by Martin Jacobs, Equity Portfolio Manager, Capital Group

Culture eats strategy for breakfast, according to management guru Peter Drucker.

In other words, the success of any business strategy depends on the strength of the company’s underlying culture, values and principles. This has never been more apparent to me than at Nucor in the early 1990s, when I covered the industrials sector as an equity investment analyst.

I remember calling Nucor once after reviewing quarterly results only to be surprised when CEO Ken Iverson picked up the phone. There was no investor relations gatekeeper screening his calls. He answered all my questions patiently and thoroughly. The company was incredibly transparent in terms of how it operated, and that was all reflective of the way Iverson ran the business. He was not only accessible to investors, but to each employee at Nucor. It was the type of place where workers felt part of a family and, as a result, they worked hard.

From 1981 through Iverson’s retirement as CEO in 1996, Nucor generated compound annual earnings growth of 38%, and its shares recorded average annual returns of 17%.

Successful investing is both art and science

Over 37 years as a professional investor, I have learned that investing in companies with superior leaders is critical to long-term success. Yes, finding a great investment starts with fundamental research and analysis: You analyze the industry and run financial models on a company and its competitive landscape.

But there is also an art to stock picking. Once you’ve identified a company with great fundamentals, you must also make an informed assessment of management — their business strategy, the culture they foster and whether you have confidence they can deliver on company goals. Such informed assessments are honed through experience and hundreds of face-to-face meetings.

At Capital Group, meeting with company management is a key part of our stock picking process, something that sets us apart from passive index investing. Our team of investment professionals travels the world visiting companies every year to help identify compelling investment opportunities. In 2024, more than 470 investment professionals attended over 21,000 such meetings.

Road warriors: We meet with companies thousands of times a year

470+investment professionals |

21,000+meetings |

Source: Capital Group. As of December 31, 2024. Reflects the global organization.

Elite leaders have driven strong results

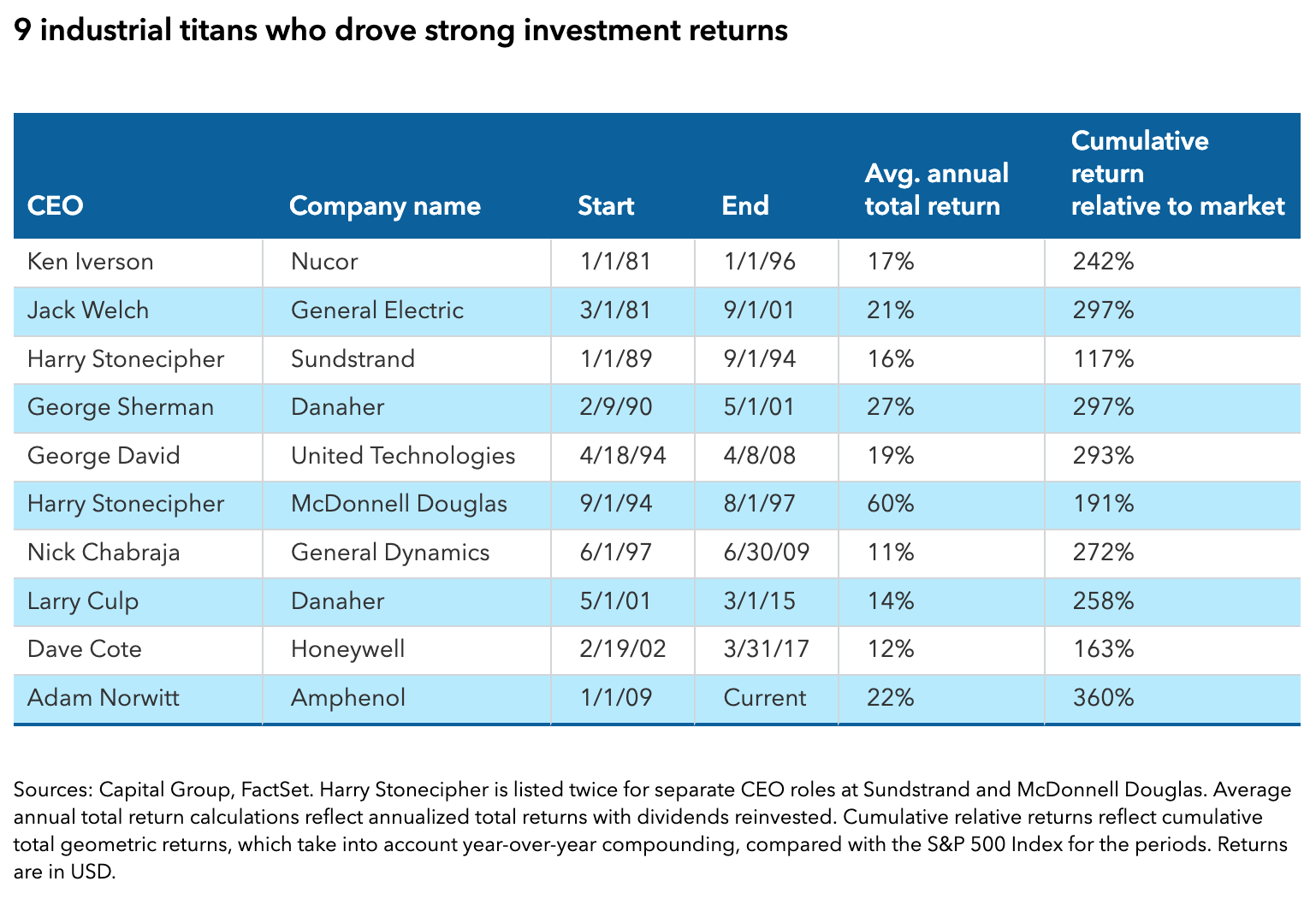

What I have learned from all my meetings is that exemplary leadership is a rare quality. I recently looked back on more than 200 CEOs with whom I met over my career and identified nine I believe were superior leaders. These individuals collectively helped generate an average annual shareholder return of 22% during their tenure, which averaged about 13 years. In other words, when you can identify great leaders at good companies, it can be a powerful driver of investment returns.

5 leadership lessons from great CEOs

This list of nine leaders includes lawyers, a scientist and even a failed fisherman. Each pursued different strategies and approaches to leadership, but all possessed these five attributes:

- Attain a mastery of business operations — One consistent thread among top leaders is the ability to drive operational improvement across business lines.

- Think like an investor — Great leaders have tended to be superior capital allocators in the form of smart acquisitions and divestitures.

- Be an inspiration — The ability to get people rowing in the same direction is necessary to attract, retain and develop a strong leadership team.

- Deal effectively with crisis — Good leaders can pivot and adapt to adverse circumstances.

- Maintain high ethical standards — Unfortunately, I have invested in two companies where the CEO went to jail and a third that should have. This taught me that personal integrity is table stakes for great leadership.

To help paint a picture of these qualities in action, here is a closer look at four great CEOs I have known.

Ken Iverson of Nucor: A disruptor in an old economy industry

In addition to bringing transparency, a flat organizational structure and an entrepreneurial spirit to Nucor, CEO Ken Iverson was a disruptor.

While innovation today is associated with technology giants like Amazon, Meta and Tesla, not that long ago, one of the most disruptive technologies was the steel mini mill, which used scrap to make steel products at far lower cost than old line blast furnaces. Nucor, under the leadership of Iverson, pioneered the mini mill along with a more agile work force that brought tremendous efficiency to the industry.

When I met Iverson in the 1990s, I was impressed with the technology, lean work practices, decentralization and pioneering spirit he brought to the company. He placed the power of decision-making at the plant level and encouraged risk taking and experimentation.

This attitude led to innovations like thin slab casting, which brought mini mills into higher value steel markets such as automotive. Iverson, who started his career as a research physicist, transformed what was a nearly bankrupt conglomerate into the largest steel producer in the U.S.

Larry Culp of Danaher: An inspiring second act

I first got to know Larry Culp, today the chief executive of GE Aerospace, when he was named CEO at Danaher in 2001. At Danaher, he took a successful but relatively small manufacturing company and transformed it into a multi-billion-dollar medical technology and life sciences powerhouse. Years later, he left retirement to turn around a then-troubled GE.

During his 14-year tenure at Danaher, Culp generated superior returns via acquisition growth and operational performance while growing scale across core company platforms. Culp is that rare individual who brings a combination of solid operating competencies with superior capital allocation savvy while also surrounding himself with strong leaders. At Danaher, he focused his acquisition strategy on businesses with high gross margins while attacking sales and administrative expenses to drive margin improvement.

Culp’s next chapter was at GE, which was a financial mess when he stepped into the job in October 2018. He had retired from Danaher at the young age of 52, and at the time was teaching at Harvard.

I remember asking him why he would come out of retirement to run such a troubled company. His response was motivated by patriotism. “General Electric is an icon,” he said. “This is a rare opportunity to turn around and restore a great brand, this great company and all these great people that work for this company, to its proper place in corporate America.”

Culp hit the ground running by quickly tackling insurance liabilities and paying down debt. He was also driving standardization across operations to restore GE to its roots as a world-class manufacturer. He then shed some underperforming businesses and ultimately engineered the three-way split between GE Aerospace, power business GE Vernova and GE HealthCare, which today operate independently. Culp remains at GE Aerospace, where he continues to drive the turnaround.

Dave Cote of Honeywell: Fisherman turned culture champion

Dave Cote was an unlikely candidate to lead Honeywell: He wasn’t the board’s first choice for CEO. But humble beginnings were fine with Cote, who in his youth tried his hand at commercial fishing. By his own telling, he and his partner racked up more empty beer cans than fish.

Yet, he became one of the most celebrated chief executives in the industrials sector. He did so by driving a strong culture throughout the organization and a single uniform process on the manufacturing floor.

When he was hired, Honeywell had recently merged with AlliedSignal and Pittway, and workers were still wearing badges from those individual businesses. To make matters worse, he was set up for failure. Honeywell hid its poor financial health and outlook from him during his courtship and first months on the job.

Cote didn’t always have command of the granular financial details of Honeywell’s business lines. But once he got his hands around the organization, he spent 12 to 15 weeks a year on the road visiting facilities and asking a lot of direct questions of his operating team. He often made recommendations to local managers during these visits.

Early in his Honeywell career, Cote paid a visit to one of the company’s operational facilities. Senior managers there launched into a polished presentation. After a number of pointed questions from Cote, one senior manager said, “Dave, if you keep interrupting, we’ll never finish.” To which Cote replied, “Is this a performative exercise, or are we here to improve operations? If I can’t ask questions, we’re wasting our time.”

Cote was also a shrewd capital allocator. He completed 100 acquisitions and 70 divestitures during his 14-year tenure while taking the company from US$22 billion to US$120 billion in annual revenue. This resulted in a higher growth, higher margin portfolio with a higher percentage of recurring revenue and earnings.

George David of UTC: A professor focused on margin improvement

In stark contrast to Cote, George David of United Technologies Corporation (UTC) was a polished communicator. He struck me as a modern-day Renaissance man. He spoke eloquently about art history as well as geopolitics. His nickname at the company was “The Professor.” But he also knew the intricate details behind the geared turbofan and was a student of management and strategy.

David did not fit the mould of the down-in-the-trenches, operationally focused CEOs that I have come to look for, but he was equally effective. During his time running United Technologies, shareholder returns outpaced the S&P 500 Index by almost threefold.

Before David became CEO in 1994, UTC lagged the industry despite strong market positions across businesses. Under David, it became a model of consistent execution and balance. Every year he built a cushion in his outlook for things that could go wrong, and the company consistently exceeded expectations. UTC’s success was largely driven by margin improvement under David, given a pedestrian 3% organic revenue growth, but consistent margin improvement was able to drive mid-teens earnings per share growth.

Great leadership comes in many forms

As an equity portfolio manager, I still meet regularly with CEOs before making an investment. At Capital Group, we enjoy great access to leadership at companies around the world. That helps inform investment choices for our investors’ portfolios.

One mistake investors often make is judging the quality of a CEO by how granular they can get with the financial results across business lines. Although that can be important, it can be just as important to be the kind of leader who can get in a room, articulate a clear set of priorities and inspire others to strive for excellence.

Martin Jacobs is an equity portfolio manager with 37 years of investment industry experience (as of 12/31/2024). He holds an MBA from Wharton and a bachelor's degree from the University of Southern California. He also holds the Chartered Financial Analyst® designation and is a member of the CFA Institute.

Copyright © Capital Group