by Jeffrey Buchbinder, Chief Equity Strategist, LPL Financial

Additional content provided by Brian Booe, Associate Analyst, Research.

With 90% of S&P 500 companies having reported second quarter results, corporate America has handily topped expectations, displaying resilience in the face of a challenging policy environment. Although the S&P 500 had a relatively low bar to clear of just 4.9% earnings growth expected for the quarter, America’s largest companies have cruised past estimates. S&P 500 earnings per share (EPS) growth, tracking over 11% year-over-year growth, is more than doubling the level expected at the start of the season on July 1. Alongside the better-than-anticipated results, an earnings season rarity has also caught investors’ attention.

Forward earnings per share (EPS) estimates typically decline over the course of each earnings season as companies adjust guidance and Wall Street fine-tunes its expectations — especially amid times of uncertainty, such as this year, when policy changes cloud the earnings outlook. However, through the end of last week, forward (next 12 months) EPS estimates for the S&P 500 have impressively increased 0.9%. To put this in perspective, over the last 20 quarters (going all the way back to the fourth quarter of 2020) S&P 500 earnings estimates have only risen seven times during the first month of the new quarter. This earnings season marks the seventh occurrence, and five of those instances came in the wake of the COVID-19 pandemic when expectations became far too pessimistic, with the second quarter of 2024 the other rarity.

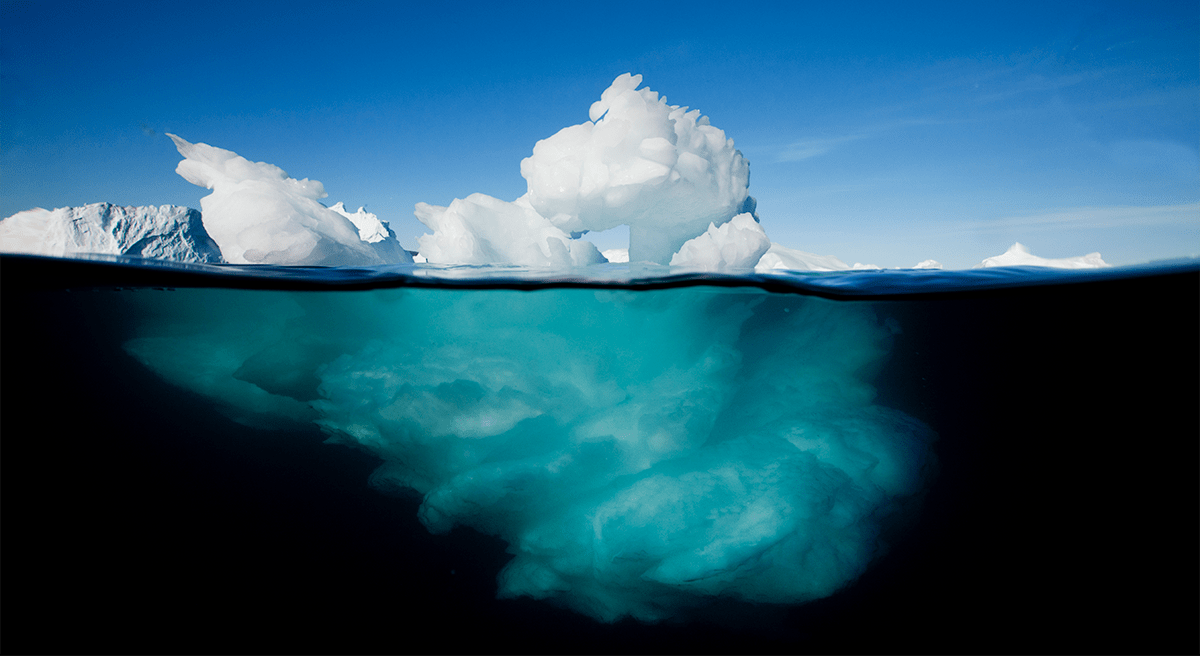

Support Under the Surface

How does this impact markets? Earnings revisions represent a resetting of expectations, and can be used to help judge an earnings season, but they’ve also been a quiet catalyst underpinning the market. Based on a basket of 100 S&P 500 names curated by our friends at Bloomberg, stocks with the highest earnings revisions over a rolling three-month period outperformed the broader index over both the last year and five years. Year to date, the EPS revision factor trails the S&P 500 by less than 0.3% and is bested only by the size factor, made up of the largest companies by market cap, which is the only basket to outperform the broader index — no surprise here. The EPS revision basket has also (somewhat surprisingly) outperformed the seemingly ever-dominant growth factor. Similarly, performance for the EPS revision factor has been the leading factor across the small cap benchmark Russell 2000 since the start of the year and has led factor returns across the Bloomberg World Index over the same period.

Stocks with the Highest EPS Revisions Outpaced the S&P 500

Source: LPL Research, Bloomberg 08/12/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Given that markets are forward looking, it may not come as a surprise that the factor has emerged as a quiet force driving equity performance. The recent and longer-term strength of the factor is a reminder that earnings revisions are one of many important fundamental metrics for market participants to consider, as the factor tends to correlate with pockets of the market that are performing well on a relative basis. Broadly, with earnings revisions ticking higher at the index level this quarter, this gauge of fundamental momentum and market sentiment may continue to act as a tailwind for stocks.

Conclusion

Positive earnings revisions, while generally supportive of stock market gains, do not point to a one-way street higher. A weak U.S. dollar has supported earnings revisions this quarter, while analysts got overly pessimistic after the initial tariff announcements in April and have simply reset expectations. While companies deserve credit for managing through a difficult trade policy environment amid a slowing economy, we caution against complacency as bouts of volatility may arise throughout the second half as delayed tariff-related effects filter through to economic data, as well as corporate results, as front-loaded inventories are depleted and margins in some corners of the market face downward pressure.

Financials, technology, and communication services are the top three industry groups boasting the most names within the earnings revision basket of stocks, with the sectors capturing 51% of the names that comprise the gauge (22, 17, and 12 names, respectively). Financials and communication services have led EPS revisions this earnings season, underscoring LPL Research’s overweight stance in both sectors as the industry groups remain on solid fundamental footing. LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) remains neutral toward equities overall; slightly favors the growth style over value, large caps over small caps, and remains neutral on a regional basis.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #782638

Copyright © LPL Financial