by Blaine Rollins, CFA, 361 Capital

If you are a bit more adventurous in your travel destinations, then Turkey is calling your name. And, if the financial markets gave you some lemons in your Emerging Market portfolio last week, it’s time to start thinking about getting to Turkey and buying a lemonade down on Calis Beach. You had fun going to Greece two years ago, right?

Okay, as we have discussed in the past, this is all happening as planned. As the Fed drains liquidity from the system and raises interest rates, other assets are getting squeezed. One of the best beneficiaries of zero interest rates were foreign governments who borrowed at low rates, not only in their own currency, but worse, in other countries’ currencies. And as rates rise and the U.S. Dollar, Yen and Euro appreciate, these Emerging Markets get squeezed like lemons. First on deck looks to be Turkey. Will Indonesia, South Africa, Russia, Argentina and Malaysia follow? The pressure is on. Fighting higher rates is not in an Emerging Market’s best interest or else their currency will go the way of the Turkish Lira. Better to be a tourist than an investor in the Emerging Markets right now. So go dial up ‘Skyfall’ on your Amazon video account, rewatch the opening sequence and then book your trip to Fethiye.

To receive this weekly briefing directly to your inbox, subscribe now.

The Deputy Prime Minister of Turkey warned you this week not to invest in Emerging Markets…

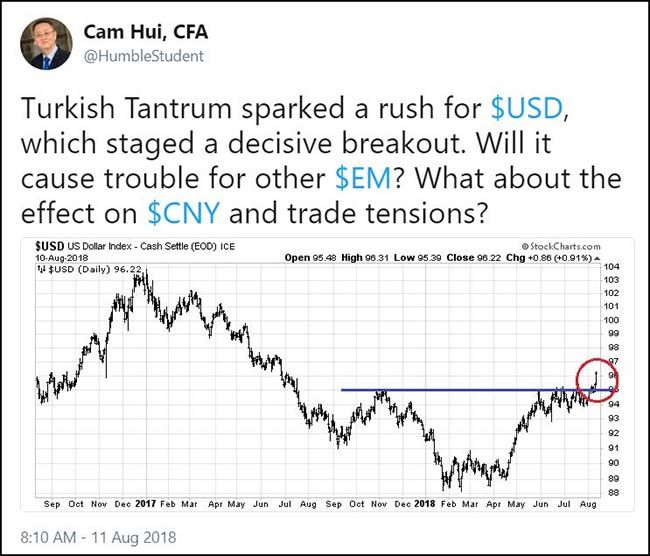

(@HumbleStudent)

Now a chart of the Turkish damage…

@Schuldensuehner: Chart of doom: #Turkey’s 10y yields keep rising as Lira gets hammered. 10y yields trade above 21% for first time.

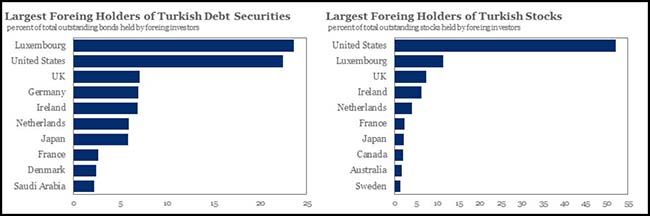

U.S. investors are among the largest foreign owners of Turkish debt and equity…

(@tiftikemre)

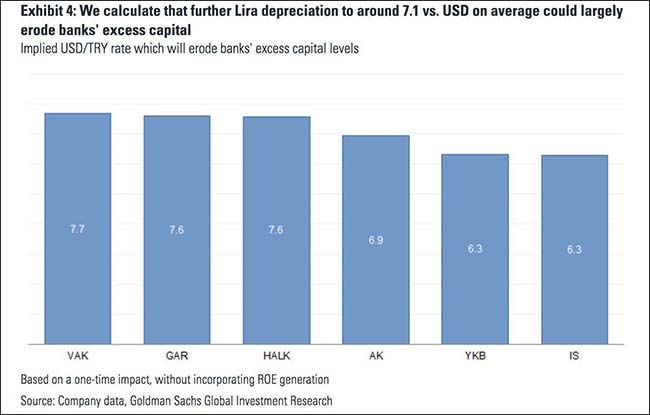

Looks like the Turkish banking system will need a capital injection…

@jsblokland: ‘Retweet’ of the Goldman Sachs chart indicating #Turkey’s large cap banks’ excess reserves will largely erode at #USDTRY > 7

Flight to the safety of the U.S. dollar only makes the situation worse for the Emerging Market currencies…

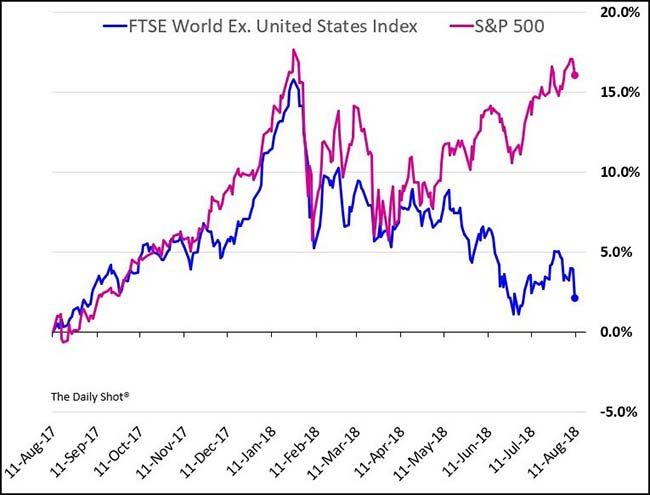

As well as putting further pressure on global market equities…

((SoberLook)

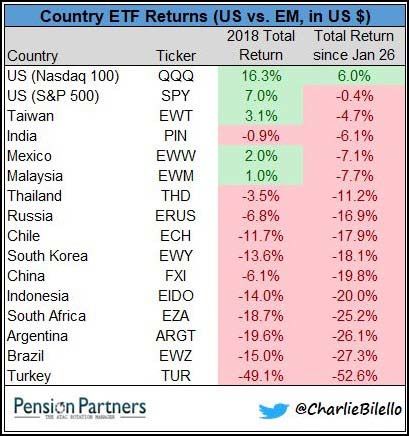

Emerging Market equities have ruined the performance of U.S.-based portfolios…

(Through 08/10/18)

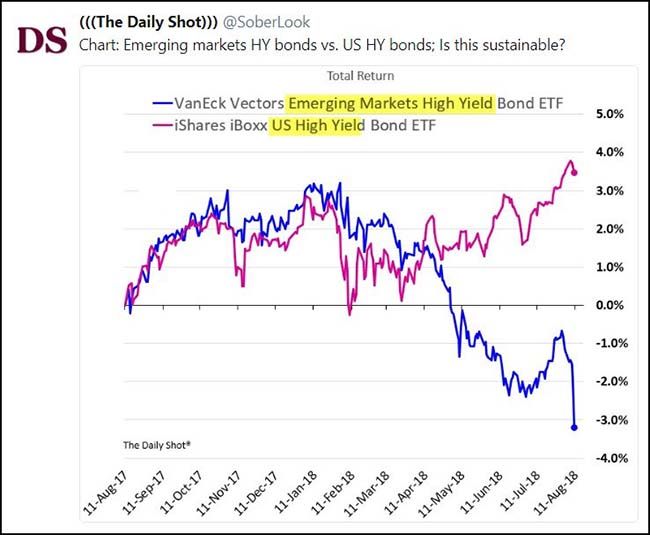

US High Yield bonds are just running away from EM High Yield bonds in the last four months…

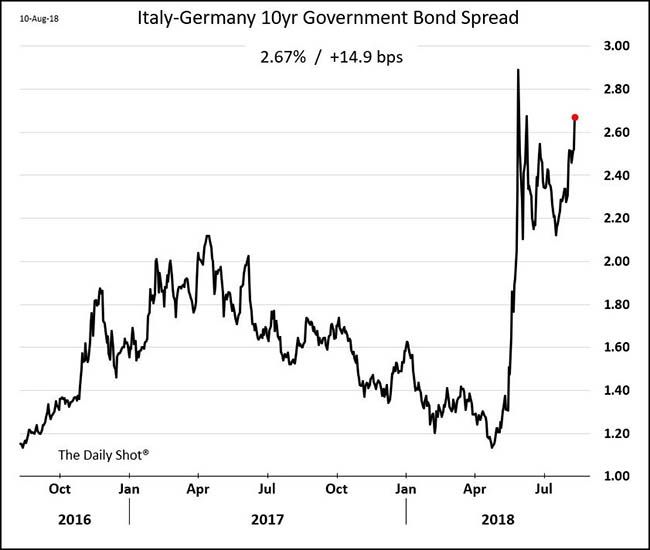

Turkey and EM risk is beginning to affect Italian spreads which is more problematic…

(SoberLook)

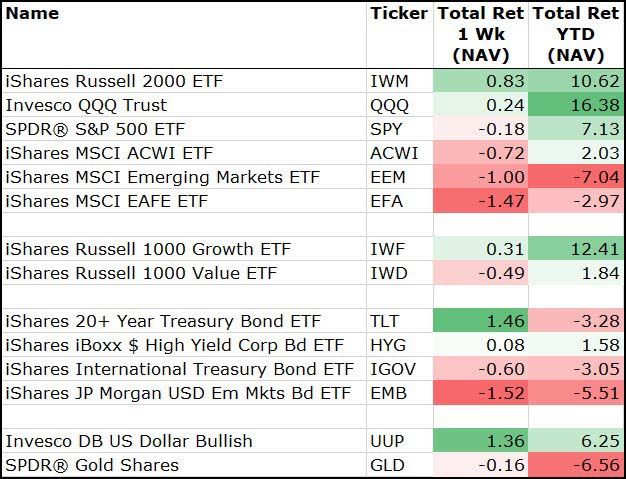

For the week, U.S. assets were the place to be…

And with Treasury yields falling, Growth outperformed Value.

(Through 08/10/18)

U.S. High Beta’s recent two-year run is now being tested…

(@JLyonsFundMgmt)

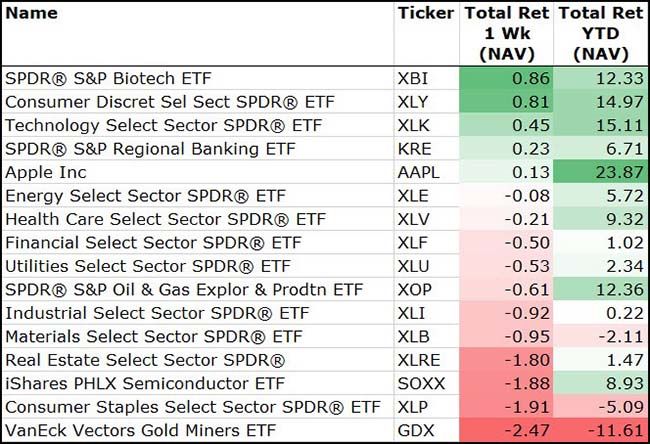

Among sectors, the Growth areas of Biotech, Consumer Discretionary and Tech led last week….

(Through 08/10/18)

I couldn’t agree with Liz Ann Sonders more…

Better or worse matters more than good or bad

Investors have a tendency to focus more on the absolute than the relative. But inflection points in the data matter and stocks tend to sniff those out before it becomes obvious in the levels of the data. It’s growing more likely that an upcoming “second derivative” change in U.S. economic growth will be of the negative variety, which could mean today’s suppressed volatility will become a thing of the past.

(Schwab)

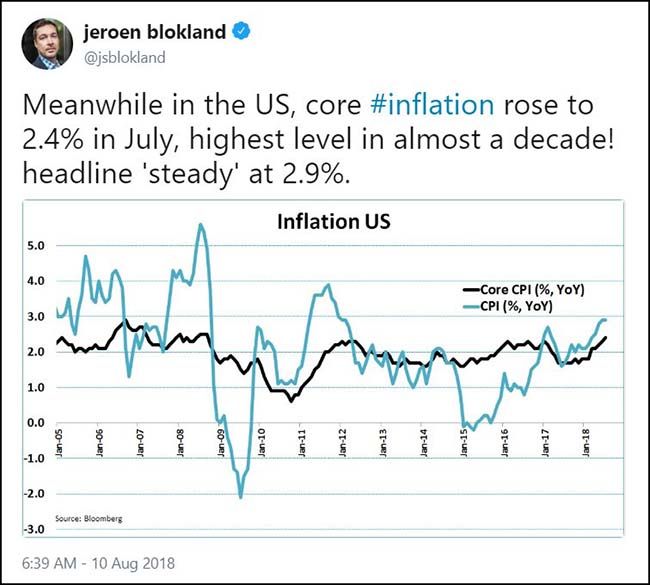

Inflation data hit last week and Core CPI continues to eat away at wage gains…

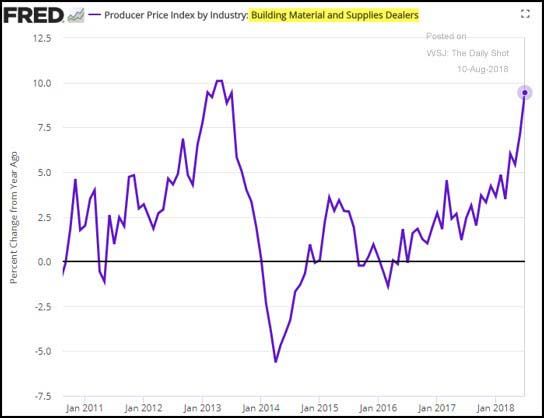

Speaking of inflation, go talk to your friends in the construction industry…

(WSJ/Daily Shot)

The Redfin conference call was very interesting if you have U.S. housing exposures…

Year-over-year U.S. home sales declined in June. We expect U.S. home sales growth to have improved slightly in July, then to weaken again in August and September.

What’s striking about this change is that it seems to have been driven by dissident demand from homebuyers, not just a low supply of homes for sale. Nationwide, there were still 5% fewer homes for sale in July 2018 than in July 2017. But in Seattle, Portland and San Jose where prices have increased the most, the percentage of homes selling in the first two weeks on the market declined in June from 61% to 52%.

And the percentage of listings that dropped their prices increased from 31% to 33%. June sales were down in these markets by double-digits and inventory was up also by double-digits. The trend is continuing in July and reports are now coming in from Washington D.C., Boston, Virginia and parts of Chicago as well, that homes there are getting harder to sell…

Important to highlight that Zelman & Associates notes that large slowdowns in homebuilder new order growth tends to persist into future periods…

“To put this quarter’s 500 basis point deceleration in order growth into perspective, over the last 28 years spanning 113 quarters, order growth has decelerated at least 500 basis points in 32 other quarters, or 28% of the time. In 69% of these instances, order growth decelerated further in the subsequent quarter, by an average of 1,000 basis points. In other words, periods of large deceleration in order growth more times than not are followed by additional periods of weakness.”

Either: 1) Chain Restaurants are losing to the Independents or 2) Americans have cut back on eating out this summer

The restaurant industry took a vacation in July. Again.

Same-store sales rose 0.5% in the month, according to the latest Black Box Intelligence index.

That was a slowdown of 0.5 percentage points from June. Worse, it came despite some easy comparisons from a year ago, when same-store sales fell 3%.

The numbers suggest that consumers are shifting their restaurant behavior in midsummer, or perhaps they are indicative of an overall industry slowdown that has been ongoing for three years now. There were no factors such as weather or other issues that could have pulled down sales during the month.

“We’re not able to solve the real underlying issues, where we keep losing traffic to competitors,” said Victor Fernandez, vice president of insights and knowledge at Black Box parent company TDn2K.

The biggest problem is a persistent decline in guest counts. Same-store traffic fell 1.8%. But on a two-year, stacked basis, it’s far worse than that: down 6.6%.

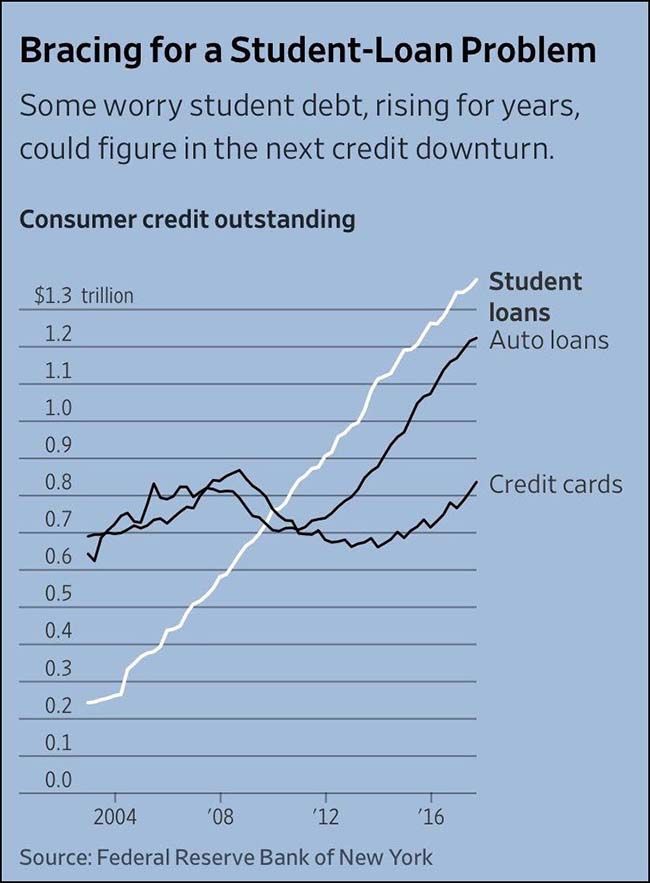

Student loans might be a problem in the future…

But would be more worried about the 50% jump in auto loans happening at the same time as the seismic shift in vehicle ownership demand.

(@PlanMaestro)

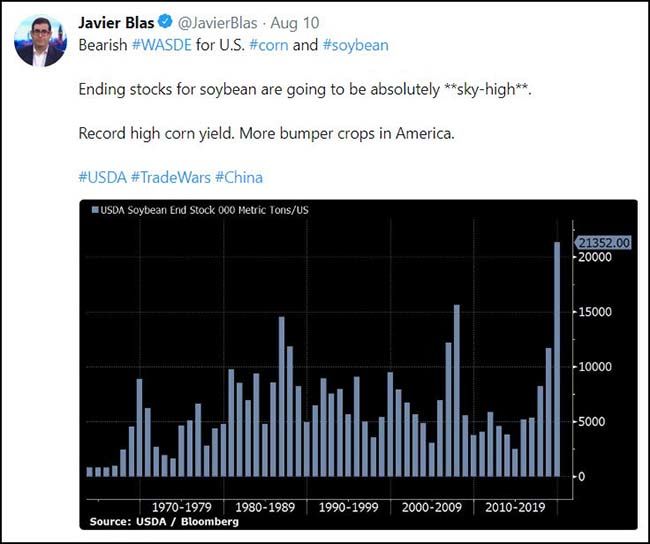

Grain supplies UP. Grain demand DOWN…

A tough week for grain farmers…

How fast can you say “Poof”?

A fast-growing digital currency that claims to be backed by U.S. dollars has become a cornerstone of the volatile cryptocurrency market. The problem: There isn’t hard evidence the cash supporting it exists.

Tether, whose main selling point is its tie to the U.S. dollar, has grown dramatically over the past year—its daily trading volume of around $3 billion trails only bitcoin’s $5 billion. Tether has also become a “crypto bank” for cryptocurrency businesses that have trouble maintaining real-world banking relationships, providing liquidity and a place to park assets, according to a new study from blockchain research firm Chainalysis…

Tether has never produced an audit showing it has the purported reserves. The company that controls tether maintains it has the reserves, yet it has never named the banks it uses to hold these funds, nor said where they are based and regulated.

Explains the death of the ‘Wingman’?

“In this country 35% of marriages are the result of dating apps and people don’t mind paying 20, 30, 40 bucks a month for the hope of finding someone that they can fall in love to marry.” –Match Group CEO Mandy Ginsberg

Copyright © 361 Capital