Wall Street, like any professional sport, has its own language—and often, that language obscures more than it clarifies. As Ryan Lobdell, Jason Josephiac, and Brian Dana put it, “Wall Street jargon runs rampant throughout the investment services world and a single term can have meaningful differences depending on an investor’s perspective and inherent biases.” Their landmark whitepaper1 for Meketa Research, Risk Mitigating Strategies (RMS) Framework, opens with a mission: to strip away that jargon and teach investors “in language clearer than, for example, ‘hedge funds,’ which tends to be a nebulous term.”

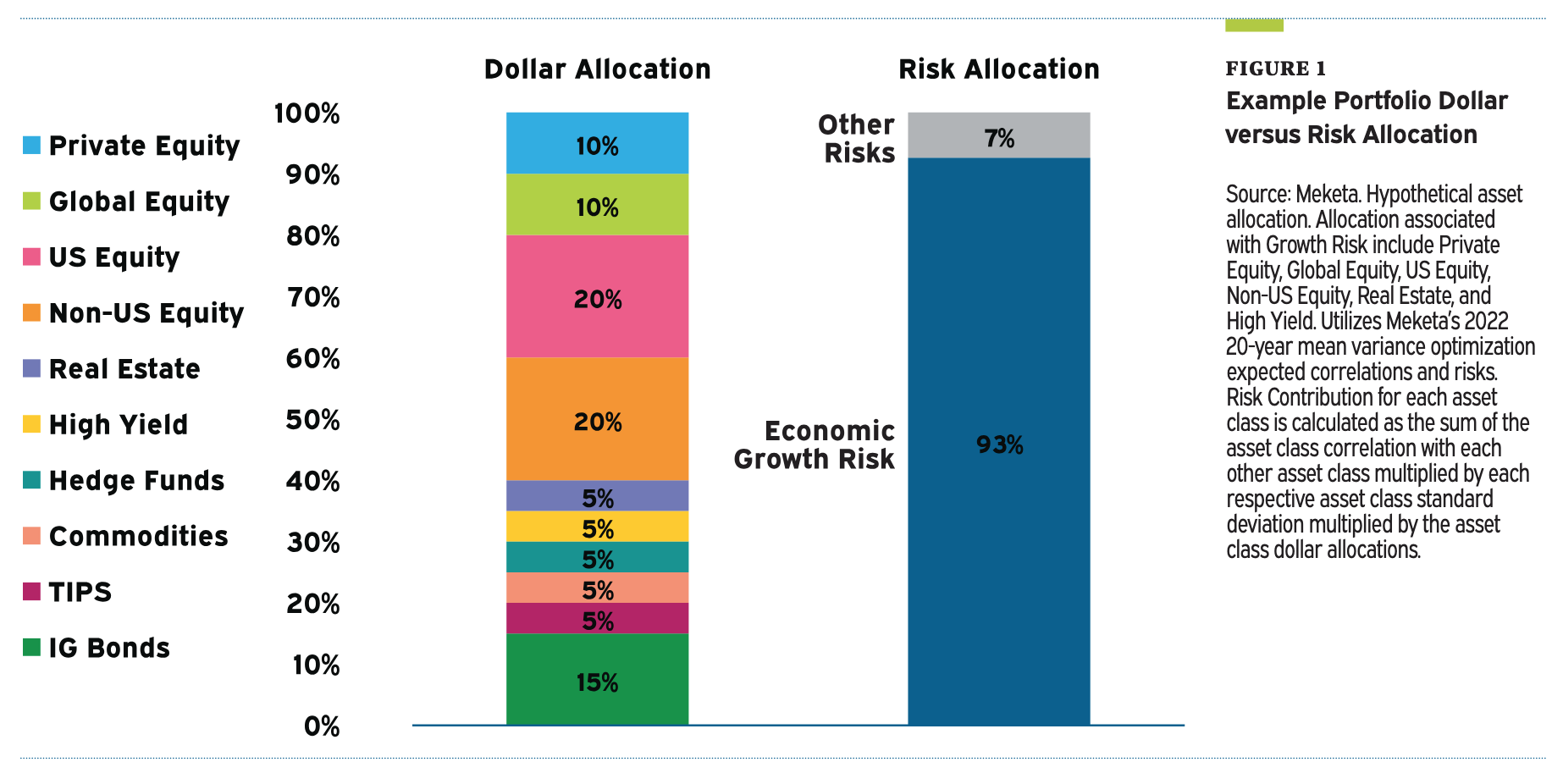

The authors lean into metaphor. Investing in hedge funds, they say, “is akin to playing sports.” But which sport? The idea of a “hedge fund” is as broad as saying you’re into “racing” — which could mean NASCAR, Indy, or rally cars. The same conceptual fog, they argue, clouds asset allocation. Too many portfolios appear diversified on paper but are, in reality, “overly reliant on offense.”

“Championship teams tend to have both a talented offense and defense,” they write. Yet, when viewed through a risk lens rather than a label lens, “the portfolio likely has a high dependence on economic growth.” This is the first major provocation: diversification by name is not diversification by risk.

From “Hedge Funds” to “First Responders”

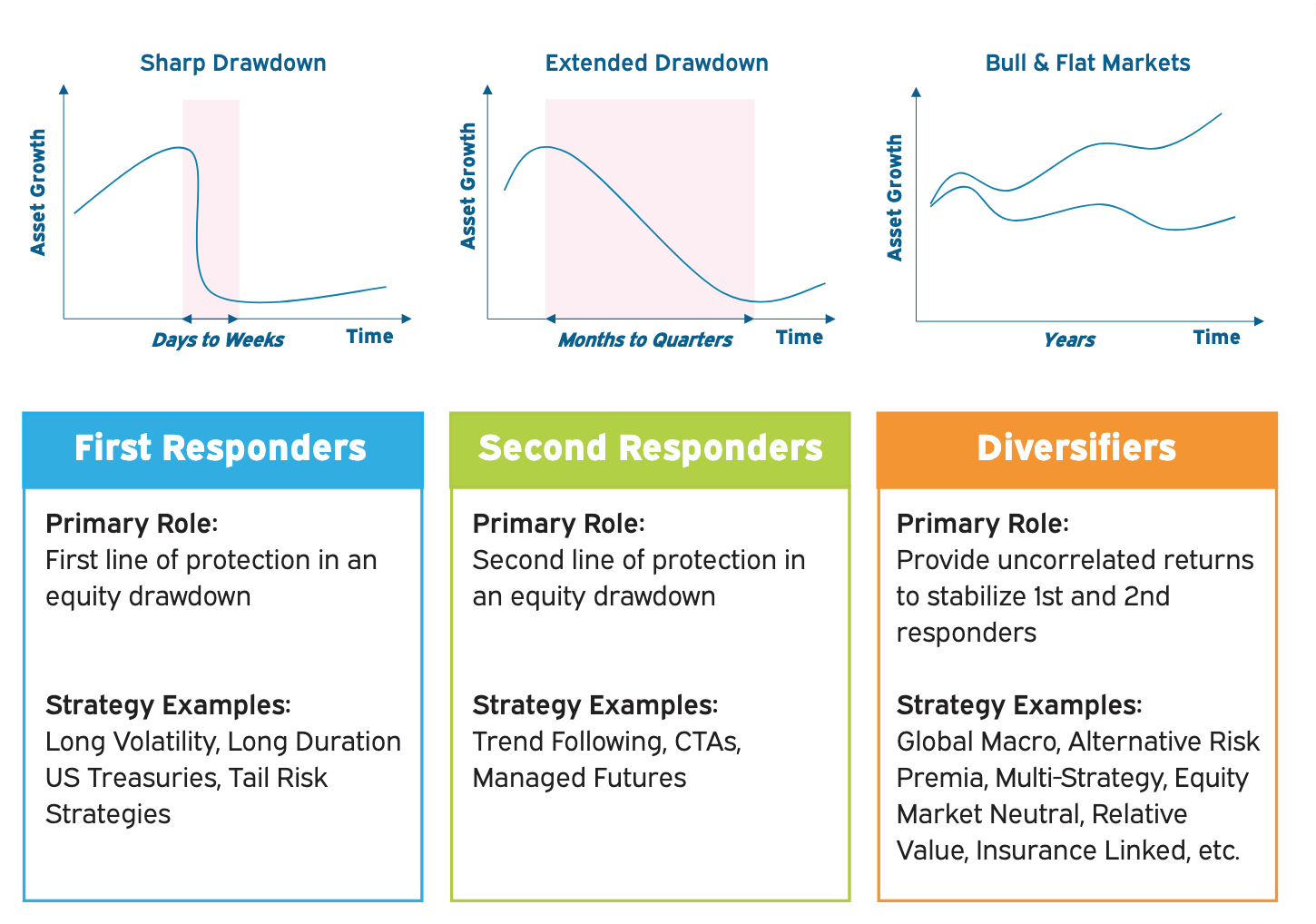

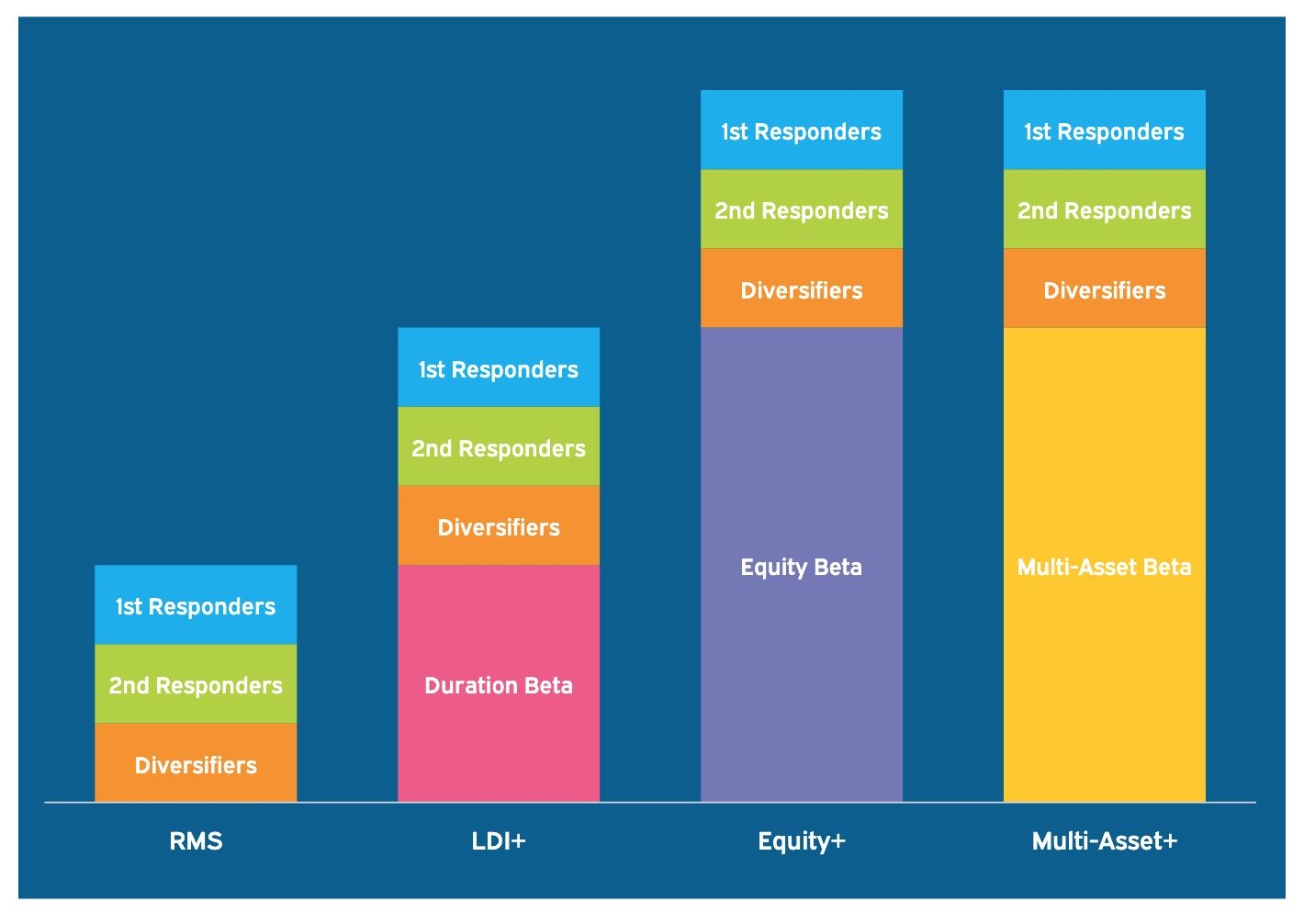

Lobdell, Josephiac, and Dana propose a clearer structure — one grounded in function rather than form. Instead of the vague “hedge fund” label, they use a framework called Risk Mitigating Strategies (RMS), which organizes investments by how they behave in a crisis. The RMS model divides defensive assets into three functional categories: first responders, second responders, and diversifiers.

“First responders,” they write, “are meant to include strategies which are intended to be the first line of protection in a material equity drawdown.” These typically include long-duration U.S. Treasuries, long volatility, and tail-risk strategies. They’re the players who step in when markets panic.

The second tier — second responders — “are meant to include strategies that may capitalize on protracted bear markets,” such as trend-following or managed futures. These are the ones who “may also produce gains in extended bull markets,” because they adapt.

Finally, diversifiers act as the ballast. “The main goal of a diversifier,” they explain, “is to provide returns that are uncorrelated to the first and second responders, and to the rest of the investor’s portfolio.” Think global macro, relative value, or market-neutral strategies — the ones that quietly grind out stability when the others aren’t needed.

Together, these three groups form what Meketa calls a functional defense system for portfolios — a way to “raise the probability of constructing a team or portfolio that consistently competes at a championship level.”

Anatomy of the Defense

The paper dives deeply into the anatomy of each category.

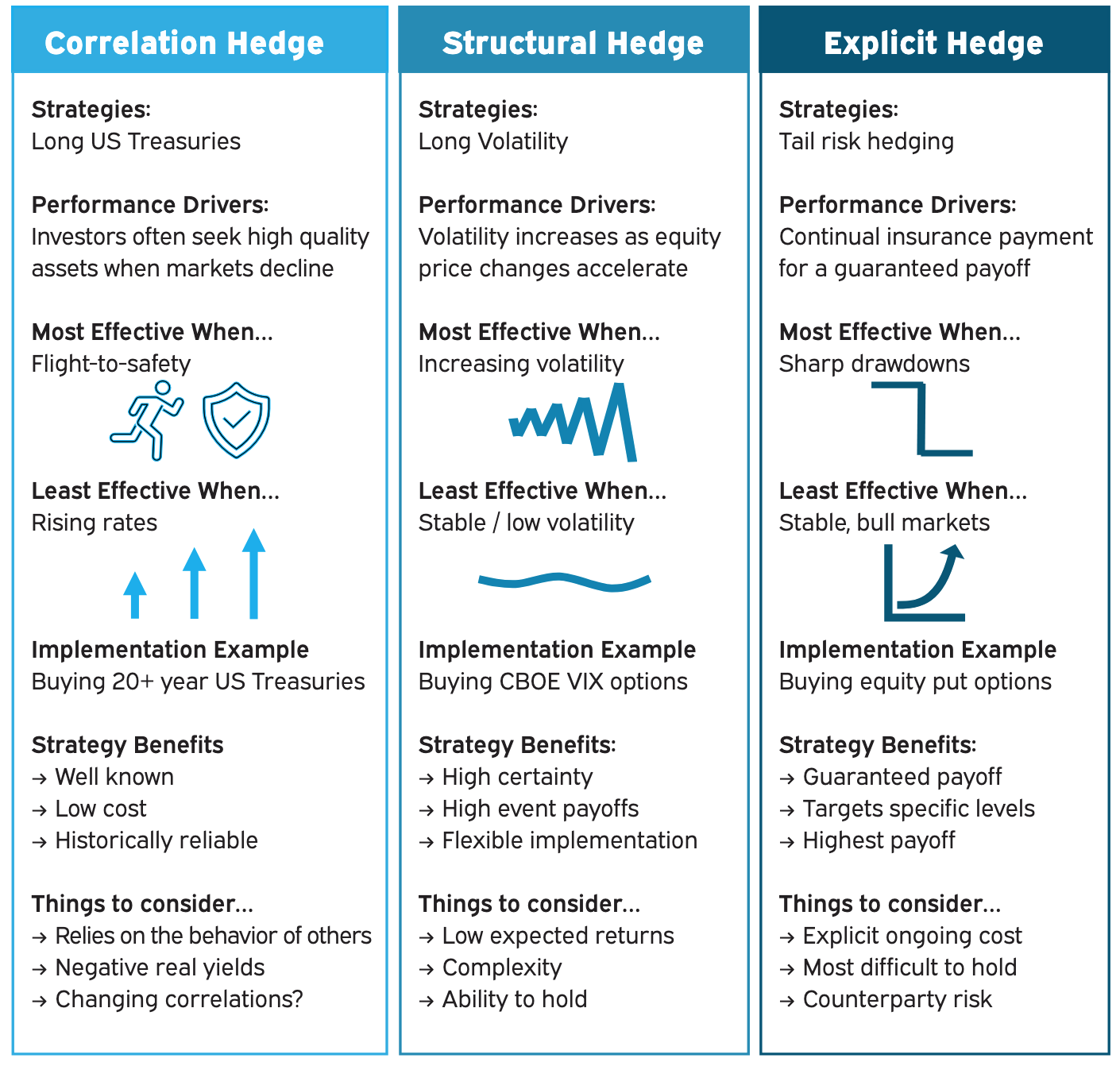

First responders are grouped into three hedge types: correlation, structural, and explicit.

- Correlation hedges, such as long-duration U.S. Treasuries, have “historically had a negative correlation to equities due to the behavior of other market participants.” They’re low cost and familiar, but, as the authors note, “their behavior during an equity drawdown may be reliant on the actions of other investors and government institutions.”

- Structural hedges, such as long-volatility strategies, “profit from changes in a security that are closely related to or based upon movements in markets.” They thrive when volatility spikes — though they can suffer in quiet markets.

- Explicit hedges, the purest form of insurance, “describe a highly certain payoff when an event of a specific magnitude occurs.” Tail-risk strategies like buying put options fall here. They “have a negative long-term expected return,” but “are often the most reliable way to hedge a portfolio.”

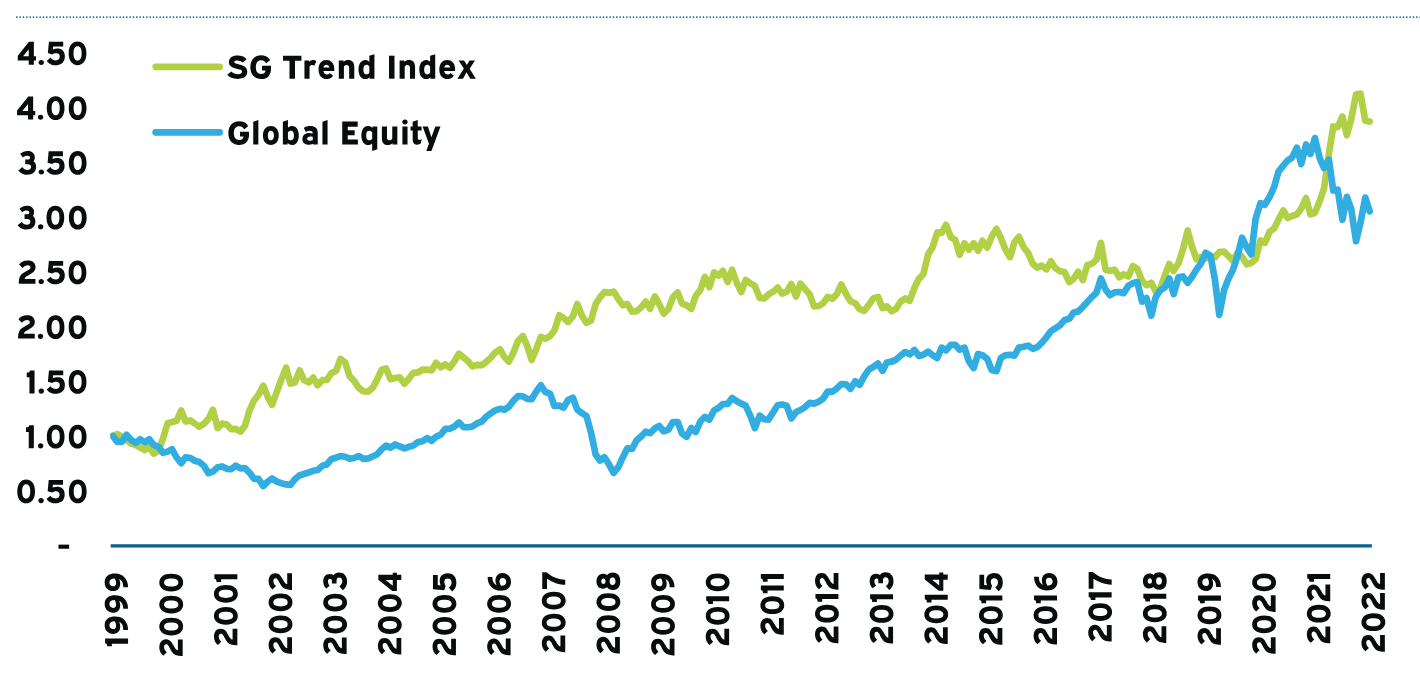

Second responders, mainly trend-following strategies or CTAs, take a different approach. They use “systematic processes to invest based on the direction (or trend) of equities, interest rates, currencies, and commodities.” Their strength lies in persistence: “Over the long term, trend following strategies have no structural bias for long or short positions; they are designed to equally capture both upward and downward price trends.” Their weakness? “They can struggle during market inflection periods, as well as during trendless but volatile environments.”

Finally, diversifiers form the third leg of the stool — a catch-all of global macro, insurance-linked, or relative-value strategies. Meketa’s trio write that diversifiers “provide higher expected risk-adjusted returns than first and second responders,” and “are largely uncorrelated to first and second responders.” But they caution that “setting aside labels and categorizations of hedge funds is important when identifying diversifying strategies because some hedge fund categories may be associated with high levels of embedded beta.”

Designing the Portfolio: The RMS in Action

When implemented in a strategic asset allocation, the RMS framework “seeks to provide positive long-term returns while producing negative to modestly positive correlations to traditional sources of risk.”

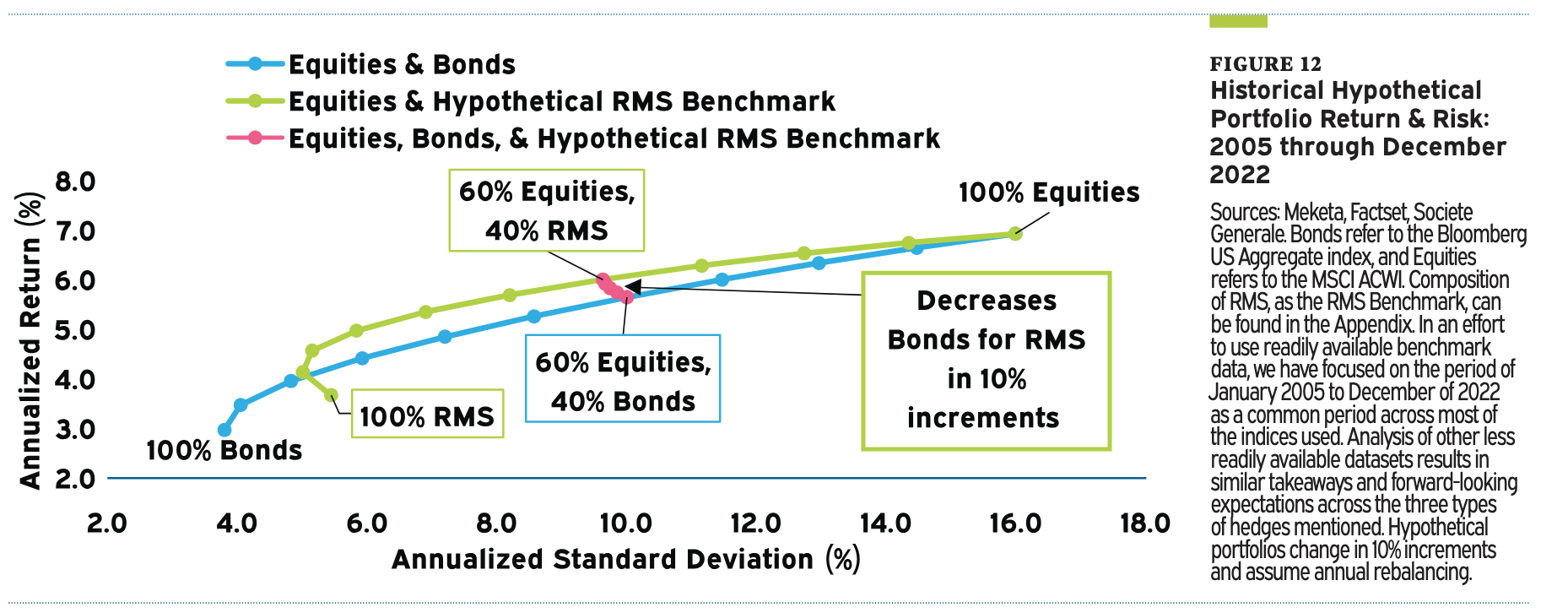

To demonstrate, the authors built a hypothetical composite blending equal weights of first responders (tail risk, long volatility, long Treasuries), second responders (trend following), and diversifiers (macro, relative value, equity market neutral, event-driven).

They found that such a mix “may help investors achieve an improved risk-return trade-off,” effectively bending “the efficient frontier up and to the left.” The trio point out that “many investor portfolios with long-term horizons, hence heavily invested in growth assets, might benefit from establishing an RMS framework.”

Crucially, an RMS allocation changes the game. Because it provides convexity—or positive payoff acceleration during market stress—investors can afford to take more risk elsewhere. “RMS allocations with high expected conditional performance during drawdowns may allow investors to increase equity or growth risk exposures, thereby implementing a ‘barbell’ approach to risk allocations.”

Crucially, an RMS allocation changes the game. Because it provides convexity—or positive payoff acceleration during market stress—investors can afford to take more risk elsewhere. “RMS allocations with high expected conditional performance during drawdowns may allow investors to increase equity or growth risk exposures, thereby implementing a ‘barbell’ approach to risk allocations.”

In other words: defense makes offense possible.

A Hedge Against Uncertainty

The whitepaper concludes on a pragmatic note: “An RMS framework provides building blocks to design a defensively oriented portion of an investor’s strategic asset allocation that seeks diversification of risks, rather than diversification of labels.”

The authors stress that RMS is not a tactical hedge, but “a long-term strategic allocation.” It’s “a hedge against uncertainty,” meant to withstand “geopolitical risk, economic risk, and financial market risk.”

And perhaps most importantly, it’s about rebalancing the portfolio’s psychology. Most investors, they note, build their portfolios around offense — “strategies that are focused on producing offense through exposure to economic growth.” RMS “may be a way to add strategies which seek to provide complementary defensive attributes.”

In short, Meketa’s framework reframes portfolio construction as team design: offense and defense, each with clear roles. The goal isn’t perfection—it’s resilience.

Key Actionable Takeaways for Advisors and Portfolio Managers

- Replace label diversification with risk diversification. Don’t confuse a long list of asset classes with true diversification. Evaluate each position by its correlation to economic growth, not by name.

- Build your RMS framework across three functional tiers. Use first responders (long Treasuries, long volatility, tail risk) for fast shocks, second responders (trend followers, CTAs) for drawn-out downturns, and diversifiers (macro, relative value, market-neutral) for balance.

- Use convexity to go on offense. Allocating to RMS strategies that rise during stress may allow you to hold more equities without increasing total portfolio risk — a modern barbell approach.

- Treat RMS as strategic, not tactical. Don’t chase short-term hedges. As Lobdell, Josephiac, and Dana remind us, “An RMS framework may serve as a long-term strategic allocation rather than a tactical hedging strategy.”

In a market where most portfolios still rely on offense, Meketa’s Risk Mitigating Strategies Framework is a playbook for those ready to compete at a championship level.

Footnote:

"Risk Mitigating Strategies - Meketa Investment Group." Meketa Investment Group, 20 Mar. 2023, meketa.com/leadership/risk-mitigating-strategies.