by Asset Allocation Team, GMO LLC

Some investors still shudder when they consider their experience with hedge funds. Contrary to fantastical promises, realized returns were often lackluster, largely due to poor risk management and the deduction of onerous fees. Some opaque black-box strategies that appeared to offer diversification endured significant drawdowns alongside traditional risk assets, just when diversification was needed the most. The aggressive use of “discretionary liquidity provisions” placed restrictions on redemptions during the 2008-09 financial crisis, and some investors had to resort to legal action to get (a fraction of) their money back.

So why are we suggesting that investors revisit an asset category that has not always treated them well in the past?

- The emergence of liquid alternatives allows investors to capture the undoubted benefits of alternative strategies without the objectionable packaging.

- A strategy that can provide a meaningful expected return and is uncorrelated with other assets can significantly increase the Sharpe ratio of a total portfolio. This could be even more important if, for example, we enter stagflation, an environment where stocks and bonds both tend to do poorly and offer little diversification to each other.

- The return opportunity today for liquid alternative strategies is genuinely exciting given the prevalence of valuation dislocations (an ideal hunting ground for alpha) coupled with high real cash rates, which is the foundation upon which alpha is layered.

GMO’s Approach

Earlier this year, GMO’s Asset Allocation Team invested a sizeable 13% of its flagship unconstrained Benchmark-Free Allocation Strategy into the GMO Alternative Allocation Strategy (ALTA). ALTA provides daily liquidity and seeks to deliver equity-like returns with sensible and competitive fees, allowing for realistic return forecasts and prudent risk management.

GMO Alternative Allocation Strategy

Source: GMO

The above information is based on a representative account in the strategy selected because it has the fewest restrictions and best represents the implementation of the strategy.

The cornerstone of our approach is our proven ability to generate alpha across many of the strategies that we manage. Some examples include GMO Quality’s consistent outperformance relative to the iShares MSCI USA Quality Factor ETF, Equity Dislocation’s superior returns versus an MSCI ACWI Value less MSCI ACWI Growth proxy, and the strong relative performance of our Event-Driven and Systematic Global Macro strategies.

ALTA brings these capabilities and others together, offering diversified exposure across asset classes and risk premia. By combining distinct styles and categories within the liquid alternatives universe, ALTA delivers a comprehensive solution designed to enhance portfolio resilience and return potential. 1

Dynamic Allocation Across and Within Strategies

As the opportunity set changes, we seek to anticipate and respond to evolving market conditions. While some strategies are evergreen (e.g., Event-Driven), GMO is also positioned to selectively take advantage of opportunistic strategies. Two strong examples of this capability in today’s portfolio include:

- Equity Dislocation, which exploits today's attractive spread between the valuations of value stocks and growth stocks. Value is currently priced to outperform growth by more than 60%, assuming a reversion to historic norms.

- Emerging Currency (EM FX), which takes advantage of both the current attractive carry and valuations for EM currency vs. USD.

We are also dynamic within strategies and understand that the common approach of maintaining a constant volatility profile can be inefficient if it encourages taking more risk when return potential is muted, and less risk when return potential is strong. Many of our strategies calibrate the risk they are taking in relation to the risk/reward environment at any particular time.

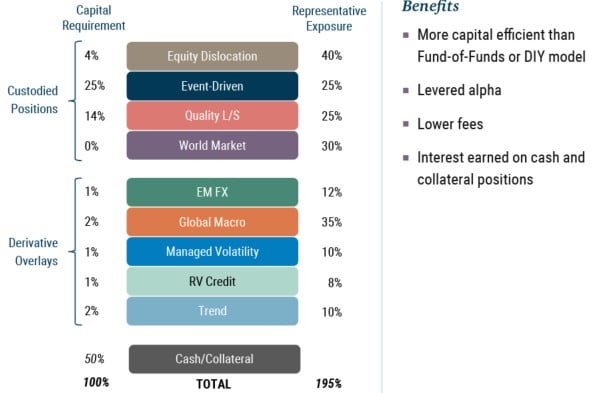

Capital Efficiency

To maximize the likelihood of meeting long-term return objectives, ALTA uses derivative overlays and collateralized long/short positions. This allows a dollar of invested capital to have more than a dollar of economic exposure, thus enhancing capital efficiency without compromising risk discipline. By engaging in such opportunities for responsible leverage, ALTA is much more capital efficient than a fund-of-funds or DIY approach while also benefiting from a single competitive fee.

Insightful Risk Management

While many alternative strategies rely on some beta to generate returns, we manage ALTA to have a beta to equities and bonds of zero. In particular, when combining strategies we explicitly account for stress-period beta expansion in portfolio construction, ensuring ALTA remains a reliable source of risk mitigation in a crisis.

Low Correlation Across Asset Classes

Index |

Correlation with ALTA |

| HFRX Absolute Return | 0.3 |

| S&P 500 | 0.2 |

| Russell 2000 | 0.3 |

| MSCI EAFE | 0.4 |

| Bloomberg U.S. Aggregate | 0.2 |

| FTSE 3M Tbill Index | 0.1 |

| S&P GSCI | 0.4 |

Data from 5/1/2019 to 6/30/2025 | Source: GMO

The above information is based on a representative account in the strategy selected because it has the fewest restrictions and best represents the implementation of the strategy.

Liquidity

GMO has been managing multi-asset portfolios for four decades and has experience and expertise across the skills required to be successful, including the considered use of “dry powder.” Historically, cash was the way to protect capital values in troubled markets, ready to redeploy into risk assets at more favorable valuations. However, the excellent liquidity associated with some of today’s alternative strategies makes them an exceptional store of dry powder, as was clearly evident in 2022-23.

In 2022, our unconstrained Benchmark-Free Allocation Strategy had an average weight of 52.5% in alternatives, which generated a 6.9% positive return. That same year, MSCI ACWI was down 18.4% and the Bloomberg U.S. Aggregate Index declined 13.0%. Our alternatives exposures had another strong year in 2023, up 6.8%, but this time trailed far behind the recovering MSCI ACWI’s massive return of 22.2%. We had used the liquidity of our alternative assets to seamlessly transfer about a third of the total exposure into equities near the start of the year and thus benefited from the strong equity rebound.

Closing Thought

In today’s environment of elevated uncertainty and stretched valuations, liquid alternatives like ALTA can offer a compelling way to enhance diversification, improve portfolio resilience, and pursue alpha. We believe it’s time to take another look.