by Cem Inal & Chance Hardy, AllianceBernstein

Finding attractively valued stocks that can overcome evolving conditions requires a new mindset.

Market uncertainty often creates classic value-investing controversies. This year, sweeping US policy change has shaken the macroeconomic outlook and raised hurdles for many companies. So how can value investors find stocks with recovery potential when it’s hard to predict the next disruptive shock?

The hunt for value isn’t easy these days. While the S&P 500 touched record highs in August, investors remain fearful about the impact of tariffs on economic growth and corporate earnings. Extreme volatility in early 2025 highlighted the extraordinarily fragile market sentiment.

Navigating a Year of Acute Controversy

This environment has all the hallmarks of a value opportunity. Traditional value opportunities are formed when a stock trades below its intrinsic value, often because investors lose confidence in its business prospects because of a controversy. When markets overreact to troubles in a company or industry, it frequently sets the stage for a potential recovery.

Investors understandably have real anxiety about how businesses will manage through changing trade and macro conditions. Yet some companies are better equipped to cope than perceived.

Recognize What Is Researchable

Policy uncertainty is making the investing challenges of 2025 particularly testing. So what can equity investors do?

The first step is to identify what can be researched—and what cannot. It’s ineffective to try and predict what tariff levels will ultimately be imposed on different countries or products. Similarly, efforts to forecast inflation, interest rates and GDP growth trends in such a fluid environment won’t help us find companies that can surmount new challenges. Instead, we believe investors should focus on company-specific issues that are researchable—regardless of the policy clouds—such as:

- Companies undergoing positive change: Share prices may fall hard when a company falls on hard times. But businesses that change for the better often aren’t recognized until their stock catches up. For example, Walmart is working to combat years of losses in its e-commerce business. Value-focused investors can study the company’s efforts to fix its profitability through third-party resellers, subscriptions, advertising, shipping and better distribution-center management. This type of research can help assess Walmart’s recovery prospects, no matter how the macro situation develops.

- Sustainable competitive advantages are always a good driver of earnings growth that can withstand near-term challenges. In the financial sector, Charles Schwab has continued to gather new assets at high rates due to its low-cost structure, robust product delivery and strong service model. Even as regulatory questions and interest-rate uncertainty hover over the financial sector, we can gauge the company’s business advantages versus peers and make an educated judgement about its ability to do well over time.

- Strong or improving industry dynamics: Think about the healthcare industry, which faces severe policy uncertainty. However, the pace of long-term R&D spending is still likely to remain above GDP growth. That means select healthcare companies can buck the negativity over the long term. Agriculture equipment is another industry with subpar earnings growth, though its long-term productivity enhancements should fuel industry growth that is poised to outpace GDP growth. Deere & Co., one of the world’s largest agricultural equipment manufacturers, has an edge in areas such as precision agriculture that can help it thrive in an industry rebound.

A New Value Universe

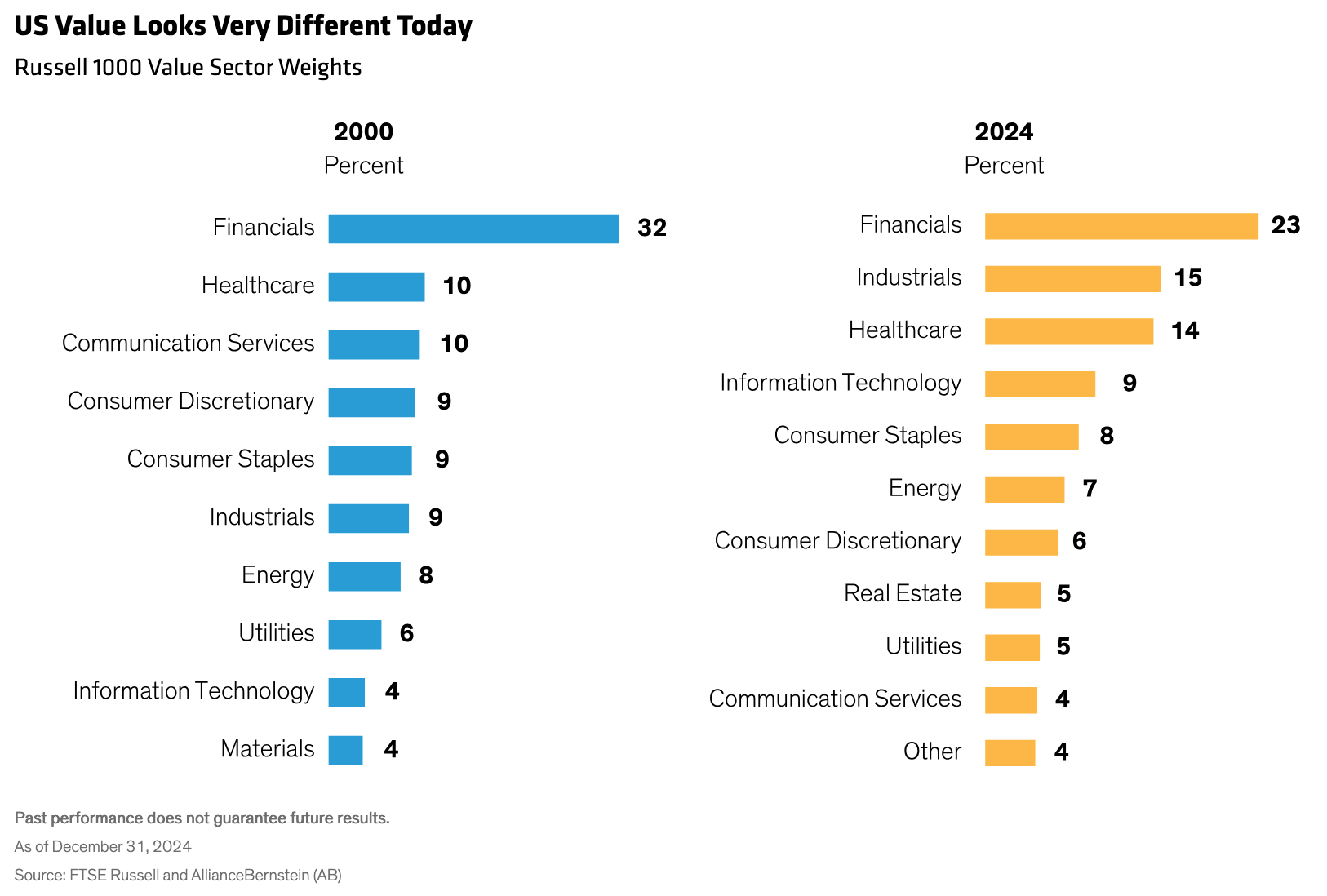

Companies like these can be found in surprising places. In 2000, financials accounted for nearly a third of the Russell 1000 Value Index, followed by healthcare, communication services and the more cyclically sensitive consumer discretionary sector. Technology stocks comprised only 4% of the value index. Nearly a quarter-century later, the weight of financials has decreased, while investors can find a larger cohort of industrials and technology stocks in the value mix (Display).

This means the types of stocks investors can access for a value portfolio have changed too. In the past, value stocks were usually more cyclically sensitive. Today, many high-quality companies meet value criteria, with higher profitability, durable growth prospects and less sensitivity to GDP growth.

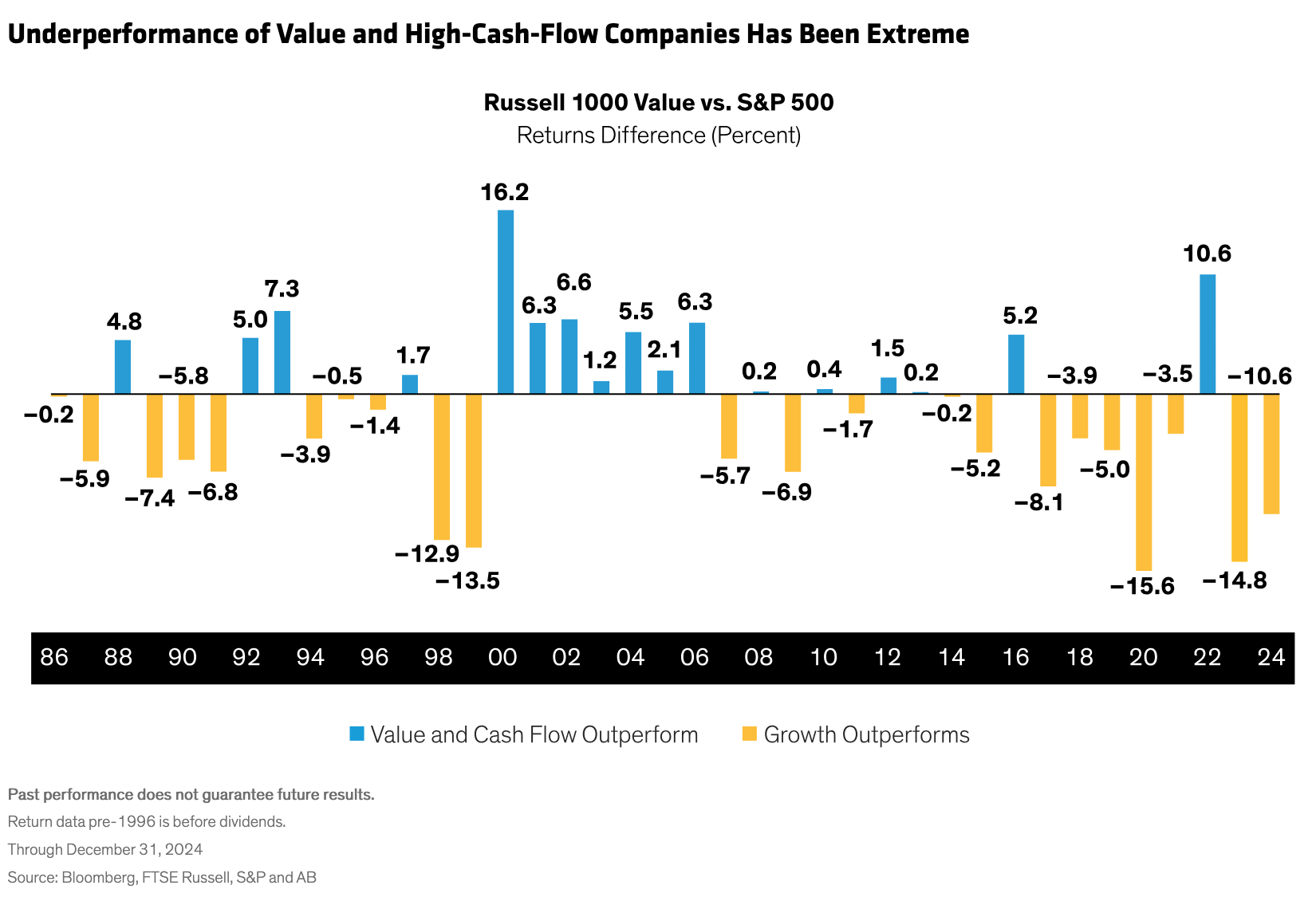

Meanwhile, the US market has become less capital intensive. As a result, the traditional way of looking at value companies, through a price/book value lens, is inadequate. Instead, we think free cash flow (FCF) metrics are a better way to pinpoint value companies that can perform in different economic conditions.

Over the last decade, value stocks with strong cash-flow yields have generally underperformed (Display). In our view, this trend will eventually revert to the mean, and attractively valued shares of companies with strong FCF will be rewarded.

Choose Your Risk

Strong FCF is becoming more important for companies as the world lurches from crisis to crisis. In our view, companies with robust and consistent FCF—backed by healthy balance sheets and skilled management teams—will be more capable of adapting to surprising policy moves than their peers.

Equity investors can’t eliminate risk. But they can choose the risks they take. In today’s markets, steering clear of companies exposed to the most unpredictable risks can help portfolios avoid potential blowups from an unfavorable turn in policy. By focusing on researchable, company-specific factors, investors can build a portfolio of value stocks that is more resistant to exogenous shocks and supported by diverse sources of recovery potential.

Copyright © AllianceBernstein