by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

Key Takeaways

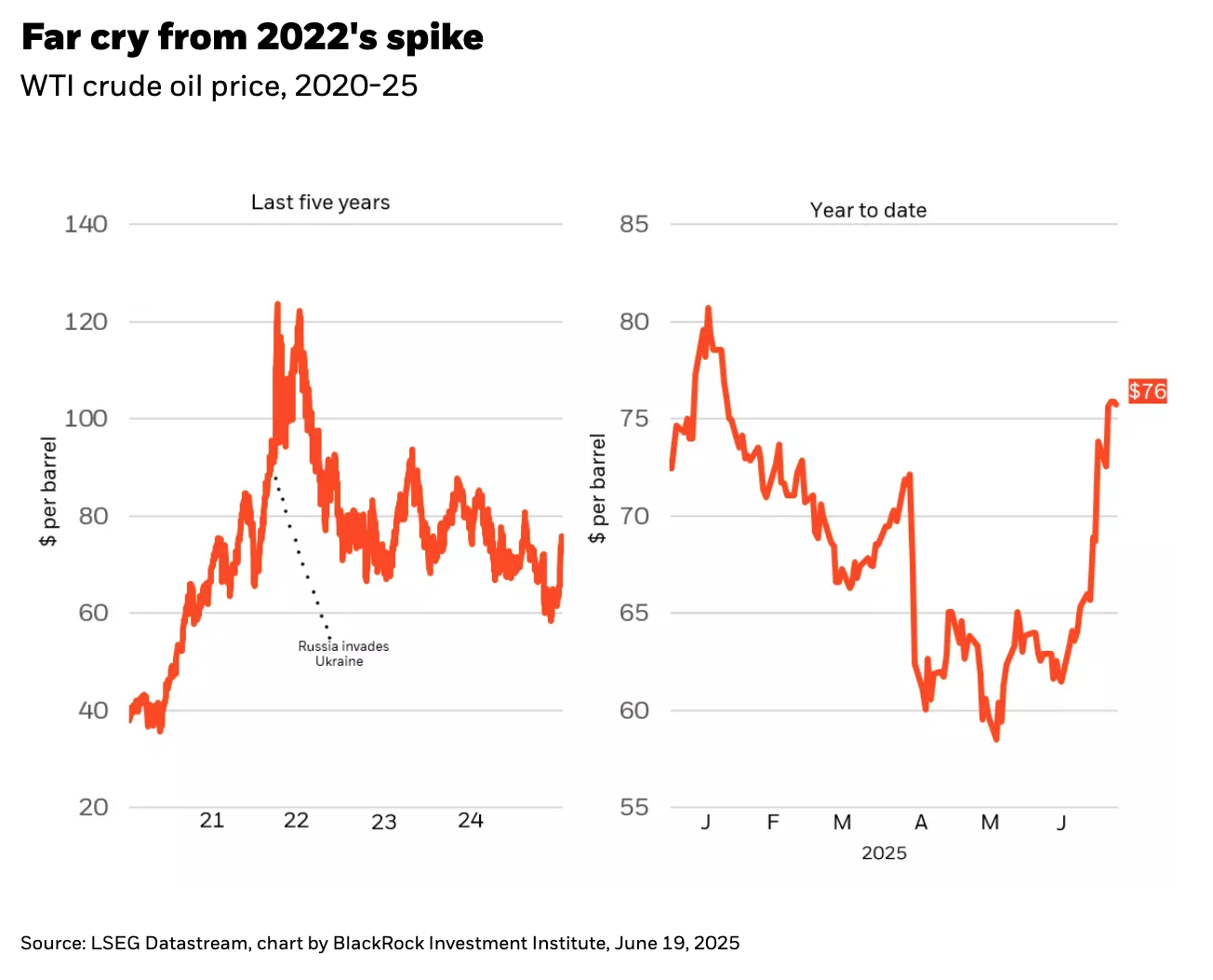

- June saw a spike in oil prices, followed by a sharp pullback, but investors seemed relatively unphased. Why? The move itself was modest compared to other changes seen in recent history and proved to have little impact on the equity market itself.

- Since 2020, data shows that the correlation between oil prices and the U.S. stock market has a modest positive correlation. Further, gasoline and energy goods only account for 4% of consumer spending, down from 6% in 1990.

As oil shocks go, the late June spike in oil was one of the less disruptive ones. After surging more than 30% at the onset of the Iran/Israeli conflict, crude oil experienced the sharpest 2-day pullback since 2022. Even at the peak in oil prices, equity markets were incredibly resilient. My take is that absent a much sharper and prolonged spike in the price of crude, oil prices are not a major risk to stocks.

Stocks & Oil: It’s complicated

Why did investors look past the recent spike in oil prices? I’d cite several reasons, starting with the magnitude or lack thereof. While a 35% spike in oil is not trivial, it is modest relative to the doubling that occurred during the first Gulf War. Also worth highlighting that even at the peak of nearly $75/barrel, crude prices were still below the January peak and only back to last year’s average price, at around $75/barrel (see Chart 1).

Even when oil does spike, the relationship between stocks and oil is not what you’d expect. Based on data from Bloomberg, since 1990 there has been a modest positive correlation, approximately 0.15, between changes in oil prices and changes in the S&P 500. While this seems counter-intuitive, it makes sense when you consider that both stocks and oil are cyclical assets. In other words, both tend to rise when the economy is strengthening and fall on rising recession fears.

A good example of this dynamic occurred in May of 2020. Oil prices advanced nearly 90%, with the U.S. benchmark West Texas Intermediate (WTI) advancing from $18 to $35/barrel. That same month the S&P 500 rallied 4.5%. Both oil and stocks took comfort in an unprecedented set of monetary and fiscal packages, as well as a surprisingly resilient U.S. consumer.

Energy commands less wallet share

The risks from rising oil prices are normally two-fold: higher inflation leading to tighter monetary conditions and higher gasoline prices crowding discretionary spending. Both are less of a threat today. The Fed is likely to look past any temporary impact from oil on inflation. On the consumer side, energy spending is a far smaller percentage of wallet share than back in the early 90’s. According to the Bureau of Economic Analysis in 1990 gasoline and energy goods accounted for roughly 6% of consumer spending. Today, it is around 4%.

To be certain, lower-end consumers are more exposed to spikes in gasoline, particularly in the context of higher inflation on select consumer goods due to tariffs. But the key point is that, in aggregate, the U.S. consumer sector is less exposed to energy prices than was the case 35 years ago. And to the extent consumers are more insulated, the stock market probably is as well.

Copyright © BlackRock