by Chris Buchbinder, Martin Jacobs, Samir Parekh, Chitrang Purani, Capital Group

Who would have thought that after multiple wars, unpredictable trade policies and fraying geopolitical alliances, markets would have bounced back at the midpoint of 2025? Yet after a few volatile months, the S&P 500 Index hit multiple record highs and is up 8.18% through July 30, 2025 — a testament to market resilience.

Still, rising tariffs, complex trade negotiations and ongoing conflicts in Ukraine and the Middle East suggest that uncertainty will continue to influence markets in the months ahead. To help put these events in context for investors, here are five charts that illustrate Capital Group’s 2025 Midyear Outlook.

1. Four scenarios for global realignment

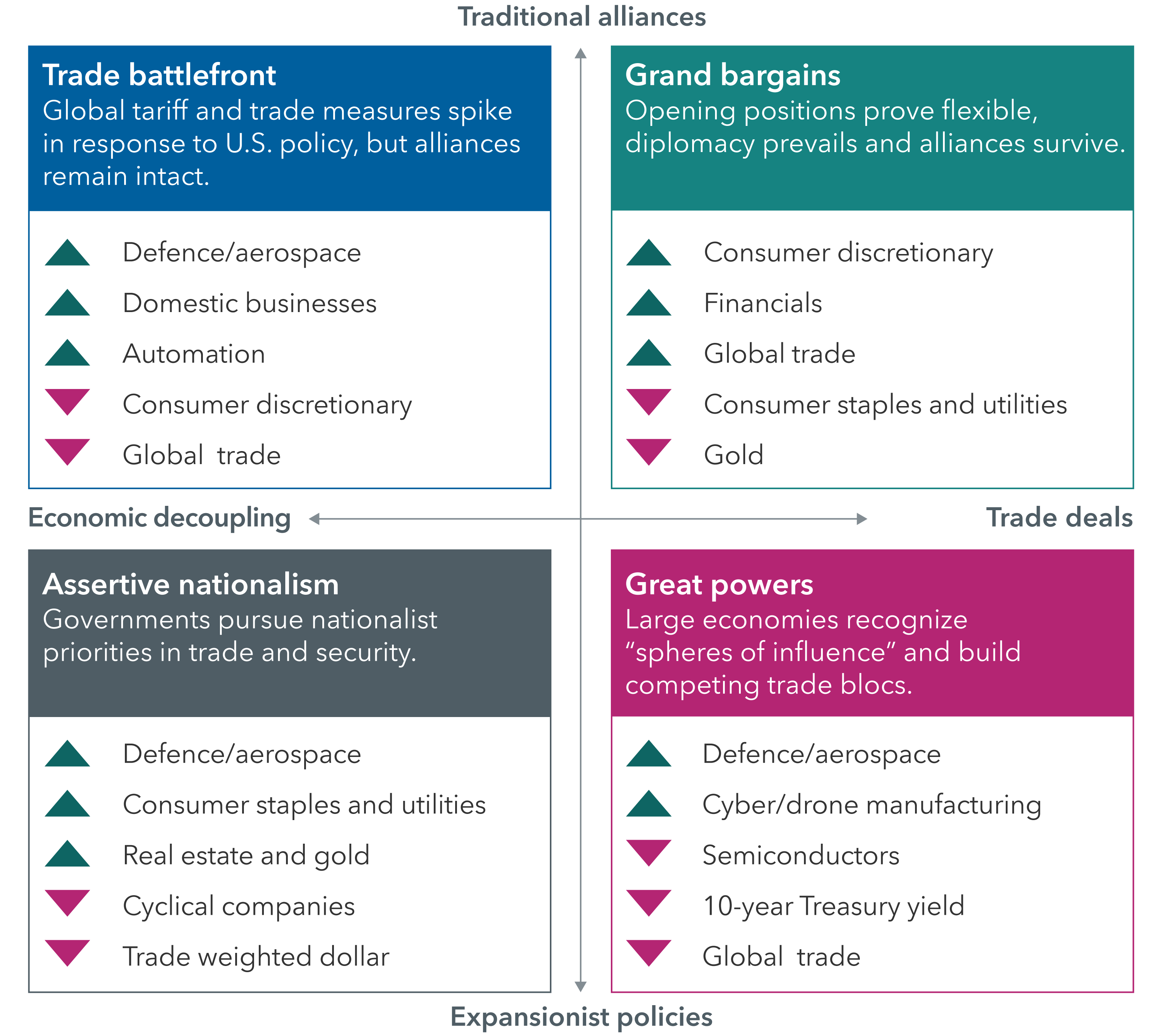

Rising uncertainty has complicated the task of creating economic forecasts. A global trade war and shifting political alliances could slow growth, boost inflation and raise the risk of a recession. Alternatively, markets may continue to respond positively to constructive trade negotiations.

Global realignment: A world in transition

Source: Capital Group. Scenarios reflect analysis of Capital Group’s Night Watch team as of April 2025, and are not predictive of future outcomes.

That’s why Capital Group’s Night Watch team of economists and portfolio managers uses scenario planning, rather than predictions, to prepare for whatever the future brings. They identify a range of outcomes, then connect them to investment implications.

Four potential outcomes have emerged: a trade battlefront, characterized by significant tariffs and other protectionist measures; grand bargains, the most benign scenario; the return of great powers; and assertive nationalism.

Each scenario has different implications for specific industries and stock and bond markets. But one commonality across all four is greater defence spending due to rising geopolitical conflict — an unfortunate reality in today’s world.

2. Security emerges as an investment theme

A fragmented and increasingly hostile geopolitical landscape has forced nations to invest aggressively to safeguard vital resources. In this environment, security has become a key investment theme.

For starters, governments are escalating defense spending. “There has been a recognition in Europe, Japan and elsewhere that they must be more self-sufficient in terms of their defence,” says Samir Parekh, a portfolio manager for Capital Group International Equity Fund™ (Canada).

Security also extends beyond national defence. Worldwide, countries are prioritizing resilience in energy, supply chains and technology. Several industries and companies could benefit. Global giants like Mitsubishi Heavy Industries in Japan, Siemens Energy in Germany and GE Vernova in the U.S. offer products across these categories, including power generation, grid modernization, defence systems and cybersecurity.

Push for security may open opportunity

Sources: Capital Group, FactSet. Companies shown are among the largest constituents of their respective sub-industries within the MSCI All Country World Index. As of June 30, 2025.

3. Market selloffs present opportunities

Markets often overreact to near-term volatility, punishing strong companies along with the weak — a dynamic that played out in early April. This can present long-term opportunities for patient investors.

A look back at the pandemic-induced bear market in 2020 is a case in point. Stocks across a range of industries suffered double-digit losses. “With travel and leisure activities halted, cruise lines like Royal Caribbean were priced as if no one would ever book passage again,” recalls Chris Buchbinder, portfolio manager for Capital Group U.S. Equity Fund™ (Canada). “This turned out to be an excellent investment opportunity for those who recognized that global travel would one day bounce back.”

After plummeting more than 83% in the depths of COVID-19, Royal Caribbean rebounded strongly, advancing more than 1,000% in the five years since.

Of course, such powerful turnarounds don’t come along every day. “When markets were whipsawed by tariff news in the first half of the year, we saw an opportunity to invest in certain health care companies offering GLP-1 weight loss therapies,” Buchbinder adds.

Semiconductor companies are another area of opportunity, given the long runway of potential growth for AI infrastructure. “The key when great companies go on sale is you have to be prepared to weather some anxiety near term,” Buchbinder continues. “Not all companies will have such powerful recoveries, which is why fundamental research helps me select those that I believe may prosper.

4. Bonds offer relative stability

Investors count on bonds to zig when stock markets zag. That’s exactly what happened during the policy-induced stock market volatility that roiled markets earlier this year.

Specifically, when the S&P 500 Index fell 18.7% from the record high set on February 19, 2025, to the recent low on April 8, 2025, the Bloomberg U.S. Aggregate Bond Index gained 1% (in U.S. dollar terms). This relationship will be vital should economic conditions weaken abruptly. The U.S. Fed can lower interest rates beyond expectations and provide a tailwind for bond returns since bond prices increase as yields decline.

Maintaining a balanced core bond portfolio is important to Chitrang Purani, fixed income portfolio manager.

“I currently favour high-quality issuers across bond sectors, as you’re not getting paid appropriately to take on riskier investments. The market has priced in a very optimistic outlook, and while recession is not my base case, it’s crucial for bond portfolios to serve as a ballast when volatility hits.”

5. Markets have been resilient over time

The desire to act when markets tumble is understandable. But the cost of selling could be significant.

In 2018, during U.S. President Donald Trump’s first term, a series of new tariffs launched against China sparked a trade war that roiled markets and dominated headlines, much like today. How did stocks react? The S&P 500 Index in U.S. dollar terms dropped 4.4% in 2018 on fears of an economic slowdown and higher inflation. But the index recovered sharply in 2019, rising 31.5%, as trade deals were announced and consumer spending remained steady.

Markets recovered from trade uncertainty in Trump’s first term

Sources: Capital Group, U.S. Bureau of Labor Statistics, Peterson Institute for International Economics, Standard & Poor’s. Value of investment in the S&P 500 reflects the total return of the index over the period from January 1, 2018, to December 31, 2019. Past results are not predictive of results in future periods. Returns are in USD.

“Trump’s first term shows the outcome can vary significantly from the initial headlines,” says Martin Jacobs, a portfolio manager for Capital Group U.S. Equity Fund™ (Canada). “As someone who believes the market tends to go up far more than it goes down, I am not discouraged by this year’s volatility. I view the dislocation as an opportunity to invest in great companies and multiyear investment trends where I have conviction, setting up the portfolios I manage for years to come.”

The world has changed since that initial round of tariffs. The rapid development of artificial intelligence and the greatest inflation shock in decades have had significant economic implications. The first half of 2025 shows just how unpredictable markets are. We don’t know what next year will bring, but history shows that markets have proven to be resilient over time.

Chris Buchbinder is an equity portfolio manager with 29 years of investment industry experience (as of 12/31/2024). He holds a bachelor’s degree in economics and international relations from Brown University.

Martin Jacobs is an equity portfolio manager with 37 years of investment industry experience (as of 12/31/2024). He holds an MBA from Wharton and a bachelor's degree from the University of Southern California. He also holds the Chartered Financial Analyst® designation and is a member of the CFA Institute.

Samir Parekh is an equity portfolio manager and a global research coordinator with 23 years of investment industry experience (as of 12/31/2024). He holds a post-graduate diploma in business administration (equivalent to an MBA) from the Indian Institute of Management, Ahmedabad, and a bachelor’s degree from Sydenham College, Bombay University. He also holds the Chartered Financial Analyst® designation.

Chitrang Purani is a fixed income portfolio manager with 21 years of investment industry experience (as of 12/31/2024). He holds an MBA from the University of Chicago and a bachelor's degree in finance from Northern Illinois University. He also holds the Chartered Financial Analyst® designation.

Copyright © Capital Group