The past few years have dismantled the easy faith investors once had in the 60/40 portfolio. Bonds no longer hedge stocks the way textbooks promised. Volatility leaks across asset classes like a contagion. Against that backdrop, two research paths are converging on the same idea: if you can’t count on diversification from traditional building blocks, you must manufacture it.

One path comes from the academic world — Bruno Schwalbach and Christo Auret’s Enhancing Global Equity Returns with Trend-Following and Tail Risk Hedging Overlays (Investment Analysts Journal, 2025)1. The other is the practitioner’s blueprint — Filling the Gap: Stacking Managed Futures2 from Return Stacked Investments’ Rodrigo Gordillo (Resolve Asset Management, 2025) and Corey Hoffstein (Newfound Research, 2025).

Together, they describe the same revolution from opposite ends of the spectrum: using capital-efficient overlays to bolt uncorrelated “crisis alpha” onto core portfolios — without surrendering the beta investors live on.

The Portable-Alpha Mindset

Schwalbach and Auret’s study begins with a deceptively simple claim:

“The performance of a 100% global equity portfolio is compared with a Portable Alpha portfolio that retains full equity exposure (beta) while layering on trend-following and tail-risk-hedging strategies (alpha).”

The distinction is philosophical as much as mathematical. Portable alpha, they argue, isn’t about leverage for its own sake; it’s about capital efficiency — “a single capital base supports both beta exposure and the alpha overlays.”

Return Stacked’s paper echoes the same conviction in plainer English:

“Return stacking uses the capital efficiency of derivatives to overlay a new return stream on top of an existing allocation, rather than funding it by selling other assets.”

Both authors see this as the escape hatch from the “funding problem.” Traditional diversification demands that you sell something — reduce stocks or bonds — to buy an alternative. Stacking and portable alpha reject that trade-off. Keep your core, add the diversifier, and let derivatives do the heavy lifting.

Trend-Following: The Engine of Convexity

Schwalbach and Auret ground their analysis in 79 global futures contracts — equities, bonds, commodities, and currencies — building a systematic trend-following model across twelve-month lookbacks.

They quote Moskowitz, Ooi & Pedersen (2012):

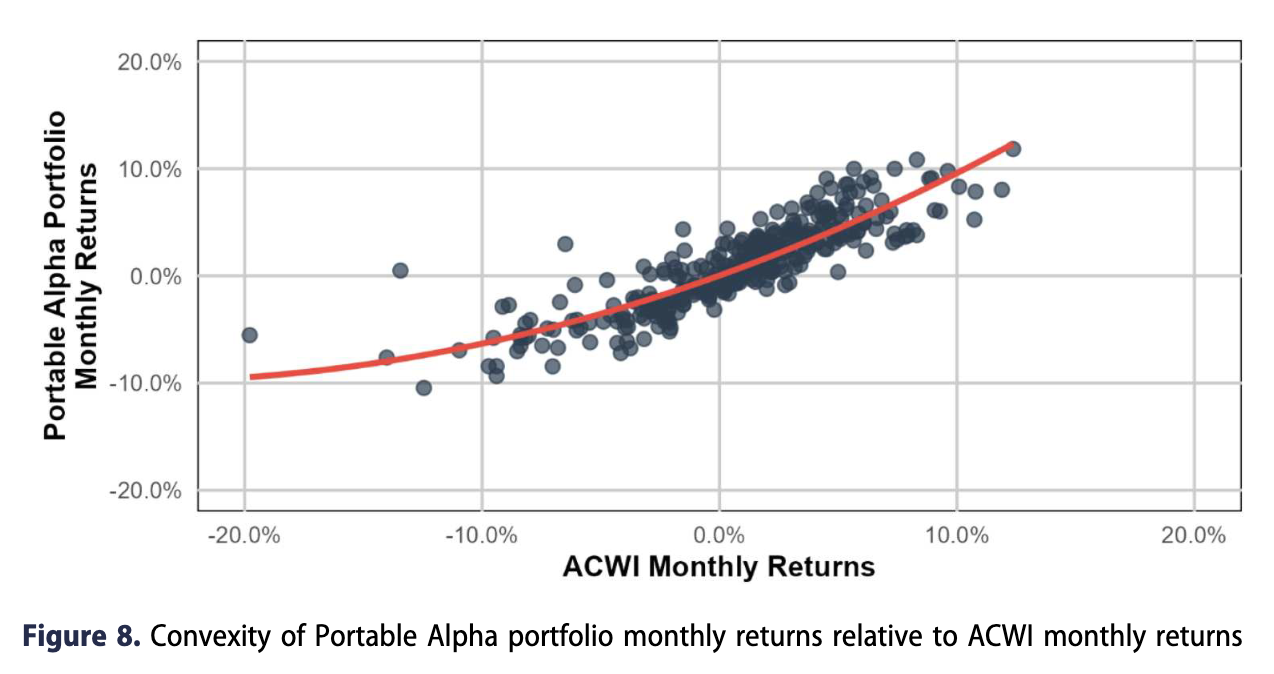

“Trend-following strategies have historically delivered attractively high returns while exhibiting convexity in both the extreme left and right tails of equity return distributions.”

Convexity is the point — the ability to zig when markets zag. Trend-followers, the paper notes, “perform particularly well during prolonged bull and bear markets but less effectively during sudden and severe market crashes.” Tail-hedging fills that gap.

Return Stacked calls the same phenomenon by a friendlier name: managed-futures CTAs that “profit from trends in equities, bonds, commodities, and currencies,” historically posting “gains during prolonged equity and bond market crises.”

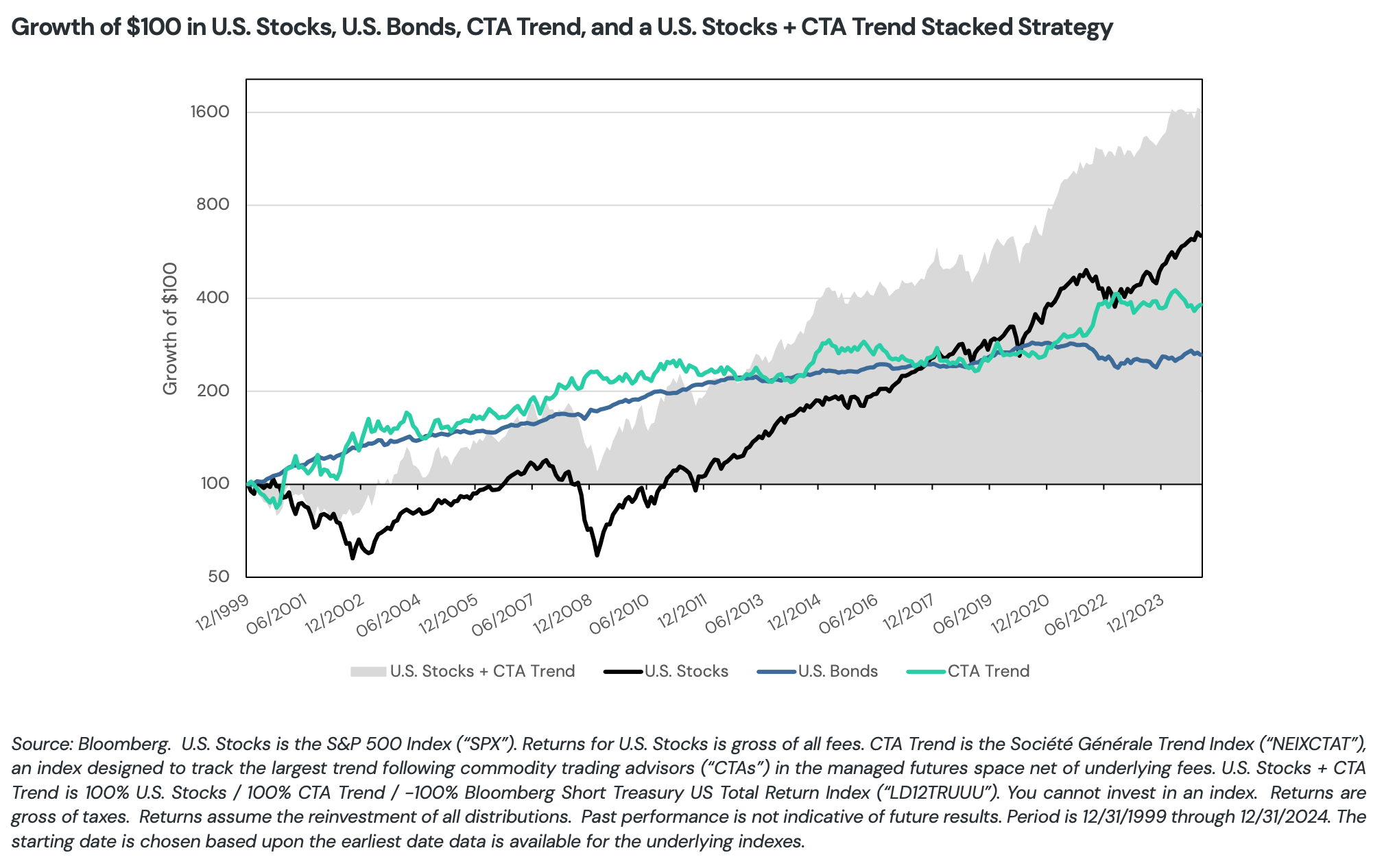

Where the academics measure convex payoffs, the practitioners show the pictures: in 2008, CTA strategies added +20.9% vs U.S. equities which lost –37%; in 2022, CTAs added +56% as bonds lost –18%. Numbers that make the abstract tangible.

Tail-Risk Hedging: Insurance You Hope Never to Use

For the Schwalbach and Auret team, tail hedging is the complement that completes the system. They write:

“Tail-risk hedging mitigates equity risk effectively during sudden market crashes, while trend-following supports equity during slower bear markets.”

Their approach uses 10-delta, one-year S&P 500 put options — “far-out-the-money” insurance chosen for maximum convexity per dollar of premium. The math shows these long-dated options “offer a favourable trade-off between convexity during stress periods and reduced theta decay in normal conditions.”

Eifert (2020) had called this offensive risk management — hedges that pay for themselves when the world burns. Schwalbach and Auret prove it empirically: a 0.25% per-month alpha after controlling for equity and factor exposures — statistically significant and strongest “during periods of market turmoil.”

Return Stacked doesn’t advocate insurance; instead they emphasize adaptability. They point out that trend-followers ride the storm instead of buying puts.

Yet, it’s evident that the result rhymes: in both frameworks, crisis protection comes not from prediction but from design.

Behavioral Engineering: Keeping Investors in Their Seats

Both papers recognize that a brilliant strategy fails if investors abandon it at the first drawdown. The Return Stacked authors attack this problem head-on:

“Return stacking seeks to avoid the psychological dislocation of adding a new strategy outside of a client’s mental model… By overlaying rather than reallocating, the investor avoids displacing core holdings.”

Schwalbach and Auret reach the same conclusion through behavioral finance citations — Bhansali (2015 b) on “panic selling during crises,” Chekhlov et al. (2005) on confidence collapsing after 15% drawdowns. Tail hedges, they argue, “act as a pre-commitment device that curbs panic selling.”

Both see psychology as part of portfolio construction. Convex payoffs and overlays aren’t only risk-management tools; they’re behavioral scaffolding that keeps humans from sabotaging themselves.

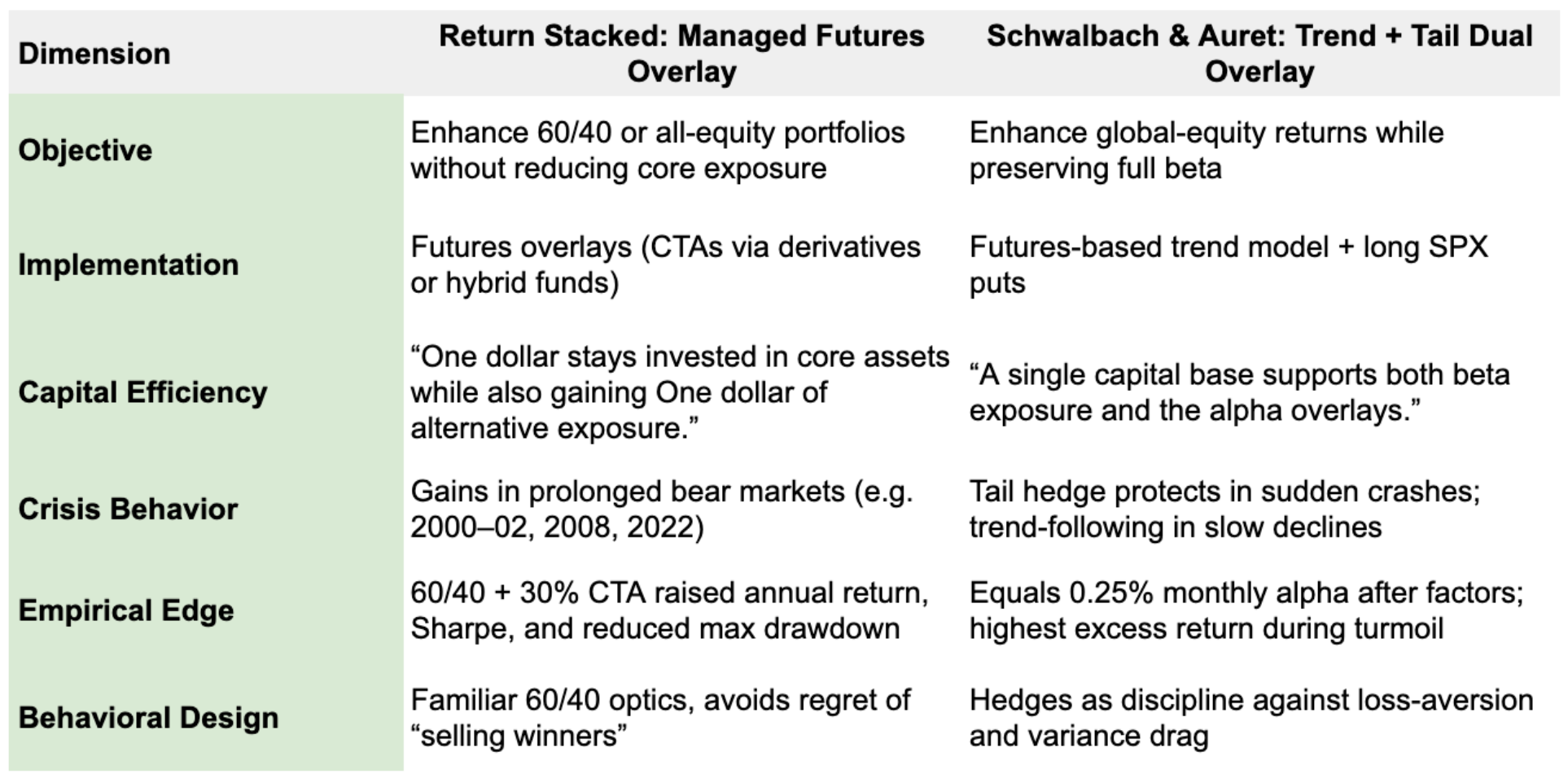

Comparing Architectures: Managed-Futures Stack vs Dual Overlay

In short: Return Stacked offers simplicity and behavioral comfort; Schwalbach and Auret offer completeness and academic validation. One sells elegance; the other, precision.

The Leverage Question

Both acknowledge that overlays introduce leverage — and both defend it. Schwalbach and Auret write:

“Applying leverage to strategies with convex return profiles… can reduce overall portfolio risk rather than merely magnify exposure.”

Return Stacked reframes the same truth in advisor language:

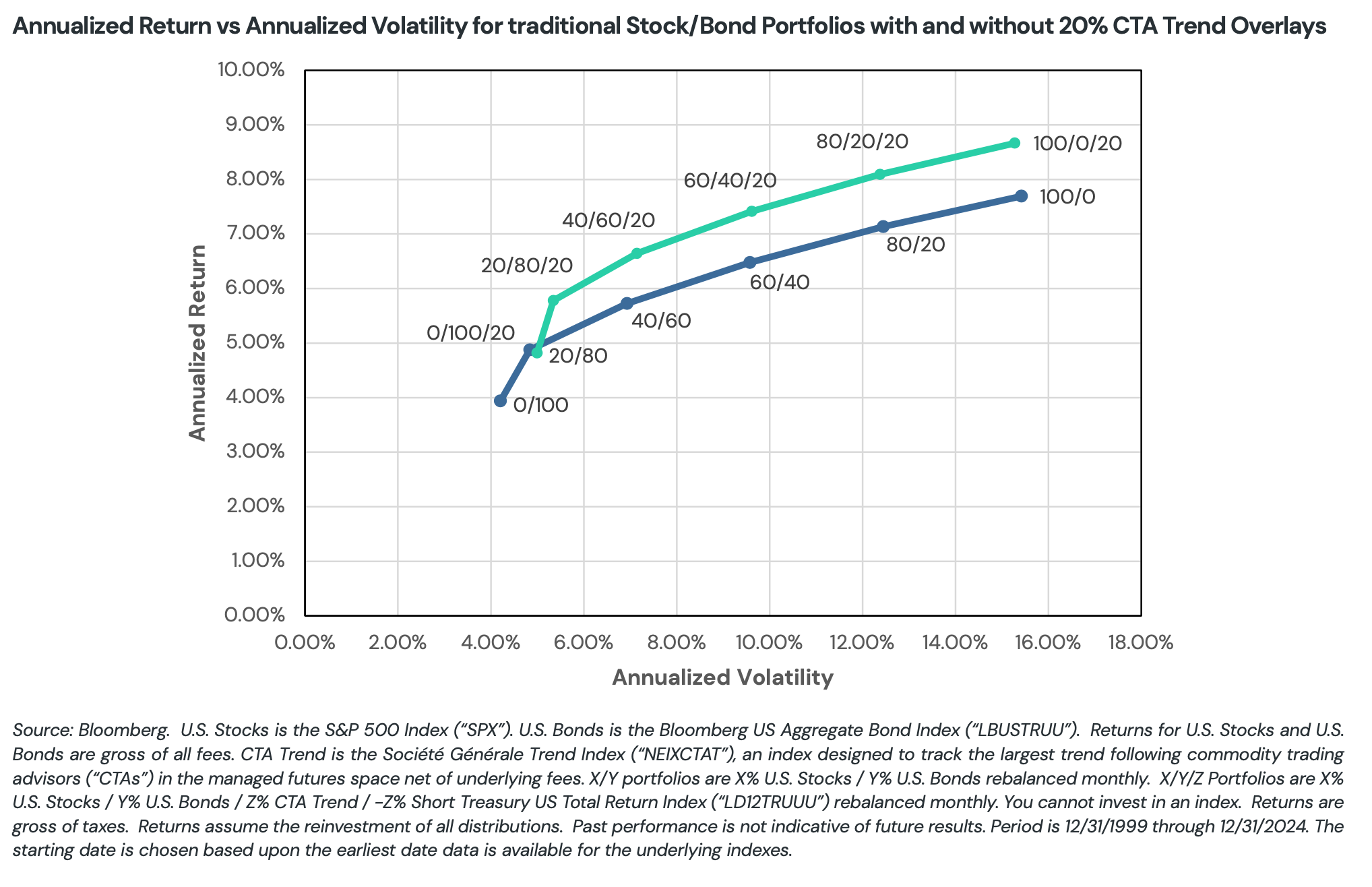

“From a risk perspective, return stacking does introduce leverage, meaning volatility will increase to some degree. However, if the added strategy is uncorrelated… the diversification effect can offset some of the increased volatility.”

This is modern leverage: not borrowed recklessness, but structural efficiency — the ability to stretch one dollar across multiple uncorrelated engines.

Results in Context

- Return Stacked: a 60/40/30 (CTAs stacked) portfolio delivered higher compounded returns with only modestly higher volatility; a 100% equity + 100% CTA version achieved ≈11.8% annualized vs 7.7% for stocks, yet with a smaller max drawdown (–40% vs –51%).

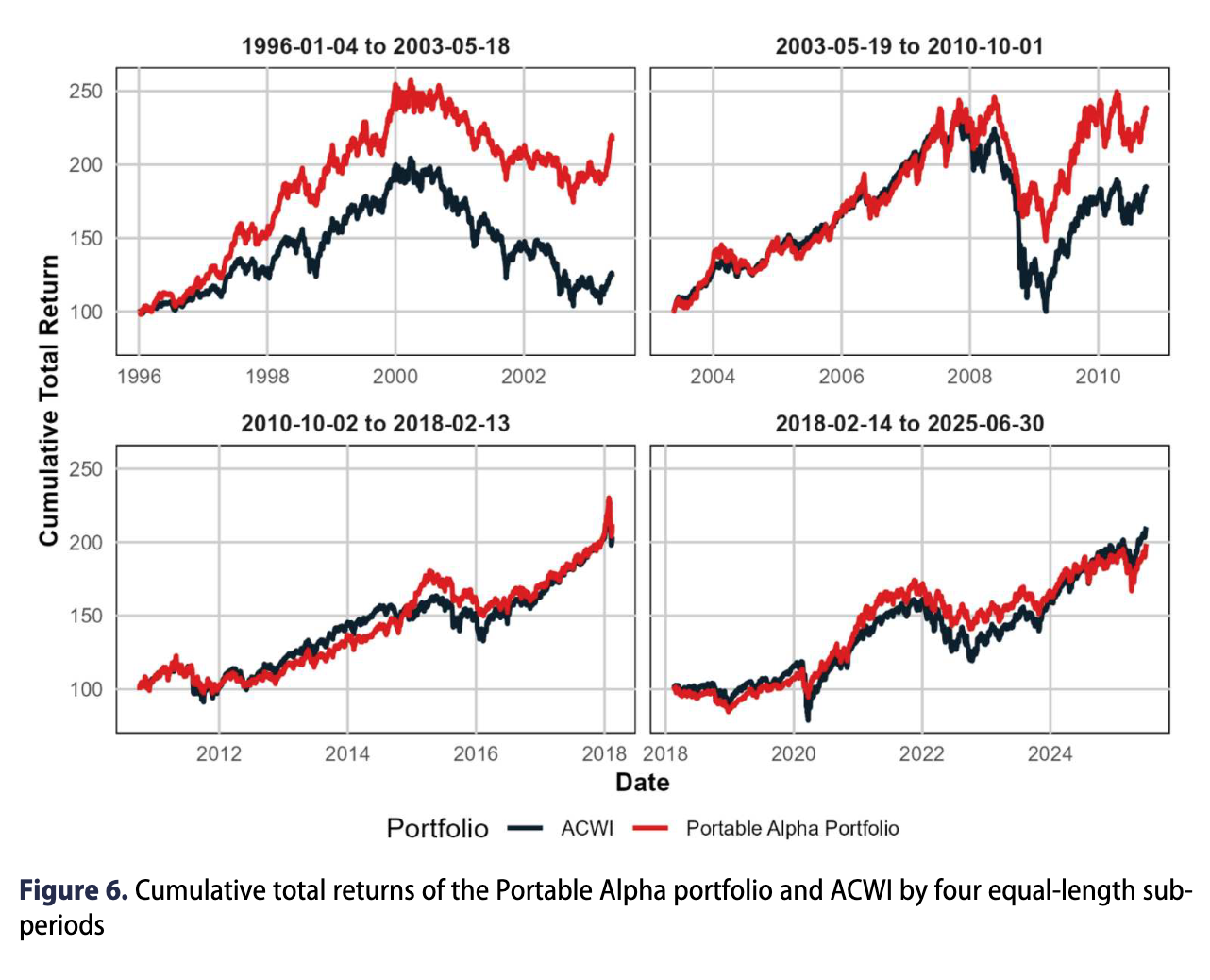

- Schwalbach & Auret: the dual-overlay portable-alpha portfolio produced “a large, positive, and statistically significant alpha of 0.25% per month,” its outperformance “strongest during periods of market turmoil.”

Both arrive at the same moral: crisis alpha is portable — and it compounds quietly in the background until the world breaks.

Philosophical Synthesis

Viewed together, these papers describe a new orthodoxy forming in real time:

- Capital efficiency replaces capital allocation. Portfolios are no longer carved into rigid slices; they are layered like code — beta at the base, uncorrelated alpha stacked above.

- Convexity replaces prediction. Instead of forecasting recessions or inflation, investors buy payoffs that self-correct when stress arrives.

- Behavioral alignment replaces product novelty. The best innovations are those that clients never notice — portfolios that “look and feel like a traditional 60/40” yet quietly carry airbags.

Conclusion: The Architecture of the Future Portfolio

Schwalbach and Auret offer the empirical scaffolding; Return Stacked provides the blueprint for implementation. One shows that it works; the other shows how to build it.

Both point toward the same endgame: resilient compounding through portable convexity — a world where diversification is no longer a sacrifice, but an overlay; where leverage, used judiciously, becomes the tool that restores balance instead of breaking it.

In an era when every traditional hedge has failed, these papers remind investors that the real innovation isn’t in prediction — it’s in engineering outcomes that don’t depend on being right.

Footnotes:

1 Schwalbach, Bruno and Christo Auret. "Enhancing global equity returns with trend-following and tail risk hedging overlays." Investment Analysts Journal, 21 May 2025.

2 Gordillo, Rodrigo. Hoffstein, Corey. Return Stacked® Portfolio Solutions. "Filling the Gap: Enhancing Traditional Stock and Bond Portfolios with a Managed Futures Stack." Return Stacked® Portfolio Solutions, 25 Jun. 2025.

Copyright © AdvisorAnalyst.com