by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

Key takeaways

- For the better part of the last three years, technology stocks have outperformed their peers. More recently, the sector has been showing signs of struggle.

- Amid concerns around growth going into 2026, investors have begun rotating out of the heavily concentrated mega-cap tech names and into more economically sensitive sectors, such as energy, materials and industrials.

- However, as most tech companies continue to deliver strong quarterly earnings growth, Russ cautions that holding – not abandoning – these names is still warranted.

After more than three years of stellar gains, technology companies, or more specifically their stock prices, are struggling. Expectations for economic acceleration and overly concentrated portfolios have led investors to re-allocate to many previously ignored parts of the market. While I believe there are interesting non-tech opportunities and some re-allocation is justified. I don't think investors should abandon the sector.

It was a very good run while it lasted. Between October of 2022 and last November’s market bottom, the S&P Technology sector gained roughly 130%, outperforming the market by approximately 50%. For the leaders, the gains were far larger. The semiconductor industry advanced 275%, while market leader Nvidia surged by more than 1,500%. Given the length and magnitude of these gains, a little catch-up by the rest of the market appears warranted.

Beyond bargain hunting, there are at least two factors driving the broadening out of the equity rally and the recent underperformance by technology companies. The economy is accelerating, and the earnings gap between tech and the rest is narrower than a few years ago.

Following a brief collapse in confidence last spring, economic expectations are rising. According to Bloomberg, a consensus of economic forecasts for 2026 real GDP has risen from 1.4% last May to 2.1% today. As investors discount faster growth on the back of capital spending and tax refunds, they are more inclined to rotate towards economically sensitive sectors, notably energy, materials and industrials.

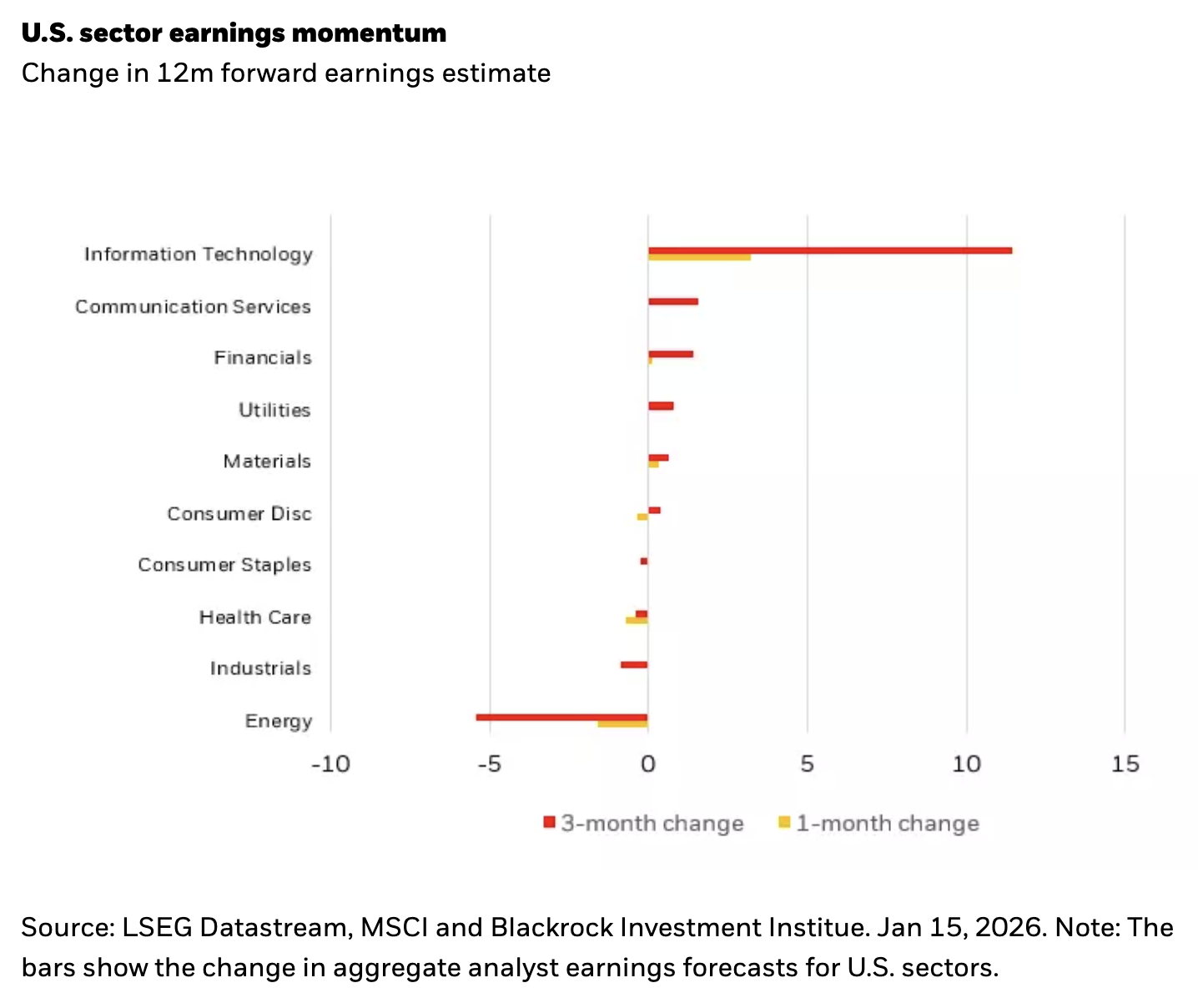

The second catalyst for the rotation is a shift in earnings expectations. To be more precise, investors are now expecting a narrowing gap between mega-cap tech and the rest of the market. This marks a significant shift, as the large tech companies were one of the few bright spots during the earnings slowdown of 2023 and 2024. Today, with more sectors expected to post positive earnings growth, the differential between mega-cap tech and the rest of the market is much smaller.

However, the rush out of technology names, particularly the mega-cap variety, ignores the sector’s earnings momentum. For Q4 the tech sector is expected to post approximately 25% year-over-year earnings growth, far ahead of the 8% for the broader market. Earnings momentum is also strongest in the tech sector, with by far the most positive changes in earnings expectations (see Chart 1). Finally, the superstar companies are still the big driver of earnings growth. Nvidia is expected to be the single largest contributor to this quarter’s earnings growth.

Diversify don’t abandon

Given the economic outlook, value differentials and the lingering impact of too much crowding, some sector re-allocation makes sense. Large banks, consumer discretionary and select industrials offer leverage to what is likely to prove an accelerating economy. That said, the valuations of many mega-cap tech names have normalized, while the sector is likely to continue to deliver unusually strong earnings growth. The sector is still very much worth holding.