by Carrie King, CIO, U.S. and Developed Markets, BlackRock

Early 2025 worries of U.S. stock malaise may have been exaggerated, if Q2 earnings are any indication. Fundamental Equities CIO Carrie King recaps a better-than-expected earnings season that she believes revealed strength beyond the market leaders.

If Q2 earnings told us anything, it’s that the early-year fears that the AI opportunity and the U.S. stock market in general had lost their luster were grossly overstated. U.S. stocks, as measured by the S&P 500 Index, are on pace for 12% growth in earnings versus Q2 2024, marking the third consecutive quarter of double-digit growth. The AI-leveraged super earners led the charge once again, yet a deeper look reveals some quieter signs of a broadening in stock market strength.

More breadth in beats

In Q2, 79% of S&P 500 companies beat analyst estimates on revenues and more than 80% beat on earnings. Both of these measures are well above longer-run averages, which are closer to 60%. With some 80% of the index exceeding expectations on both the top and bottom line, this suggests to us that corporate dynamism exists well beyond the handful of names that are driving stock indexes higher. And this makes it a particularly exciting time for fundamental stock pickers to unearth opportunities in the next generation of performers.

Even the energy sector, which saw earnings fall 18% in the quarter, had an EPS beat rate above 80%. While the sector, led by oil, has been on a downward trend since the start of the Ukraine war in 2022, we are starting to find value now after another steep decline on the April 2 tariff announcements.

Revised to the upside

Analyst estimates of earnings growth were revised higher throughout the quarter. June 30 projections saw Q2 earnings landing in the area of 4%-5%. But steady upward revisions throughout the quarter brought that figure to 11%-12%.

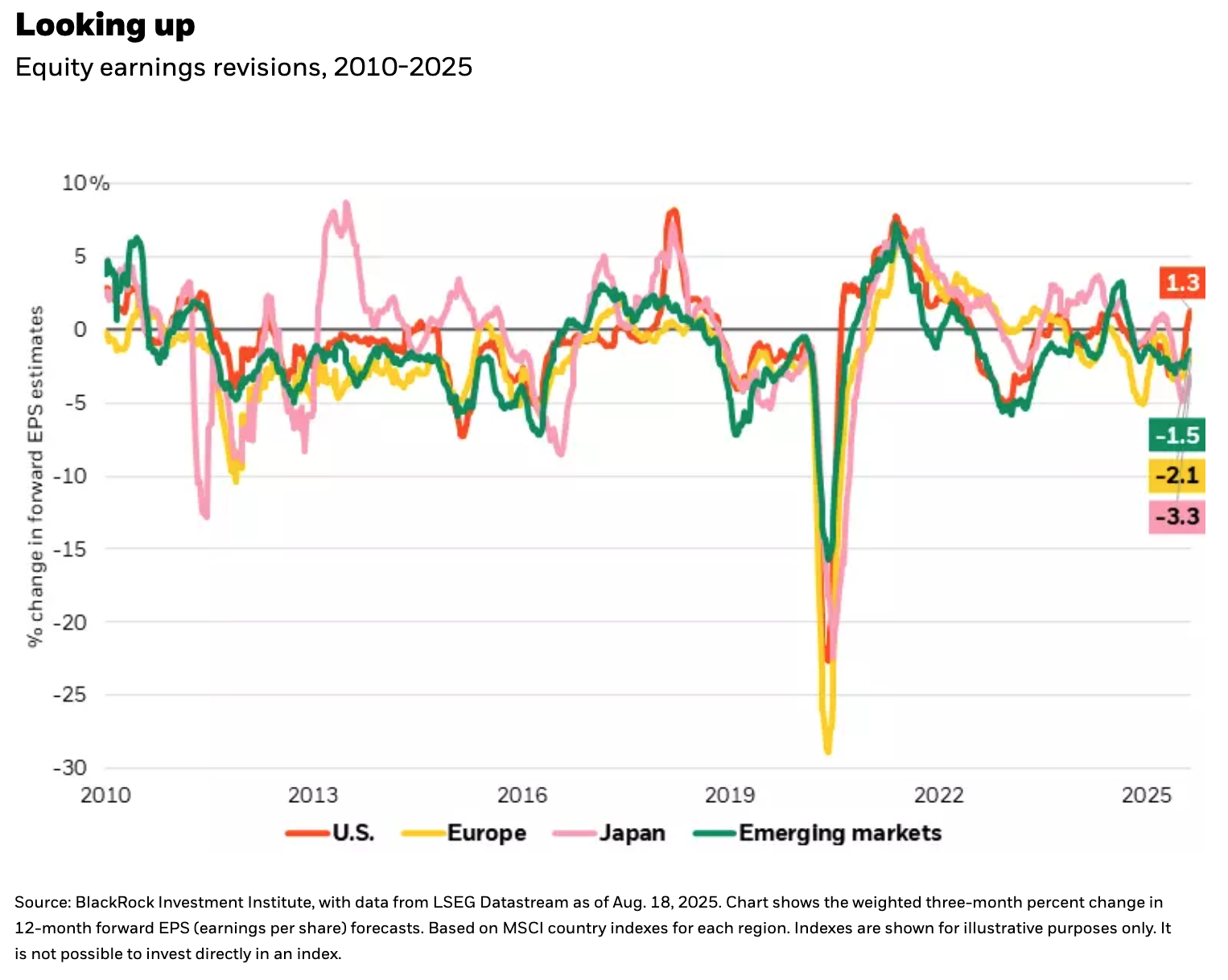

Tariff fears were said to be responsible for the lowered analyst expectations leading into the quarter, but we did not note a larger than normal degree of downward revisions in the approach to Q2. Earnings estimates are almost always revised down leading into a quarter, though we have yet to see any of that for Q3, another promising signal. The chart below shows that U.S. earnings revisions for Q3 are currently trending higher, while other countries are following the more typical downward tendency.

Good-looking guidance

Company guidance has shown an unusually positive bent as well, supporting the rise in analyst estimates. We found little sign of tariff impact in the Q2 data, with profit margins holding up exceedingly well in the quarter. And despite worries of tariff hits in the coming quarters, companies are so far guiding ahead of expectations.

On balance, we find U.S. companies to be adept at managing their balance sheets and diversifying their supply chains to accommodate any structural shifts that changes such as tariff rates might impose. Retailers, for example, are working down their pre-bought inventory and many have purchased conservatively in anticipation of lower sales volume on discretionary items should consumers resist higher prices.

The buzz beyond tariffs

What are companies focused on outside of tariffs? We hear managements talking about strong AI-related capex, figures that were once again revised higher this earnings season by the four biggest spenders. Potential for lower taxes is another topic of discussion we are watching, as it could ignite strong free cash flow, giving companies more to invest in their business. Several companies cited the potential benefit of accelerated bonus depreciation (a more immediate deduction of business expenses) in allowing them or their corporate customers more flexibility to pursue investment. Healthcare, a sector with high capex and R&D spending, could potentially benefit disproportionately from a more favorable tax paradigm.

We believe a combination of easier taxes and greater certainty around tariffs could boost corporate confidence and drive broader capex across sectors. We are sharpening our pencils to capitalize on opportunities as this develops. One area we have our eyes on is industrials, which could see increased demand for things like electrical equipment, heating and cooling systems, and even elevators as AI data center buildout continues. Some of this may be priced in, as multiple expansion has been a driver of strong returns for the sector year-to-date while earnings have yet to shine.

Final thoughts

Some worry that U.S. stocks have come too far too fast since the April market plunge, and that the path of least resistance for prices is down. We would argue that high multiples in and of themselves do not cause market corrections. As long as companies have the money and the opportunities to invest ― thereby driving continued earnings growth ― multiples are not a worry. Markets derail when the underpinnings of the economy fall apart. We do not see worrisome signs here. Despite weakness in the lower-income cohort, Q2 earnings showed a resilient U.S. consumer, buoyed by a strong high-income consumer, still low unemployment and continued wage growth.

We also see robust earnings, healthy company margins, strong free cash flow (that could get stronger with policy support) and ample opportunity for corporate America to grow. Of course, volatility is a feature (not a flaw) of the stock market and could be elevated as investors anticipate and digest incoming macroeconomic data. To us, this underscores the importance of rigorous fundamental research to understand each company’s underlying strength and the wisdom in building elements of resilience into equity portfolios in times of change and uncertainty.

Copyright © BlackRock