How 3Edge Thinks Investors Should Navigate Today’s Crosscurrents

As the S&P 500 claws back its early-year losses and hovers near break-even, a pressing question confronts investors: are we out of the woods—or just enjoying a deceptive calm before the next storm?

In the latest 3Edge Asset Management Week in Review1, Chief Investment Strategist Fritz Folts and CEO & CIO Steve Cucchiaro explore this dilemma with a dual-lens perspective—one eye on the market’s recent resilience, and the other fixed on the risks still looming just offshore.

“Investors are wondering, is it all clear now?” asks Folts. “Can equities continue to rally from here, or is there another shoe—or shoes—still to drop which could send the markets back down?”

The Bull Case: Stability, Earnings, and Retail Confidence

Cucchiaro begins by laying out the case for optimism. “There have been a number of positives,” he notes. “We’ve been through earnings season, and we’ve seen very strong Q1 corporate earnings. No question about that.” He also points to a “very stable” employment report, encouraging inflation data, and most critically, a de-escalation in trade tensions.

“The latest tariff news was a de-escalation, not a re-escalation,” Cucchiaro emphasizes. “That’s a positive sign.”

In addition to these macro factors, retail investors have been instrumental in powering the rally. As Cucchiaro observes, “It’s been the retail investors that are largely behind that big rebound that we had… the buy-the-dip mentality that existed for many months and a few years is still intact.”

Together, these elements form what he called a “hope that now the momentum will continue” as market confidence builds.

The Bear Case: A False Calm and the Lessons of the 1970s

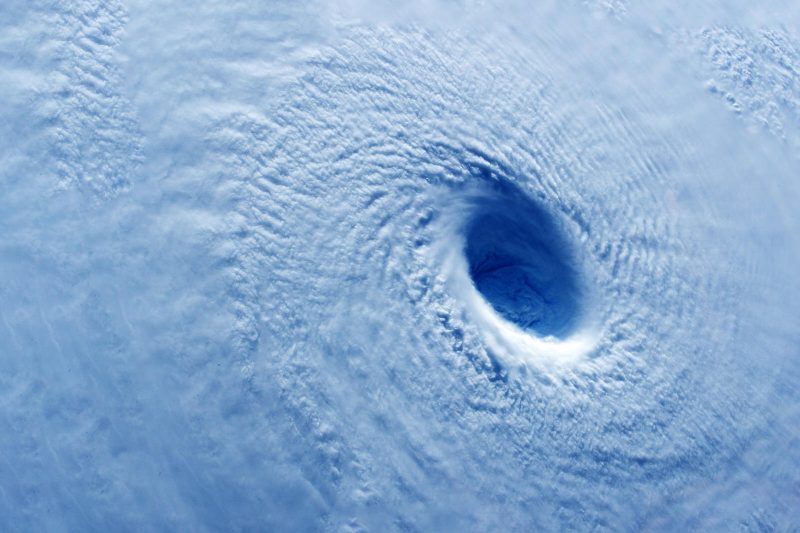

But then comes the pivot—marked by a vivid meteorological analogy. “I want to draw an analogy… with hurricanes,” Cucchiaro says. The idea? We might be sitting in the “eye of the hurricane”—a temporary lull in market turmoil, not its conclusion.

“Everything gets calm. In some cases, the sun comes out… But what really is the case is that you’re in the eye of the hurricane… it’s just a matter of time before… sometimes even more destructive [winds]” arrive.

This metaphor frames Cucchiaro’s caution: while current economic data looks solid, the lagging impact of trade policy disruptions and corporate uncertainty may still be making its way through the system.

“A lot of the chaos that’s been created in corporate planning… haven’t hit the hard data yet. And it might take another month or two before we start to see that show up.”

He warns of potential second-order effects, including:

- Supply chain disruptions

- A resurgence in inflation

- Rising long-term interest rates

- An economic slowdown driven by hiring freezes or layoffs

- And the worst-case scenario: stagflation

“That’s exactly what happened in the 1970s after President Nixon raised tariffs just 10%,” he notes. “We just saw this week Walmart announcing they’re going to have to raise their prices just with the tariffs that are already in place.”

Folts added that many investors and advisors may be underestimating the risk. “People in our industry… just haven’t experienced stagflation,” he says. “So maybe that’s why it’s not getting quite as much attention.”

Portfolio Strategy: Diversify with Purpose

Given this dichotomy—“all clear” vs. “eye of the hurricane”—Cucchiaro argues for balance, not boldness.

“It would be a big mistake to be overly confident and put all the marbles on the all clear scenario,” he says. “And we also think it’d be a mistake to put all the marbles in the eye of the hurricane scenario.”

Instead, 3Edge favors a nuanced, risk-aware approach:

- Avoid extreme positioning in equities: “We don’t think you should be at your maximum allocation… we think you should be somewhere in the middle, maybe a little bit more cautious.”

- Diversify globally: “It shouldn’t be all in one country like the U.S.… International stocks have finally started to outperform U.S. stocks for the first time in many years.”

- Include stagflation hedges: “Stocks don’t protect you from stagflation. Longer-term bonds don’t protect you from stagflation. But gold, Treasury Inflation-Protected Securities, and short-term U.S. Treasury bills do.”

In sum, this is a market that demands humility. As Cucchiaro puts it, “There’s still going to be a period of radical uncertainty.”

Final Word: Multi-Asset Resilience in a Foggy Outlook

“We think this is—if there’s ever a time to be diversified—this is the perfect time,” Cucchiaro concludes.

For 3Edge, preparedness means being positioned for both clarity and chaos. Investors needn’t pick sides between bullish momentum and looming threats. Instead, the task is to build portfolios resilient enough to handle either.

As Folts signed off, he left viewers with a sobering reminder: “One thing seems certain… increased uncertainty will most likely remain the market’s full-time companion in the months ahead.”

And perhaps that, above all, is the only real “all clear” signal we should trust.

Footnote:

1 Management, 3edge Asset. "All Clear or In the Eye of the Hurricane?" YouTube, 16 May. 2025, www.youtube.com/watch?v=ptdnwmHsoMw.