As global trade uncertainty rattles confidence and investment, Canada’s economy enters the second half of 2025 with a tenuous grip on growth. The Q1 GDP figures, expected to post a 1.8% annualized gain, mask a more complex and uneven story—one that RBC’s Assistant Chief Economist Nathan Janzen calls a “catch.”1

“The catch,” Janzen writes, “is that most of the increase came early in the quarter from a 0.4% rise in January.” By February, momentum had already faded. GDP contracted by 0.2% that month, weighed down by the expiration of the federal GST holiday, disruptive weather, and intensifying trade tensions.

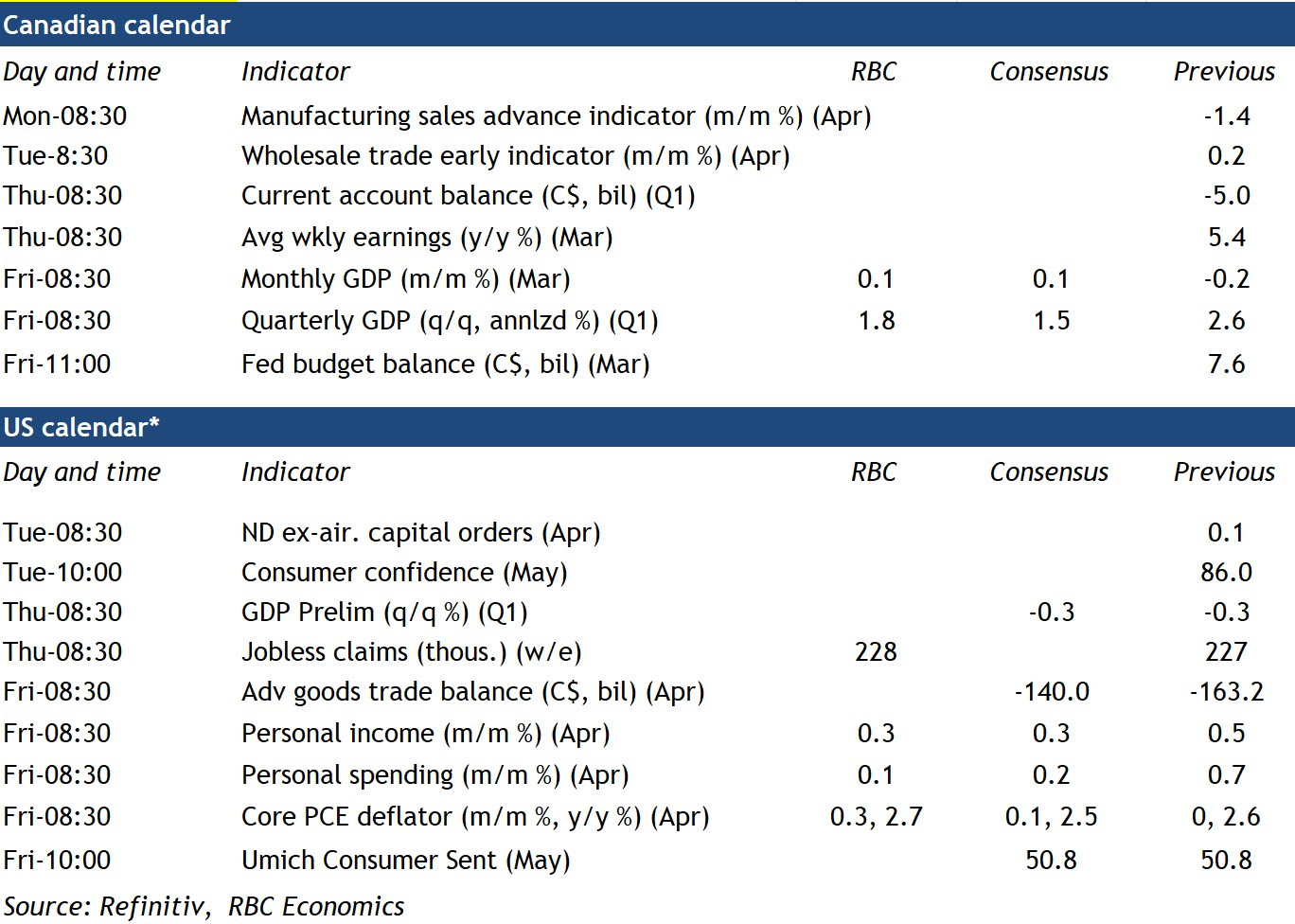

While a modest recovery in March—a 0.1% increase, per Statistics Canada’s advance estimate—helped cap the quarter on a slightly firmer note, the overarching narrative is one of economic deceleration driven by external instability and waning domestic confidence.

Q1: A Quarter of Two Halves

Canada’s first quarter performance was front-loaded. A strong January gave way to a drag in February, as one-off policy tailwinds reversed and inclement weather choked transportation activity. “GDP contracted 0.2% in February from January,” Janzen noted, “as the federal GST tax holiday ended, severe weather disrupted transportation activity, and weakened sentiment from international trade uncertainty began to weigh on the economy.”

March brought some relief—particularly in oil production and transportation services—but it wasn’t enough to reverse the broader trend. Growth was uneven, and underlying weakness persisted in key areas.

From an expenditure standpoint, household consumption carried much of the load in Q1. “We expect to see an increase in household consumption in Q1,” said Janzen, “that was partially offset by a contraction in residential investment as home resales cooled.” Business investment ticked higher, but Janzen warned that “it is expected to soften in the coming quarters as businesses freeze spending plans amid disruptive trade policies.”

Trade Turbulence and Manufacturing Pains

The impact of trade friction—particularly as Canada remains exposed to broader U.S.-led tariff uncertainty—is already rippling through manufacturing and business sentiment. RBC expects data releases this week, including April’s manufacturing and wholesale sales and the preliminary GDP estimate, to offer critical insight into whether this softening is deepening into Q2.

The signs are worrying. “Manufacturing has already posted its largest one month of job losses (-30,600) since the pandemic,” Janzen revealed. Meanwhile, without the temporary lift from federal election hiring, employment would have declined in April, suggesting underlying labour softness.

While Canada currently faces the lowest tariff rate among all U.S. trade partners—thanks to a temporary exemption from reciprocal tariffs granted in April—Janzen cautions that “trade uncertainty will likely continue to dampen business investment.” With decision-makers hesitant to commit capital amid shifting policy sands, business spending could remain tepid.

Resilience Where It Counts

Yet despite these headwinds, pockets of economic strength remain. RBC’s cardholder data shows that consumer spending has held up better than sentiment surveys suggest. “Our RBC cardholder tracking shows consumer spending has remained resilient despite plunging confidence,” Janzen notes, aligning with Statistics Canada’s April retail sales estimate of +0.5% following a +0.8% gain in March.

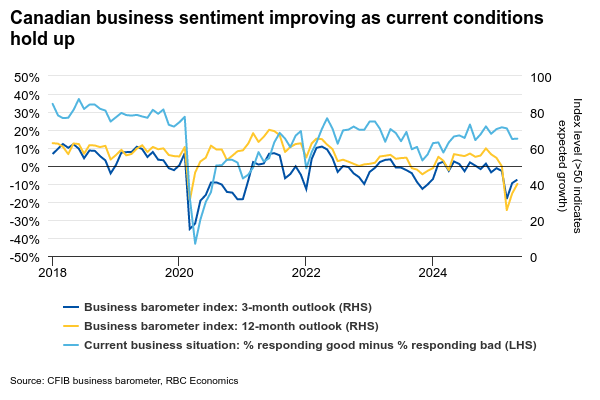

Small business data also supports this view. The Canadian Federation of Independent Business’s latest readings showed that while future expectations are weak, “the assessment of current conditions was firmer,” highlighting a divergence between real-time activity and forward-looking anxiety.

In labour markets, stabilization may be taking root. “Job opening data in early May from Indeed.com shows signs of stabilization,” said Janzen, indicating that even with pressure in some sectors, the employment picture isn’t uniformly deteriorating.

Looking Ahead: Slower, Not Recessionary

For policymakers and investment professionals, the message is one of measured caution. “Overall, we expect Canadian GDP growth to slow significantly this year,” Janzen concludes, “but not contract as strength in domestic demand continues to offset external weakness from trade turbulence.”

This outlook supports a more cautious stance from the Bank of Canada, which must weigh inflation trends and a cooling labour market against the risk of overtightening into an externally induced slowdown.

For advisors, the implications are clear:

- Domestic demand remains a stabilizer. Consumer spending, while vulnerable, has not collapsed—offering ballast amid declining investment.

- Trade policy risks remain paramount. Watch for renewed tariff actions and business sentiment data, which will guide investment trends.

- Housing remains under pressure. With residential investment declining, recovery here is likely to lag other segments.

- Sector-specific divergence will grow. Transportation, oil, and consumer services will each respond differently to global and domestic signals.

In a year increasingly shaped by geopolitics, Canada’s economy continues to walk a tightrope between resilience and retreat. As Janzen’s analysis highlights, the country's near-term fortunes may depend less on what happens at home—and more on whether international tensions escalate or cool.

Sources:

1 Nathan Janzen. "Forward Guidance: Our Weekly Preview." RBC, 23 May. 2025,