by Dylan Ball, Executive VP, Franklin Templeton Global Equity Group

It’s easy to understand why the return of equity market volatility in the first quarter of 2018 caused some consternation for investors. But Dylan Ball, head of European Equity Strategies, Templeton Global Equity Group, is largely unfazed. He outlines how he’s adapted his approach to what he considers to be more normal levels of volatility, incorporating deep stock research and an eye on risk/return dynamics.

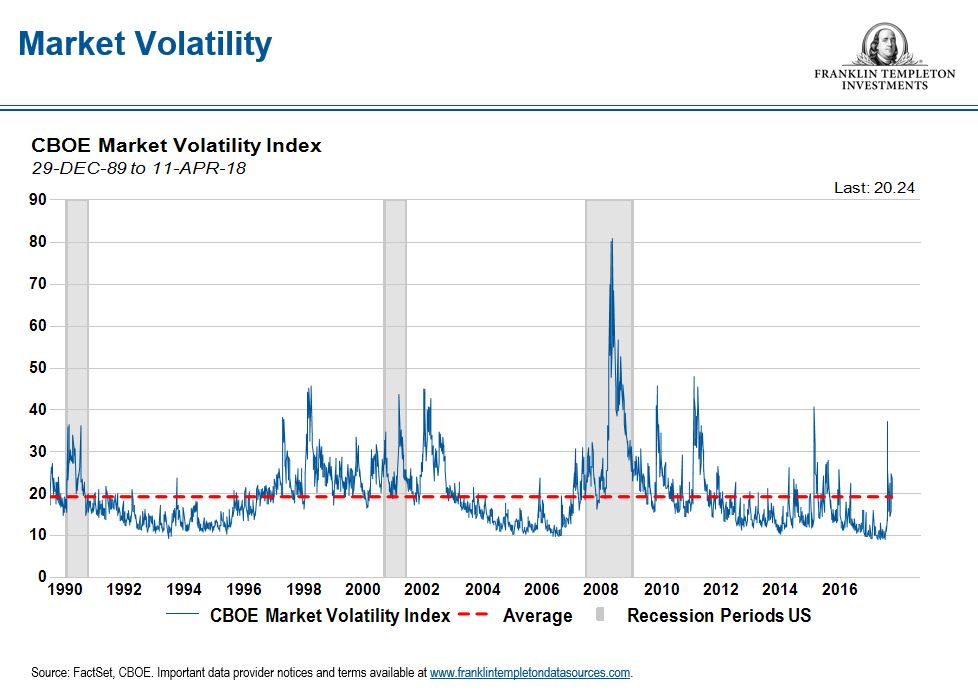

Unusually subdued levels of volatility during 2017 possibly lured some investors into a false sense of security. But as precipitous market moves in early February and late March suggested a return to more historically normal levels of volatility, the question for investors now is how to adapt their approach to the new environment.

An Alternative to Derivatives

To help address volatility, some equity funds use the derivatives market to hedge against downturns. For example, an investment manager may use put options to limit the downside, and protect returns. Put options give the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. Buying a put typically represent a bearish view on the security since there’s an expectation for the market price to decline.

But this type of insurance comes at a cost, and while derivatives may offer protection against a decline, they can also erode the potential upside.

We think there’s another way long-term investors can potentially manage volatility: using fundamental earnings analysis to look for those ideas with what we call an asymmetric upside/downside.

Attractive Upside Potential, Limited Downside Potential

In general terms, the investment universe is replete with companies offering attractive upside—stocks which have the potential to generate outsized returns. The problem is the vast majority of these ideas have a symmetrical downside—the equal potential for outsized losses.

As we build our portfolios, we’re looking for companies where we see asymmetric risks: for example, upside potential that is two or three times greater than the downside risk.

Clearly, stocks with that type of risk profile are hard to find. So, we have to roll up our sleeves and apply our analysis to as many stocks as we can.

Three Categories of Analysis

To do this, we break down our expectation of upside into three categories: earnings growth, valuation rerating and capital return (including dividends). In each case, we take a five-year view.

We take a similar approach to downside analysis. We examine the potential for earnings to collapse, valuations to fall to trough levels, or capital erosion through a dividend cut or rights issue over the next 12 months.

This analysis shows us whether a stock has an asymmetric upside/downside profile.

Compared with the use of derivatives, this use of fundamental analysis is a longer-term approach. It can be labour-intensive and to be most effective, we think it needs to be carried out before volatility strikes.

Jumping on Opportunities as They Arise

In our view, 2017’s low volatility was an ideal environment for picking up stocks which we felt could fare relatively well should volatility rise, and which we felt could also potentially reduce the overall risk metrics of our portfolios.

We found some opportunities among financial companies, including financial exchanges and brokerage firms or securities dealers, that have the ability to prosper even when volatility rises.

In addition, we believe companies with inflation-resilient pricing power could potentially offer opportunities to outperform amid a rising-volatility environment. For example, intellectual property rights and legal patents have traditionally offered support to certain health care names.

Lastly, rising commodity prices, particularly oil, have historically tended to be correlated with higher volatility. So, the opportunity to buy large integrated energy companies at discounts to their long-term average price also proved attractive to us in our search for potentially higher returns and lower risk than the benchmark.

Incorporating Analysis of a Full Range of Risks

Our approach reflects intense research analysis that goes deep into stock selection for our portfolios. In our view, the more risks that an investor factors into their investment case when purchasing a stock, the lower the impact volatility could have on their portfolio—as long as those risks have been discounted.

Conducting this kind of research can include factoring in third-party data where appropriate. For example, while our analysis has traditionally cast an environmental, social and governance (ESG) lens over potential investments, we also use outside analysis to inform our reckoning of ESG considerations that we’ve not already factored into our original investment case.

If that analysis uncovers a previously unconsidered risk, we may discount our earnings expectation for that stock accordingly.

In effect, we’re trying to get ahead of any ESG discount that the market might want to price in if a risk manifests itself. We believe that with effective research and analysis, put options can potentially reduce the susceptibility of our portfolios to volatility.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Value securities may not increase in price as anticipated, or may decline further in value. To the extent a portfolio focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a portfolio that invests in a wider variety of countries, regions, industries, sectors or investments. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

Investments in derivatives involve costs and create economic leverage, which may result in significant volatility and cause losses that significantly exceed the initial investment. Short sales involve the risk that losses may exceed the original amount invested. Liquidity risk exists when securities have become more difficult to sell at the price they have been valued.

Copyright © Franklin Templeton Global Equity Group