“There will come a time when you will be happy to have been out of the market.”

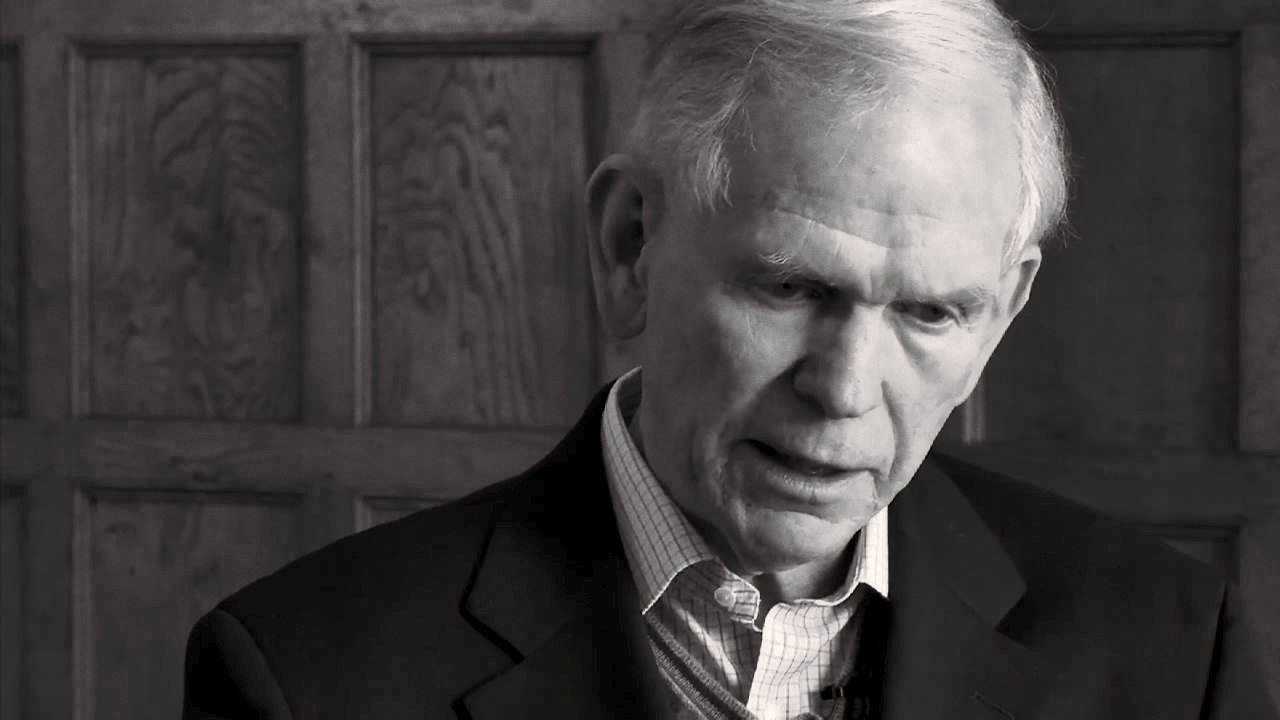

With that chilling forecast, legendary investor Jeremy Grantham once again delivered a sobering reality check on WealthTrack1 with Consuelo Mack. Long known for his prescient calls—from the dot-com bust to the housing crash—Grantham didn't disappoint, warning that today’s markets are not just irrational, but historically warped by a trio of structural anomalies: COVID’s economic aftermath, the unchecked rise of AI, and escalating global trade tensions.

Grantham, now Long-Term Investment Strategist at GMO and steward of the Grantham Foundation for climate and biodiversity, pulls no punches as he assesses the markets through the dual lenses of valuation extremes and systemic disruption.

Fog, Froth, and the Fear of the Unknown

Opening with a metaphor as thick as the air outside his office—"You can't even see the next building"—Grantham likens today's markets to a landscape engulfed in pea soup fog. “All the old ratios don’t seem to work,” he laments.

The world, he explained, has been knocked off its axis by a trio of distortions:

- COVID’s Speculative Shock: “The COVID stimulus was an order of magnitude bigger than anything we had ever seen… it ended up with trillions of dollars in very weird hands,” Grantham notes, adding, “People who were bored and forced to be at home… speculated on stocks, and they did”.

- The AI Catalyst: “It came to be recognized with ChatGPT in October 2022... it kind of ended [a] traditional bear market overnight,” Grantham recalls. The Mag 7 surged, distorting normal reflexes and resurrecting market optimism, despite wider instability.

- Tariff War Uncertainty: “No one has a clue what the tariff war is going to do,” he warns, placing trade policy at the center of economic unpredictability.

As Mack put it, “It strikes me that what you’re describing too are extremes in the market.” Grantham agrees—and then some.

Market Valuation? Try "Colossal"

Grantham argued convincingly that the U.S. stock market remains grotesquely overpriced by every metric that matters.

Using the total market cap to GDP ratio—“Warren Buffett’s favorite,” as Mack reminds viewers—Grantham declares, “The market could easily go down by 50% and be well within its historical boundary”.

His historical comparison? February 2021's price-to-earnings ratio of 35—“higher than 1929,” he stresses. “And at 35 times earnings, it finally quit,” he says, recounting how the Nasdaq collapsed by 80% thereafter.

The lesson? “The market can stay irrational longer than the investor can stay solvent,” he warns, channeling a quote often (mis)attributed to Keynes.

AI Is the Real McCoy—But That’s the Problem

While Grantham acknowledged AI’s transformative potential, he cautioned against the euphoria fueling today's valuations.

“AI is going to be the biggest destroyer of jobs that you have even thought about,” he says. And like all truly disruptive innovations—railroads, canals, internet—its long-term benefits are often preceded by catastrophic busts. “Amazon went down 92% in 2001… and out of the wreckage, the Internet worked,” he reminded.

AI, he argues, is “precisely [the kind of] wonderful idea that actually works” but also “gives you upfront the biggest bubbles”.

A Bubble Within a Bubble

What makes today’s market so confounding, Grantham emphasizes, is that we've now witnessed “a bubble within a bubble.” COVID euphoria fueled meme stock mania. That collapsed in 2022. And then AI reignited the frenzy.

“There is no precedent for this kind of bubble within a bubble,” he insists. “We had the growth stocks come down 50%, and then they rewrote the novel with AI”.

Practical Takeaways: Where Grantham Puts His Money

When Mack asked for actionable guidance, Grantham doesn’t hesitate:

“Emphasize value, emphasize non-U.S.,” he says bluntly. “The gap between value and growth is as big as it gets… The gap between foreign and the U.S. is at or close to an all-time record”.

Within the U.S., he advises focusing on high-quality stocks—low debt, high margins—and investing in climate and resource sectors, which have been “utterly crushed.” Notably, resources remain the only asset class that shows no positive correlation with the broader market on a ten-year basis.

In his own family accounts, Grantham discloses the following asset allocation:

- 30% in developed country value stocks

- 10–15% in emerging market debt

- 10–15% in long/short strategies (including GMO’s long-short value fund)

- A sizable cash position for liquidity

- 10% in emerging market equities

Solvency, Sanity, and Staying Power

Ultimately, Grantham emphasizes long-term discipline over short-term performance envy. “You get fired by underperforming in a bull market,” he quipped, “not in a bear market”.

As he puts it bluntly, “We ebb and flow from looking like heroes to looking like idiots. And, of course, we think the market is the idiot, and we're long-term sensible”.

Takeaway

Grantham’s message is at once unnerving and instructive: this is not a normal market. It is suspended between eras, inflated by artificial liquidity and hope, obscured by historical fog. The “wild rumpus,” as he calls it, may be far from over. But those who sidestep the allure of short-term gains and lean into value, caution, and global diversification may find themselves not only solvent—but vindicated.

“There will come a time when you will be happy to have been out of the market.” —Jeremy Grantham

Stay invested. Stay skeptical. And above all, stay sane.

***

Footnote:

1 Mack, Consuelo. "GREAT INVESTOR WARNINGS – WealthTrack." 27 May. 2025.