by Leola Ross, Russell Investments

In our previous blog post, we noted that active managers demonstrated the potential to generate strong performance, even with large AUM, across several equity and fixed income strategies and regions. Such an observation may be surprising given our early research on the “Perils of Success,” our continued preference for lower AUM managers and University of California Professor Jonathan Berk’s well-known 2005 conclusion that “competition between them increases the size of the fund and drives the alpha to zero. Instead the manager himself captures this value through the fee he charges.”

In all of these examples, the common link is that size alone can erode success. The most damning, however, is the Berk conclusion. Is it true? Can active managers kill the goose that lays the golden egg? And why would investors continue to fund the active manager once the manager has extracted all value?

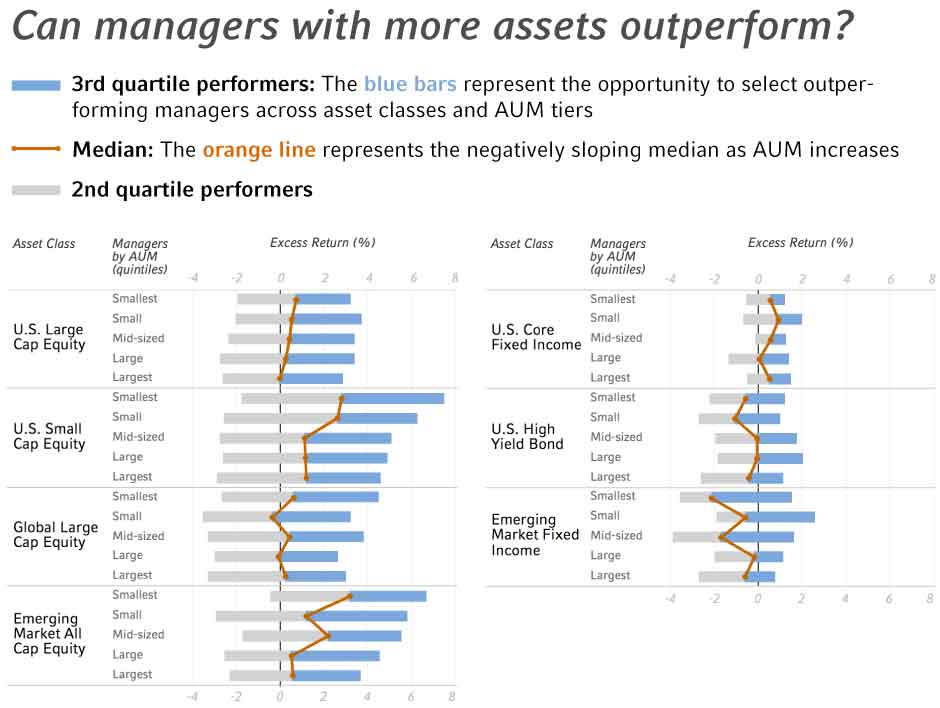

The charts from our last post suggest that some active managers, with large AUM, have produced strong excess returns. The charts, also shown below, depict interquartile ranges of 1-year returns (2001-2015), broken out by AUM quintiles, for active managers across various equity regions and fixed income strategies. If the amount of AUM really is such an issue—and if active managers were trying to capture all the value for themselves by taking on too much AUM—it is unlikely that we would observe fifth-quintile managers (across various asset classes and equity regions) with still mostly positive returns.

Source: Russell Investments. These are based on observations from products in Russell Investments’ active manager universes. The average number of products per period ranges from approximately 50 to 300 by region.

Why? We suspect that skilled active managers may carefully manage their AUM to have it both ways. A reasonable strategy for them is to collect profits while also providing value to their clients—in the long run.

So, if we have evidence of larger AUM managers producing strong returns (and indications that it’s in their best interests to do so), how do these active managers manage their success? Especially when market impact, costly trading and illiquidity are constantly nipping at their heels?

We typically see active managers accomplish this by increasing the number of holdings, reducing their active share, reducing turnover and moving toward more liquid stocks. Some managers do this better than others and, through our 48 years of researching managers, we’ve identified some of the better techniques for improving success. To accommodate AUM effectively, we prefer managers that:

- Manage growth, so that it doesn’t come too quickly

- Don’t hide growth in multiple, similar, products

- Stay in their habitat (capitalization, risk profile)

- Stay invested (less in cash)

- Play liquidity well, are mindful of their investment horizon

- Are mindful of cash flow requirements

- Employ wise use of derivatives and other capacity expanding securities

Ultimately, our conclusions support an investment community that is mindful of AUM limitations and has learned to manage AUM growth well.

*****

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page.

Investing involves risk and principal loss is possible.

Past performance does not guarantee future performance.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

This material is not an offer, solicitation or recommendation to purchase any security. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Please remember that all investments carry some level of risk. Although steps can be taken to help reduce risk it cannot be completely removed. They do no not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

Investments that are allocated across multiple types of securities may be exposed to a variety of risks based on the asset classes, investment styles, market sectors, and size of companies preferred by the investment managers. Investors should consider how the combined risks impact their total investment portfolio and understand that different risks can lead to varying financial consequences, including loss of principal. Please see a prospectus for further details.

Indexes are unmanaged and cannot be invested in directly.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments’ management.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

Copyright © Russell Investments Group LLC 2018. All rights reserved.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-11166

Copyright © Russell Investments