by Tom Hollenberg, Jared Franz, Charles Ellwein, & Jody Jonsson, Capital Group

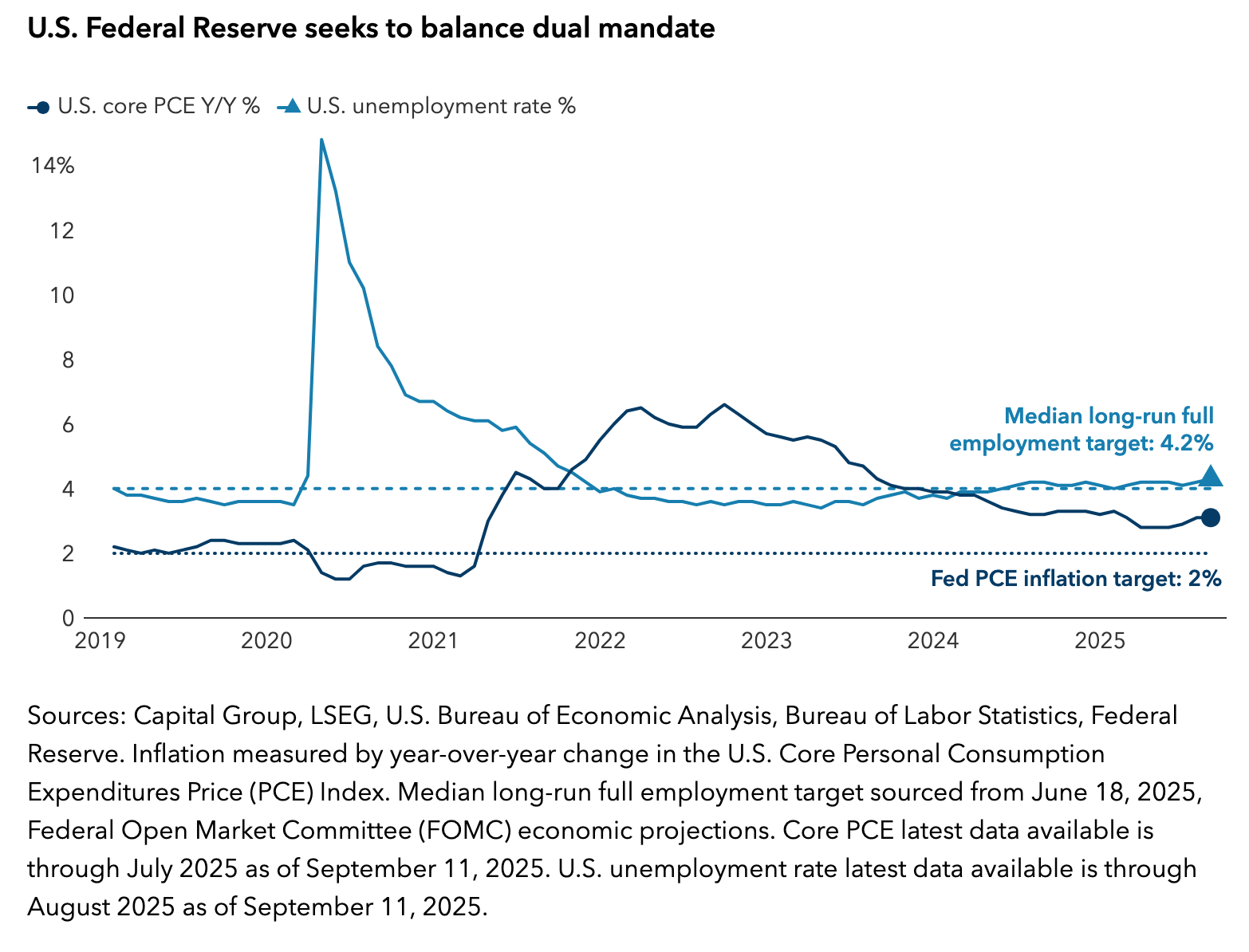

The scales have tipped in the U.S. Federal Reserve’s long running balancing act between taming inflation and promoting full employment. With September's quarter-point interest rate cut, the first such move in nine months, Fed officials appear to have made the labour market a key concern.

Despite signs of rising inflation, the Fed reduced its key policy rate following a series of weak job reports and growing concerns that many companies aren’t hiring amid the economic uncertainty posed by tariffs and trade disputes.

“Going forward, I do think the labour market is going to get more of the Fed’s attention than inflation,” says Tom Hollenberg, fixed income portfolio manager. “I think the Fed is basically expressing the view that tariff-related inflation is a one-off, and that clears the ground for a rate cut now, as well as additional cuts later this year.

“For better or worse, we are at the start of another rate-cutting cycle,” Hollenberg adds. “It may ultimately be 50 to 75 basis points, or it may be more. The Fed has put inflation on the back burner, and I think that matters.”

The Fed’s decision comes at a time of conflicting economic crosswinds and renewed concerns about Fed independence as President Trump implores the central bank to lower interest rates. Year-over-year core PCE inflation is likely to come in at 2.9% in August, the highest level since February. Meanwhile, the August jobs report showed that hiring has essentially stalled, with just 22,000 new jobs added. The U.S. unemployment rate has creeped up to 4.3% from a 50-year low of 3.4% in April 2023.

U.S. economic outlook weakens

The U.S. economy has remained resilient so far this year despite worries that higher tariffs might trigger a recession. No such downturn has materialized yet. U.S. GDP growth rose 3.3% in the second quarter, but signs of weakness are spreading, according to Capital Group economist Jared Franz.

“In my view, the U.S. economy is entering a mini-cycle slowdown,” Franz says. “Hiring may stall across multiple sectors, but not enough for the unemployment rate to rise to levels commonly associated with a recession.”

The Fed’s focus on jobs is understandable since consumer spending accounts for roughly two-thirds of the U.S. economy. More recently, massive AI spending by U.S. tech companies has provided a significant boost to economic growth.

In addition, tighter U.S. immigration policy has influenced labour markets. Immigration enforcement has reduced the overall number of workers in the economy, contributing to relatively stable unemployment levels this year, even as hiring has drastically slowed.

With this rate cut, the U.S. federal funds rate now sits in a range from 4% to 4.25%. It influences interest rates on many other forms of borrowing, including cash, U.S. Treasury bill yields, home mortgages and credit cards.

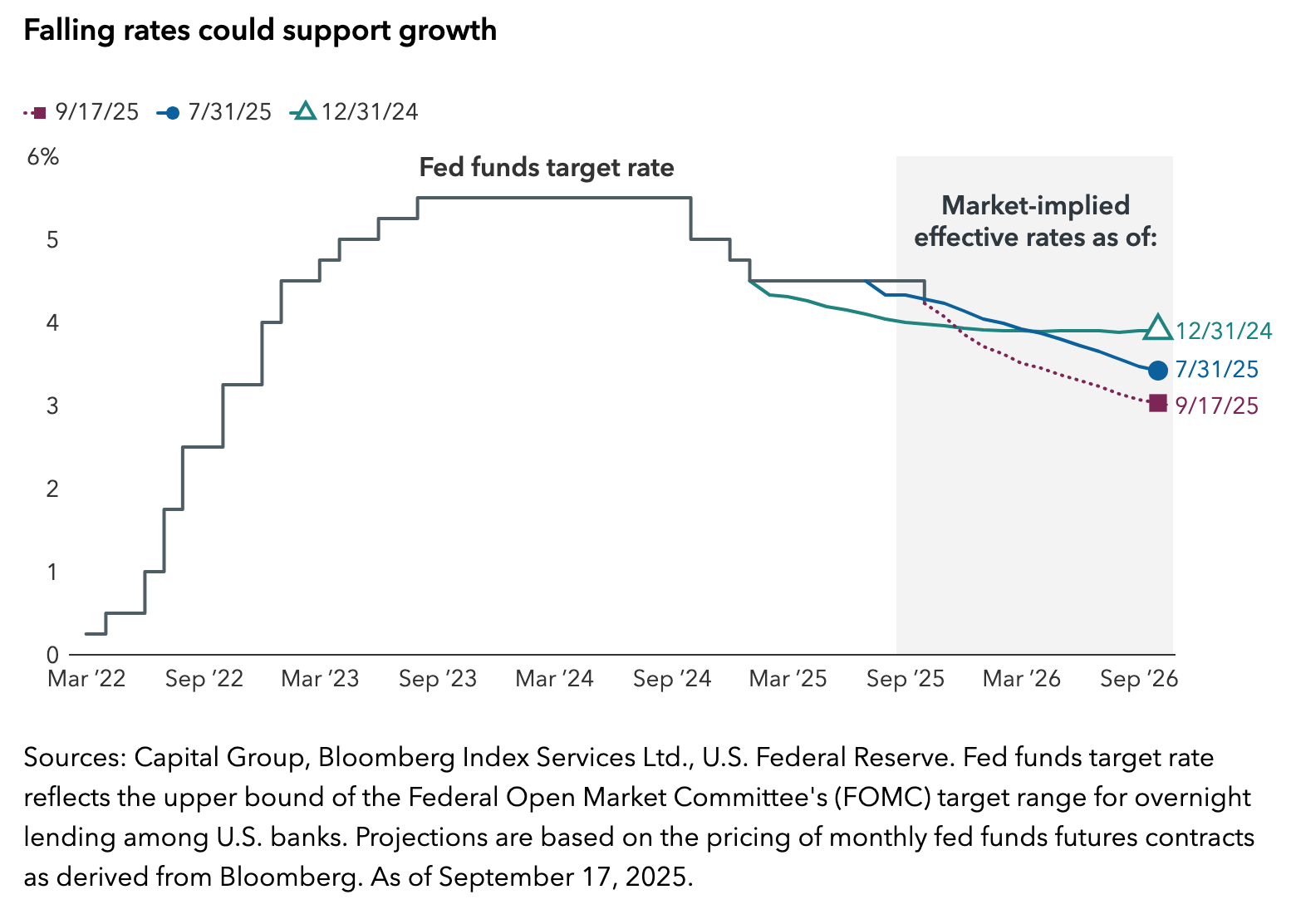

Falling rates could support growth

A line stair chart shows the upper bound of the target U.S. federal funds rate between March of 2022 through September 2025, and three projections of what the monthly effective federal funds rate could be extending through September 2026 as of three distinct dates. These projections are represented as three separate lines splitting off the actual federal funds rate. The dates represented include December 31, 2024, July 31, 2025, and September 17, 2025. On December 31, 2024, the implied federal funds effective rate for September 2026 was 3.9% and showed a gradual path down from current levels, while on July 31, the implied federal funds effective rate for September of 2026 had dropped to 3.4%. As of September 17, the estimate for September 26 rates were 3%.

Rate cuts could further boost U.S. markets

After a period of tariff-related volatility earlier this year, the S&P 500 Index has hit a series of new highs, driven largely by healthy corporate earnings and investor enthusiasm for artificial intelligence. But gains have been uneven, with sectors such as health care and industrials lagging U.S. tech, particularly AI-related stocks.

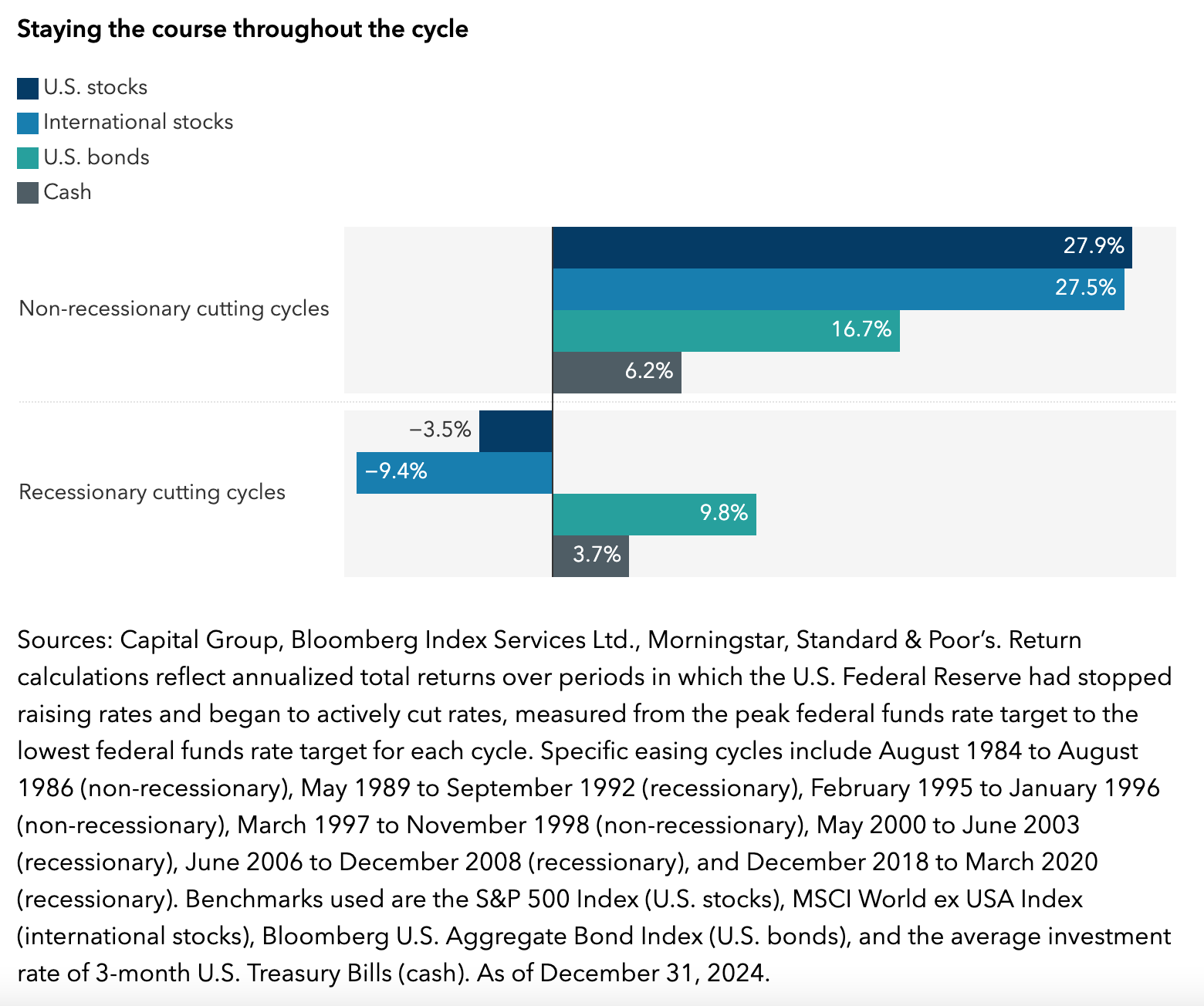

Stock and bond markets have notched solid returns in non-recessionary rate-cutting cycles, as depicted in the table. On average, the S&P 500 Index has returned nearly 28% in the three non-recessionary cutting cycles since 1984. U.S. bonds too have benefited, seeing a nearly 17% annualized return, while cash has lagged.

Staying the course throughout the cycle

Two horizontal bar charts compare average annualized returns across U.S. stocks, international stocks, U.S. bonds, and cash during the last seven Federal Reserve interest rate easing cycles. One chart represents non-recessionary cutting cycles, the other recessionary. Returns are notably higher in non-recessionary periods: 27.9% for U.S. stocks, 27.5% for international stocks, 16.7% for U.S. bonds, and 6.2% for cash. In contrast, recessionary cycles show lower or negative returns: -3.5% for U.S. stocks, -9.4% for international stocks, 9.8% for U.S. bonds, and 3.7% for cash.

However, tariff uncertainty and its impact on global supply chains continues to influence company decisions and could influence market sentiment in the months ahead, says Charles Ellwein, equity portfolio manager for Capital Group Capital Income BuilderTM (Canada).

“In my conversations with large U.S. companies, tariffs have led their customers to delay orders,” Ellwein explains. “The uneven rollout, changing tariff rates and court challenges to the legality of U.S. tariffs have complicated the picture. Trading partners want to know how tariffs are being passed along to them, and they are seeking ways to claw back those costs if the tariffs are ultimately overturned.”

Maintaining a balanced portfolio

The ongoing uncertainty around global trade policy, inflation, employment, economic growth and other market forces provides a reminder of why it’s important for investors to maintain a diversified, well-balanced portfolio constructed to help it buffer market shocks.

“Inflation and Fed independence are issues that I am particularly concerned about and watching closely,” says Jody Jonsson, Capital Group Vice Chair and equity portfolio manager.. “U.S. equity valuations are at very high levels right now, so an inflationary shock or a crisis at the Fed would probably not be well received by investors.”

“I remain fully invested,” Jonsson adds, “but I am coupling growth-oriented companies with more defensive names. I think it’s always important to keep that balance. Defensive companies are generally lagging the overall market today, but I think there will be a moment when investors will be happy to have them in their portfolios.”

Tom Hollenberg is a fixed income portfolio manager with 20 years of industry experience (as of 12/31/2024). As a fixed income investment analyst, he covers interest rates and options. He holds an MBA in finance from MIT and a bachelor's degree from Boston College.

Jared Franz is an economist with 19 years of investment industry experience (as of 12/31/2024). He holds a PhD in economics from the University of Illinois at Chicago and a bachelor’s degree in mathematics from Northwestern University.

Charles Ellwein is an equity portfolio manager with 27 years of investment industry experience (as of 12/31/2024). He holds an MBA from Stanford and a bachelor’s degree in electrical engineering from Brown University.

Jody Jonsson is vice chair of Capital Group, president of Capital Research and Management Company and an equity portfolio manager. She has 38 years of investment industry experience (as of 12/31/2024). She holds an MBA from Stanford and a bachelor’s degree in economics from Princeton.

Copyright © Capital Group