by Walt Czaicki, CFA, Robert Milano, David Wong, AllianceBernstein

As their share price patterns diverge, selectivity among the US mega-caps is paramount.

The Magnificent Seven (Mag Seven) stocks are no longer trading like a homogenous group. Performance patterns have shifted amid closer scrutiny of their capital-spending strategies and exposure to global supply chains.

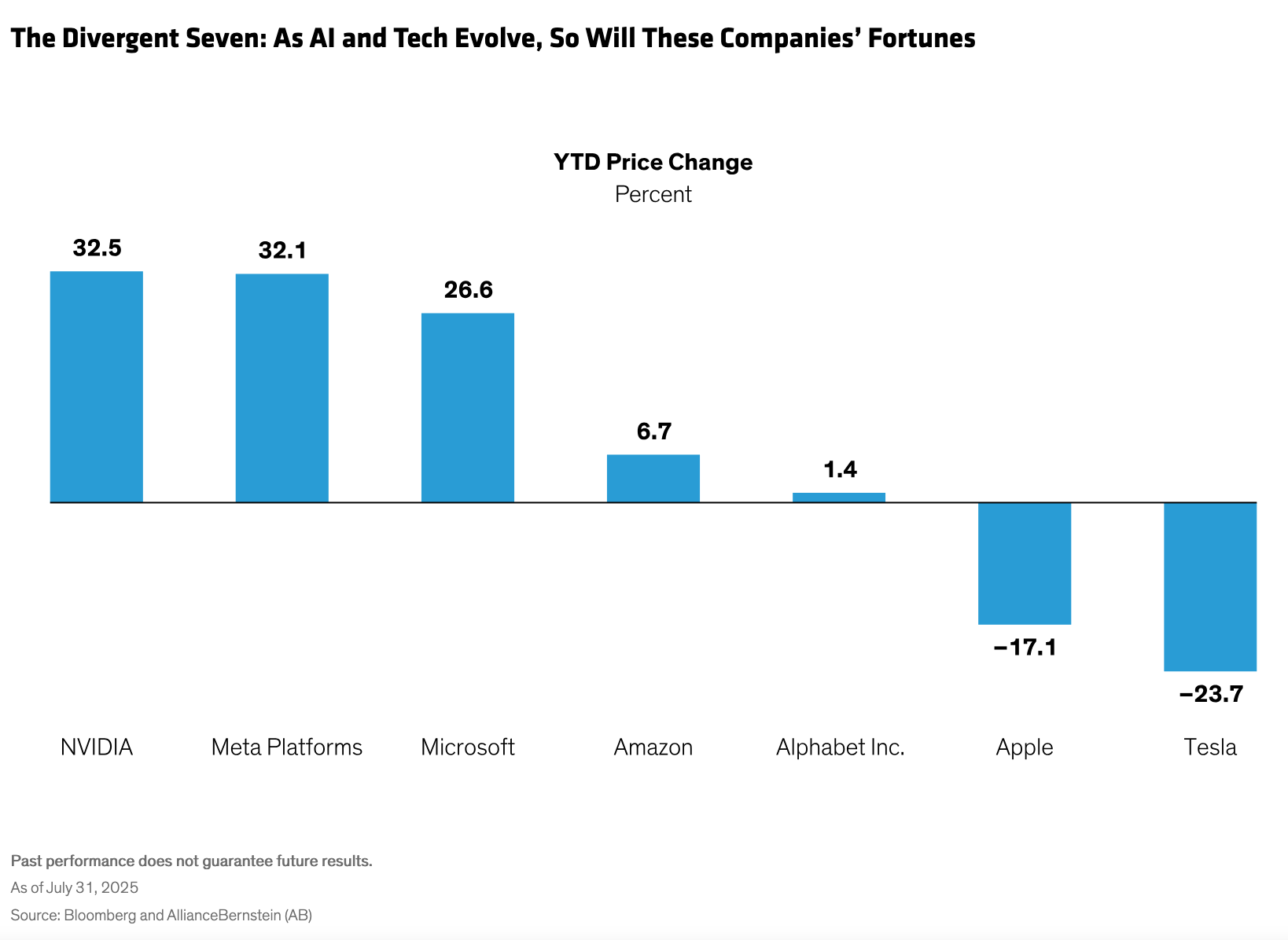

From Apple to NVIDIA, the Mag Seven stocks generally moved in near lockstep during 2023 and 2024, handily outperforming the S&P 500. This was driven largely by their dominance in innovation and growth, given their leading role in the artificial intelligence (AI) revolution. But in 2025, we’ve seen a wide dispersion in year-to-date stock performance (Display).

The divergence has been driven by several variables, with two standing out in a world being redefined by AI and trade wars.

Capex Has Been a Differentiator

Developing and deploying AI technology requires heavy investment. That’s why investors are currently rewarding companies that are spending generously to stay ahead of the AI curve.

In the AI era, underinvestment is seen as a risk. So investors are voting their confidence in companies that are aggressively building infrastructure, expanding computing capacity and securing their place in the AI value chain. The market is signaling that bold investment isn’t just tolerated—it’s expected.

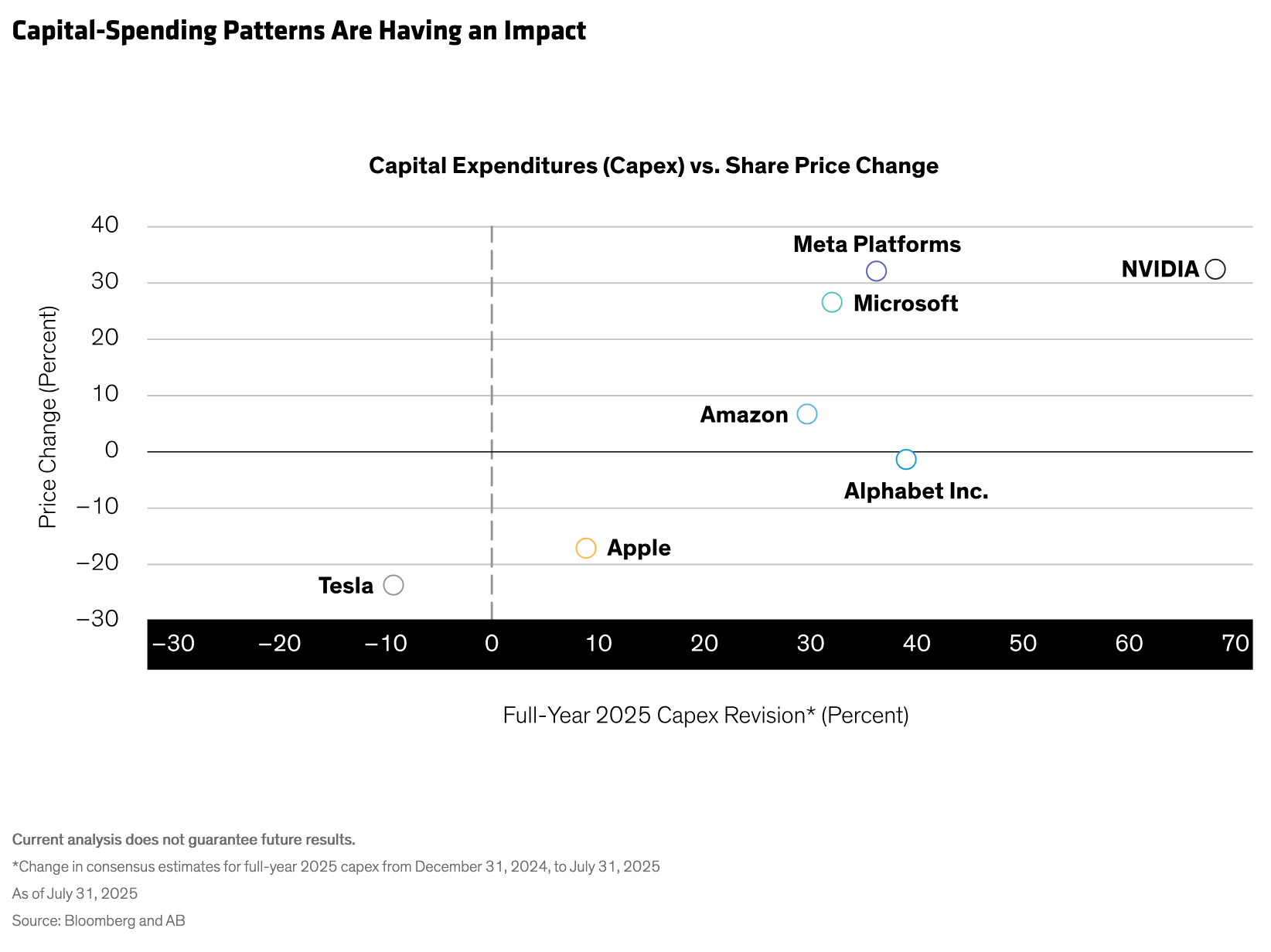

Comparing capex and share price performance spotlights the trend (Display). Companies like Apple and Tesla are spending comparatively less on capex and have underperformed this year. In contrast, shares of NVIDIA and Meta Platforms—which are expected to increase their incremental capex—have surged.

Domestic Sourcing Is a Perceived Strategic Advantage

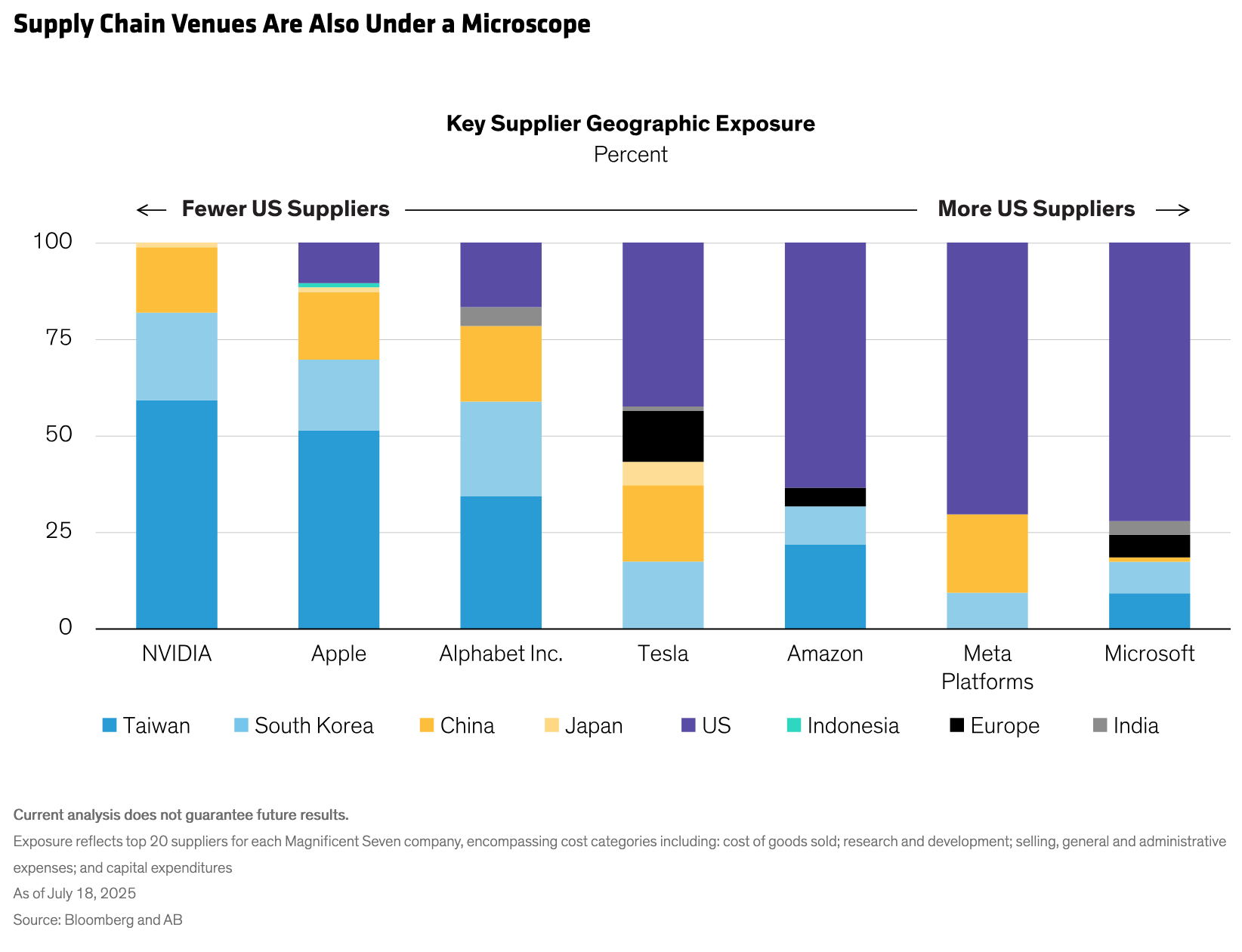

President Trump’s tariffs have posed challenges for companies across sectors. The vulnerability of each Mag Seven company to higher trade barriers varies based on their supply chain structures. Companies with more US-based suppliers—and less reliance on foreign suppliers—have performed better in the face of rising tariff threats.

Those sourcing more inputs from the US are experiencing more resilient share prices in the face of rising tariff threats. For example, Microsoft and Meta Platforms, which have relatively higher US sourcing and lower foreign supply chain exposure, have seen stronger stock performance versus Apple and Alphabet Inc. (Display).

To be sure, NVIDIA is an outlier, as the company has been the best performing Mag Seven stock this year, even though it sources almost its entire supply of chips from Taiwan. This shows why we believe investors must apply rigorous fundamental research to understand the complex set of business factors that affect a company—and its share price performance.

Business Models Shape the Future

It’s not surprising that these stocks are charting different paths after a powerful surge. History shows that the largest stocks by market cap often change as new leaders emerge. Catalysts for such shifts have ranged from macro-trend changes to technological disruption.

Even dominant companies may see their competitive advantages erode over time. New innovations can challenge incumbents or customer demand might fall short of management expectations. And each Mag Seven company has a different business model. Microsoft and Alphabet are focused on services, rather than goods, which makes them less vulnerable to tariff risk. Apple faces trade-war risks because its manufacturing footprint is largely in China.

Distinct Investment Stories

Of course, all the Mag Seven companies have strong business foundations and may enjoy continued upside. But in our view, when investing in the mega-caps—as in any stock—factors such as valuations and management execution can alter the course of their growth and return outlooks. Investors must also consider which companies are doing a better job at adopting and enabling AI in this fast-changing landscape. In January, the AI breakthrough of China’s DeepSeek triggered sharp declines in the Mag Seven stocks and showed how technology challengers can emerge from nowhere to disrupt industry leaders.

Treat these mega-caps as distinct investment stories—not a monolithic group. As we see it, passively investing in the entire Mag Seven cohort may expose a portfolio to concentration risk, given their huge weight in key benchmarks. Active equity investors must research each company to gain conviction in their strategic investing plans and to determine whether their business model advantages will be sustained over the long term.

Don’t assume that all these stocks will continue to sharply outperform indefinitely. Each company is subject to dynamic fundamental forces. Thoughtful position sizing and selectivity, aligned with a portfolio’s philosophy, are likely the best playbook to capture the return potential within the Mag Seven group of stocks—while prudently managing the associated risks.

The authors wish to thank Bryan Chang, Investment Strategist—Equities, and Steffi Napoli, Product Analyst, for their research contribution to this blog.