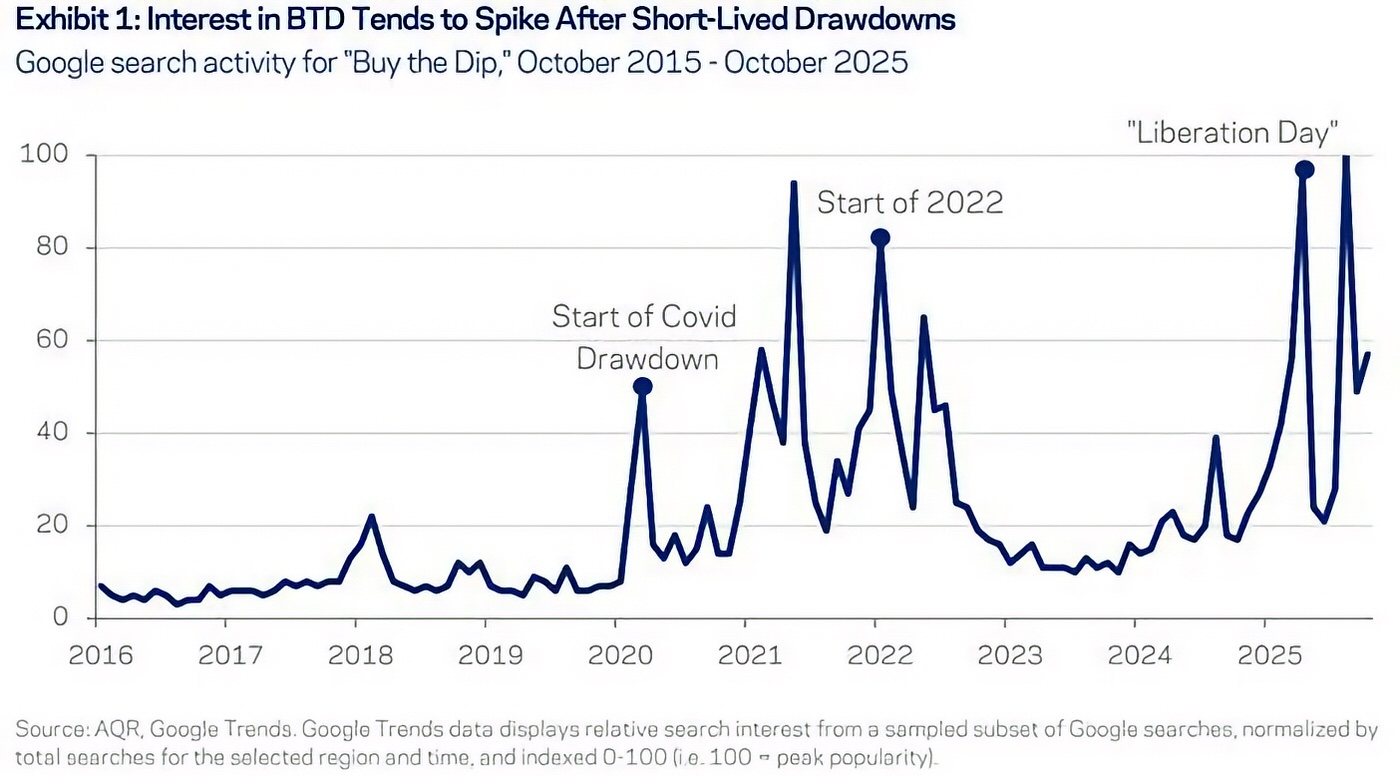

“Buy the dip” has become one of investing’s most comforting mantras—especially after the whiplash recovery that followed the COVID crash in 2020. As Larry Swedroe puts it plainly, the idea has taken on almost religious status. When prices fall, you buy. Markets bounce back. End of story.

Except it isn’t.

Swedroe’s walkthrough of the research pulls that intuition apart and replaces it with something far less comforting, but far more useful: evidence. This isn’t a debate over catchy slogans or clever narratives. It’s a hard look at what actually works when investors try to time markets—when they attempt to step in and out rather than simply stay the course.

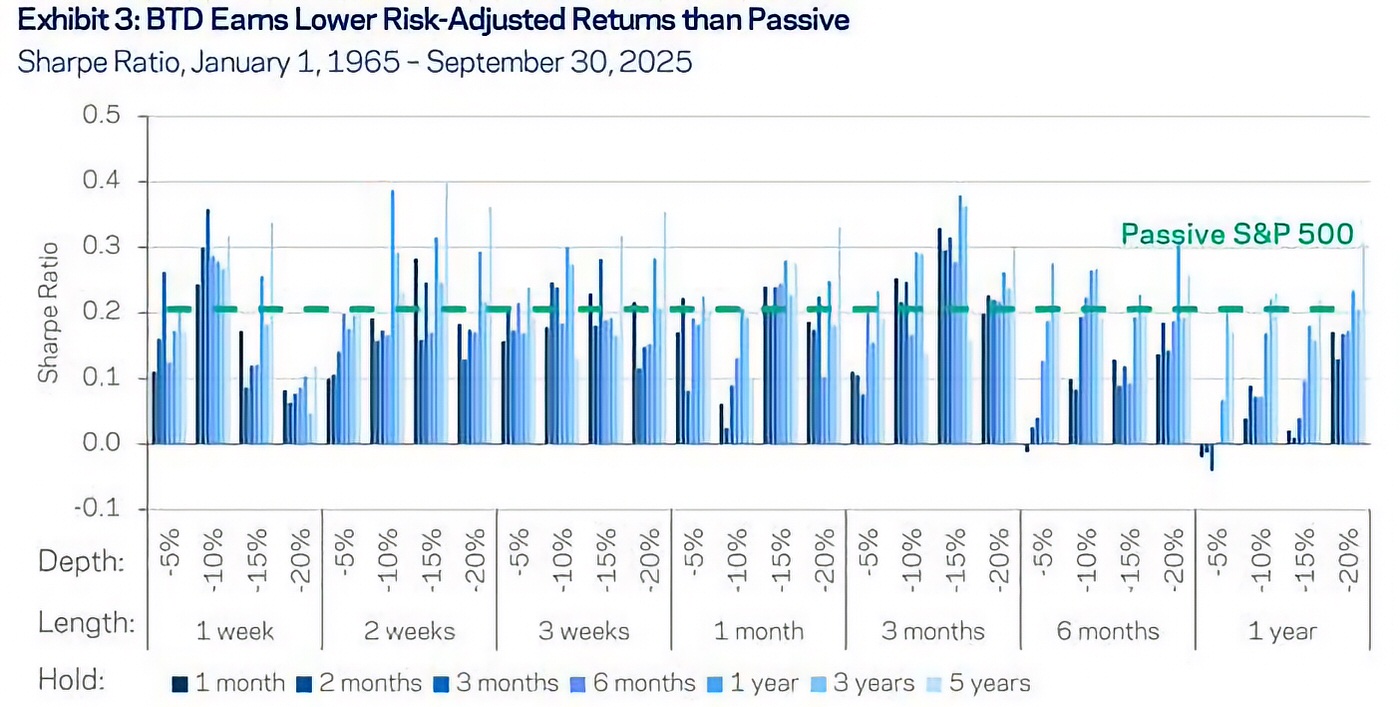

At the center of the discussion is an AQR Capital Management paper titled “Hold the Dip.” Instead of testing one neat version of buy-the-dip (BTD), the researchers went much further. They examined 196 different BTD strategies applied to the S&P 500 from 1965 through 2025. Different dip sizes. Different time windows. Different holding periods. Cash parked in T-bills when not invested. In other words, this wasn’t theoretical—it closely mirrored how real investors try to play dips in real markets.

And the results? They weren’t kind to the myth.

Across the board, buy-the-dip strategies delivered worse risk-adjusted returns than simply holding equities. On average, Sharpe ratios were lower, not higher. When the data zooms in on the post-1989 period—the era most investors emotionally anchor to—the gap gets even wider. Whatever edge people think they’re exploiting by “waiting for the dip,” the numbers say it isn’t there.

Even when you stretch the math to look for alpha, the results are thin. Only a small fraction of those 196 strategies showed statistically meaningful outperformance. That’s not skill. That’s randomness.

Why does this happen? Swedroe points to a structural flaw most investors never consider. Buy-the-dip is effectively value investing over a very short time horizon—while markets, over weeks and months, tend to exhibit momentum. BTD fights that momentum. It tries to catch reversals before they actually happen. Sometimes it works. Often it doesn’t.

Now put that next to trend following, and the contrast sharpens.

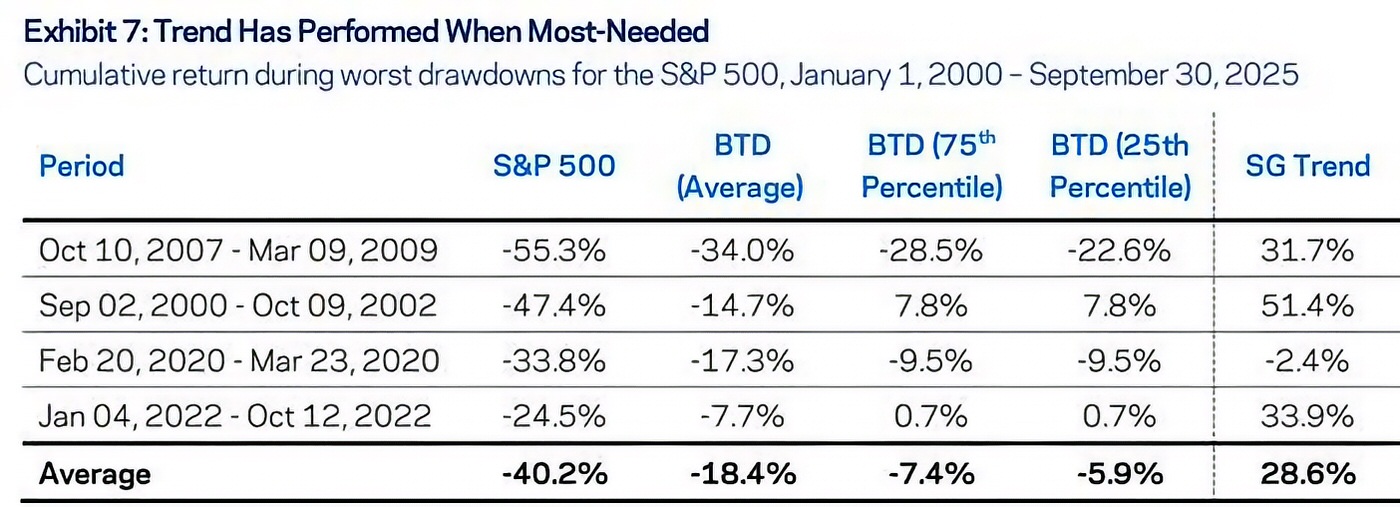

Using broad trend-following proxies like the SG Trend Index, Swedroe shows that trend strategies have historically delivered meaningful alpha relative to equities. More importantly, they’ve done so when investors needed help the most. During the worst market drawdowns since 2000—periods where losses exceeded 20%—trend-following strategies posted strong positive returns on average. Buy-the-dip strategies, by contrast, suffered deep losses.

That’s the real test. Anyone can look smart in a bull market. Stress is where strategies reveal their true character.

The practical lessons are hard to ignore. Buy-the-dip may feel systematic, but it isn’t a reliable system. It’s emotionally satisfying, not empirically robust. Trend following, while far less intuitive, aligns with how markets actually behave—cutting exposure as trends turn down and re-engaging when strength returns.

Swedroe is careful not to oversell tactical timing altogether. In fact, his message leans in the opposite direction. Most investors are still better served by disciplined, long-term asset allocation than by trying to outsmart market swings. Holding extra cash while waiting for the “right” dip isn’t a free option. More often than not, it’s a drag.

In the end, this isn’t really about buy-the-dip versus trend following. It’s about narrative versus evidence. “Buy low, sell high” sounds timeless. But markets don’t reward slogans. They reward alignment with reality.

Swedroe’s moderation lands on a simple but uncomfortable truth: investing success comes less from clever timing and more from humility, discipline, and respect for what the data actually says—not what we wish were true.

Footnote:

1 Swedroe, Larry. "Is Trend Following Better than “Buy the Dip”?" Alpha Architect, 12 Dec. 2025