by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

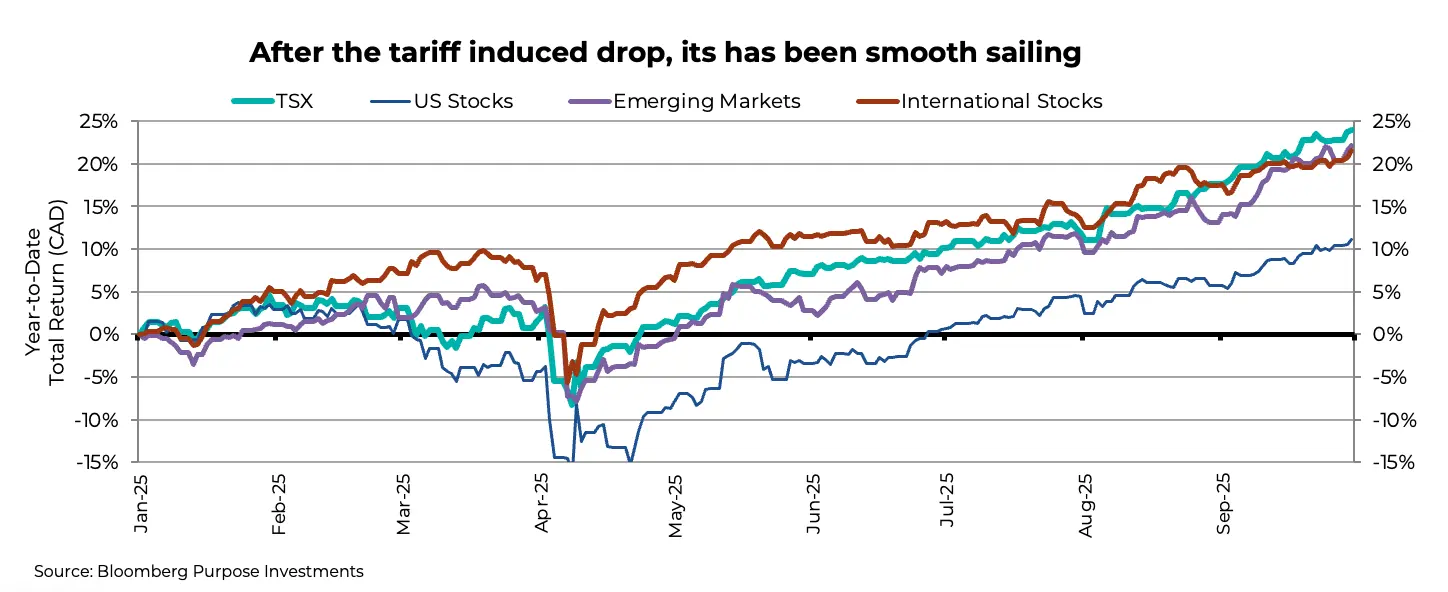

At the three-quarter mark, how could we sum up 2025 in a word? Awesome. If you’re an equity index up a respectable 10%, you’re a laggard this year. Canada's TSX is up an eye-watering 24%, breaching the 30,000 level. U.S. equities are that laggard at +10% (in Canadian dollar terms), compared to 25% for Europe, 15% for Japan, and 21% for emerging markets.

This market keeps shaking off tariffs, political uncertainty, deficit concerns, soft economic data, and sticky inflation. Bonds are up mid-single-digits, with higher returns for those with more credit risk. In a word? Awesome.

If you’re scratching your head over how markets just keep climbing, you’re not alone. There isn't any great news story driving them up—it’s more a mix of factors.

Inflation hasn't gone away, but it hasn't gone up much either. Economic data softened somewhat in Q2 but firmed up enough recently to ease growth concerns. Earnings estimates followed a similar path: softer in Q2, but revised upward in Q3. In short, nothing dramatic to the upside or downside: things are perhaps even boring. Markets like boring.

While macro fundamental data may be dull, the headlines certainly aren’t. There may be a broader lesson for investors here: policy changes, whether interest rates, tariffs, or regulations, rarely have an immediate effect. Adjustments ripple through the economy gradually. Meanwhile, markets often overreact to the initial news but then quickly move on, perhaps even forgetting the news altogether.

Take tariffs, for example: their impact on prices and trade is becoming more pronounced, yet equity markets have clearly moved on. But, as policy changes gradually make their way through the economy and into earnings, things may not remain boring for long.

Why We’re Mildly Defensive Heading Into Q4 2025

One of the most frequent questions we hear from clients and advisors is: can this rally keep going? What was shaping up to be a challenging investment year has delivered strong gains, albeit not without a few bumps along the way. With a plain-vanilla 60/40 portfolio up around 10-12%, it’s only natural to want to tilt a bit more defensive.

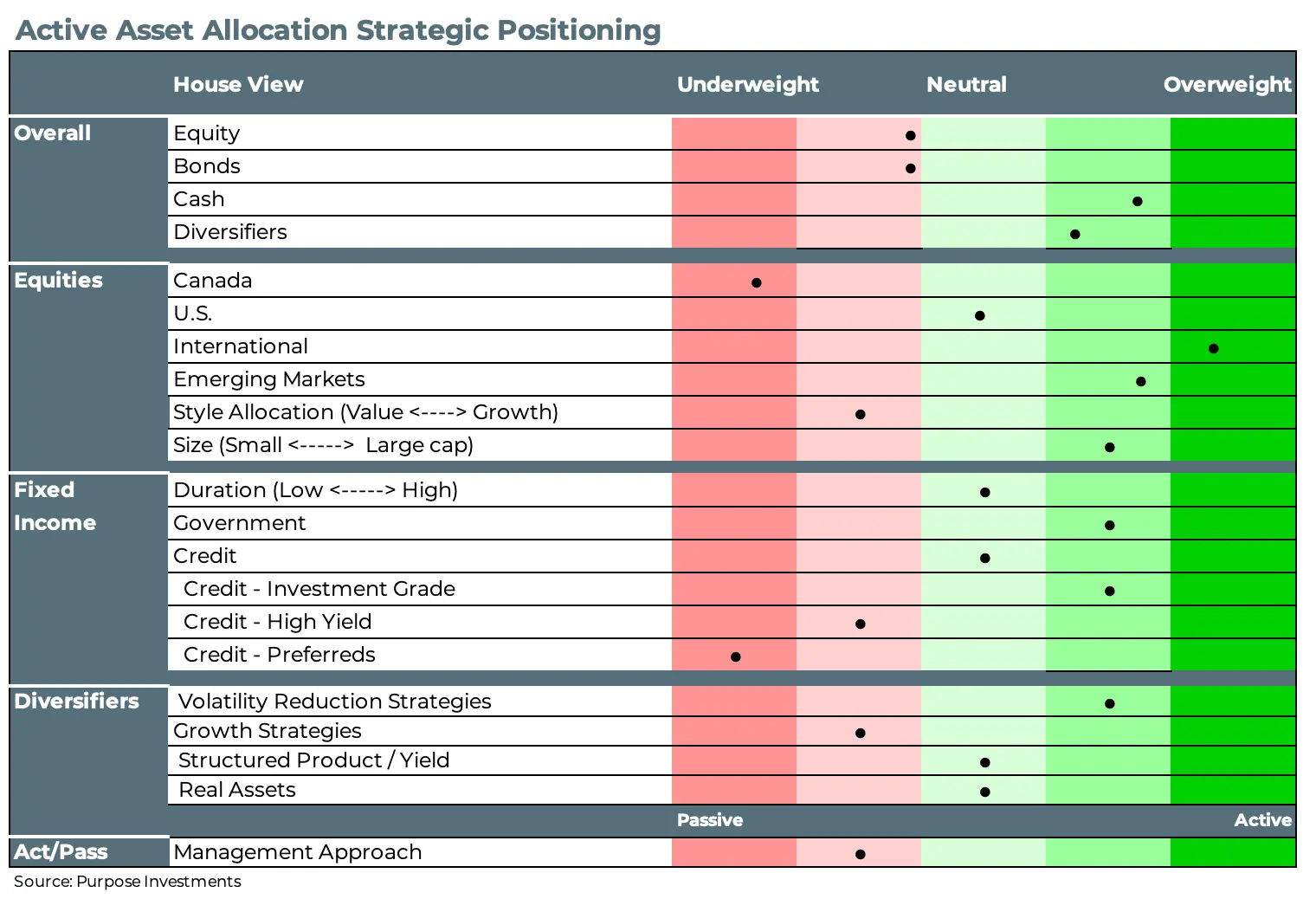

We would concur. Heading into Q4, we have a bit of a defensive tilt in the form of a mild underweight in equities and bonds with increased holdings in cash and diversifiers.

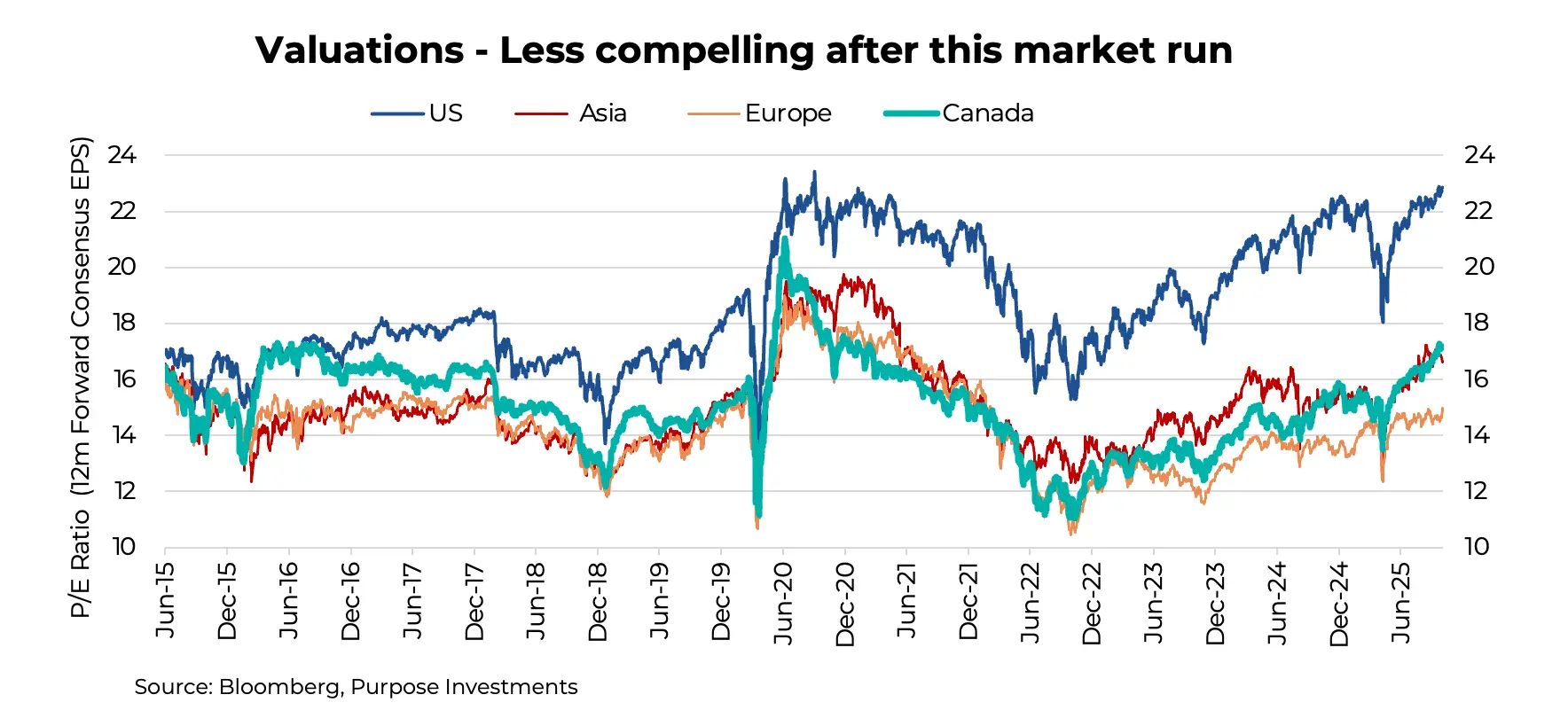

The relative valuations between equities and bonds are actually pretty close right now, based on equity risk premium or our adjusted Fed valuation model. But neither is really compelling after this year’s run.

We will pick on the U.S. market a bit, acknowledging it’s been the laggard from an equity performance perspective. The price-to-earnings ratio of 23x, which has proven to be an upper limit for valuations a number of times over the past few years. Canada’s TSX, thanks to strong gains mainly driven by multiple expansion, isn’t cheap like it used to be. Same with Asia. Perhaps only Europe remains on the cheaper side.

In short, equity valuations are not overly compelling.

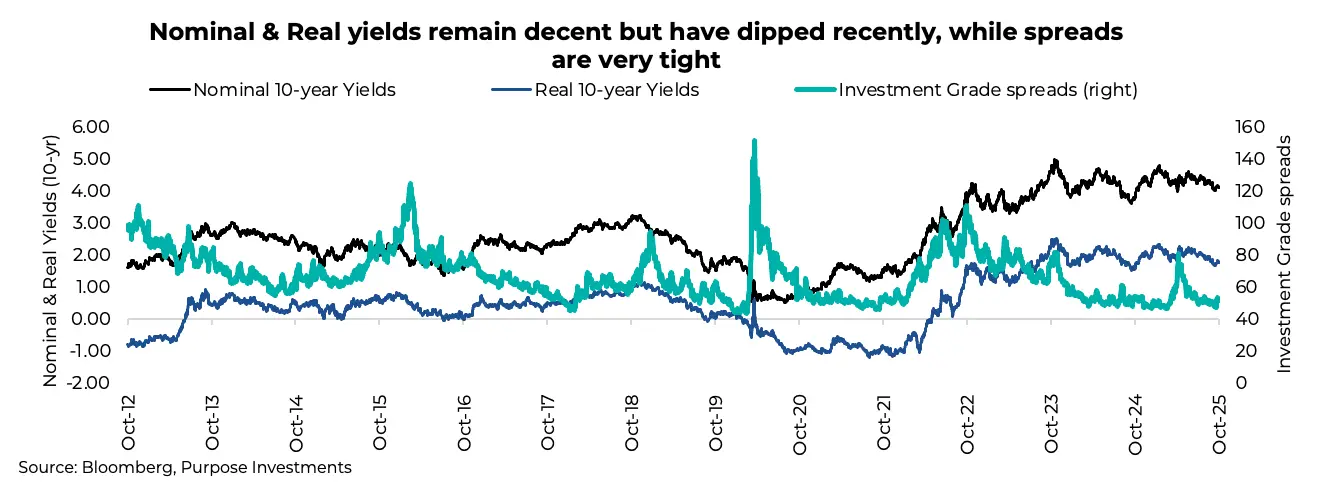

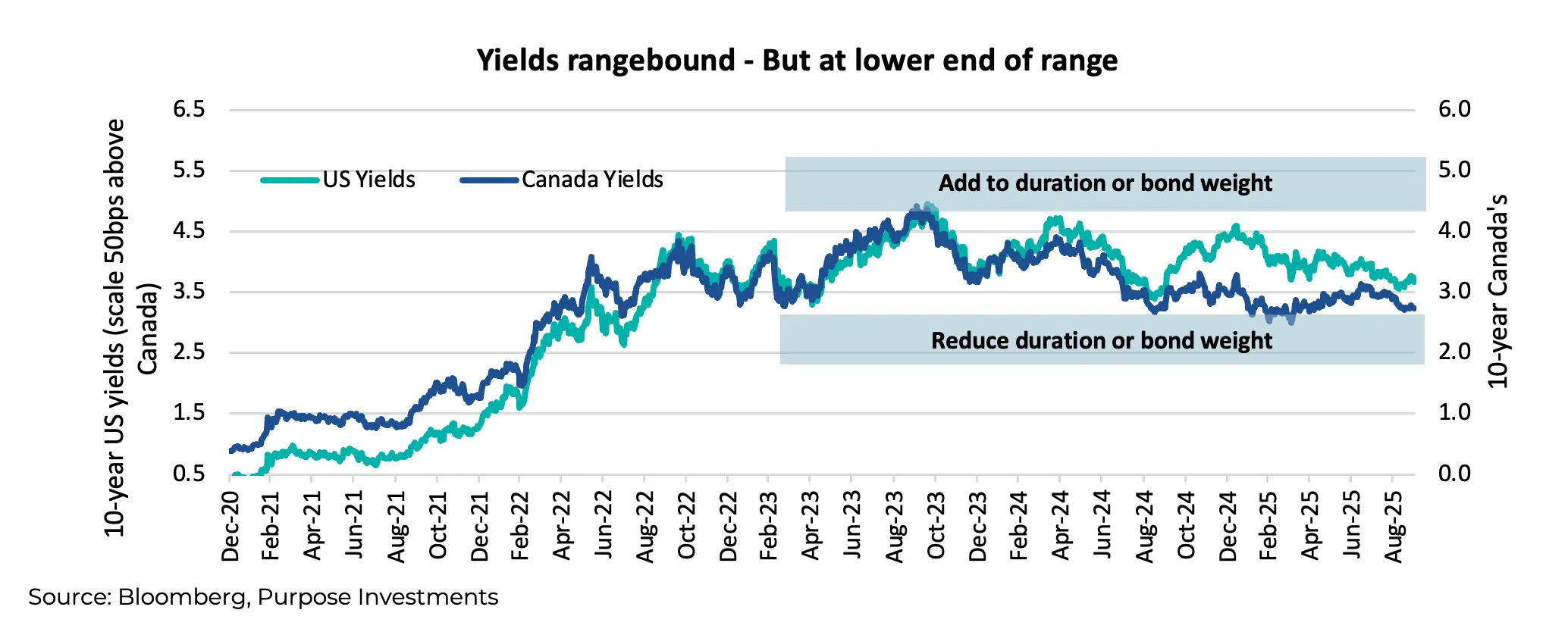

Bonds too. Bond yields, whether based on 10-year Treasuries or Govies, have been somewhat rangebound between 4–5% over the past few years (a lower range for Canadian yields). At the moment, yields sit closer to the lower end of that range.

The real yield on U.S. 10-years is running about 1.8%: not bad, but not great either. Throw in credit spreads at very low levels, and how does this all add up? We’re not negative on bonds, which carry a decent yield compared with years past, but we’re not really excited about them either.

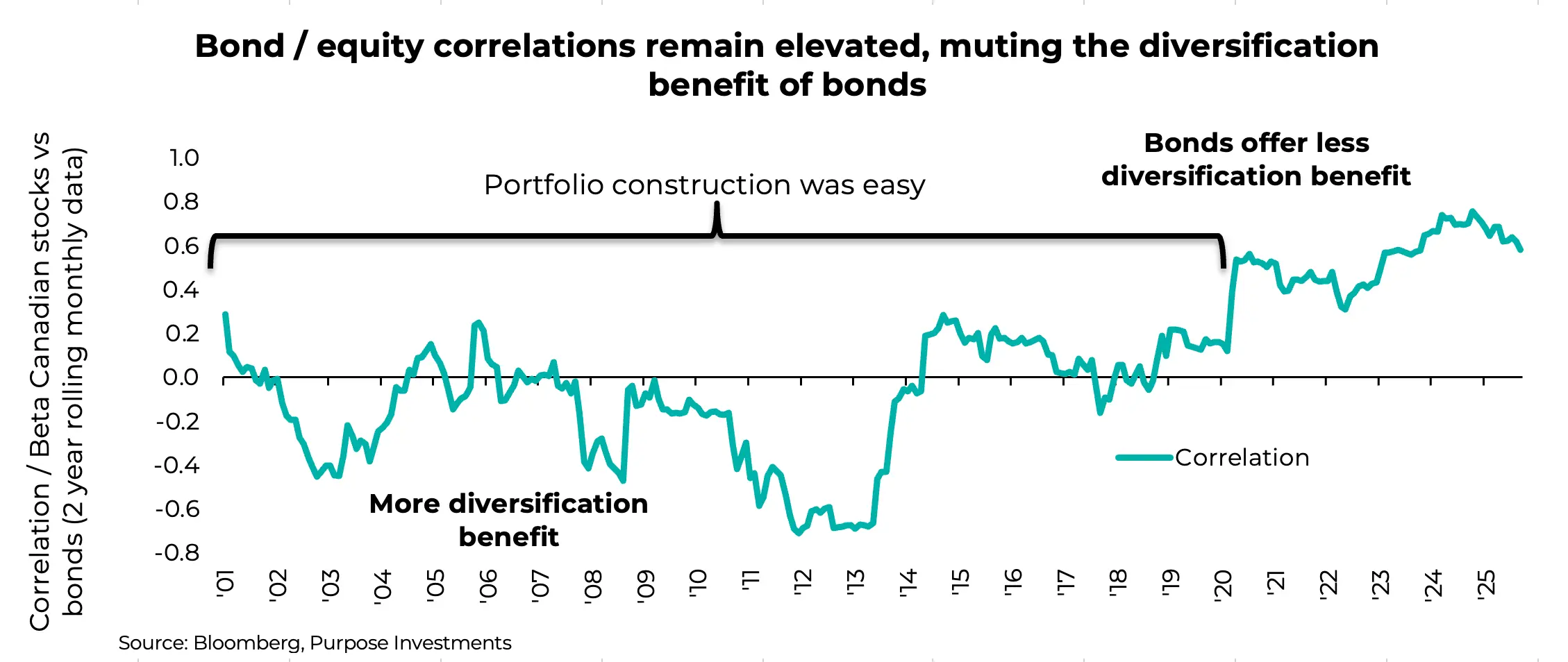

With mild underweights in equities and bonds, we’re parking extra capital in cash and diversifiers. Diversifiers help especially given that bond-equity correlations remain elevated, which may continue to mute the portfolio-stabilizing role bonds have traditionally played. The extra cash gives us flexibility to be opportunistic should there be a period of market weakness ahead, perhaps in Q4.

What Could Upset This Rally?

To say this market’s advance since April has been resilient is an understatement. Anecdotally, it seems that any bit of bad news only has a fleeting impact on market prices, which then push higher. This is thanks to decent macro fundamentals from mildly improving economic data, inflation that isn’t accelerating, and positive earnings revisions.

Outside a complete surprise from left field (always possible), we remain most focused on the upcoming Q3 earnings season, any signs of inflation heating up, and whether the softness in labour markets spread within the economic data.

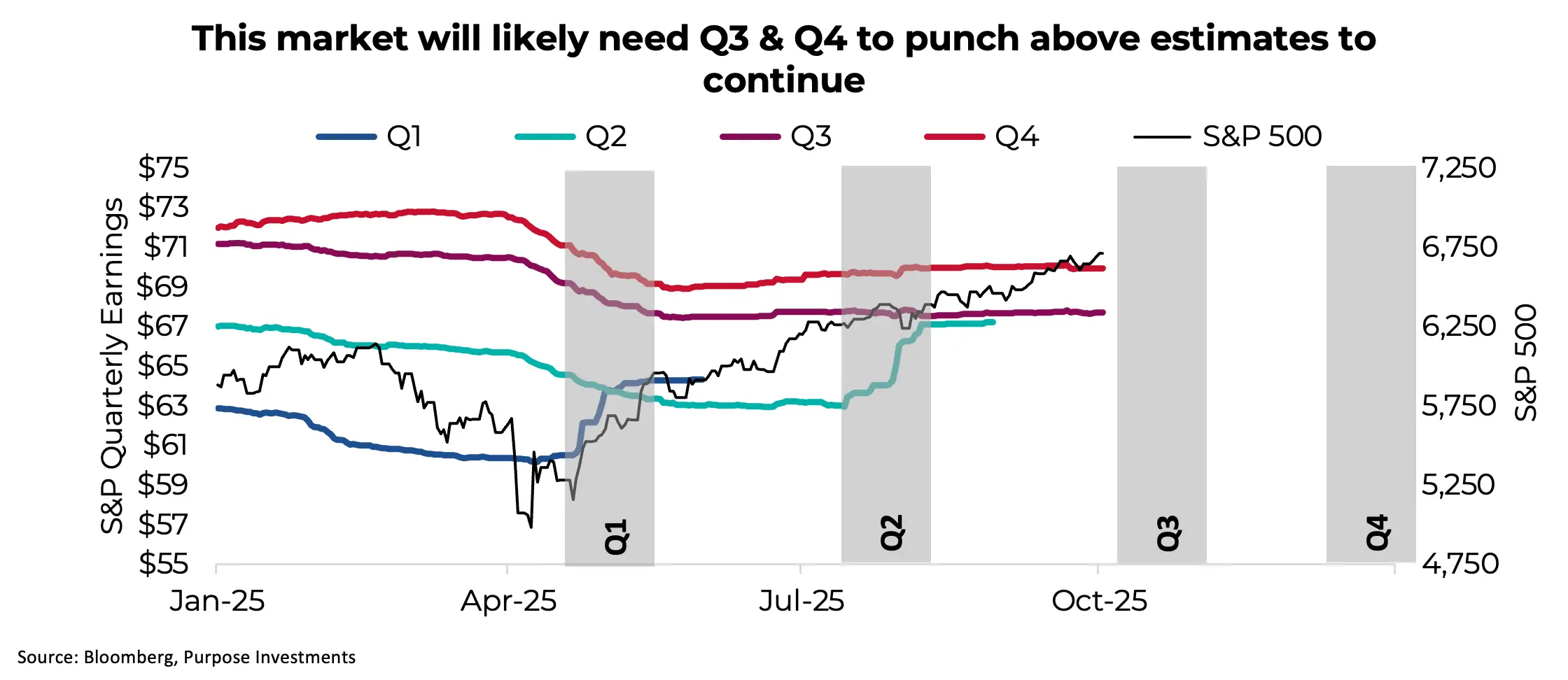

Q3 earnings season will be interesting. The pattern for Q1 and Q2 saw estimates revised materially lower, only for actual earnings to easily beat the lowered bar.

Again, this may go towards that temporal lesson for investors. Uncertainty and the impact of tariffs have been mild so far and companies have navigated well by pulling levers to mitigate the impact on the bottom line. Will this continue or will these factors start to show up in Q3 or Q4 or even later? That is the risk as estimates have ticked up somewhat for the upcoming quarters.

There are lots of positives as well. Global growth is improving, and a weaker U.S. dollar has been supportive for many markets and sectors. But let’s just say this: as the market moves higher, we incrementally become a bit more cautious and have an allocation that has lots of flexibility should we run into something disruptive. We’re tilted a bit defensive, but with enough exposure to enjoy if this rally continues.

Less Canada: Strong Gains, Growing Caution

We’re less enthusiastic about Canadian equities as we head into Q4, in part thanks to their resounding success in the previous three quarters. At 17x earnings, valuations looked stretched, as the vast majority of gains this year have come from multiple expansion.

TSX valuations should always be taken with a grain of salt given the composition of the index. With about 40% of gains coming from the Materials sector, which is dominated by gold, we’re happy—given our positive exposure to gold—but wary that these gains can disappear just as quickly.

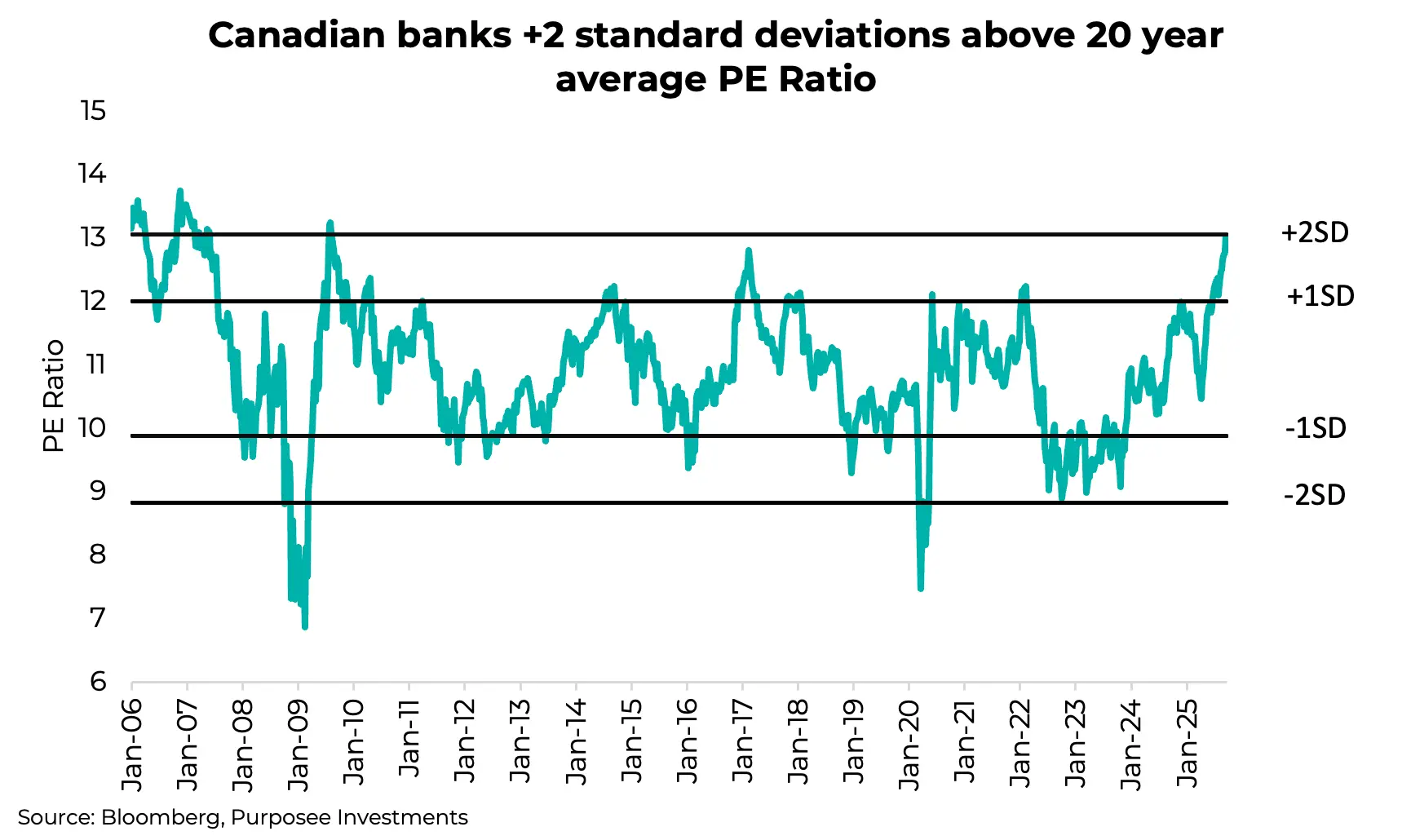

Maybe gold just keeps going…it is expensive though. But a bigger concern is with the beloved Canadian banks. The Canadian economy is not doing great, after a negative Q2 GDP print and expectations of almost no growth in Q3. Meanwhile the banks, which are sensitive to domestic economic growth, are trading at valuations 2 standard deviations above the historical average.

Is this the time to be giving Canadian banks a premium valuation?

Outside the lift from gold exposure, it’s fund flows. Global investors appear to be diversifying a bit away from America. Canada is capturing some of that demand, alongside other international markets, which has helped push the TSX higher. We believe this trend will continue, but it will have limits given higher valuations.

This dynamic does have us more constructive on the international side of equities overall.

More International - Revisiting Japan

We have a positive view on international equities, namely developed Europe, Asia, and emerging markets. After 15 years of U.S. equity market dominance, no question Asia and Europe seem to be due.

But there are other factors that support this view. The currency setup is one factor: with the U.S. dollar still overvalued and losing some of its reserve currency status. There has also been a change in focus from policy with the U.S. enacting policy that is less investor friendly while many international governments are adding to fiscal growth spending and tackling regulations.

We believe this will lead to a longer-term great rebalance of global portfolios, which will gradually cause fund flows to become more global and less America weighted. Given most portfolios remain very overweight in U.S. equities, this could be a very long-term trend.

Japan’s re-emergence

One market that often flies under the radar is Japan. Decades after a spectacular crash, Japanese markets have been quietly roaring back. Thirty-four years in the making and Japanese markets finally broke out to new highs last year. Since that time, the Nikkei has endured two 20%+ pullbacks (in local currency) but is now back on track.

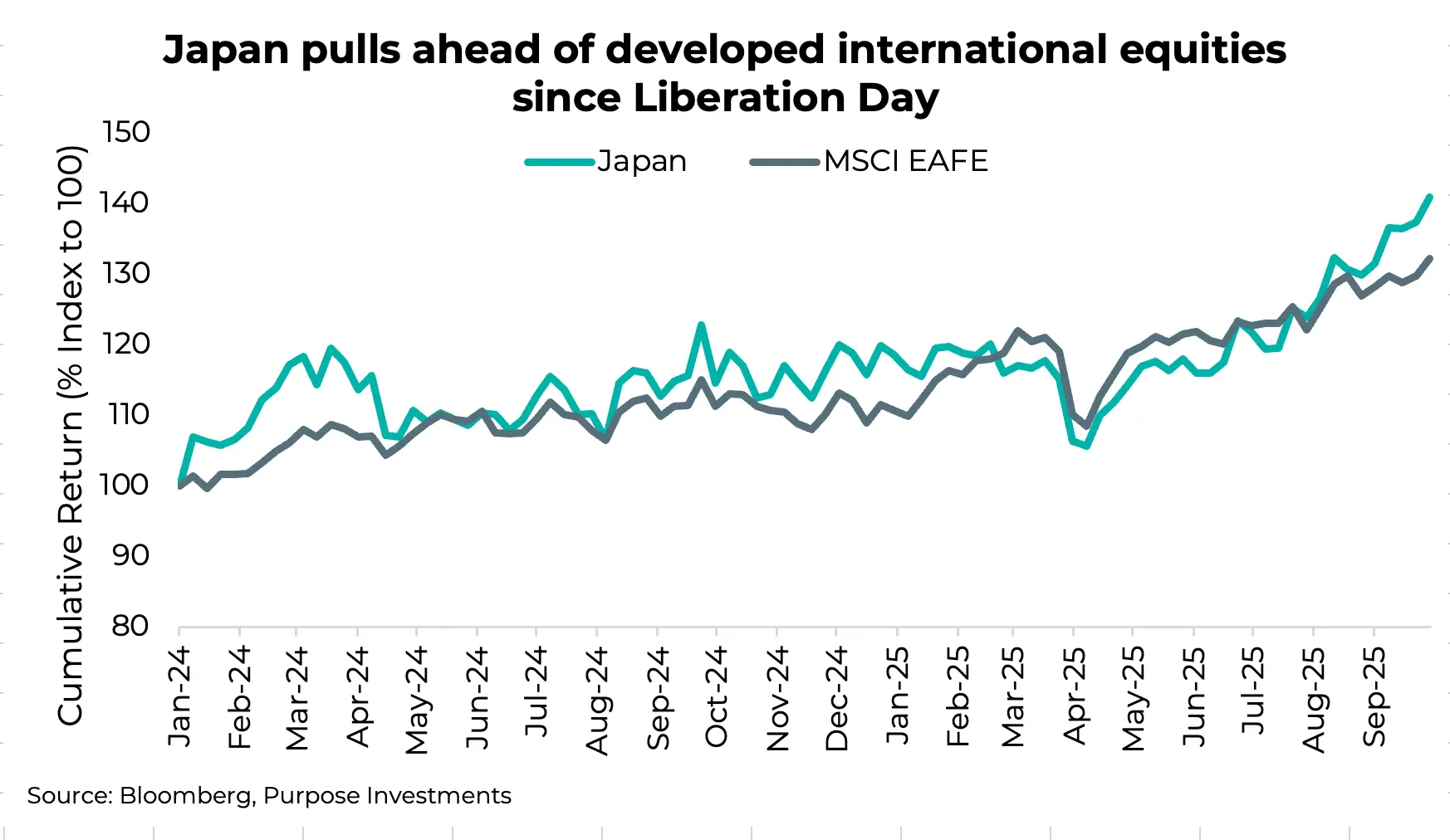

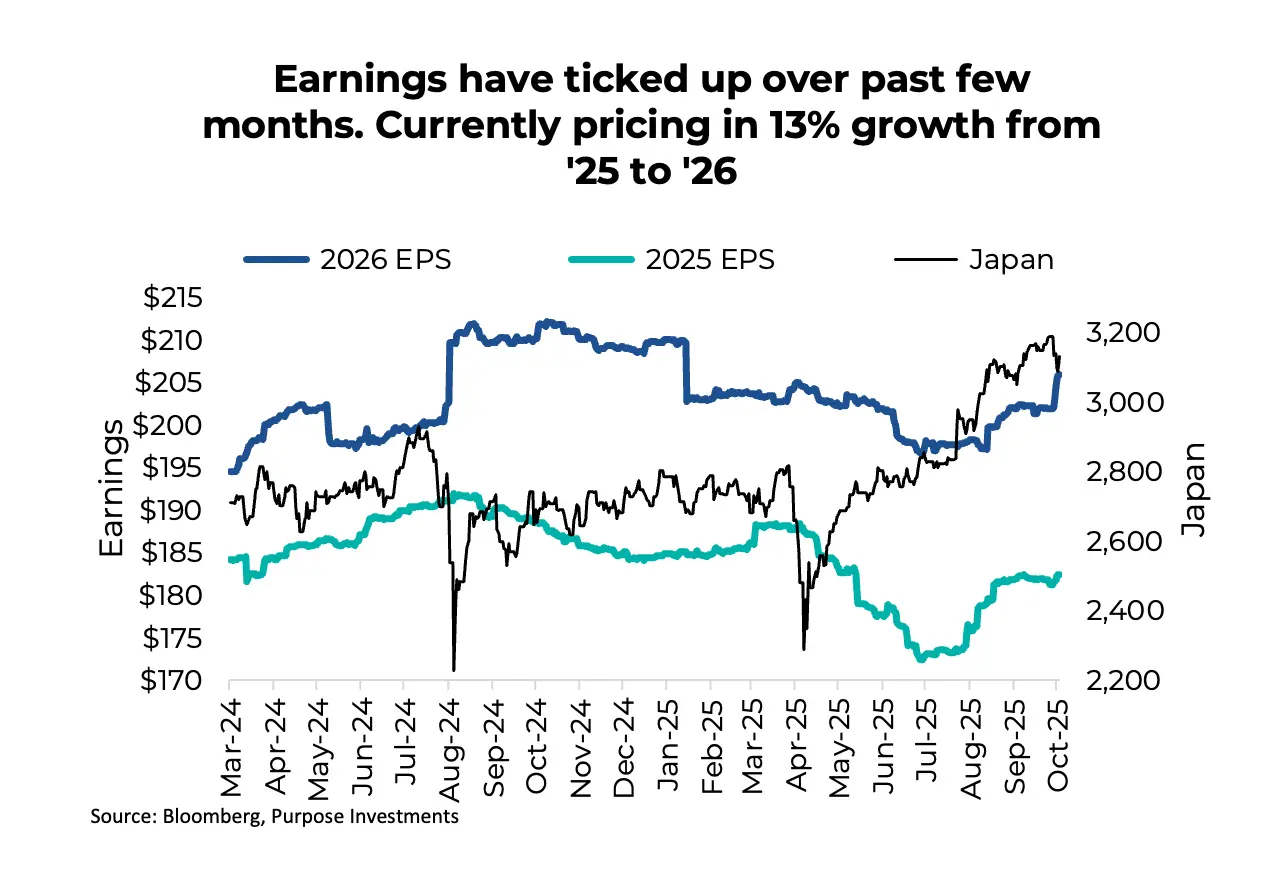

Year to date, the Nikkei is up 16.7% in local terms and 21% in Canadian dollar terms. So far, it’s been lagging other developed international markets this year, but that is beginning to change as seen in the chart below.

Since the market bottomed post-Liberation Day, the Nikkei is up 44% in dollar terms compared with ~30% for broader developed international market indices and the S&P 500. Most of that difference has occurred just in the past three months where Japanese markets have risen over 10%.

Our bullish view on Japan centers on four key pillars:

- Modest yen appreciation,

- Recovery of the Japanese economy,

- Corporate earnings growth, and

- Ongoing corporate reforms.

Behind the buying

So, what’s different this time? There are a variety of forces at play pushing Japanese markets higher. As the old adage from any political thriller goes: just “follow the money.”

Tokyo Stock Exchange data shows it’s not just one group driving the move. Foreign investors are steady net buyers, domestic retail investors are slowly returning, and corporations themselves are stepping in as net purchasers. There is a noteworthy counter acting force: the Bank of Japan. They’ve now begun to unwind the ETFs sitting on their balance sheet. At the moment, the pace is quite small, and it would take them over 100 years to fully exit all ETFs. It’s a tug of war, but given the amount of international capital pouring in, the war has been somewhat lopsided.

Japanese currency

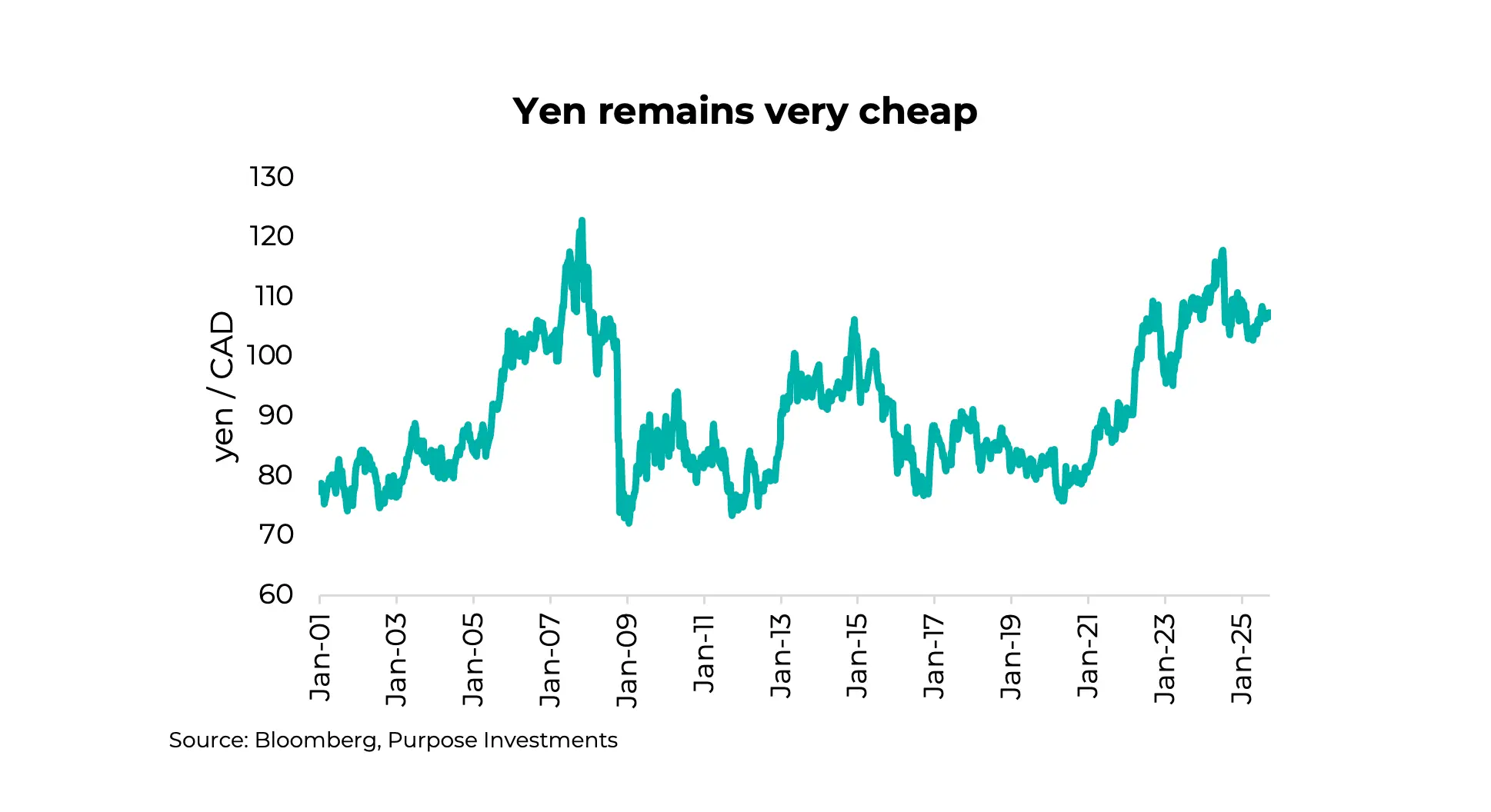

The yen remains spectacularly weak and has been since the BoJ decided to keep monetary policy very easy compared to other countries. Back in 2021, one dollar was worth 102 yen, now it’s around 150 yen. That’s a big reason why so many people you may know have been visiting Japan.

A weak yen isn’t just good for tourism; it’s also a big demand driver for Japan’s export-centric economy. Since the Bank of Japan first hiked rates last year, the yen has begun to appreciate, which is an added boost for foreign investors of Japanese assets.

Now, that the BoJ and the Fed are moving in different directions, the rate differentials that sustained the carry trade are beginning to erode. It remains profitable, but less so, diminishing the counterforce keeping the yen weak. That said, runaway yen appreciation could again unsettle the carry-trade, which as we saw last August, can very quickly rattle markets.

Economic shift and the boardroom evolution

For the first time in a generation, Japan is breaking out of a deflationary backdrop. It’s now in a sustained period of nominal growth, and normalized inflation, which translates to a higher stock market. Unlike Canada where the stock market and economy can sometimes move in very different directions, Japanese equities are very much tied to the Japanese economic engine, which is again moving along at a decent clip.

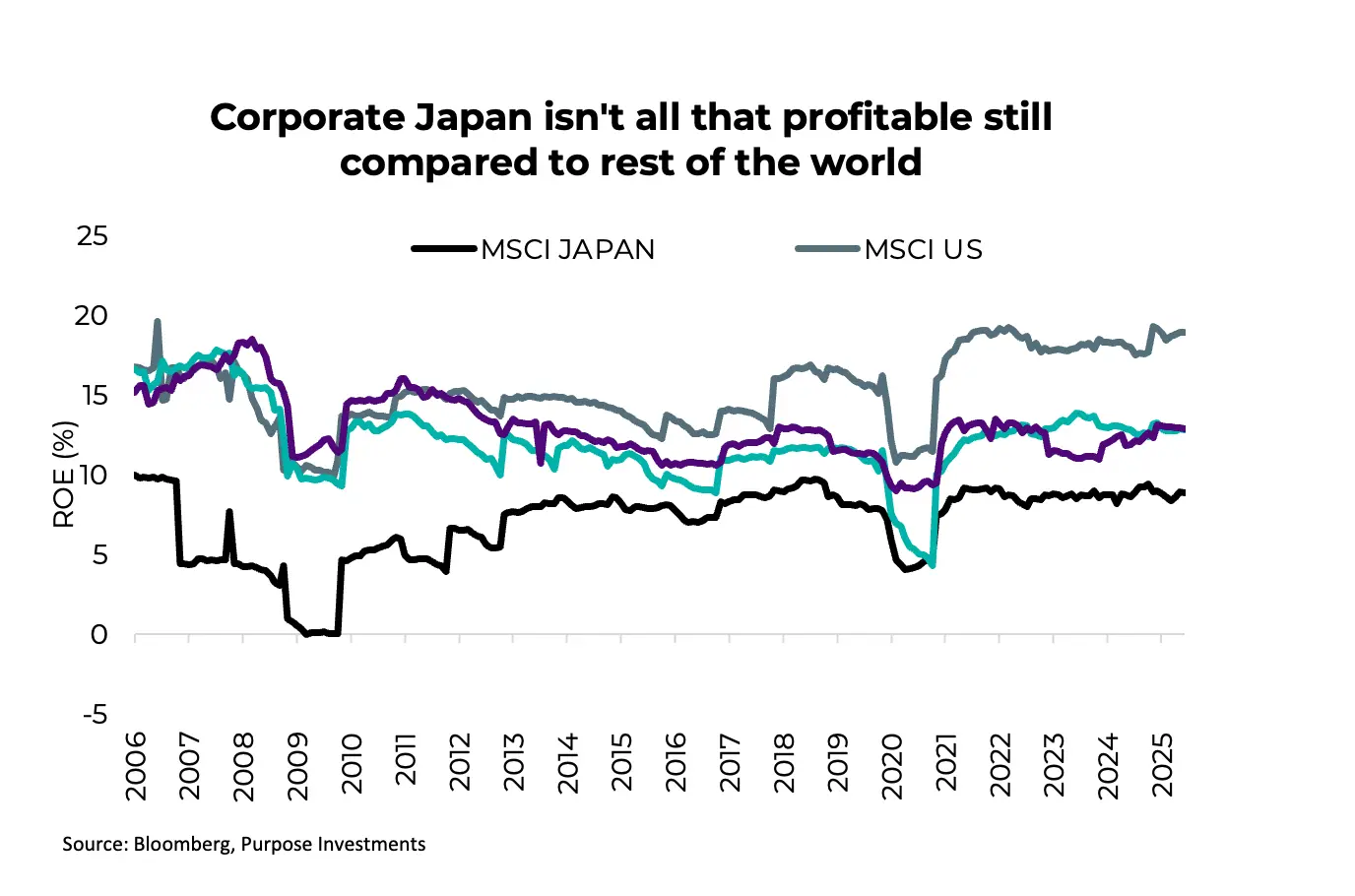

There is a quiet revolution changing Japanese board rooms, which have historically been very conservative and not the most rewarding place for equity ownership. Japanese companies are known for making quality products, but the companies don’t always make big profits.

Their culture has emphasized stakeholder capitalism, with surplus value distributed between customers, employees, suppliers, and society at large with shareholders further down the list. While still in place, there have been some very real government actions to pressure firms to improve capital efficiency. This renewed focus on returns should continue to pay dividends (literally) for shareholders as well as some large buybacks. While the profitability conundrum remains somewhat unsettled, it is moving in the right direction, which is a big opportunity.

We have a strong belief that the pro-business policies now in place should drive earning improvement over the next few years. Profitability, as based on return on equity, is still quite low compared to other markets as seen in the chart below. This means there is lots of room for improvement.

Earnings expectations have begun to pick up in a meaningful way. 2026 EPS expectations have seen a substantial move higher, and the market is currently pricing in around 13% growth from 2025 levels.

For Canadian investors looking to diversify internationally, we still believe Japan deserves serious consideration. The country is experiencing a real economic reawakening alongside long-overdue corporate governance reforms—both of which are creating opportunities for equity investors.

The yen's weakness continues to support exporters, and at roughly 16.5x forward earnings, Japanese stocks aren't expensive given the improvements we're seeing in profitability and capital allocation. While U.S. and European markets have captured most of the attention, Japan offers a market undergoing structural change that's still reasonably priced. It's exactly the kind of diversification that makes sense in today's environment and offers a great complement to passive international exposure, which does not own enough developed Asia in from our point of view.

Cooling Duration

Bond yields have come down over the past quarter to the lower end of their recent ranges. We did have a more constructive opinion towards carrying higher duration in portfolios as we had expected an economic soft patch in the second half of 2025.

While still not out of the realm of possibilities, the probability of a material economic soft patch has diminished. The U.S. economy remains resilient while global economic growth has turned more positive. Yet the higher duration has worked out with yields coming down.

So for yields to come down further we would likely need to see the economic temperature cool. Certainly possible, but more likely the current improving economic data, tariff impacts and labour market challenges leads to an uptick in inflation. This would move bond yields higher and is more probable path. As a result, we have cooled on duration, wanting to carry less on the bond side of portfolios.

Market Cycle & Portfolio Positioning

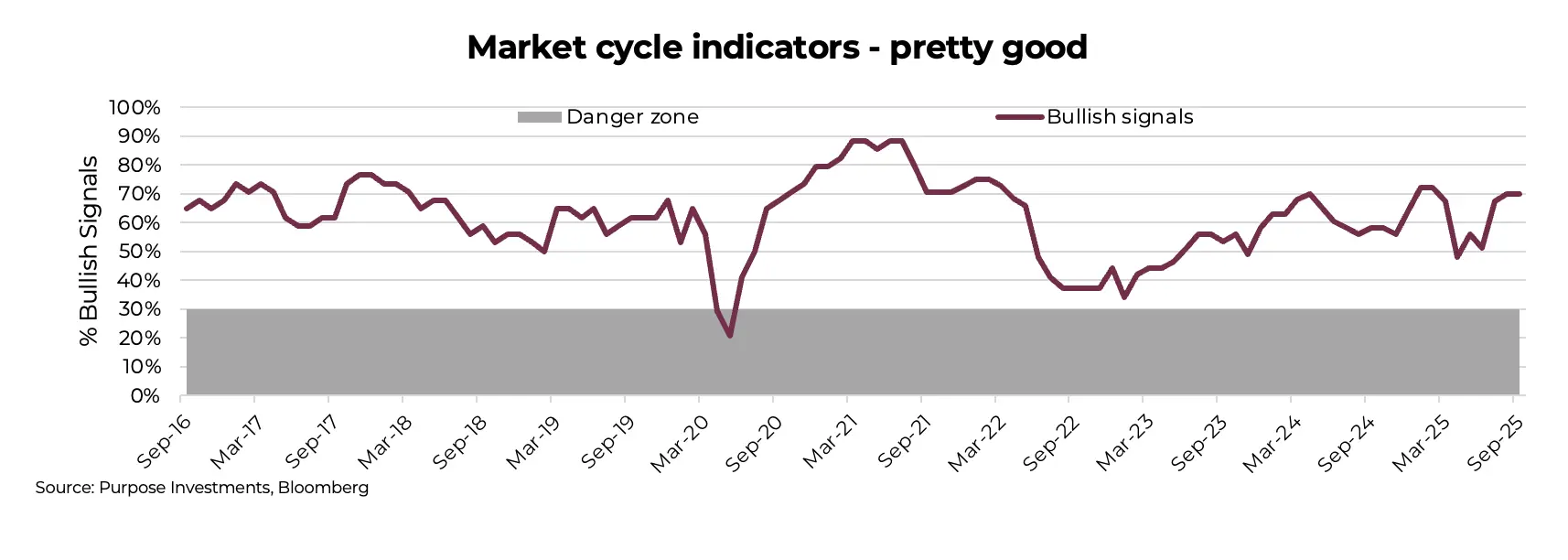

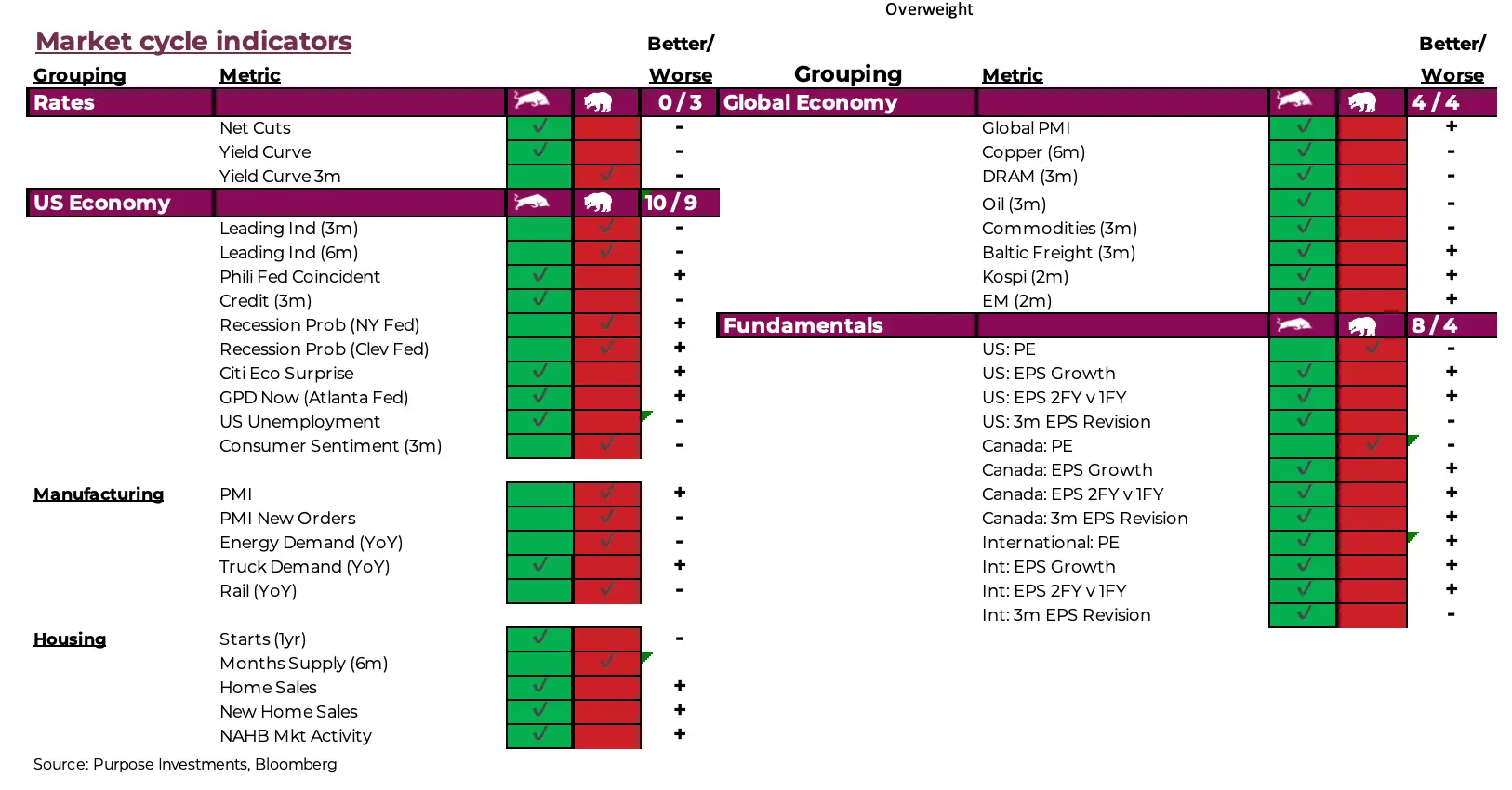

With the economic data improving somewhat, it comes as no surprise that our Market Cycle indicators have remained healthy. These are a compilation of economic, sentiment, market and fundamental indicators. The soft area remains the U.S. economy that is slowing somewhat. Consumer sentiment turned negative and while there were improvements in housing industry data points, manufacturing lost some of its previous momentum.

The good news remains the global economy, where all signals are bullish. There is stronger economic momentum outside of North America at the moment. Fundamentals are encouraging as well with earnings factors all positive apart from valuations for the U.S. and Canada. Overall, still support of a cycle continuation.

Final Note

2025 has been an awesome year, from an investment perspective, with gains aplenty and few pain points. Improving global economic data is encouraging, as is the robust spending on the AI buildout.

But how much of the good news is priced in already? We would say a good amount, which has us tilting a bit more defensive.

Maybe earnings start to feel the strains of tariffs and policy uncertainty, maybe inflation picks up, maybe the economic growth falters. That is a lot of ‘maybes,’ eh? With no clear and present danger visible, this is often when surprises come. It is usually easier to make money climbing a wall of worry, not surfing market euphoria.

— Craig Basinger, Derek Benedet and Brett Gustafson

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Copyright © Purpose Investments