by Karen Watkin, CFA, Portfolio Manager—Multi-Asset Solutions, & Edward Williams, Investment Strategist—Multi-Asset Solutions, AllianceBernstein

Multi-asset investors should conside r a deep bench of factors besides dividends in the hunt for income.

Dividends remain a key income source for multi-asset investors. But we think there are more ingredients to think about when designing an approach to capture equity income. Yield is important, of course, but other factors may help investors balance income with broader return potential.

A Narrow Focus on Income Alone Has Its Trade-Offs

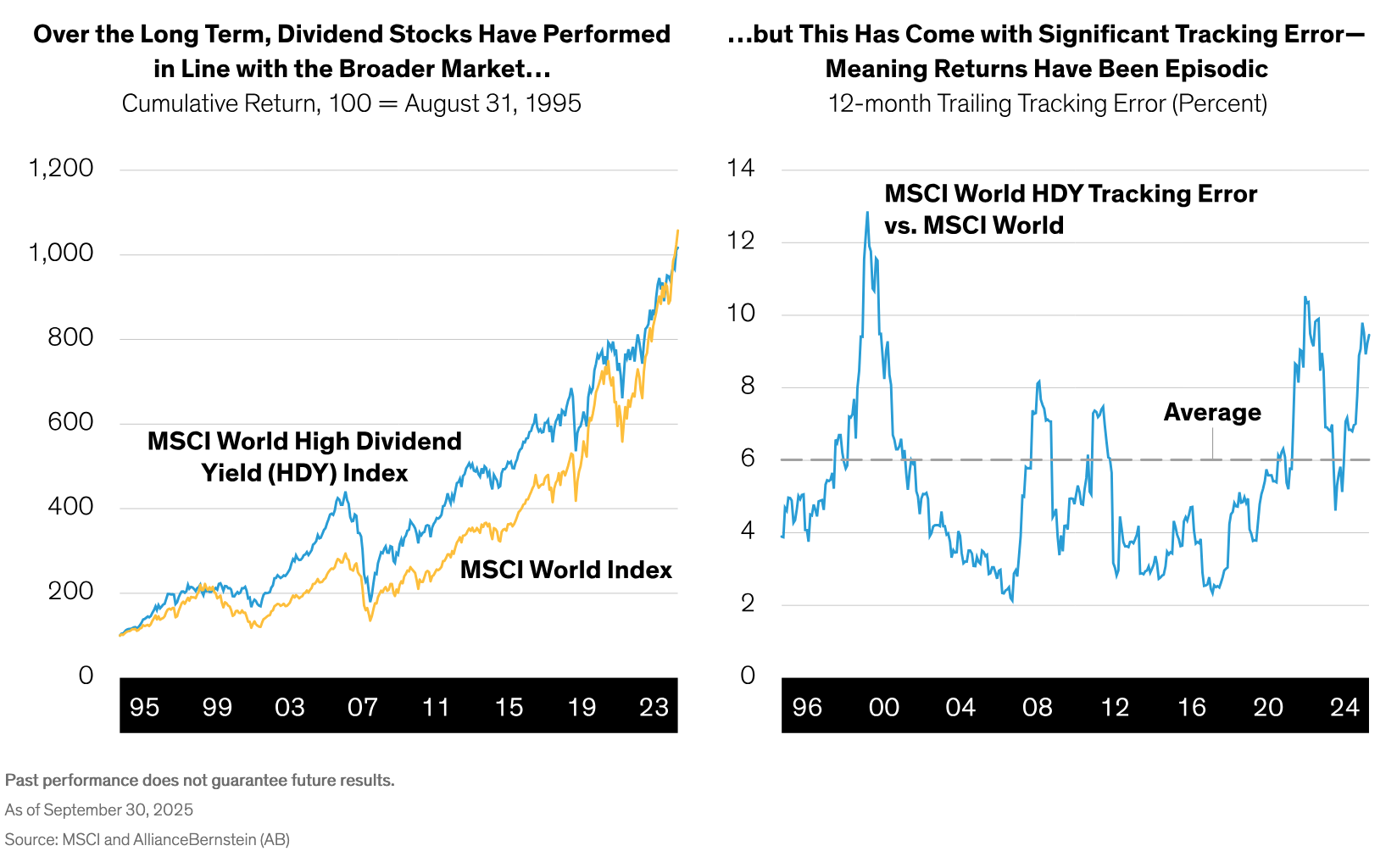

Over the last three decades, dividend stocks have delivered total returns similar to those of the broad global equity market (Display, left). But equity dividend performance has been episodic, with a high degree of variability versus the broader market (Display, right).

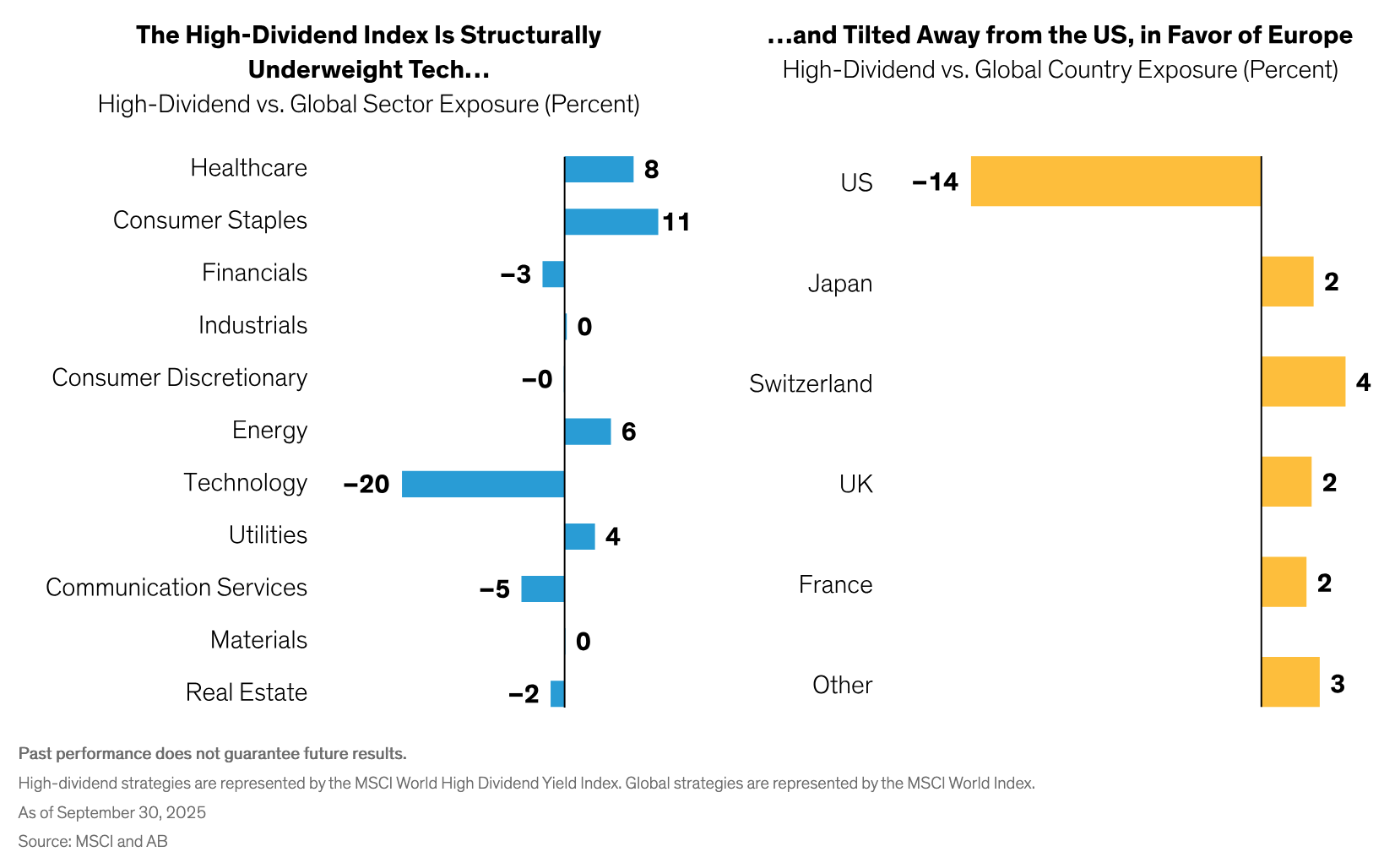

As we see it, focusing purely on dividend yield can create another problem: narrowing your investment universe to only high-dividend payers can drive unintentional biases in exposures to market segments. For example, high-dividend indices tend to lean into Europe and defensive sectors such as utilities and consumer staples. Conversely, they’re often underweight the US and technology—the very areas that have driven much of the market’s growth over the past decade (Display).

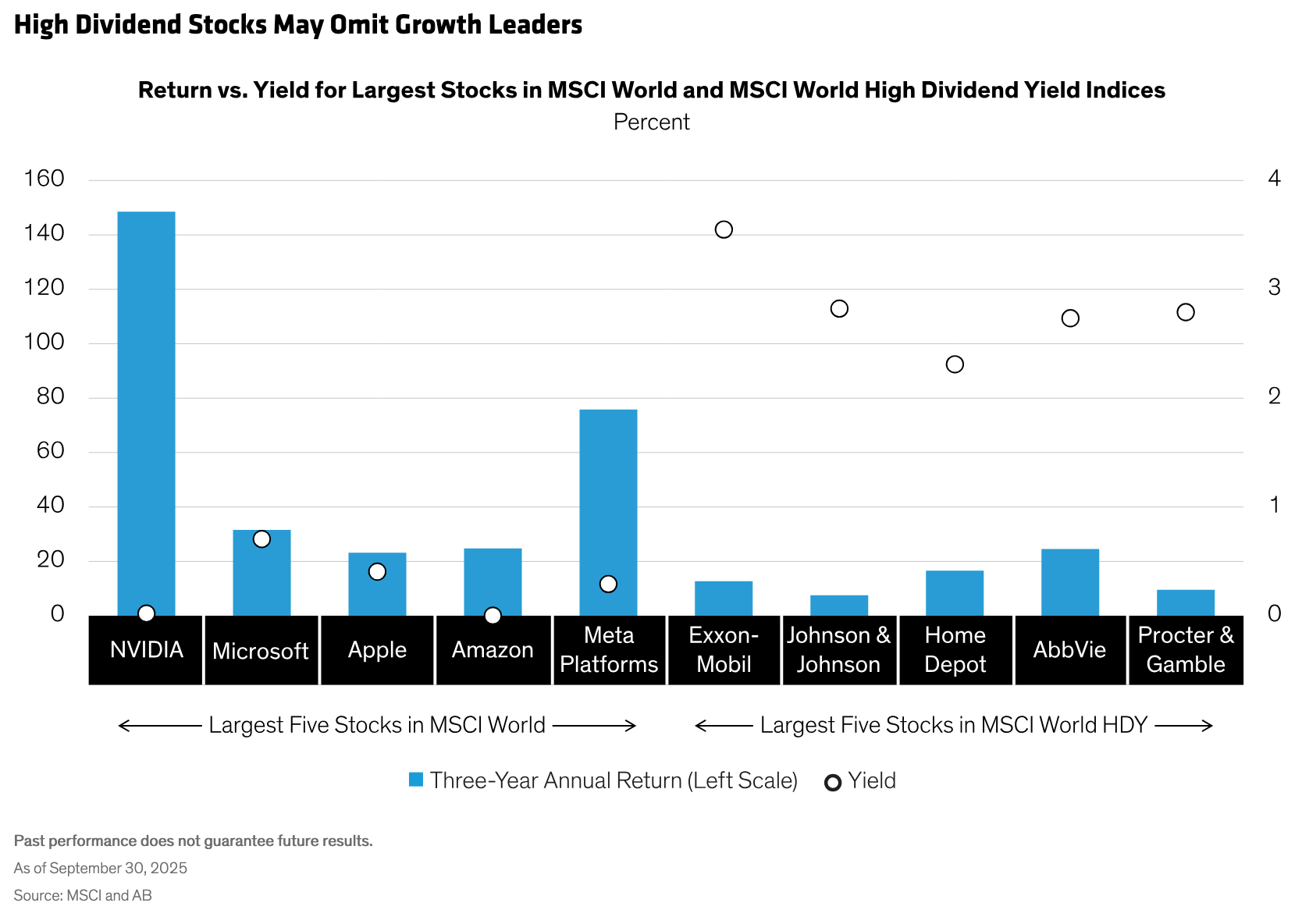

In our view, this creates a significant opportunity cost. Many of today’s most innovative and profitable companies—particularly in US tech—reinvest earnings rather than pay dividends. A glimpse at the five largest stocks in global and high-dividend equity benchmarks highlights this point (Display).

Companies such as NVIDIA have seen strong upside in recent years but pay little to nothing in dividends. By excluding these growth leaders, traditional dividend strategies risk missing out on key sources of capital appreciation and future growth. We think this trend is likely to continue, given the rise of artificial intelligence.

A More Holistic Way to Capture Dividend Income

We think a diversified, systematic approach that reaches beyond traditional yield sources to pursue long-term growth potential can be especially effective. By using a quantitative framework, we can tilt toward companies that score well across a broader set of factors, especially:

- Quality—firms with strong balance sheets and stable earnings

- Momentum—companies with positive price trends amid ongoing rallies

- Low Volatility—steady names that add a defensive layer when markets dip

- Value—business models attractively priced relative to strong fundamentals and prospects

We believe this type of multifactor income produces a more balanced strategy with the potential to deliver competitive income while maintaining growth potential and staying agile across market regimes. The patterns of April’s sharp market downturn and recovery showcased the complementary nature: low-volatility and value stocks offered downside mitigation, while quality, momentum and growth-oriented stocks led the rebound.

Taking Advantage of Regional Market Divergence

Another advantage of a systematic approach is its flexibility to tailor exposures by region. Equity markets vary significantly across geographies, and aligning factor tilts with local strengths can enhance outcomes.

For example, dividend yields tend to be higher—and value opportunities more abundant—in Europe, especially in sectors like financials. The region’s banks and insurers have benefited from rising interest rates, which have boosted net interest margins and improved profitability. These “value compounders” have delivered strong returns in recent years, making Europe a fertile ground for dividend and value tilts.

In contrast, US markets are dominated by growth and innovation, with tech firms offering modest dividends but exceptional earnings growth. In this case, leaning into quality, growth and momentum factors may help capture upside potential alongside higher income-generating assets.

To sum things up, plain-vanilla dividend strategies may offer the income that investors seek, but it’s often at the expense of diversification or exposure to upside potential. A systematic, multifactor approach offers access to more flavors in a balanced strategy that we believe may be better equipped to navigate changing market conditions.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Karen Watkin is a Senior Vice President and Portfolio Manager for the Multi-Asset Solutions business in EMEA. Along with being Portfolio Manager for the All Market Income Portfolio, she is responsible for the development and management of multi-asset portfolios for a range of clients. From 2008 to 2011, Watkin was portfolio manager for the Index Strategies Group, responsible for the development and management of AB’s custom index strategies for institutional clients in EMEA. She joined the firm in 2003, after spending three years as a management consultant in the Capital Markets Group at Accenture. Watkin holds a BA in economics with European study from the University of Exeter and is a CFA charterholder. Location: London

Edward Williams is a Vice President and Investment Strategist within the Multi-Asset Solutions team, where he is responsible for the business development of AB’s Luxembourg income-thematic multi-asset strategies. Williams joined AB in 2020 when he was based in Hong Kong, supporting client activity across Asia, before relocating to London and into his current role. Prior to joining AB, Williams spent six years working at Fidelity International across a range of roles in Europe and Asia, including as an investment specialist, focusing on Fidelity’s risk-managed and outcome-orientated multi-asset solutions. He holds a BA in economics from the University of Reading. Location: London