by Shri Singhvi, Luke Pryor, AllianceBernstein

How can skilled active managers navigate periods of high market concentration and disruptive forces?

Powerful disruptive forces are creating new challenges in equity markets that could raise hurdles to passive performance in the future. In an era of rapid change, we think charting an active course that’s attuned to mounting risks is the best way to capture long-term US equity return potential.

We’re living through a highly disruptive era. From trade wars to geopolitical tensions and technological innovation, companies across industries are facing huge uncertainties. The artificial intelligence (AI) boom in particular has prompted investor concern over the possibility of a market bubble, alongside the risk of missing out on gains from a revolutionary technology.

These disruptive forces have sharpened the debate about active versus passive investing. Passive portfolios have done particularly well in recent years, as AI-enthusiasm fueled dominant performance of the US mega-cap stocks. Yet even as actively managed equity portfolios have struggled to outperform, passive portfolios could be vulnerable to a reversal in sentiment toward the largest companies.

Identifying Passive Risks in Changing Markets

Portfolios that passively track equity benchmarks can be vulnerable in times of disruption. The S&P 500’s standard cap-weighted index is locked into the prior regime’s winners, which get larger weights as their shares rise. So long as the biggest stocks continue to advance, passively tracking this index will deliver results. However, if the top names are disrupted, a passive investor could be overly exposed to a downturn in stocks with very large weights. What’s more, a cap-weighted benchmark can’t position to capture return potential in future beneficiaries from a range of disruptive trends.

In contrast, the S&P 500 Equal Weight Index is a good proxy for a more diversified view of the US large-cap equity market as it neutralizes distortions created by the mega-caps. However, since it doesn't differentiate between weights apportioned to its members, the equal-weight benchmark is also flawed. Investors who passively track an equal-weight index can’t gain higher exposure to companies poised to thrive in the future.

That’s why we think effective active management is particularly important now. Skilled active portfolio managers can be agile and identify long-term winners and losers of the new regime by positioning equity portfolios to benefit from a potential broadening of the market.

Concentrated Markets: The Risk of Reversal

We know that it’s hard to envision such a broadening after three years of an AI-driven market in which technology titans have dominated market performance. But we’ve already seen the returns of the mega-caps diverge this year. And history suggests that powerful market dynamics—such as the relative resilience of passive performance—don’t last forever.

Active portfolios performed well after periods of high market concentration in the past. For example, our research suggests that as markets broadened from 2001–2005 post dot-com concentration, most active US equity portfolios outperformed, according to eVestment data.

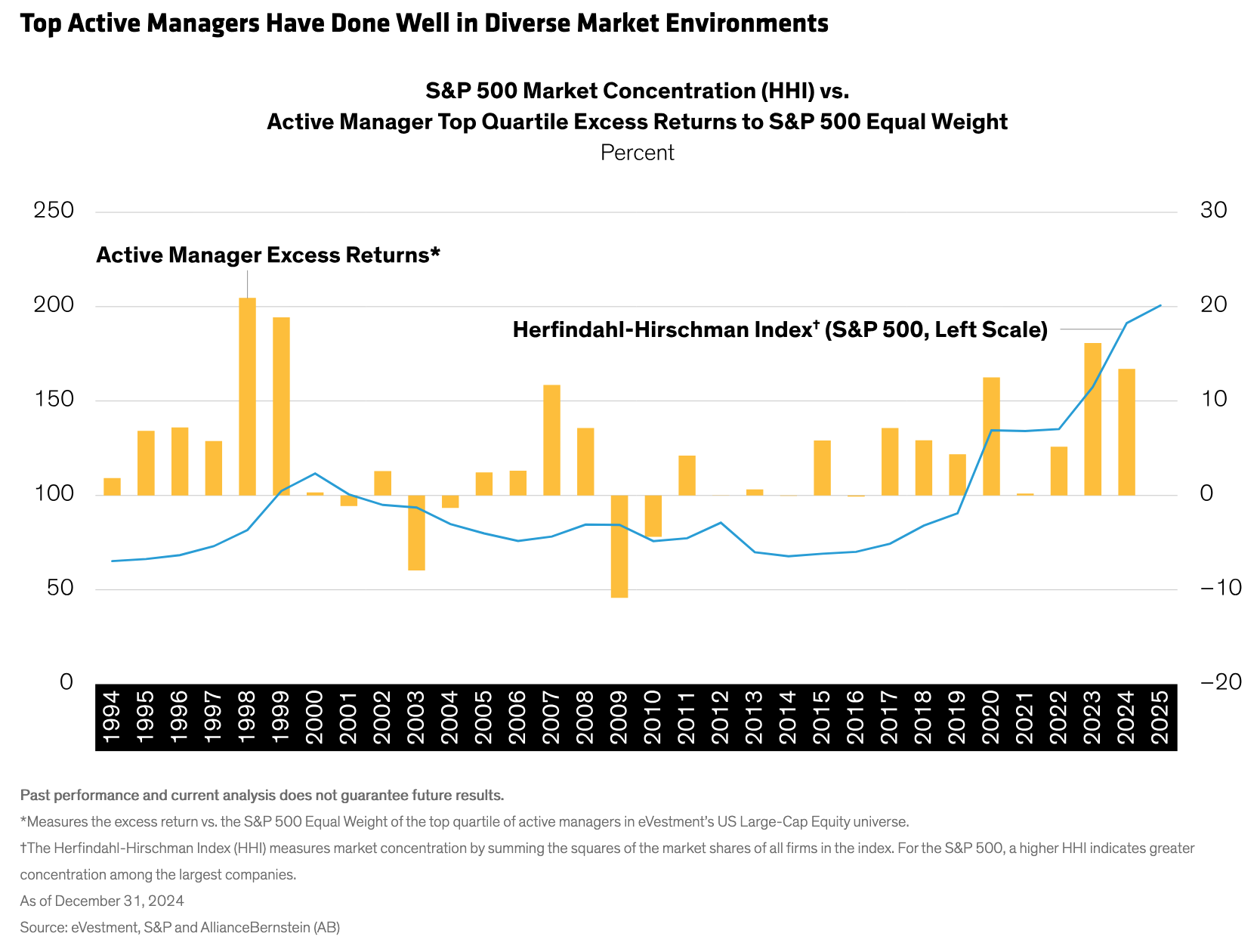

Today’s market concentration is extreme. The Herfindahl-Hirschman Index, which measures market concentration, shows that the S&P 500 (cap-weighted) is more concentrated now than at any other time over the past two decades. In fact, the HHI has jumped from 157 in 2023 to 200 today, a 33% increase in concentration over just two years since the launch of OpenAI’s ChatGPT ushered in the AI era.

Evaluating Performance in a More Equitable Market

Evaluating Performance in a More Equitable Market

It’s true that most active managers underperformed the S&P 500 during this period. But to evaluate true active investing skill, we think the S&P 500 Equal Weight is a better benchmark. We found that that the top quartile of US large-cap equity active managers outperformed the S&P 500 Equal Weight in recent years and over most of the last two decades, as shown by the yellow bars in the Display above. Positive excess returns of the top quartile persisted through most periods of higher and lower market concentration.

As we see it, the equal-weight index is a better benchmark for assessing active managers who diversify beyond the largest names, especially if market returns may broaden. Portfolio managers who consistently beat the equal-weight index should be well positioned for a potential shift in market dynamics if the momentum fueled by the largest names begins to wane.

High Bar for Active Skill

Of course, the bar for getting into that top quartile of active portfolios is high. So what can investors look for to determine whether an active manager possesses the requisite skill?

Don’t just focus on past performance. Look for portfolio teams with a coherent, disciplined investing strategy and philosophy. That means a clearly articulated definition of the fundamentals that it targets and portfolio construction strategy. For investors in core US equities, we believe the key is to focus on enduring business models while maintaining balance across factors and styles, which can help produce more consistent results over time.

Equity portfolios can be easily thrown off course by new and evolving hazards, shifts in factor performance or sector imbalances. But with active awareness of a benchmark’s blind spots, we think investors can strategically improve their chances of capturing consistently solid returns through the periods of uncertainty that lie ahead.

Copyright © AllianceBernstein