by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

Few would disagree that the U.S. Fed was late to the game in fighting inflation a few years ago. Of course, it was a rather unique time in history, coming out of a pandemic that had supply constraints still lingering while demand soared. People were bored sitting at home and had piles of accumulated savings to pay up, so revenge travel became a trend, as did just paying up. After waiting too long, claiming inflation was transitory, central banks around the world moved up rates aggressively to combat inflation.

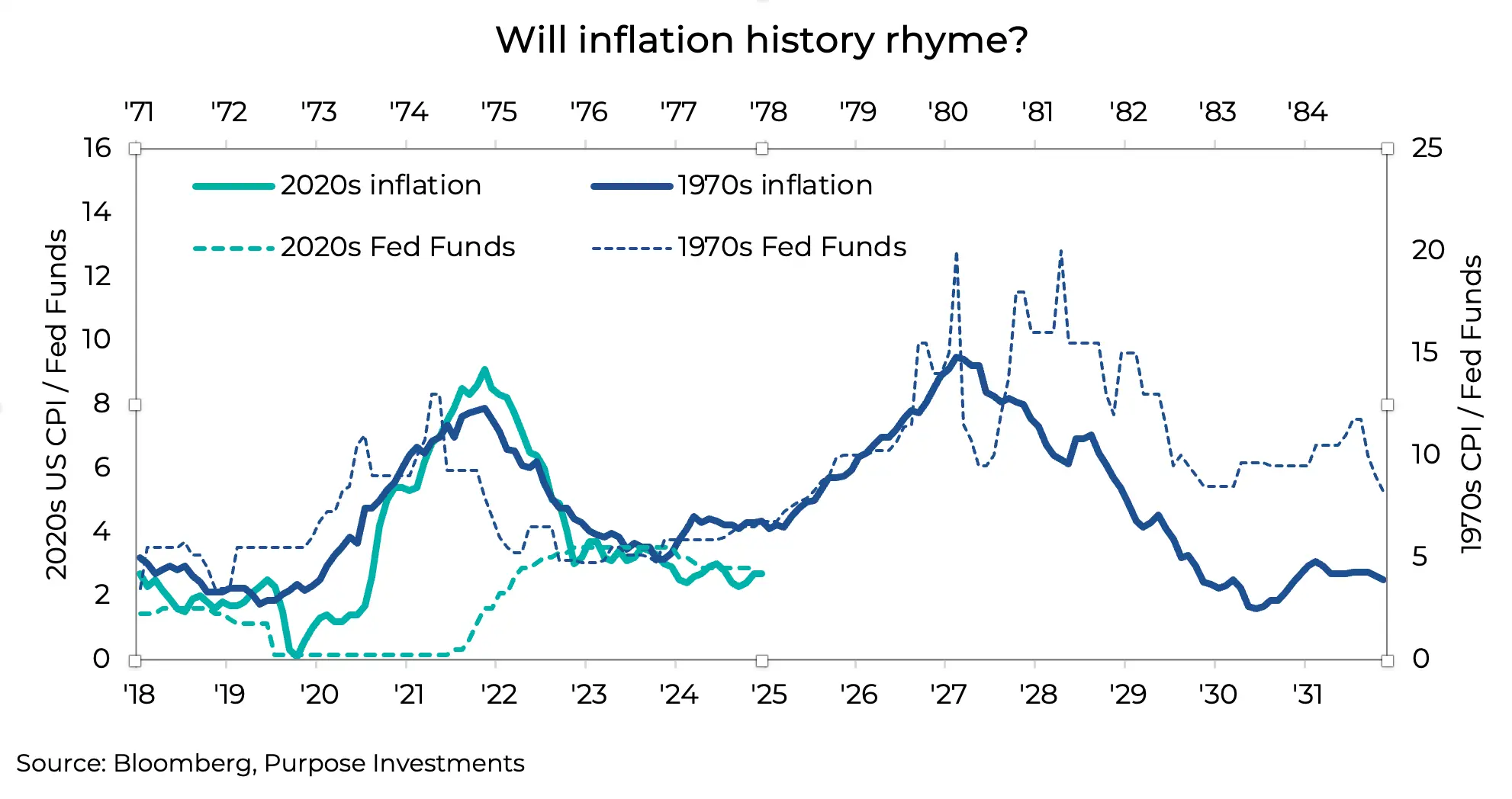

The chart below is kind of fun and contrasts the 70s with the 20s. Inflation is the thick line, while the dotted lines are the Fed Funds rate. In the 1970s, central bankers were on it, raising rates quickly to fight inflation. But after initial success, it came back and then required rates to go even higher and stay up there longer to finally beat down inflation. This led to some pretty bad recessions in the 80s, then a beautiful time for consumers and markets that lasted decades.

We are not saying 2020s inflation will follow the same path with a sudden flare-up, that would be too simplistic. However, it does appear inflation may be stirring once again. Inflation has come down from a high of around 8.5% to the current 2.7% based on U.S. CPI year-over-year. This probably is not deemed success from the central bank’s perspective, and it isn’t their fault. The Fed was late to get started, but even when the hikes began, fiscal spending in the U.S. continued very aggressively. Monetary policy is pulling the rope in one direction, and fiscal policy in the other. So apart from very interest rate sensitive pockets of the economy, there really wasn’t much of a slowdown to alleviate the inflation pressures. Instead, they mainly came down because we all blew through accumulated savings, and the higher cost of doing things sped this process. And supply or capacity caught up with demand.

Unfortunately, inflation hasn’t come down as much as hoped by policymakers and consumers. And it does potentially appear to be starting to turn back up. Meanwhile, the Fed is expected to cut rates in September, which would be the first rate cut in 2025. At the same time, a number of factors appear to be signalling inflation may re-accelerate, which may cause some surprise for markets later in 2025.

Tariffs – As tariffs begin to be collected, this is inflationary, but it also depends. If the higher prices result in less demand, the slower economic activity could limit the upside influence on inflation. But with still resilient consumer spending and renewed fiscal spending, it is possible the economy does not slow down or slow enough to mitigate the upward move in inflation from tariffs. With new and expanded tariffs starting to filter through the supply chain, tariff-driven cost increases usually take 2-6 months to fully show up in CPI. That means in Q4 we could start to see this impact, or sooner if companies choose to increase prices earlier.

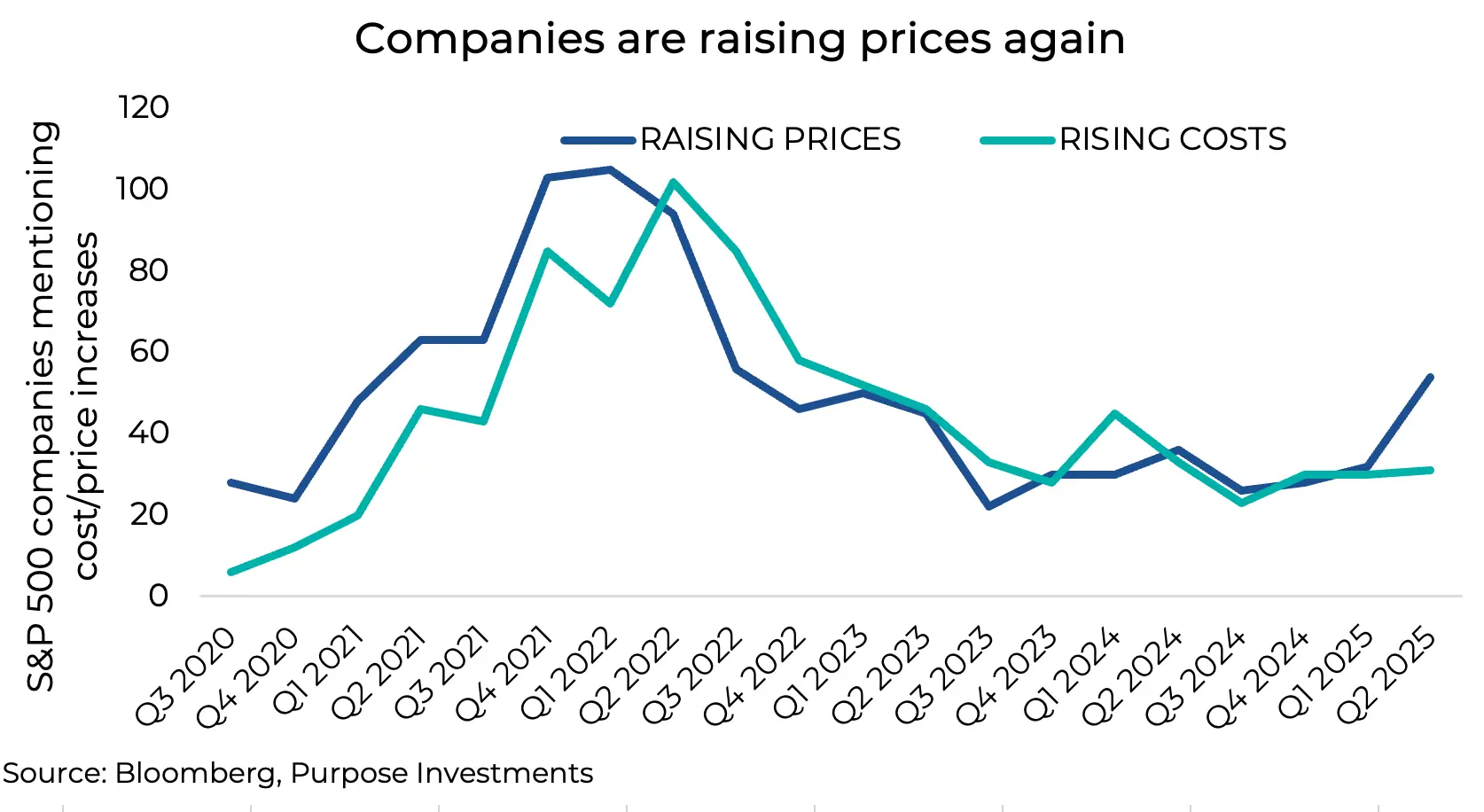

Scrubbing earnings transcripts for mentions of rising costs and prices, it would appear companies are starting to raise prices already. Keep in mind this is for Q2, even before most of the tariffs started. Q3, which we will see in October, will likely be higher. Certainly a sign of more inflation ahead. The good news is that costs are not yet rising, which means profit margins may see a positive impact. This could be good for equities, not so much for bonds.

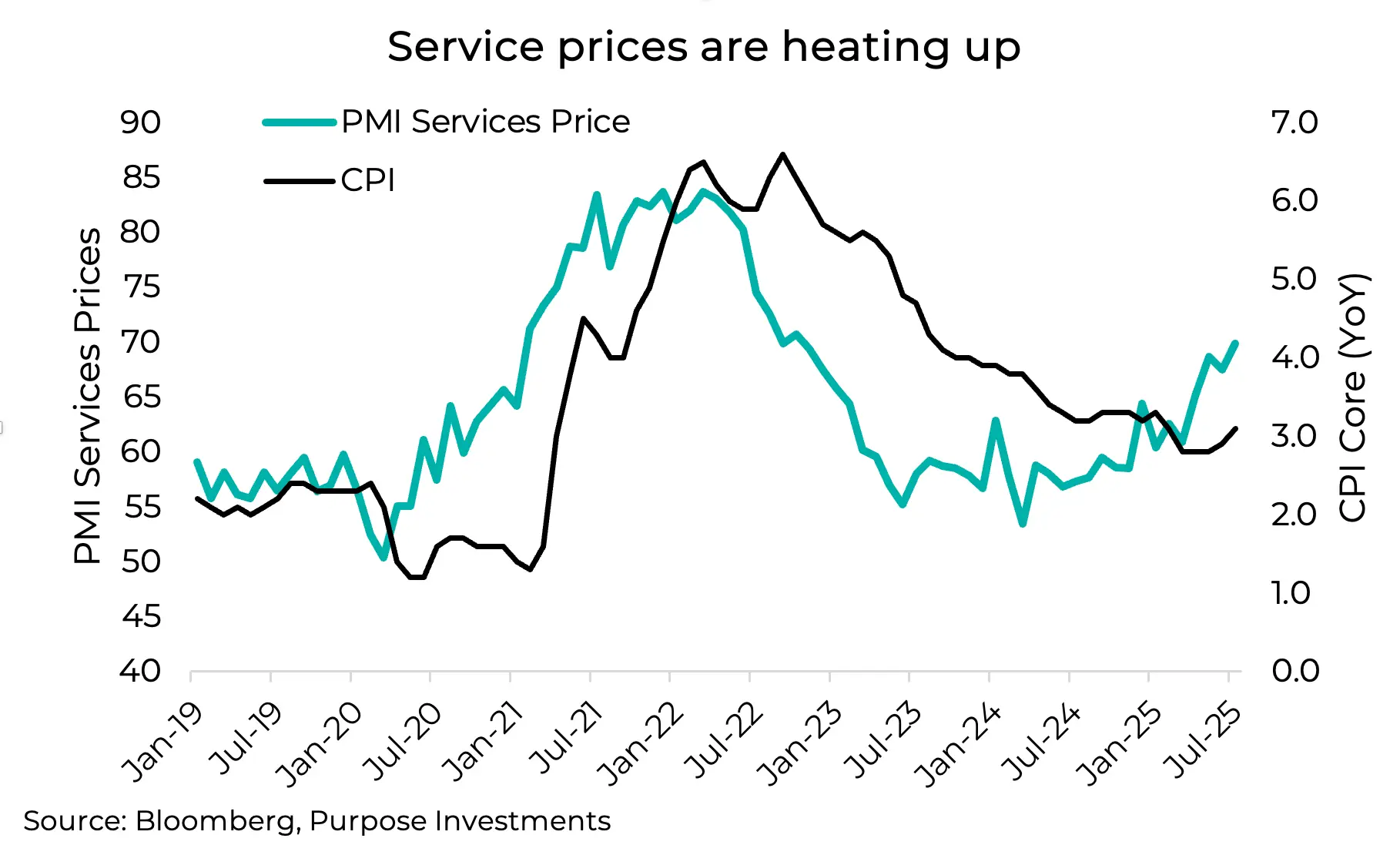

Services – Tariffs impact goods inflation, but for developed economies, such as the U.S. and Canada, services matter more. And for services, wages matter the most. Wage growth has been moderating, slowly, but unless we start seeing material weakness in employment, wage growth will likely continue. PMI surveys for service business pricing have been accelerating to the upside, which historically leads overall inflation.

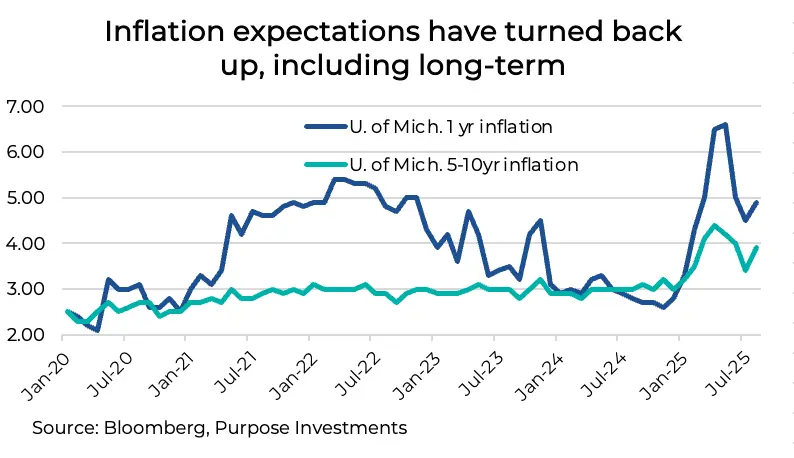

Inflation is a mindset problem, and the real damage comes when people begin to think inflation is here to stay, as this causes their behaviours to change, from consumption to wage growth expectations. It is worth noting that the University of Michigan survey data didn’t see long-term inflation expectations (5-10 years) move higher during the 2021-22 inflation spike. But they are moving higher now, with a jump in this month’s survey. Partial erosion of Fed independence, whether real or perceived, is likely adding to this view that inflation may run hotter for longer with less effective policy control.

Final Thoughts

Reducing rates, adding more fiscal stimulus in the Big Beautiful Bill, and the impact of tariffs - inflation risks are adding up in the coming months. Of course, if we get a soft patch in the economic data, that may provide the release valve. But if we don’t get a slowdown, this inflation risk may bleed into yields in the coming months.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Copyright © Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,”“will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.