by Kent Hargis, PhD, Porfolio Manager, and Peter Chocian, Portfolio Manager, AllianceBernstein

Even amid rising markets, investors in US equities should be aware of the hazards of a fast-changing environment.

From tariffs to healthcare and a prolonged government shutdown, US markets are facing major uncertainties. The US still offers exceptional return potential in the form of innovative, high-quality companies. But with elevated market concentration and valuations soaring, investors should be mindful of the market’s higher risk profile.

Policy uncertainty is testing investors. On-and-off tariffs, the absence of jobs data, and fluctuating technology export regulations have made it difficult to forecast earnings. Given efforts to reduce the Federal Reserve’s independence and a weaker US dollar, many investors are questioning the staying power of US exceptionalism.

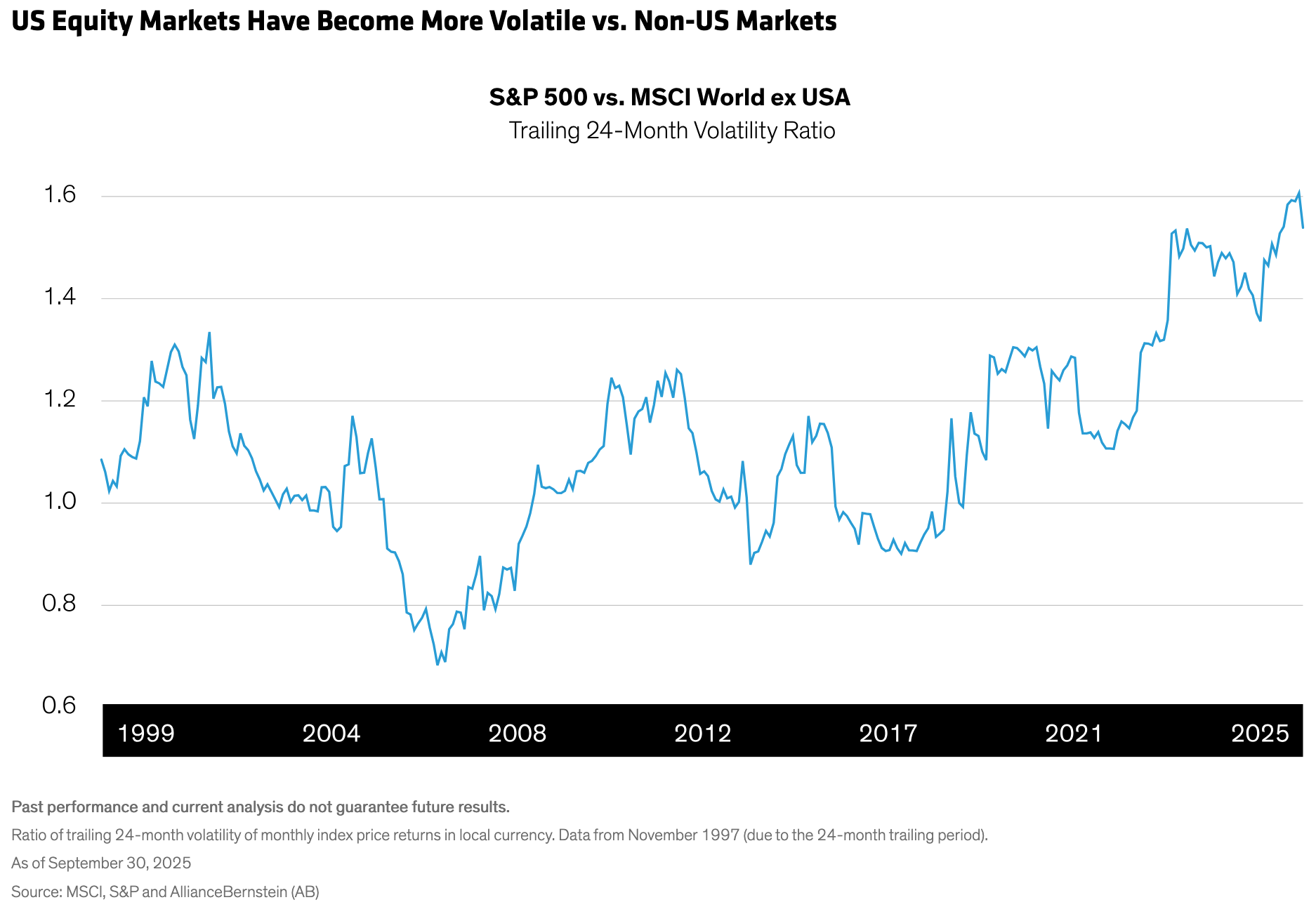

Equity market volatility reflects the challenges. The S&P 500’s relative volatility to non-US markets has jumped this year to levels not seen in the 21st century (Display).

It’s understandable to feel anxious. But reducing equity exposure can be counterproductive because it’s nearly impossible to time market inflection points. The challenge is to find a strategy that can help you stay invested through bouts of volatility. In our view, the solution is to identify stocks with attractive long-term upside potential as well as solid, defensive characteristics to weather today’s risks.

US Peak-to-Trough Drawdowns Have Been Steep

The digital age has given rise to technology firms that can generate profits without excessive cyclicality—a unique feature of US markets. US companies’ focus on profitability, coupled with favorable shareholder return policies, has widened the shareholder wealth gap between the US and the rest of the world.

But even large, profitable US companies can be punished if they don’t meet near-term expectations. Partially as a result, US markets have endured larger peak-to-trough drawdowns during recent crises than international markets, our research suggests. These include the COVID-19 pandemic, the global financial crisis and the tech bubble of the early 2000s.

Sharp pullbacks create risk drag, which can corrode long-term returns. They can be particularly unnerving in the post-accumulation stage of investing. Retirees living on fixed incomes feel the pain of a sell-off more acutely than wage earners who can dollar-cost average into a falling market. Stocks that lose more in downturns also have more ground to gain when the market recovers, making downdrafts particularly daunting for investors in a more volatile US market.

Does Market Concentration Add Risk?

That volatility could persist given the high degree of concentration in the US. In recent years, a disproportionate amount of US market gains has been generated from relatively few stocks. Technology mega-caps have taken center stage since artificial intelligence (AI) unleashed a wave of enthusiasm about future earnings growth potential.

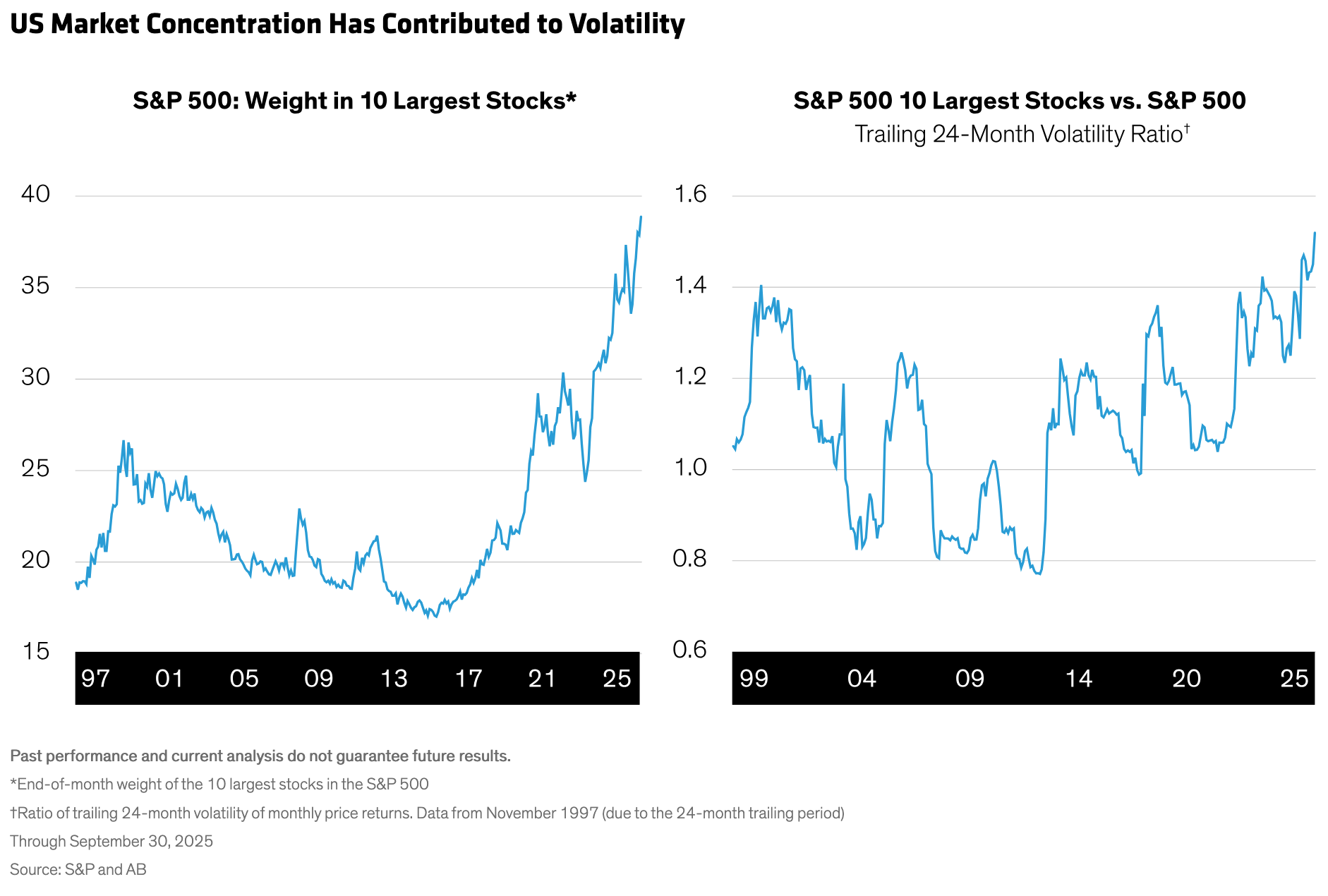

Consider, for example, the heaviest hitters of the S&P 500. The 10 largest stocks, which comprised just 15% of market capitalization a decade ago, now account for nearly 40% of the index (Display). That means a mere 2% of S&P 500 constituents have the power to move the broader market up or down.

But the bigger companies in the market tend to be riskier. And when the tides turn—as in the first quarter of 2025, when the dominance of the mega-caps waned and technology stocks underperformed—investors feel the ramifications of a highly concentrated market. Indeed, today’s market leaders are showing disproportionate instability, as evidenced by their volatility relative to the entire S&P 500 (Display above).

The last time the volatility of the S&P’s 10 largest constituents was this high was in the early 2000s, when dot-com stalwarts were flying high before a precipitous fall. That doesn’t mean a repeat of the dot-com crash is in the offing, but caution is warranted. While the initial AI infrastructure boom was largely funded by hyperscalers with strong cash flows and balance sheets, the next phase is increasingly being fueled by less stable sources.

Defensive Stocks: Downside Cushion and Growth Potential

Is there an antidote to these risks? We think a strategy focused on shares of high-quality companies with relatively stable trading patterns at attractive prices (what we call quality, stability and price, or QSP) can help investors cope effectively with today’s conditions.

Strategies that target such stocks aim to lose less in market downturns. That means they have less ground to regain when markets recover. And because these stocks start from a higher base after a downturn, they’re better positioned to compound returns in subsequent rallies.

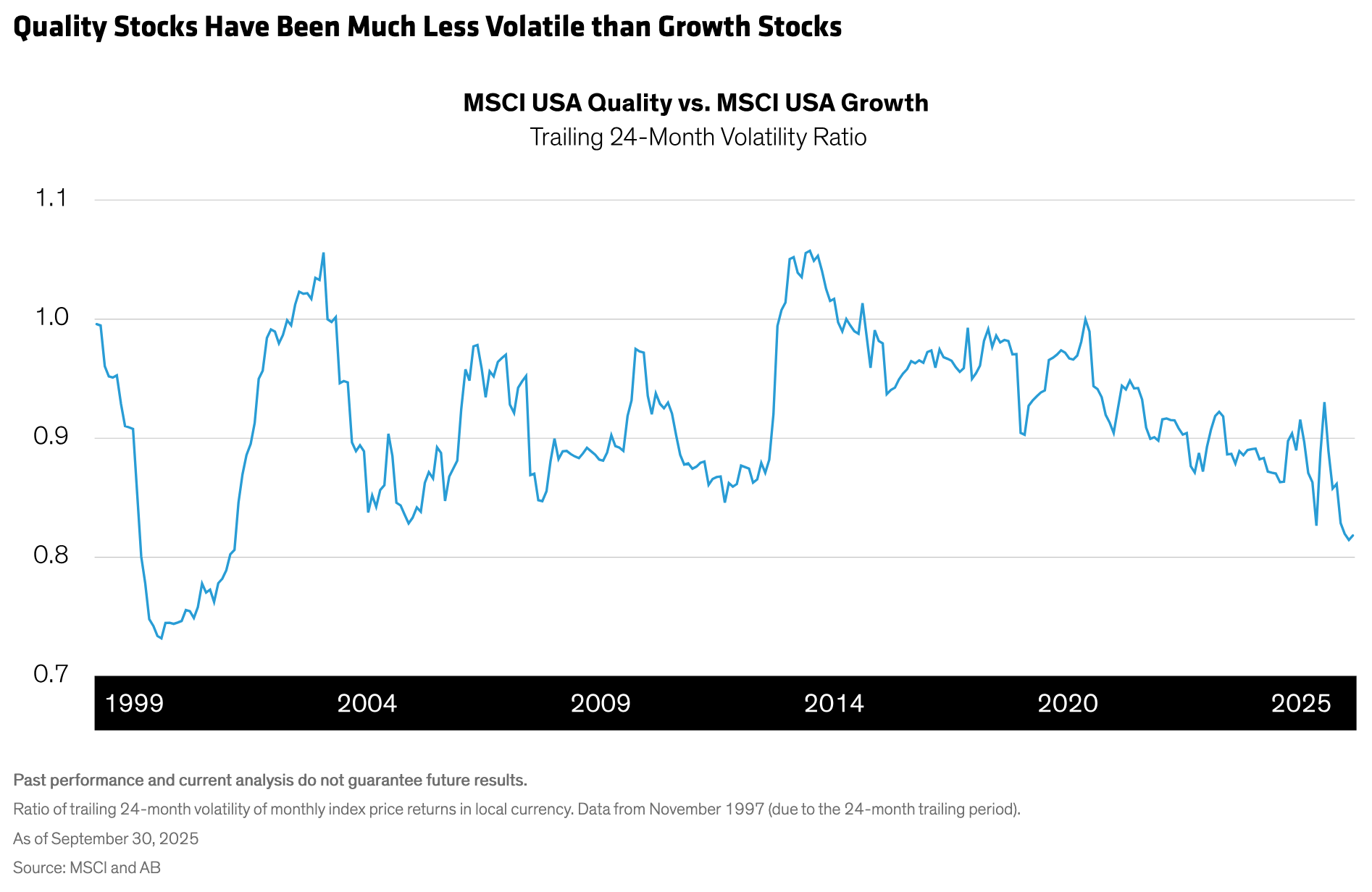

When carefully selected, quality defensive stocks can provide a smoother return pattern across different market environments. We believe this type of defensive allocation can add diversification benefits to higher-risk equity allocations as well as passive allocations, which may be more exposed to a turn in US market concentration. What’s more, the volatility of US quality stocks relative to growth stocks is currently at its lowest since the early 2000s (Display).

In today’s conditions, we believe quality stocks offer investors an unusually strong ability to stem volatility. But that doesn’t mean sacrificing growth potential. There’s no contradiction in positioning for long-term capital growth and striking a defensive posture, in our view. Portfolios that achieve both aims can help investors stay allocated in equities through changing market conditions.

Given the current intense wave of policy and market challenges, investors should brace for an extended period of relatively high US market volatility. An active approach focused on quality, defensive stocks at attractive valuations could provide investors with an important tool to manage volatility—and capture strong long-term return potential—in today’s fast-moving environment.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

*****

About the Authors

Kent Hargis is the Chief Investment Officer of Strategic Core Equities. He created the Strategic Core platform and has been managing the Global, International and US Strategic Core portfolios since their inception in 2011. Hargis has also been Portfolio Manager for the Global Climate Transition Strategy Portfolio since 2022. Previously, he managed the Emerging Portfolio from 2015 through 2023. Hargis was global head of quantitative research for Equities from 2009 through 2014, with responsibility for directing research and the application of risk and return models across the firm’s equity portfolios. He joined AB in 2003 as a senior quantitative strategist. Prior to that, Hargis was chief portfolio strategist for global emerging markets at Goldman Sachs. From 1995 through 1998, he was assistant professor of international finance in the graduate program at the University of South Carolina, where he published extensively on various international investment topics. Hargis holds a PhD in economics from the University of Illinois, where his research focused on international finance, econometrics and emerging financial markets. Location: New York

Peter Chocian is a Senior Quantitative Analyst and Portfolio Manager on the Equities team at AB. He joined the firm in 2006 as a quantitative analyst for Value Equities. Previously, Chocian worked for four years as a senior research scientist in the Numerical Weather Prediction division of the UK Met Office. He holds a BSc in physics from Imperial College London and a PhD in theoretical atomic physics from Royal Holloway, University of London, followed by research fellowships at University College London and the Max Planck Institute for the Physics of Complex Systems in Dresden, Germany. Location: London