Here’s a breakdown of what Ottawa’s 2025 Federal Budget1 means in plain English — for families, individuals, and businesses — based on the summary from Doane Grant Thornton LLP.

For Canadian Families and Individuals

This year’s budget leans heavily on the promise of “bringing down costs for Canadians.”

Here’s what that actually looks like:

- New Tax Credit for Personal Support Workers (PSWs): A refundable credit worth 5% of eligible earnings, capped at $1,100, for regulated PSWs in certain health-care settings (except BC, NL, and NWT).

- Automatic Tax Filing: The CRA will now automatically file returns for low-income individuals who qualify — a big win for people who miss out on benefits because they don’t file.

- Simplified Savings Rules: Starting in 2027, the Registered Disability Savings Plan (RDSP) can hold small business or venture capital shares — giving savers more investment options.

- Updated Tax Credit Rules: From 2026, you can’t double dip between the Home Accessibility and Medical Expense credits for the same expense.

- Underused Housing Tax Ending: The UHT program wraps up after 2024.

- Luxury Tax Changes: The luxury tax on aircraft and boats ends in November 2025, though luxury cars over $100K remain taxed.

- Housing Relief: First-time homebuyers won’t pay GST on new homes up to $1M and will pay less on homes between $1M–$1.5M (Bill C-4).

Key Takeaways for Individuals

- Easier tax filing means more low-income Canadians can actually access the benefits they qualify for.

- The PSW credit is nice recognition but limited in scope.

- The GST break on new homes could make a noticeable difference for first-time buyers.

- Removing the UHT and trimming luxury taxes may ease some financial pressure.

- But the big picture hasn’t changed much — income tax rates remain the same, and cost-of-living issues persist.

For Canadian Businesses

The business side of the budget focuses on shifting from short-term spending to long-term investment — with $32.5 billion in new capital spending over five years, paired with $60 billion in targeted savings.

Here’s what matters most:

- Immediate Expensing: Manufacturers and processors can write off 100% of eligible building costs (including upgrades) for projects started after Nov 4 2025 and in use by 2030. The benefit phases down after that.

- Dividend and Deferral Adjustments: New rules close tax deferral gaps for connected corporations with staggered year ends (applies from Nov 2025).

- Farm Co-ops Extension: Agricultural co-ops keep their deferral on patronage dividends until 2030.

- SR&ED Program Boost: The R&D credit limit jumps from $4.5 million to $6 million, and the program promises faster audits and AI-assisted reviews.

- Clean Economy Incentives:

- Expanded critical minerals list for the 30% Clean Technology ITC.

- Extended 100% CCUS credit until 2035, with a gradual phase-out through 2040.

- Broader eligibility for the 15% Clean Electricity ITC, including entities backed by the Canada Growth Fund.

- More minerals (like manganese and tungsten) now qualify for the 30% Critical Mineral Exploration Tax Credit.

- Modernized Transfer Pricing Rules: Tougher OECD-aligned standards, shorter 30-day deadlines for documentation, and higher penalty thresholds — meaning multinationals will need to tighten compliance.

Key Takeaways for Businesses

- Manufacturers, processors, and innovators win big from the immediate expensing and expanded R&D credits.

- Clean tech and mining companies get even more room to invest.

- Transfer pricing reforms increase the paperwork burden — especially for global firms.

- Smaller businesses might feel left out since most benefits skew toward larger or capital-heavy industries.

- Corporate tax rates stay the same, but the government’s “spend less, invest more” strategy is clear.

Conclusions

Budget 2025 represents a pivot from maintenance to momentum. Canada’s shifting resources toward building — infrastructure, clean energy, housing, and industry — with an eye on long-term competitiveness.

For families, it’s modest but meaningful: easier tax filing, small targeted credits, and some housing relief. For businesses, it’s a clear invitation to invest — now, before incentives phase out.

The trade-off? A deficit projected around $78.3 billion in 2025–26, with hopes of balancing operations by 2028–29. That means tough choices later — higher taxes or slower spending growth could be on the horizon.

Overall, the budget is pro-investment, pro-growth, but fiscally cautious — a bet on future productivity rather than short-term popularity.

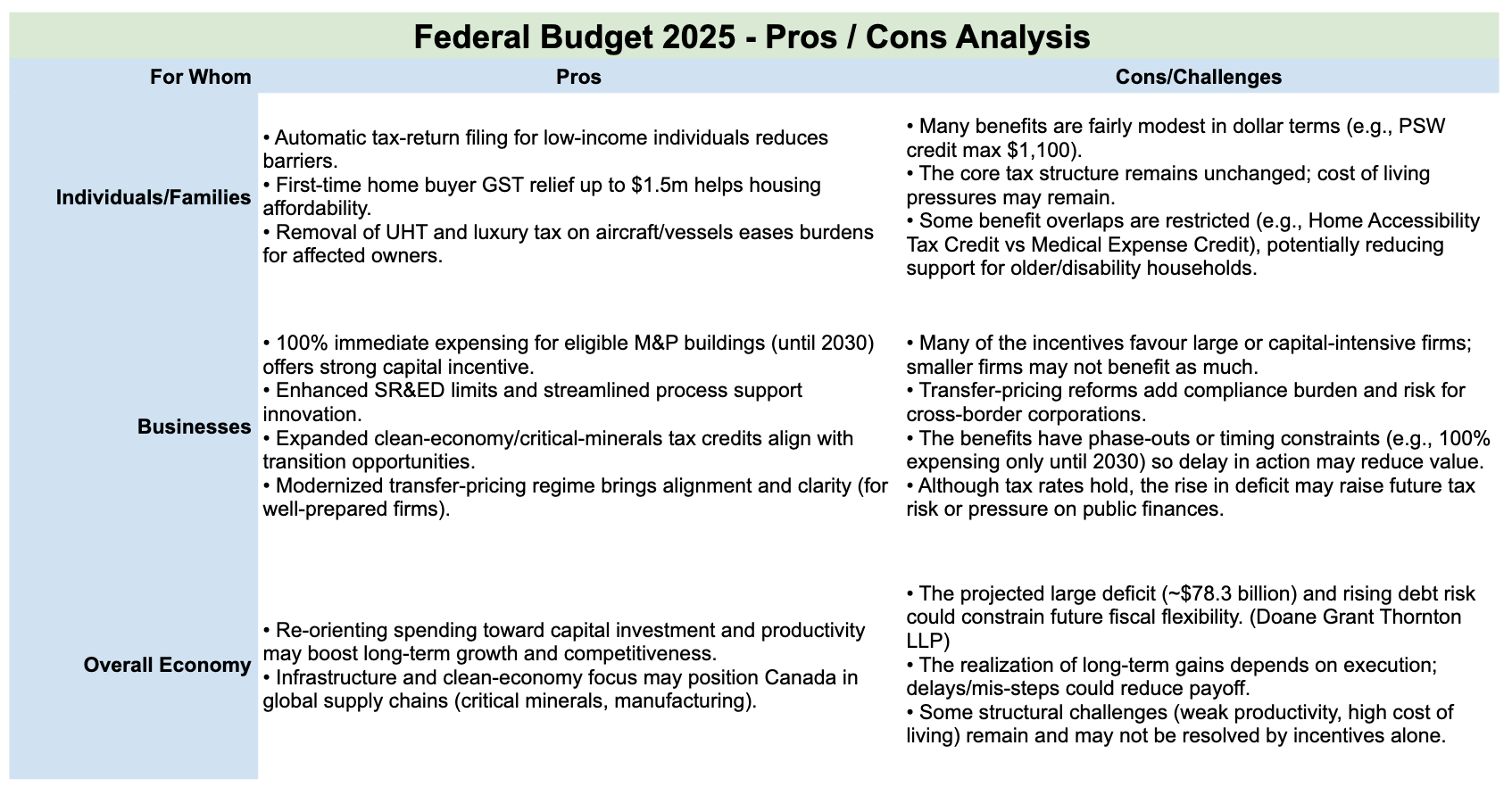

Highlights - Pros and Cons Analysis

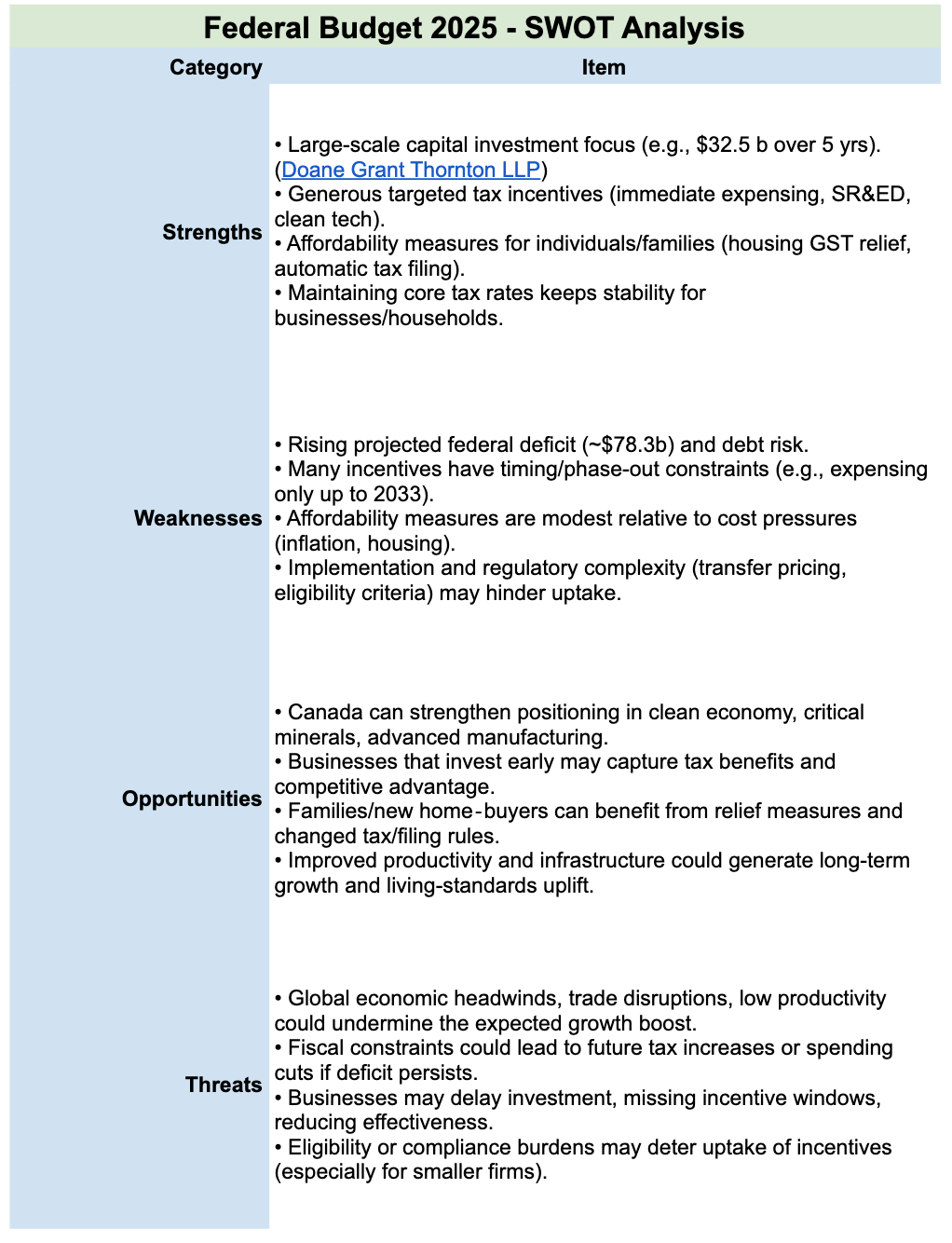

SWOT Analysis

Copyright © AdvisorAnalyst.com

1 Doane Grant Thornton LLP. "Federal Budget 2025." Doane Grant Thornton LLP, 5 Nov. 2025.