by Equities, AllianceBernstein

From the US-China trade war to the ongoing Brexit negotiations, global investors are grappling with a wide array of unpredictable events. Yet with the right approach, equity portfolios can confidently cope with the next bout of market uncertainty.

Equity investors are digesting many challenges to short- and long-term stability. Macroeconomic and demographic fault lines are widening, driven by unequal wealth distribution and political polarization. The US fiscal deficit, Chinese corporate leverage and the aging populations in Japan and Continental Europe signal trouble ahead. The question is: what will trigger the next earthquake, and when?

The answer is that nobody really knows. Even though investors are expected to have informed and insightful views on anything that can affect their portfolios’ performance, it is almost impossible to foresee how these types of events will play out. So don’t try to do it. Instead, portfolios should be positioned for the unknown by avoiding vulnerable exposures, choosing stocks with strong fundamentals and broadening perspectives on risk management.

Avoid Vulnerable Exposures

Most active equity managers deploy clear processes to identify opportunities and execute their strategies. The opportunity set is often limited to the portion of the market where investment managers believe they have an advantage, usually defined by a style or region.

As a result, some investing strategies may be more vulnerable to unpredictable events than others because exposures to specific industries and regions can become a liability. For example, if an investing approach creates a large position in European banks, Chinese exporters or Japanese domestic consumers, portfolio performance could be dramatically affected by the macroeconomic outcomes in those countries. In these cases, identifying macroeconomic, regulatory and political triggers would matter much more to performance than picking individual winners within the target group would.

This is a risky strategy when the outcome is entirely unpredictable. For example, concerns about the escalating US-China trade war might lead investors to trim their positions in exporting and cyclical companies. But that could be a mistake. If US tariffs ultimately prompt China to open up its economy and harmonize trade conditions, those sectors and companies might even outperform over time. So positioning a portfolio based on either outcome of a trade war is counterproductive, in our view.

Focus on More Predictable Company Fundamentals

There are ways to position portfolios in this environment, however. Start by defining a strategy that can combat the effects of market-trigger events by aiming to deliver alpha in all environments. When executed properly, this type of strategy should help a portfolio withstand market volatility and style rotations, which can devastate performance if left unchecked.

Fundamental business analysis makes the difference. By focusing on long-term, sustainable business models and fundamental, cash flow-based valuations across sectors and around the world, we believe a manager should be able to deliver consistent alpha from stock-picking that can withstand political risk.

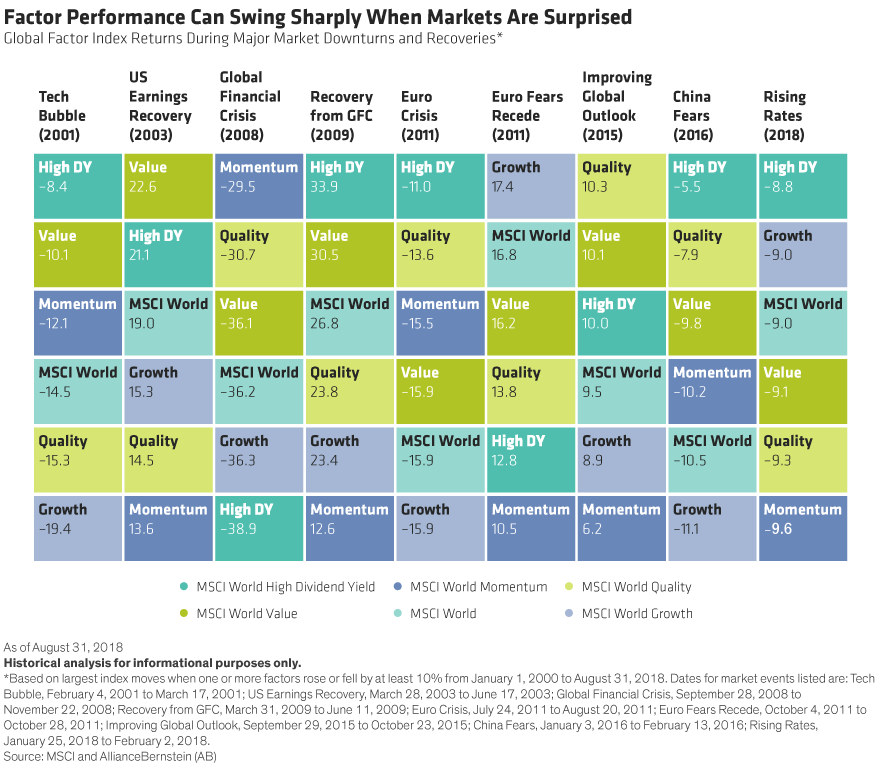

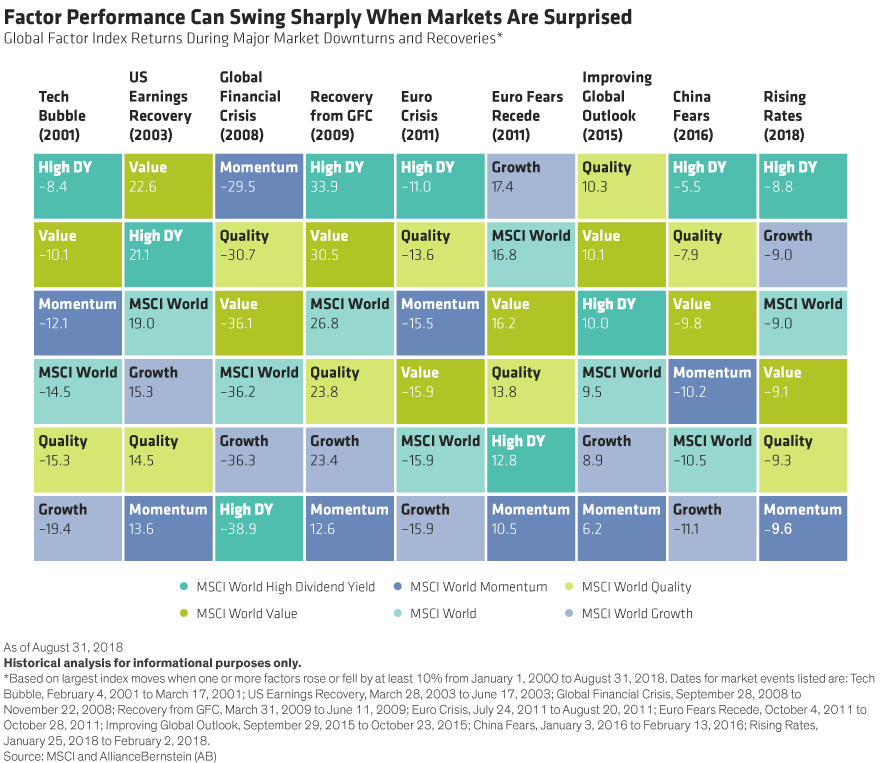

Style neutrality is also important. We believe that minimizing exposure to equity factors (or styles) is a key component of a core equity strategy. It’s true that exposures to style factors such as value, growth or momentum can be rewarding over the long term. But style performance often swings dramatically from year to year or even quarter to quarter. When markets are shaken by unexpected events—and in the recoveries that may follow—style performance patterns are highly unpredictable (Display).

Rethink Risk Models

At the same time, don’t rely on traditional diversification for protection. It’s easy to be lulled into a false sense of security if your portfolio has exposure to a broad array of regions, sectors and equity factors.

However, simple risk models may not be able to detect a portfolio’s Achilles heel. That’s because the next market crisis or correction will most likely be different from the previous ones. As a result, quantitative models on their own won’t necessarily identify the type of exposures that could pose a problem.

So what should investors do? Enhance your vision of the changing risk landscape by looking beyond standard risk models. That means integrating multiple quantitative factor risk models with historical event analysis and taking a qualitative approach to portfolio construction.

Attempting to predict the unpredictable isn’t a good way to prepare for the future. Company fundamentals aren’t certain, but they’re much easier to forecast reliably. Buying the stocks of companies that create real value over time and have the potential to generate high and sustainable cash flows—even in a cloudy environment—is the best way to position a portfolio for uncertain times ahead.

Past performance does not guarantee future results. The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Alpha, often considered the active return on an investment, gauges the performance of an investment against the market and is used as a measure of manager skill.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

Source: MSCI and AB

Copyright © AllianceBernstein