by John H. Fogarty, CFA, Co-Chief Investment Officer—US Growth Equities, AllianceBernstein

It’s the big question that many equity investors are asking. But maybe it’s the wrong question.

Over years, the US cemented its position as an exceptional source of earnings growth that fueled outsize equity returns. Many investors are now questioning whether the US will retain its advantages as President Trump’s trade policies add uncertainty to the outlook across industries.

The question is valid, but we would phrase it differently: Will investors still be able to find US companies with exceptional long-term return potential? To that, our answer is a resounding yes, though it will take a highly selective approach to find businesses that can deliver consistent, profitable growth amid new challenges.

What Is US Exceptionalism?

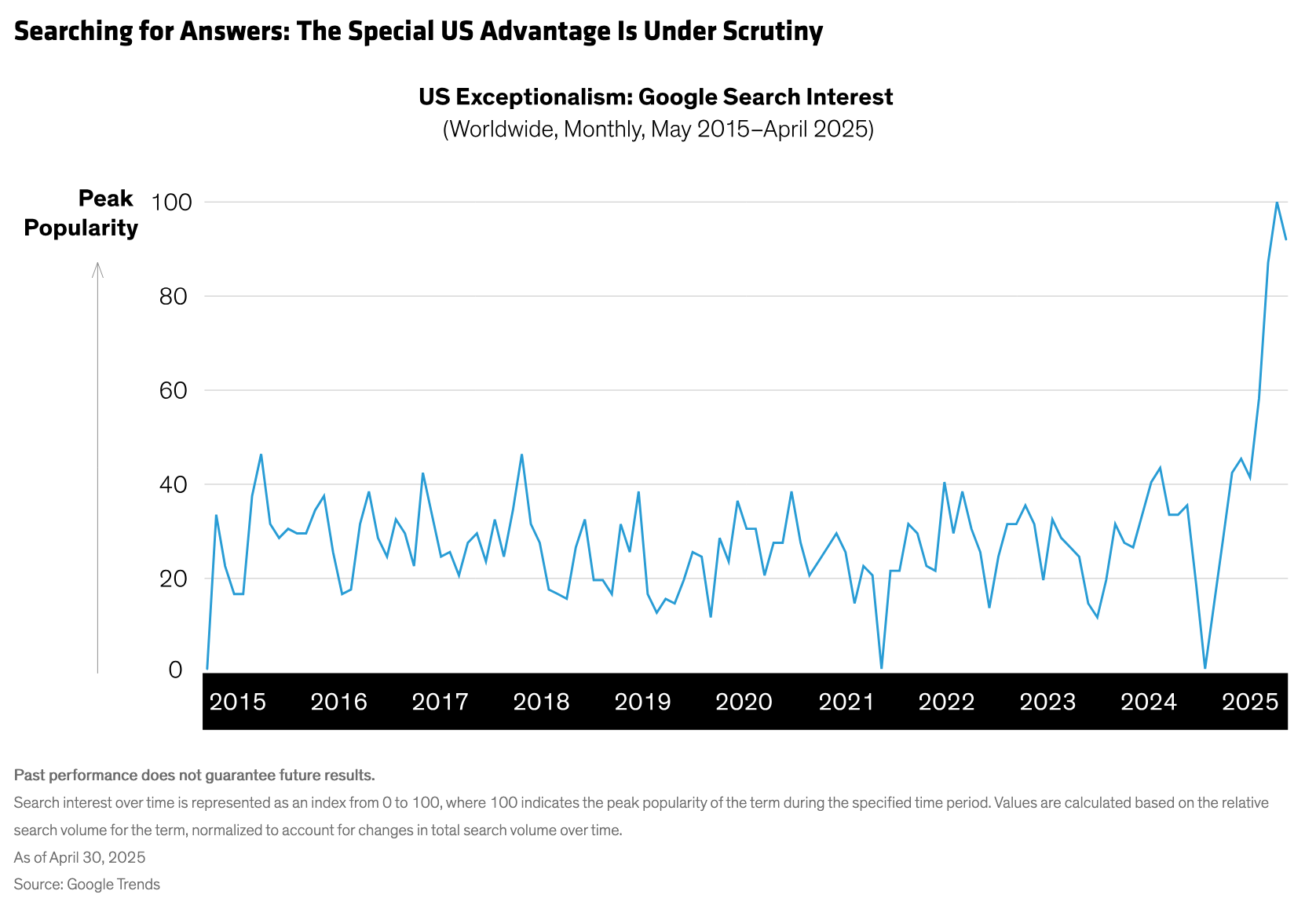

Since Trump expanded his tariff plans in early April, which challenged the status quo of world trade—and, by extension, capital flows—the idea of US exceptionalism has faced increasing scrutiny (Display). For equity investors, the notion is tied to the superior long-term returns that US stocks have delivered relative to non-US peers over the last 20 years.

Several factors have buttressed these returns. US companies operate in the world’s largest economy, offering excellent home market scale. The dollar’s status as the world’s reserve currency has been a magnet for foreign investment flows to US assets. And thanks to a culture of innovation, US companies have led the world’s major technology revolutions.

In recent years, US innovation has fostered the development of enormously profitable global technology behemoths that enjoy profitable growth without too much cyclicality. This is an exceptional feature of the US market, because companies like these don’t really exist anywhere else. More broadly, US companies are laser focused on profitability, which along with very favorable shareholder return policies has further enhanced the return gap between the US and the rest of the world.

Earnings Forecasts Reflect Uncertainty

Market reactions have cast doubt on the ability of US companies to maintain their edge. In one case, we’ve seen shares of a medical instruments company tumble over tariff fears related to a production facility in Mexico. Yet our research suggests that the company’s innovative products and top-notch management team should preserve its dominant position and long-term growth trajectory, even if it needs to adjust supply chains.

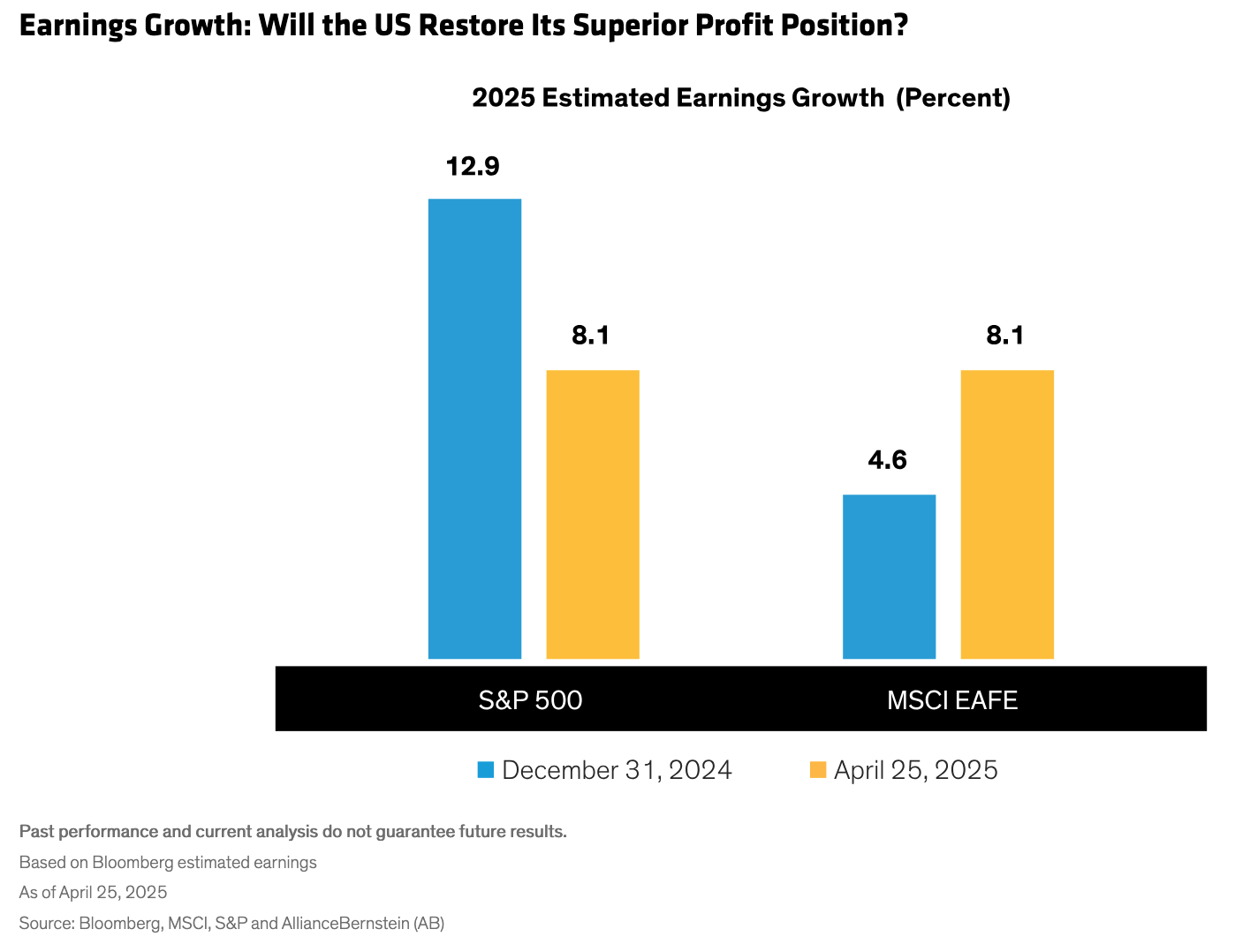

For the S&P 500 as a whole, consensus 2025 earnings growth estimates have fallen from 12.9% at the end of 2024 to 8.1% in late April (Display). In a mirror image over the same period, earnings growth estimates for the MSCI EAFE of non-US developed-market world stocks have risen from 4.6% to 8.1%. Trade conditions are still fluid, yet investors clearly expect a big step down in US earnings this year.

Will US earnings in aggregate be impaired for the long term? With so much trade uncertainty, it’s too soon to say. But here’s what we do know: the US is home to a huge pool of profitable growth stocks, underpinning a powerful position that can’t be easily destroyed, even in a trade war.

Profitable Growth Is Concentrated in the US

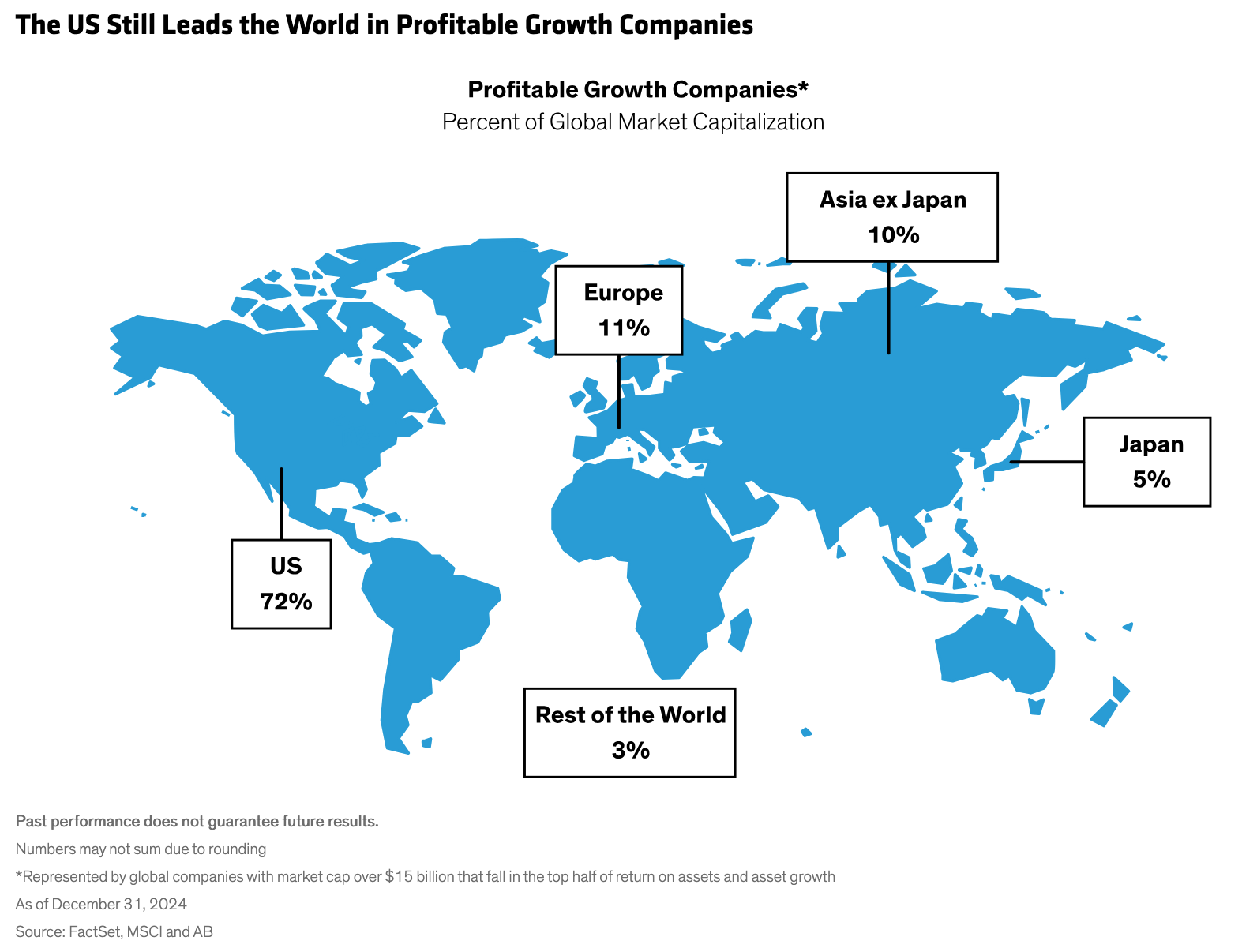

Looking at companies around the world with a market cap of at least $15 billion, we isolate those ranking in the top half of the market on return on assets and asset growth, two metrics we find are good predictors of consistent, profitable growth. By this analysis, 72% of the market capitalization of the world’s profitable large-cap growth companies were based in the US at the end of 2024—several times higher than anywhere else in the world (Display).

To be sure, this could change if the trade war inflicts structural damage on the ability of US companies to generate profitable growth. However, even if much fewer companies make the profitability cut, the US is starting from such a high point that we believe it will still offer investors a substantially larger universe of profitable growth companies than other parts of the world.

Structural Advantages Won’t Disappear

The trade war isn’t the only factor affecting the future of corporate America. The Trump administration’s broader agenda could also impact corporate profitability and competitiveness—for better (tax cuts, deregulation) or for worse (trade war–induced economic slowdown/recession, crackdown on worker visas). Still, we think several structural advantages will continue to provide an anchor for US companies to deliver results.

Independent of policy changes, consider the demographic outlook. Growth in the US working-age population is set to decline but remains positive, whereas in other major developed economies it’s contracting.

Innovation Is Deeply Rooted

Innovation is another powerful force. World-leading scientific research at US universities isn’t going to disappear. One-quarter of the world’s top 100 universities are in the US, according to QS World University Rankings. In 2024, the US ranked third in the Global Innovation Index and has a vast ecosystem of startups and global giants that have reshaped the global technology landscape of the 21st century, from the mobile web to ecommerce to artificial intelligence.

Yes, the innovation impulse is being tested by new policies, such as potential funding freezes on some scientific research or scrutiny of international students, which may deter talented young women and men from studying and working in the US. Yet we believe the entrepreneurial edge that academia and business have built over decades is an integral part of American culture that will prevail.

Meanwhile, with a population of 340 million, the US has the largest domestic market in the developed world. While global supply chains will need to adapt to tariffs, the sheer geographic size of the US market will provide many companies with options to reengineer their operations to support efficiencies.

Exceptionalism and Passive vs. Active Investing

So back to our opening question. It’s quite possible that the US exceptionalism that has lifted the entire market in recent years might not be as powerful as in the past. If that’s the case, we think passive allocations to the US stock market cannot be relied upon to deliver relatively strong results versus the rest of the world on a consistent basis. Extrapolation is always a dangerous temptation in investing, but the risks are intensified by the complexities of changing policies and challenging operating conditions.

We’ve long been wary of passive allocations, particularly as the US market became heavily concentrated in recent years by the Magnificent Seven stocks. In early 2025, we’ve seen the massive momentum gains of the megacaps start to dissipate. While the Magnificent Seven include outstanding businesses, we believe the market will no longer indiscriminately reward these companies as a group. As we see it, the AI narrative fostered unhealthy levels of concentration over the last two years, which led many investors to forgo prudent diversification that helps balance defense and offense in equity portfolios and underpins long-term investing success.

Finding Exceptional Businesses for the Future

So how can we pursue that diversification amid the uncertainty? By sticking to an investing philosophy and process with discipline. For us, it’s about searching for quality companies with profitable business models that enable reinvestment opportunities. We believe this recipe is the source of consistent growth and strong long-term equity returns through any market and macro environment.

Right now, identifying sustainable profitability is harder than usual because of tariff uncertainty over supply chains, expenses and demand drivers. But as we consider the wide range of potential outcomes, fundamental research helps us identify companies with the business attributes best able to transcend the tariff tests over time. For those companies, market volatility has even opened some opportunities, since lower valuations improve the risk/reward equation.

Selectivity has always been crucial for equity investing, in our view. Today, perhaps more than ever. But by deploying a time-tested process, we think investors can find resilient return compounders and innovation leaders to create powerful portfolios of exceptional US growth stocks for the future.

*****

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

About the Authors

John H. Fogarty is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities. He rejoined the firm in 2006 as a fundamental research analyst covering consumer-discretionary stocks in the US, having previously spent nearly three years as a hedge fund manager at Dialectic Capital Management and Vardon Partners. Fogarty began his career at AB in 1988, performing quantitative research, and joined the US Large Cap Growth team as a generalist and quantitative analyst in 1995. He became a portfolio manager in 1997. Fogarty holds a BA in history from Columbia University and is a CFA charterholder. Location: New York