Global X ETFs' Chris McHaney, Raghav Mehta, Brooke Thackray, Alex Smahtin, and Andrew Albrecht provide their perspectives in their just released mid-year outlook.

As 2025 rolls into its second half, the team at Global X Canada sees a world of investing that's shifting1—fast. Sovereign debt is climbing. Bond yields are testing levels we haven’t seen in decades. AI is still propelling mega-cap tech stocks. Gold’s gearing up for another seasonal run. And income-seeking investors are piling into yield-focused investment vehicles like never before.

According to Global X, “markets are entering a new era defined by macroeconomic tension, evolving portfolio preferences and shifting leadership across asset classes.” Translation? The playbook is changing—and investors are looking for clarity, flexibility, and smart ways to stay on offense without sacrificing defense.

Debt Is Heavy—And Getting Heavier

Chris McHaney, Executive VP and Head of Investment Management and Strategy, sounds the alarm on rising global debt. “Rising global public debt is an emerging concern… with implications for long-term market stability and investor confidence.” The numbers are hard to ignore. The IMF expects global debt to top 95% of GDP this year—and hit 100% by 2030.

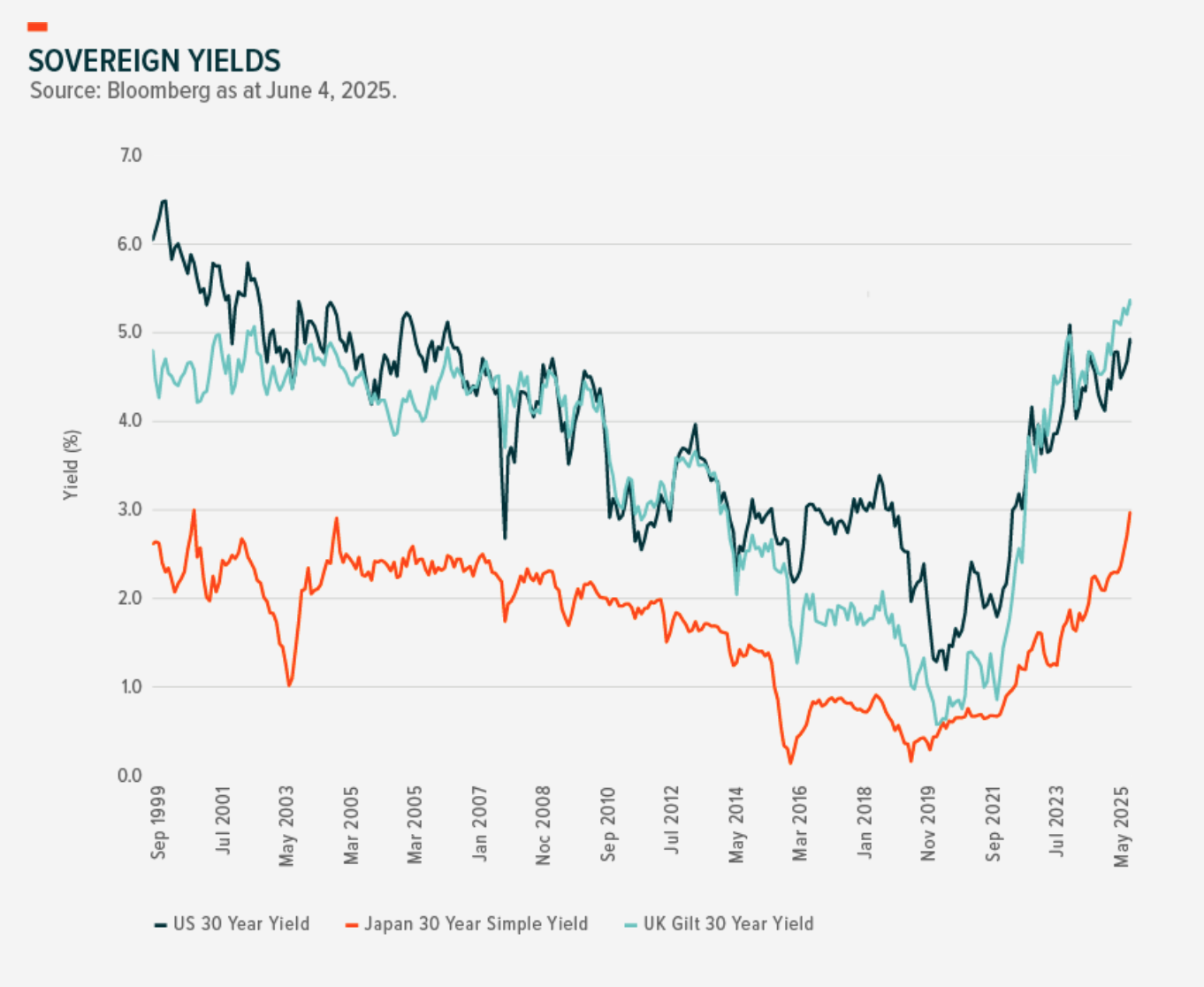

That kind of strain is pushing yields higher across the board. Japan’s 30-year hit 3.1%, the UK’s long bond cracked 5.3%, and the U.S. 30-year Treasury climbed past 5%—levels not seen since before the 2008 financial crisis.

McHaney ties it back to the macro mess: “slowing economic growth, persistent deficits, and the broader effects of deglobalization are placing mounting pressure on sovereign balance sheets.” As central banks try to juggle inflation and financial stability, investors should expect more complicated policy debates and, critically, more reason to build agility into their portfolios.

Don’t Count the U.S. Out Just Yet

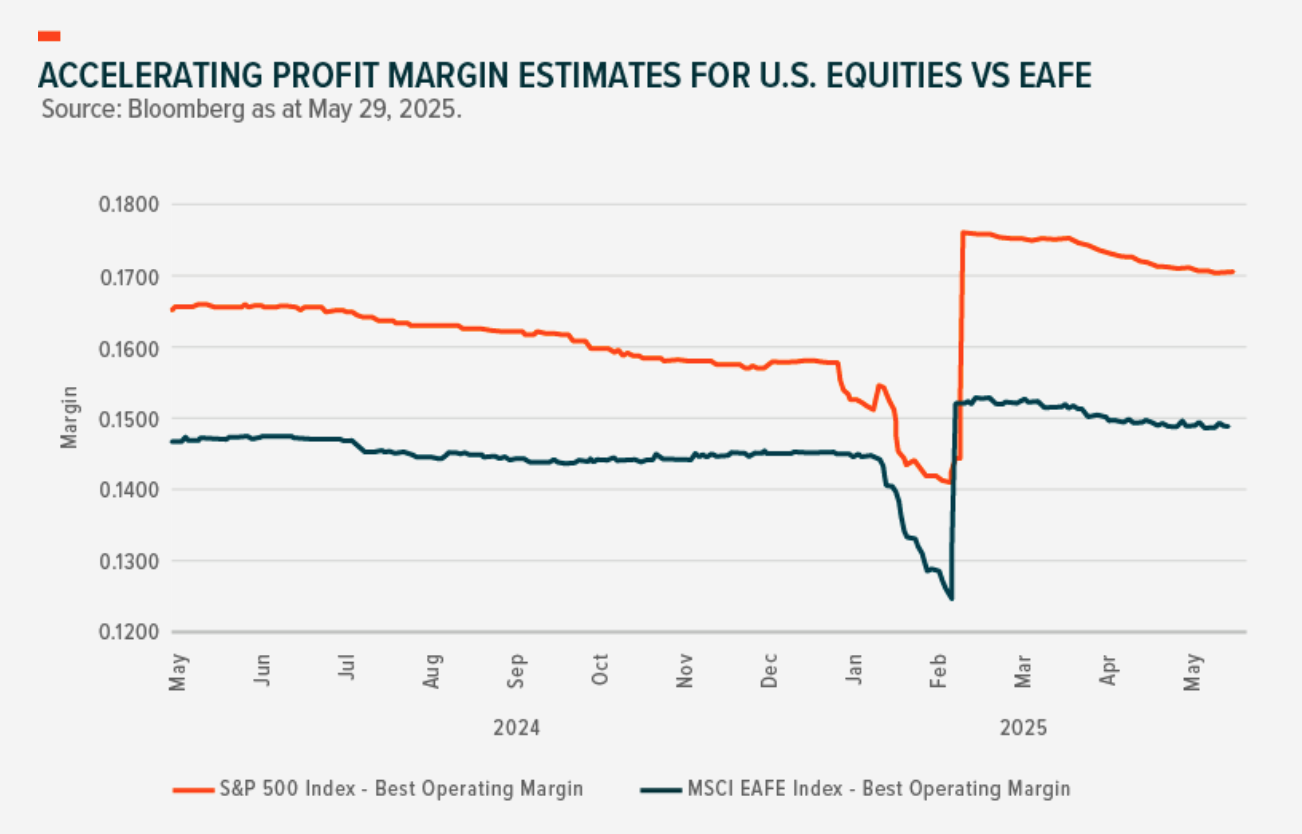

Raghav Mehta, Vice President and ETF Strategist, isn’t buying the “U.S. has peaked” story just yet. “Even with elevated valuations, the relative strength of fundamentals could sustain U.S. market leadership.” Why? Because U.S. large-caps—especially in tech—still have better earnings visibility and secular tailwinds than many global peers.

Yes, EAFE markets (Europe, Australia, Far East) have had a moment, thanks to better central bank support and rebound momentum. But Mehta suggests a lot of that is already priced in. What could shake things up again? “A shift in U.S. Federal Reserve rhetoric, particularly a clearer path to rate cuts, could reignite capital flows back into U.S. markets.”

Of course, there are caveats. Mehta flags three: labor market deterioration, tariff-driven earnings downgrades in late 2025, and the risk of bond yields sticking near 5%. Still, the AI boom—and the staying power of names like the “Magnificent 7”—could offer some serious cushion if the Fed turns dovish on time.

Gold’s Time to Shine (Again)

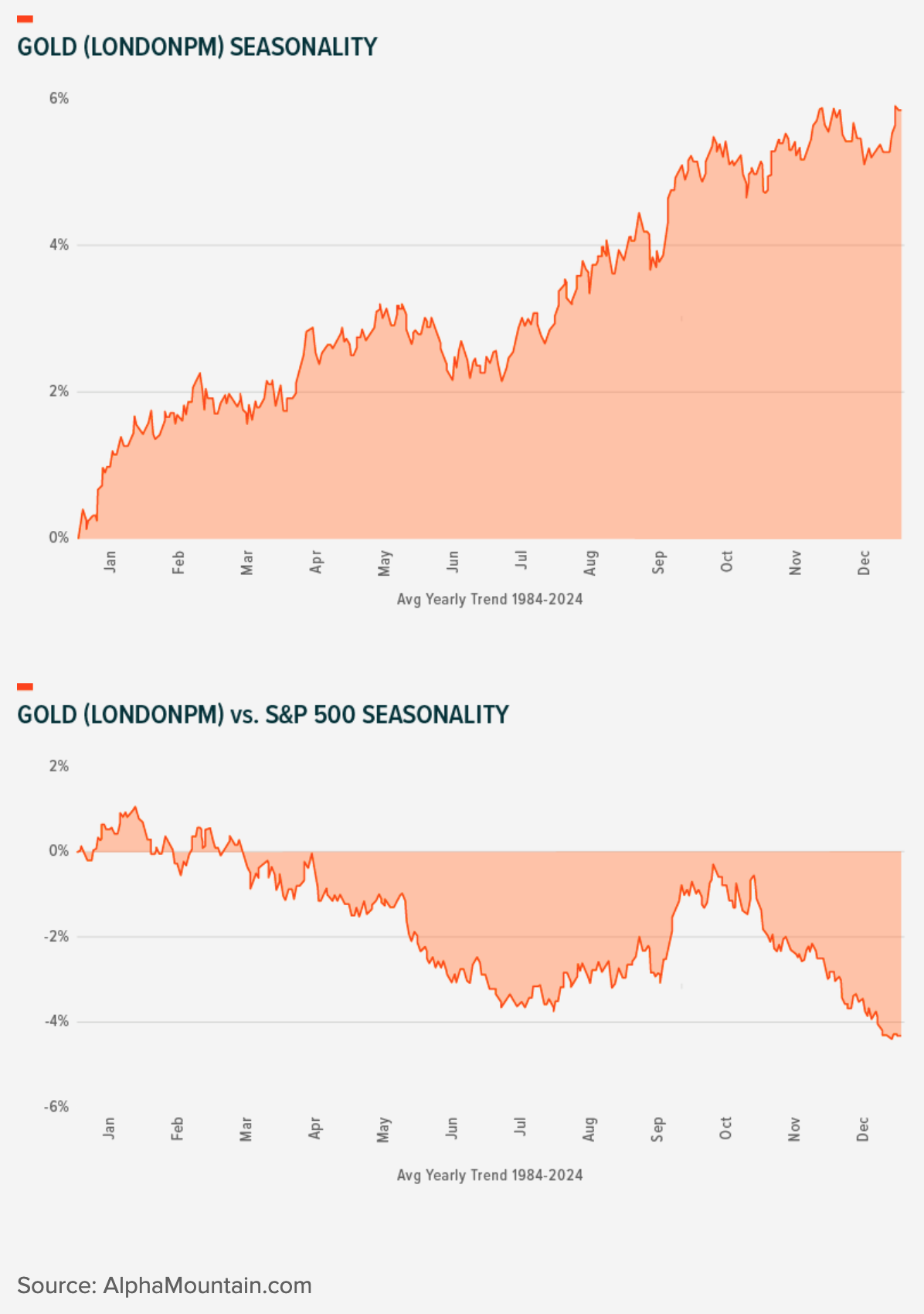

Brooke Thackray, Research Analyst, brings some seasonality into focus. Historically, gold tends to bottom in June and rally from July through September. “Gold typically enters a strong seasonal period starting in July, though the setup often begins in June,” Thackray explains. Even when June is bumpy, it often leads to solid gains.

Case in point: gold beat the S&P 500 during the same stretch in both 2023 (+13%) and 2024 (+27%). And right now, “heightened volatility and global macro headwinds” may give that trend even more fuel.

Whether it’s inflation, geopolitical stress, or investors looking for a store of value, gold’s appeal hasn’t faded. In fact, this summer might be yet another reminder that gold isn't just a hedge—it’s a tactical opportunity.

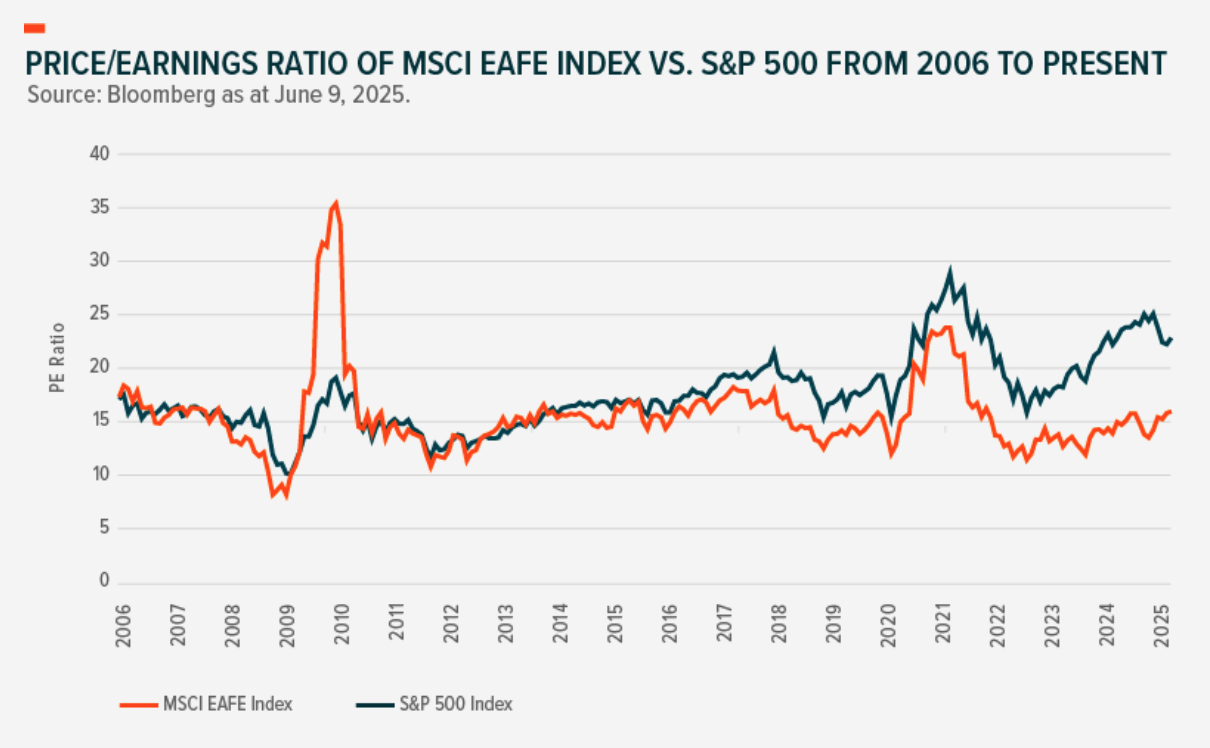

International Rotation Could Be Brewing

Alex Smahtin, Portfolio Manager and Senior Analyst, sees signs that U.S. market dominance might be taking a breather. “Since Liberation Day, investor sentiment toward U.S. assets has shifted,” he notes, “with relative valuations compressing compared to EAFE and emerging markets.”

More telling? Investors are hedging the U.S. dollar more aggressively than they were just months ago, hinting at deeper concerns about its long-term strength. “Hedging against the U.S. dollar has increased… suggesting growing concern around the currency’s medium- to long-term trajectory.”

If that trend continues, Smahtin says we could see a reallocation of capital into markets with better valuations and stronger currencies—particularly in emerging markets or developed international regions. But that rotation depends on one key thing: sentiment holding steady.

Yield is Back—And So Are Covered Calls

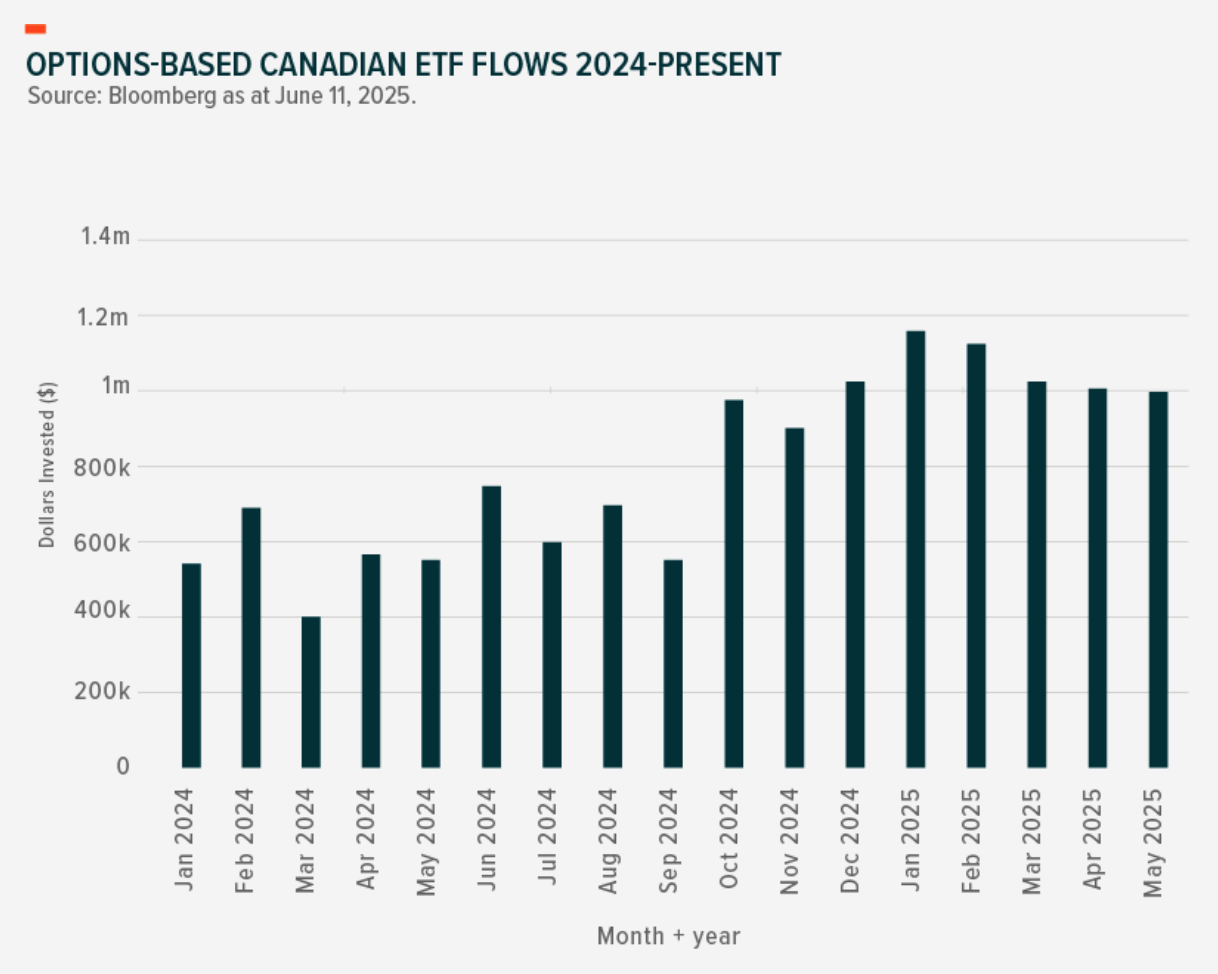

Andrew Albrecht, Vice President and Portfolio Manager, says Canadian investors are all-in on one theme: income. “Covered call and options-based exchange traded funds (ETFs) are capturing a growing share of investor interest in Canada, with nearly 10% of net inflows now directed toward these strategies.”

And it’s not just about dividends anymore. Albrecht explains: “Covered call structures allow investors to stay fully invested while collecting option premiums—often elevated during turbulent periods.” That means income and some downside buffer—all in one package.

Even more interesting is how these strategies are evolving. What started as equity-focused buy-writes has grown into a toolkit that now includes fixed income, duration-specific strategies, modest leverage, and even Bitcoin covered calls. “Income innovation,” it seems, is no longer a niche play—it’s going mainstream.

Final Word: Blend, Don’t Bet

Across the board, the Global X team isn’t advocating for a dramatic shift. They’re urging investors to stay balanced and tactical. “U.S. equities may continue to benefit from earnings resilience and innovation leadership,” they write, “while selective exposure to international markets makes sense if currency and valuation trends shift.”

Meanwhile, gold and income-oriented options strategies offer “compelling diversification plays amid volatility.” And with yields pushing higher, it’s a reminder that “a flexible, multi-asset approach” is more important than ever.

The message is clear: In a world where nothing moves in a straight line, blending growth, income, and protection might just be the smartest way forward.

Footnotes:

1 "Mid-Year Perspectives from Global X." Global X Investments Canada Inc, 25 June 2025.