by Rob Lovelace, Equity Portfolio Manager and Chair, Capital International, Inc.

As 2026 unfolds, markets are once again climbing a proverbial wall of worry. Trade wars, geopolitical conflicts and fears of a bubble in AI stocks have shaken investor confidence at times, but markets have managed to look past these daunting events and forge ahead. Can this remarkable resilience continue?

In a wide-ranging Q&A, Rob Lovelace, equity portfolio manager and chair of Capital International, Inc. offers his view on where stock markets are headed, how changes in global trade are reshaping the global economy, and why rapid advancements in artificial intelligence (AI) are among the most compelling investment themes reflected in his portfolios.

After three years of double-digit returns, what’s your outlook for global equities in 2026?

My starting point would be: Does it matter that we've had three double-digit up markets? I'll just start with a blank piece of paper, which I think is a good way to start any year. Corporate profits in the U.S. are strong. They are generally concentrated in certain sectors, such as technology and related areas, but financials have also been strong. With higher interest rates, banks are generating better profit margins. The lending environment has improved. For all the talk about U.S. market concentration, it isn't just about technology. When I look at the market going forward, the key element is that underpinning of strong earnings. Earnings growth has been evident for the last three years, and it doesn't look like it's slowing down.

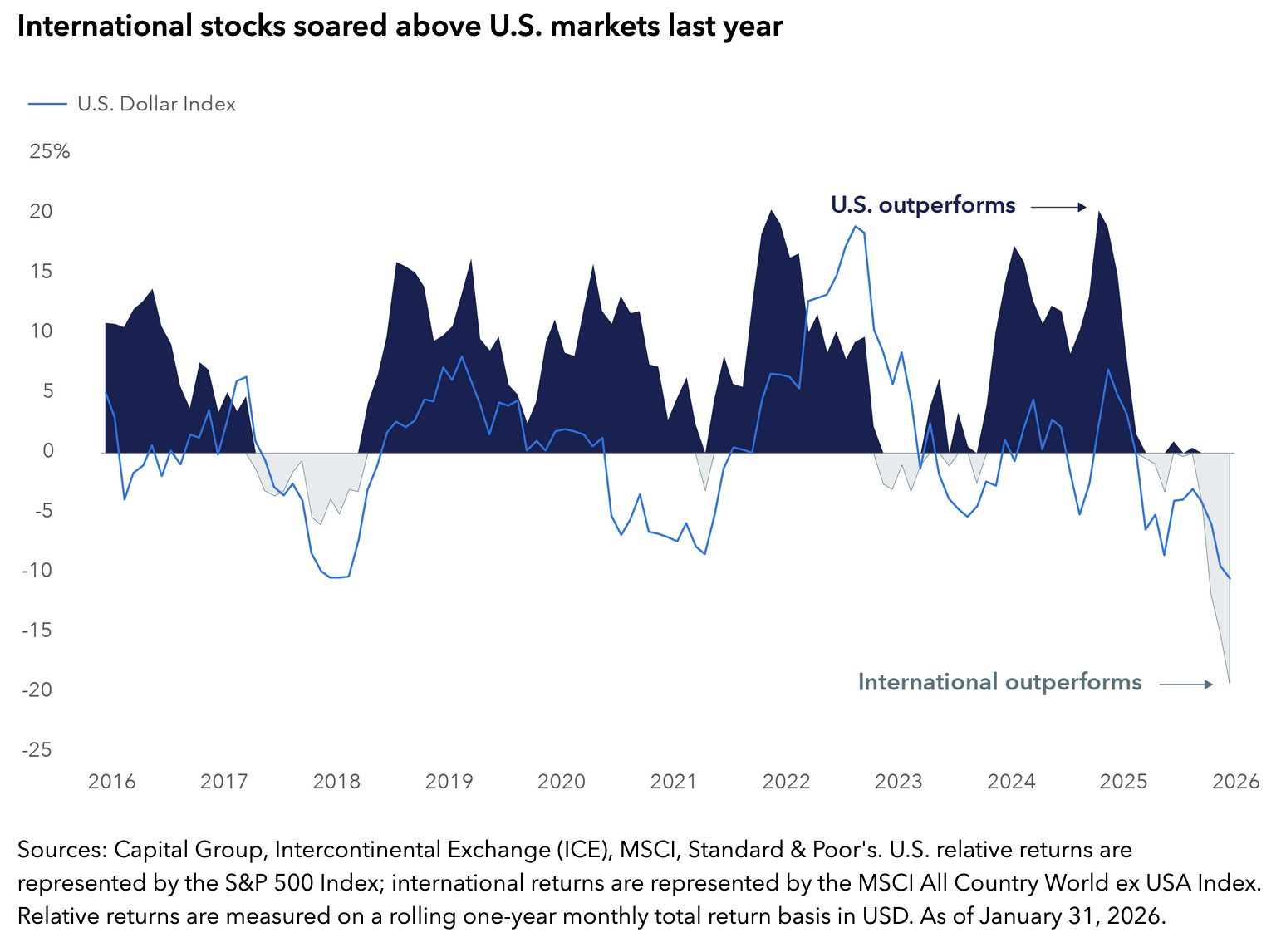

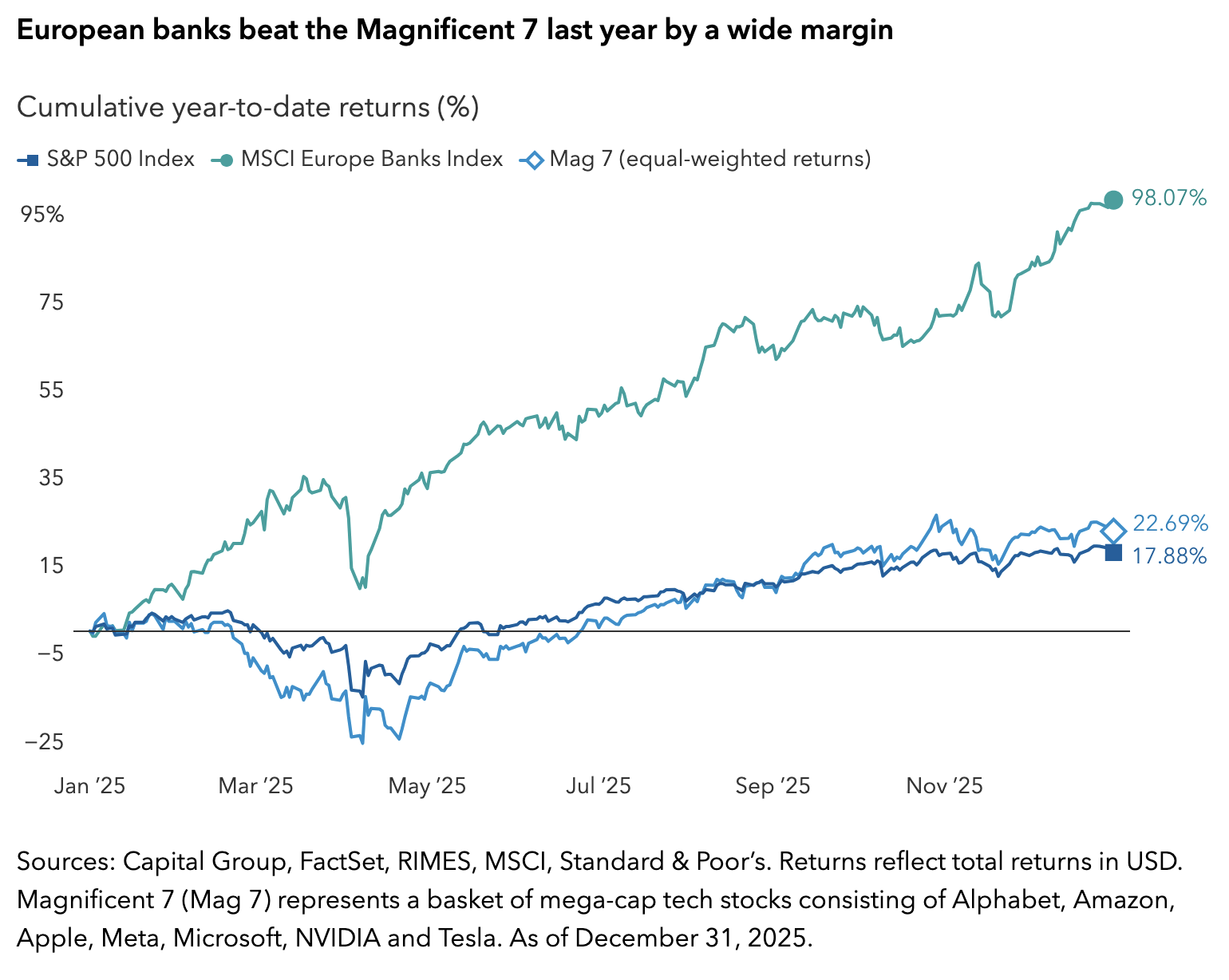

Outside the U.S., companies are scrambling to deal with a new wiring for global trade. There's a new order emerging. As that reordering happens, there will be winners and losers. Europe is realizing it must take care of itself. It needs more onshore manufacturing. Defence stocks across the board have provided some of the best returns as defence spending necessarily goes up. So far there are more winners than losers around the world and that is, in part, why I think non-U.S. stocks have outpaced the U.S. over the past year.

So with a blank piece of paper, looking at the pluses and minuses, there are enough pluses that say the market should be supported. The question then comes down to the multiple. What is the market willing to pay for those earnings? I'd rather have it pay for good earnings than not.

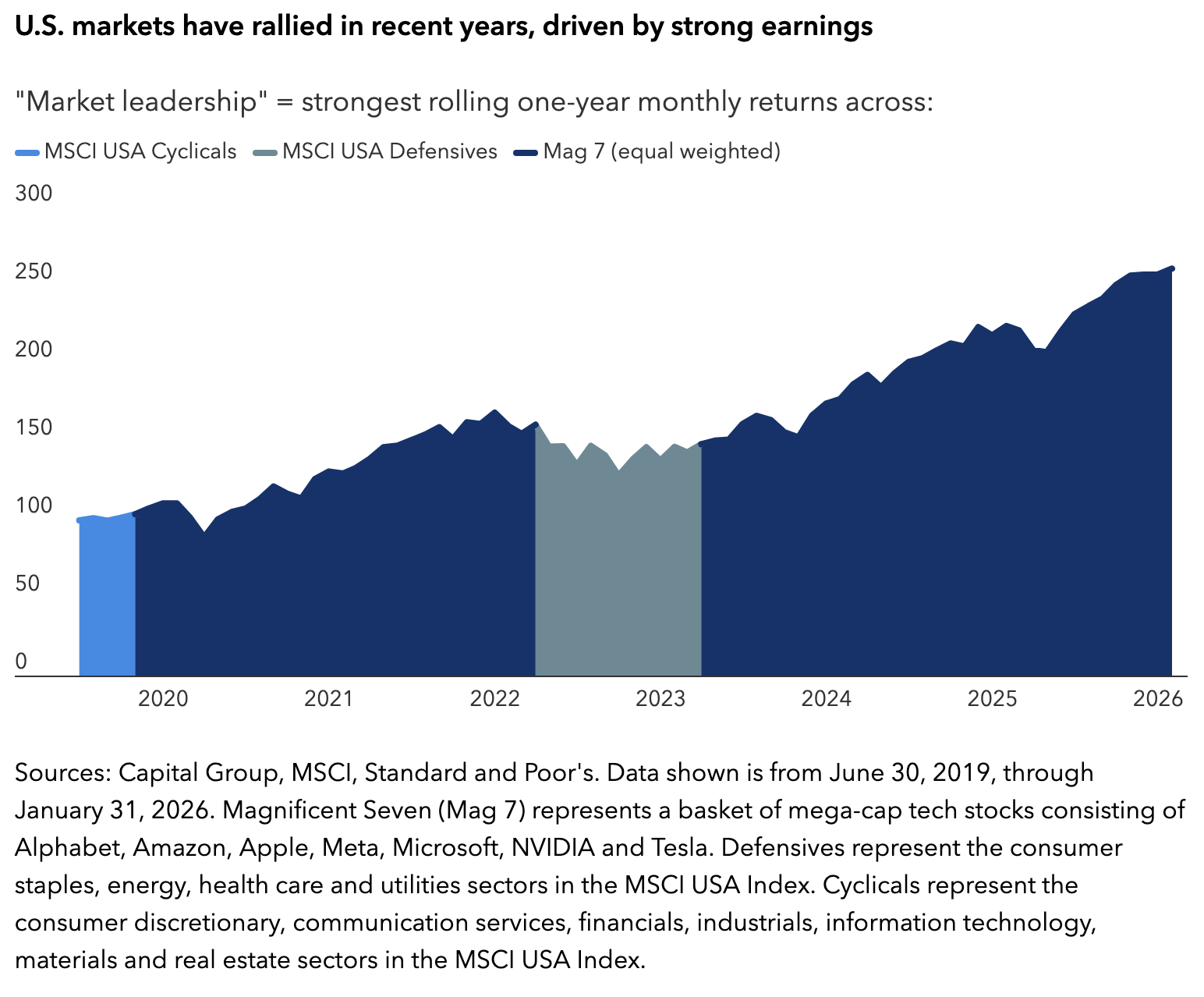

U.S. markets have rallied in recent years, driven by strong earnings

"Market leadership" = strongest rolling one-year monthly returns across:

An area chart showing S&P 500 cumulative total returns indexed to 100 on June 30, 2019. Based on rolling one‑year returns, the MSCI USA Cyclicals Index, representing the consumer discretionary, communication services, financials, industrials, information technology, materials and real estate sectors in the MSCI USA Index, led briefly in the second half of 2019 before the Magnificent 7 dominated most of 2020 through early 2022. The MSCI USA Defensives Index, representing the consumer staples, energy, health care and utilities sectors in the MSCI USA Index, led for much of 2022 amid sharply rising inflation, and Mag 7 leadership resumed from 2023 through January 2026.

Will non-U.S. stocks continue to outpace U.S. stocks?

For the last several years, the U.S. has had nearly twice the multiple as the rest of the world. I think that begins to balance out, both because earnings are catching up outside the U.S. and certainty in the investment horizon will be slightly better outside the U.S. It doesn't mean the U.S. market has to go down for the price/earnings multiple to come down. It just may not rise as much as earnings.

Two years ago, I remember sitting down, looking at the world, and trying to think how the U.S. could possibly be bumped out of its leadership role. I now know the answer to my question: It is a rewiring of the world trade and political order. Without judging that — without saying it’s good or bad — it’s a change, and it’s dramatic, and we're all sorting it out. But the U.S., so far, does not appear to be the main winner from that reordering. In 2026, I don't see anything that's going to start to change that. We'll have to see what happens with tariffs. But for now, U.S. policy uncertainty is reducing investment.

Which investment themes do you find compelling today?

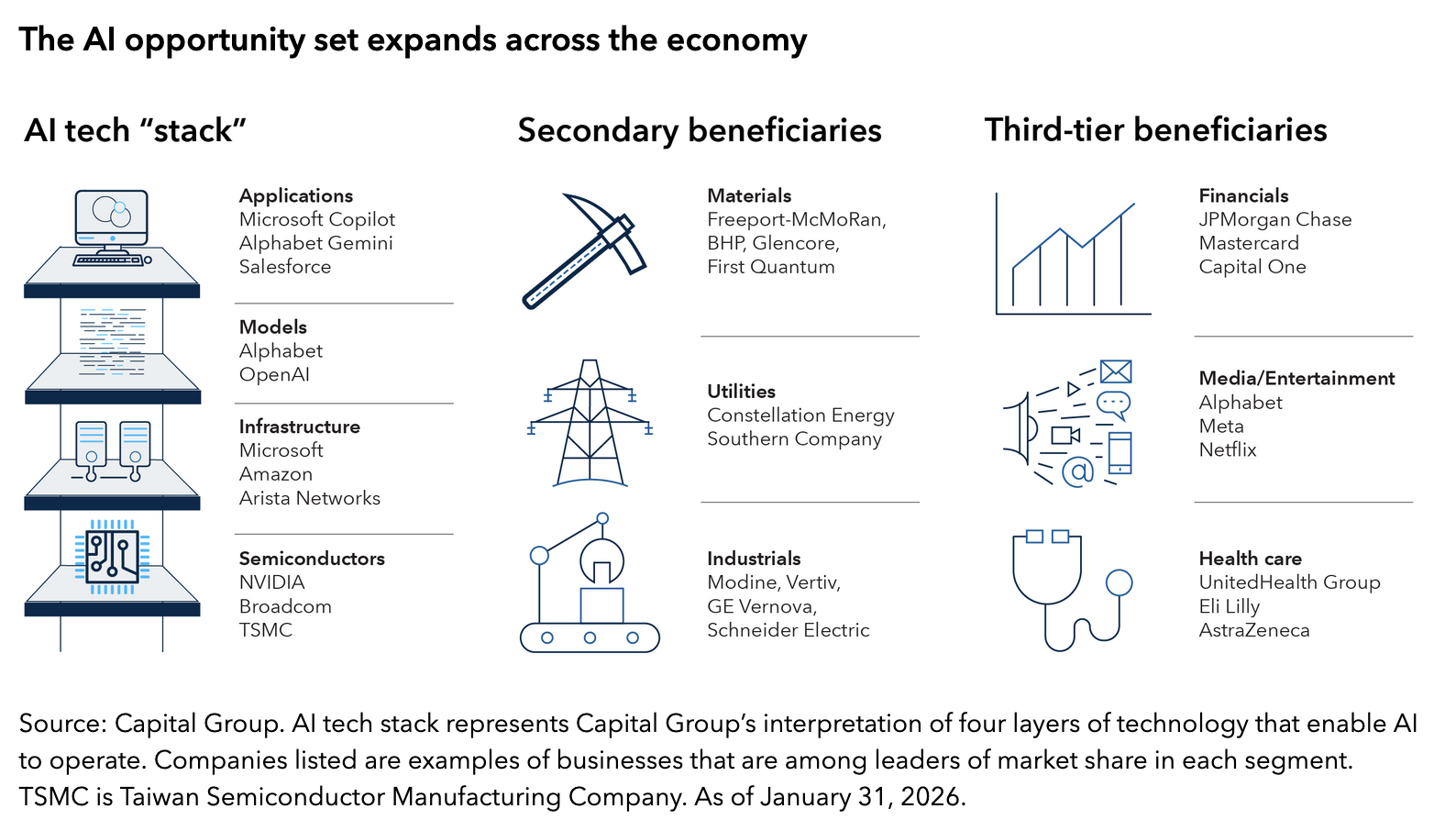

I have to start with the caveat that I, and Capital Group in general, tend to invest at the company level. As you look across a portfolio you do begin to see themes, but I want to emphasize I am not a thematic investor. Most of the leadership companies, particularly in the U.S., are focused one way or another on technology. Some develop software. Others make hardware or computer chips. Some are a mix of the two. Some specialize in IT consulting. And then there's an ancillary group dedicated to building data centres, which require a lot of cooling and electricity. There's a whole series of companies I would refer to as the technology stack. That, no doubt, is the biggest theme we’ve been talking about and will continue to talk about.

AI tends to dominate the conversation but remember, AI is simply a piece of the stack. It can be the software that we interact with when we use Google, our smartphones, or any type of device to do a search. But behind that, there are algorithms being written, and they are running on hardware located at data centres. Those buildings require cooling systems and electricity. You can invest in all those different pieces of the stack. The theme isn’t just AI, it’s the growth and strength of the technology stack itself.

A second theme we have focused on for a long time is health care and drug development. The health care sector matters a lot. We are now seeing the benefits of decades of work understanding DNA and how to develop new drugs. And we are just beginning to see the benefits of using AI in the drug discovery process, as well as other areas, such as accelerating the regulatory filing process.

Today, fewer than 5% of drugs under development are successful. That’s a terrible success rate. If AI can help identify earlier in the process which drugs are likely to fail and those more likely to succeed, we could potentially raise that success rate to 10%, which is still pretty terrible, but it's double the success rate we have now. That is likely to lead to an acceleration in drug discovery.

Health care stocks have come under pressure because of changes in the regulatory and pricing environment, but I don't think it changes the excitement we should have for an industry aiming to create more effective drugs that will help patients live better lives. We might even be getting closer to actual cures for certain diseases. Health is something we are all willing to invest in. Governments are also willing to invest in it. The money is there. It’s just a matter of finding its way to the right places.

A third theme I would mention — which was a surprise last year, but worth everyone’s attention — is financials. The rise in interest rates over the last few years benefited the financials sector. Not many other sectors celebrated it, but financials did. Financial institutions have been able to get back into the traditional banking market as lending rates increased. European banks particularly so due to more favourable interest rate and regulatory environments.

Are there any specific companies you find interesting?

One area that has my attention is technology consulting firms. They are considered AI roadkill because some people think we don't need coders anymore. We don't need anyone to come in and do the work. When we talk to these companies, our analysts are seeing that the business mix is shifting. The complexity of the business isn't getting any easier, and the complexity of AI isn't getting any easier. It's a real debate as to whether people will continue to outsource these services at the same level they did in the past.

CEOs are thinking they won’t be hiring as much in this area. But chief technology officers are more guarded, because they think we might just be hiring different types of consultants to help with this new technology. As of right now, I haven't seen anyone spend less money in this area. The overall theme is that hiring in the U.S. and around in the world may plateau for the next few years as AI works its way through the system. I think every company is adjusting with that in mind. My instinct is that the complexity of this work is going to shift somewhere else. We will need to hire people to do that other thing. And the savings from AI will be a fraction of what everyone is predicting.

Don’t get me wrong, I think AI will make us more efficient. But I think the actual financial savings of less head count or less technology spending — I just don't see that happening. I don't know if that's going to play out based on the most negative scenario. And, right now, these companies are definitely pricing in the most negative scenario. We’ve been doing a lot of work on Accenture and CapGemini. Both companies are already well positioned in the world. They're adjusting, learning and working with their partners to figure out how to be the right companies going forward.

As a former mining analyst, what are your thoughts on rising gold prices?

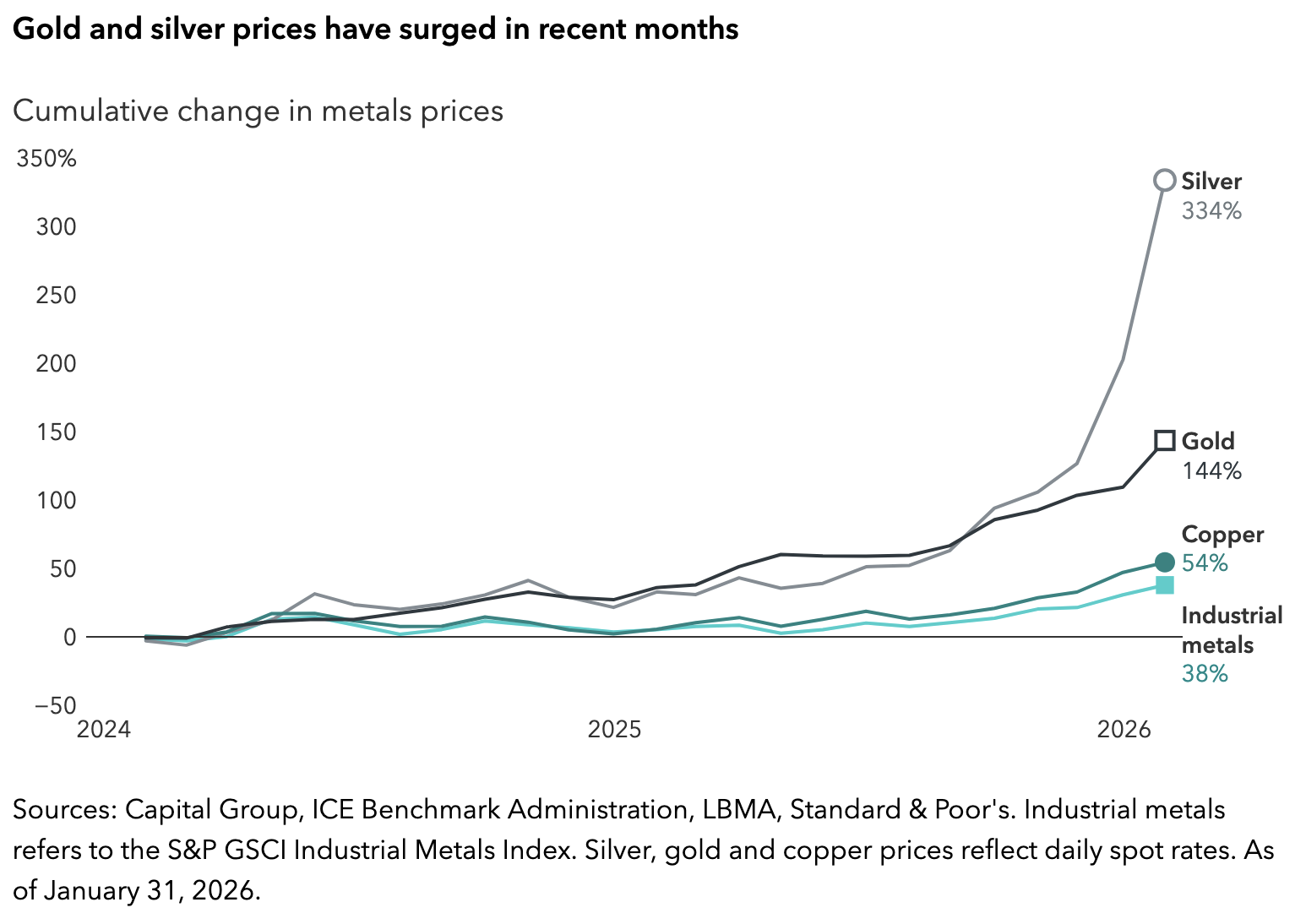

I learned early on as a mining analyst that there is about a 10-year cycle for metals and mining stocks. So what's led to the recent spike? There are base metals, such as copper and zinc. Then there are rare earth metals that are used in microchips. And then there are precious metals. Each one of those is a very different thing. Base metals tend to be about infrastructure and construction. Copper is used in wiring, for instance. So that's why copper and certain other metals are going up, but they're not as dramatic as the precious metals.

The rare earth metals are hard to find. While there are plenty out there, they're expensive and messy to extract. For a long time the U.S. decided to let other countries mine those materials. Now that everyone is worried about controlling the sources of these metals, we're trying to figure out how to bring the process back on shore. The precious metals used in technology — gold, silver, platinum, palladium — are a store of wealth. Their prices have risen the most over the past year.

With uncertainty about economic policies and inflation, there is a desire by investors to diversify portfolios into hard assets. That can be real estate, but it can also be things like gold and silver. As a geologist, I do find it fascinating that we spend so much time and effort to dig up a metal, refine it and move it, only to put it back underground and put a guard on it. That is its main purpose, but that's a separate story. What we’ve seen is a reaction in the precious metals pricing to scarcity value, a desire for hard assets, and concerns about fiat currency.

What lessons have you learned in 40 years of investing?

Well, there's certainly no shaking my faith that bottom-up fundamental research, focusing on a longer time horizon, and active management make a difference. These are the core principles we hold at Capital Group.

On a personal note, I have learned that sleep matters. So be sure to get sufficient sleep. I think especially my younger colleagues think they’ll somehow get to catch up on sleep in the future. The science is pretty compelling — that’s not the case. And being kind is something I've learned is worth the effort over my 40-year career.

Rob Lovelace is an equity portfolio manager and chair of Capital International, Inc. He has 40 years of investment industry experience (as of 12/31/2025). He holds a bachelor’s degree in mineral economics from Princeton. He also holds the Chartered Financial Analyst® designation.

Copyright © Capital International, Inc.