and Semiconductors took a big plunge to the left while Internet continues to struggle. On the other hand Computer Software and Computer Hardware picked up support and moved rightward.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.