by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

Everyone loves a great story. A proper tale with sage advice takes time to tell, and time is money. This is why investing stories often take the form of age-old quips, mantras, shorthand acronyms, and even memes. These shorthands are all narrative devices that reduce complexity through simplicity.

Acronyms remain as popular with investors as ever, especially with traditional media. Compared to acronyms, memes are far more viral, taking hold and spreading like wildfire through social media. Unlike sayings or acronyms, memes don’t describe market trends; they shape them through coordinated sentiment and bandwagon trading to push heavily shorted stocks around. Acronyms and memes are both catchy, spreading as momentum grows, but blindly following either comes with risks.

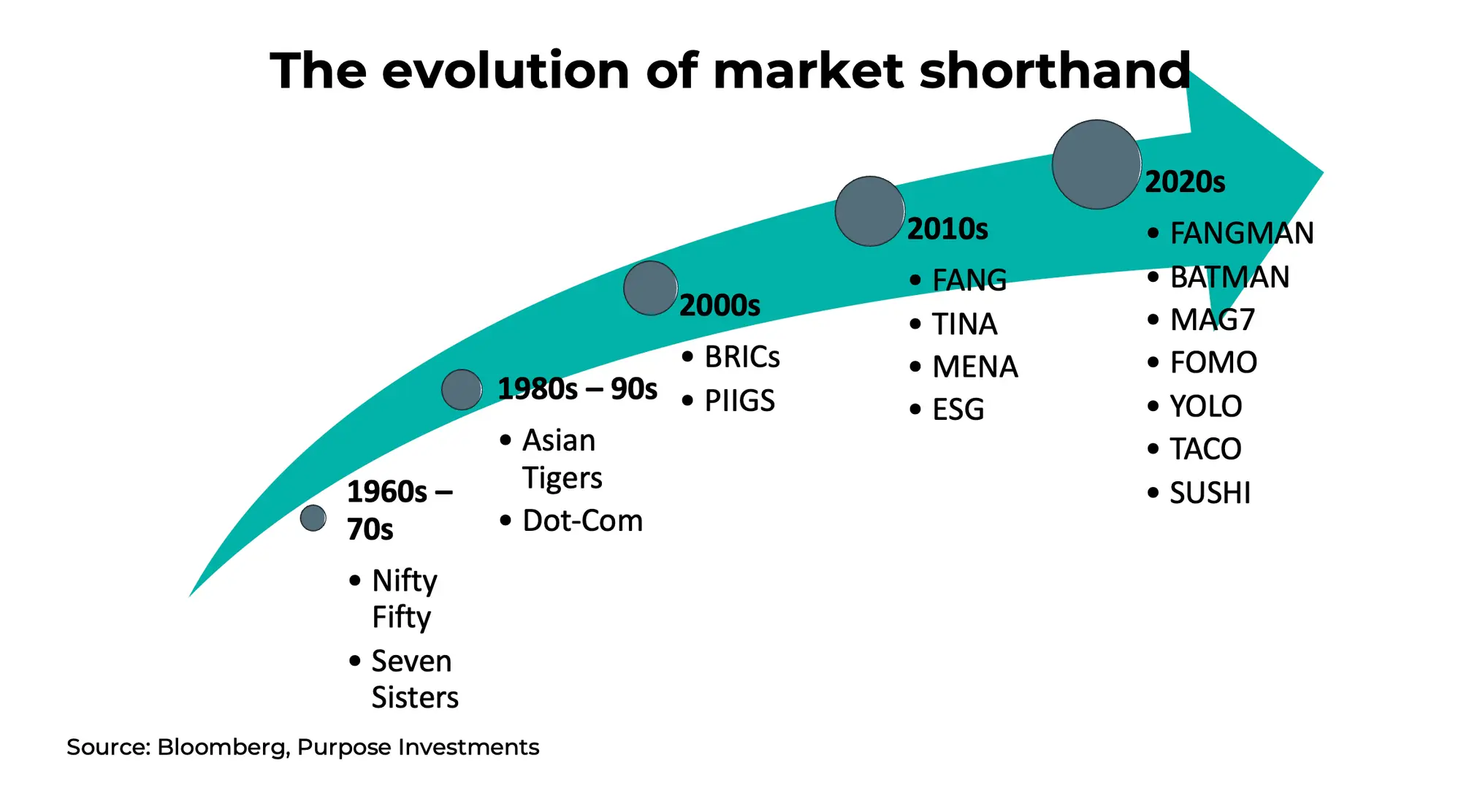

Simplifying investment narratives isn’t new. In the 1960s, you had the Nifty Fifty, a quick shorthand that described the top stocks of the day, which were very popular despite excessive valuations. Skip forward a few decades, and you had the rise of the BRICs, driven by globalization narratives. FANG and all the subsequent variations have been around for over a decade. They reflect Big Tech’s dominance and growing concentration risk.

The chart below shows the evolution and expansion of popular market shorthand. We might be missing some, but it’s enough to see that while these shorthands have been around for a long time, they’re becoming increasingly popular. Just this year, you have TACO (Trump Always Chickens Out) and SUSHI (Stocks Usually Stop Having Interest) being added to the list.

Sure, most of this is just fun and games on equity sales desks or financial news outlets, but the risk is that these generalizations get slavishly followed, preventing investors from looking at fundamentals. These mental shortcuts risk morphing into mental shortcomings without diligent critical thinking.

The Return of Meme-Mania

Meme-mania came back in a big way this week. Old-time favourites like GameStop and AMC didn’t get the invite this go around. The setup echoes 2021: heavily shorted stocks see a surge in volume, sending prices higher. Some of the popular names this time were OpenDoor, GoPro, Kohl’s and Krispy Kreme. These companies all saw some eye-popping returns, all up more than 100% just this week. Combining new tools like AI sentiment scraping, options leverage, and mass coordination, retail traders can really push a stock around, even if these meme trades are not based on macro or company fundamentals.

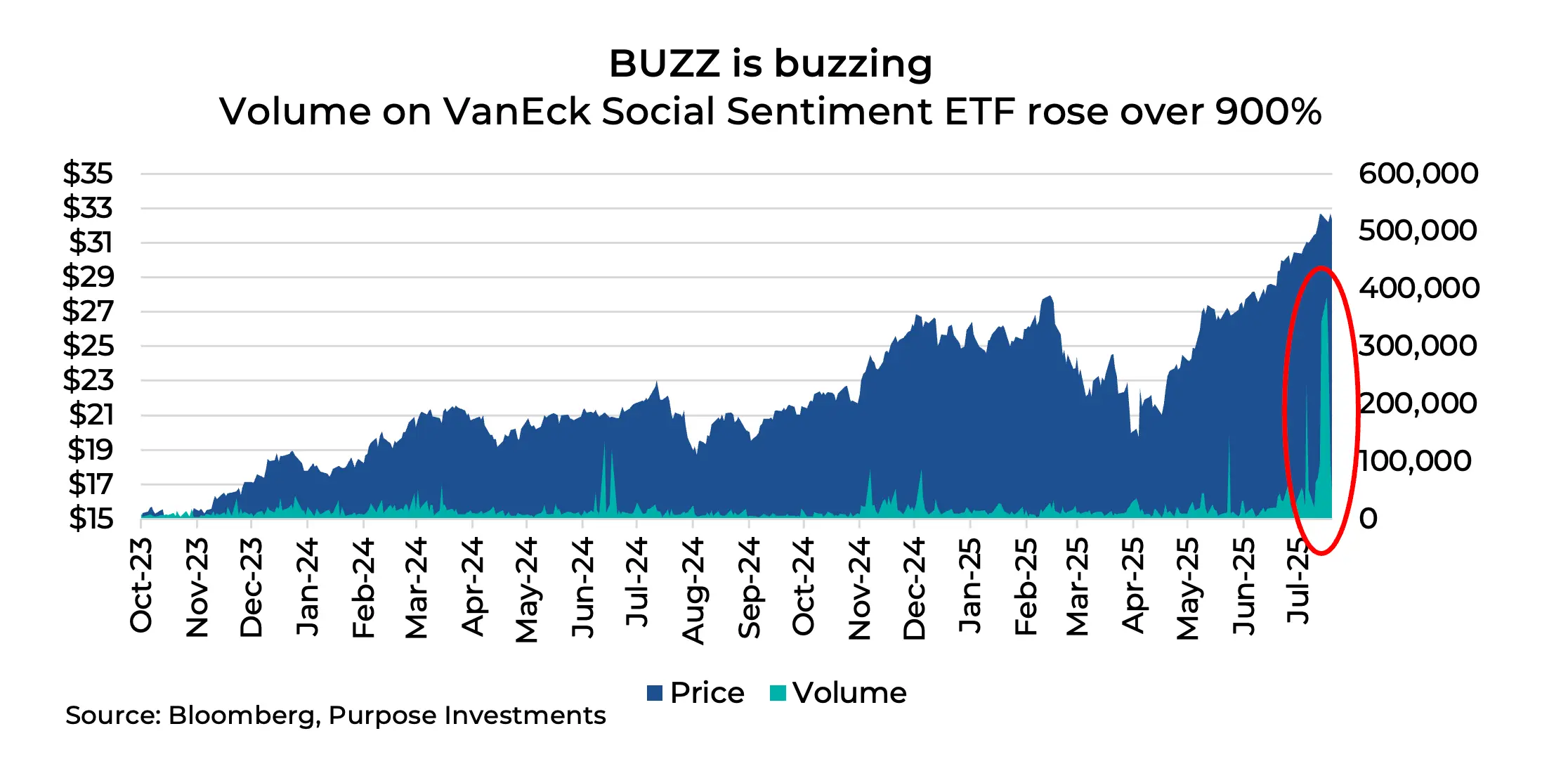

The chart below highlights another popular ETF from 2021. BUZZ was launched to much fanfare by the likes of Dave Portnoy during the r/wallstreetbets heyday. It had its time in the sun, at one point reaching $500 billion in AUM, then dwindled for years and saw AUM fall to around $40 million this past April. Just this week, volume spiked over 900% compared to typical levels, showing that, along with individual stocks, funds connected to the meme craze are back in the game.

Meme stocks sit at the extreme end of narrative-based investing. We use the term ‘investing’ very loosely here. The returns are ephemeral, viral and sentiment-fueled. The term “transitory” does not do them justice. For meme stocks, sentiment is the strategy and nothing else.

If narrative investing were a spectrum, acronyms and memes would be at opposite ends. Both are fueled by memorable and catchy slogans, and both thrive in environments of high liquidity and easy access to information. But acronyms typically move more slowly, encapsulating actual trends that have already been in place, and will continue to be for some time.

For investors, the benefits of acronym-rich communication are simple. They spread fast, are memorable, and have strong viral appeal. Most of the great acronyms or generalizations that have coincided with portions of the market have had strong returns. Often, they imply some sort of thematic exposure and have gained traction through financial media or creative product departments. Meme stocks are simply bandwagon trading spread through social media sites like Reddit and TikTok.

But narrative investing also has a number of pitfalls investors should be wary of, including:

- Oversimplification – Reducing complex themes to a simple label can cause investors to overlook potential risks.

- Herd behaviour – Once certain acronyms gain popularity, they can drive market moves and foster groupthink, inflating bubbles in the process.

- Obsolescence – Markets can change quickly, and acronyms can become irrelevant. TINA (There Is No Alternative, an equities-related strategy) lost relevance once bond yields rose.

- Jargon barrier – Overuse creates insider language that can exclude those unfamiliar with its use. Jargon favours tribalism, creating an “in crowd.”

Nothing Lasts Forever

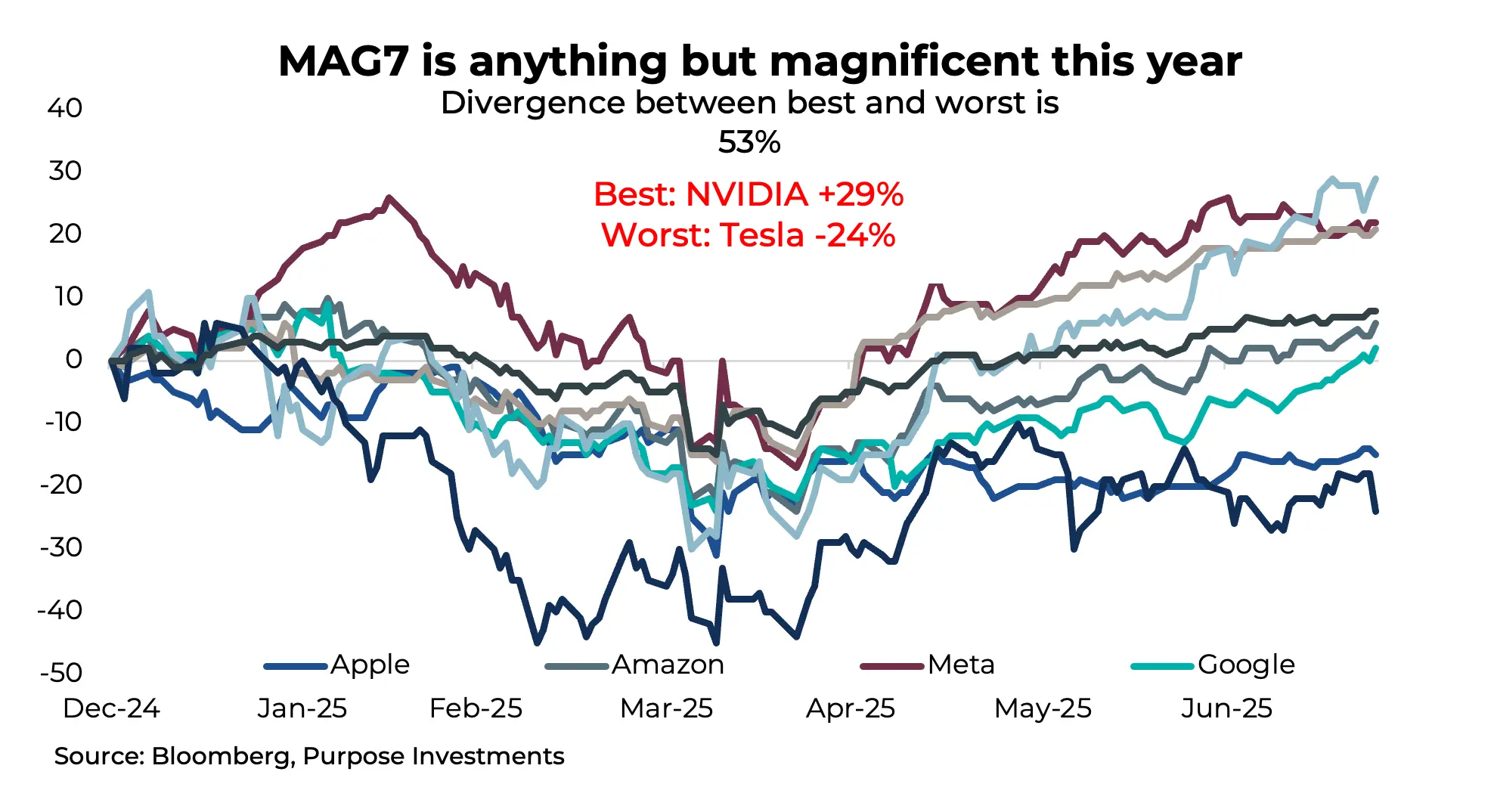

Even the MAG7 is now dated. In aggregate, the group has lagged, up just 5.5%. There is nothing magnificent about Apple’s and Tesla’s performance this year, down -15% and -24% respectively. The divergence across the group is high: 53% separates the best (NVIDIA) from the worst (Tesla).

This is enough to finally put this term to bed, but the market narrative of Big Tech dominance as a group continues. Concentration fears remain front and centre for many investors. The combined market cap of the MAG7 is now nearly $19 trillion, or roughly four times the market cap of the Canadian stock market. MAG7 now has nothing really to do with performance, but the sheer size of these companies remains magnificent.

Risk Back On?

The meme stock revival comes amid a bigger risk-on move in markets that has sent the S&P 500 to fresh highs this week. Risky market behaviour is back in fifth gear, given the renewed focus on meme stocks and fund flows pouring into U.S. stock ETFs. In total, investors have poured in a record $155 billion into U.S. equity ETFs during the first half of the year.

The similarities to 2021 are back in full view, but digging deeper into other market sentiment measures, it’s not as clear that there is rampant euphoria. The AAII Bull-Bear index reading is back into positive territory at 2.58, but is far from any sort of extreme bullish reading. The same can be said for Retail Investor Positioning survey data as well as S&P futures positioning. Certain market cohorts are back in full YOLO mode, but many others remain somewhat more modest regarding the near-term market path.

Final Thoughts

We’ll leave you with some final words: by the time labels or acronyms get popular, their best returns are often behind them. Critical thinking remains as important now as ever before. Weighing the fundamentals alongside the catchiness of an acronym is the least you should do before putting any capital work.

Feel free to use narratives as a signal to spot the latest trends, but make sure to balance them out with thoughtful analysis. From our perspective, narratives are fun to write and talk about, but we prefer cash flow to catchphrases and value to virality. Our process focuses on fundamentals and not the fads, and we’re just fine with that.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Get the latest market insights in your inbox every week.

Copyright © Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice. The mention of any specific stocks is for informational and illustrative purposes only and does not represent an offer, solicitation, or recommendation to buy or sell any securities

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,”“will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.