by Ryan Boyle, Senior Economist, Northern Trust

Electricity prices in the U.S. may heat up this summer.

Many American consumers recently endured their first inflationary cycle, and recent trade headlines have elevated fears of a another bout with higher costs. While not impacted by tariffs, energy markets may play a critical role in driving the price level during the balance of this year.

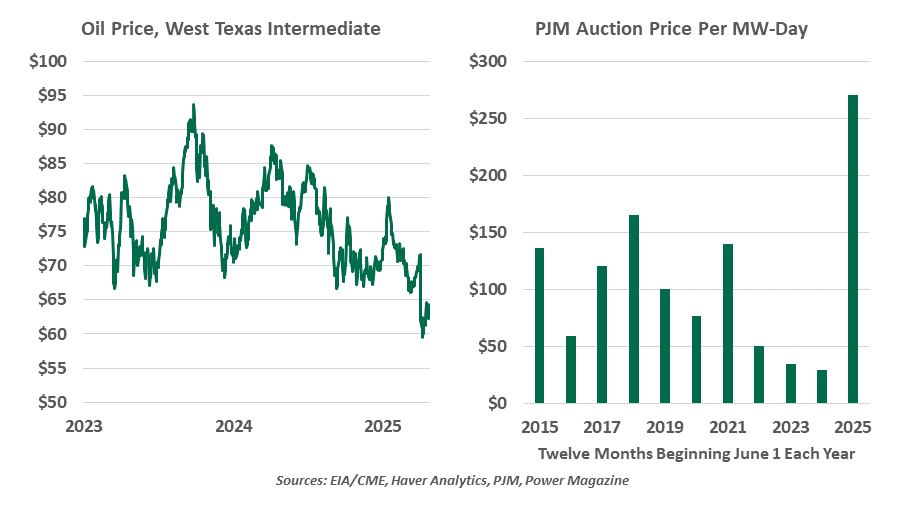

First, the good news, at least for household budgets: Oil prices have stepped down, limiting the cost of gasoline. However, lower prices are not great for the energy sector. The Administration’s strategy to keep oil prices low was to expand domestic output. Oil below $60 per barrel is not profitable for most U.S. producers and certainly not sufficient to fund exploration and extraction from new fields. Hopes for significantly lower gasoline prices in the long term may not be met.

Electricity bills may be the next place we experience an inflationary cycle.

We are also following trends in electricity prices, where the fundamentals of supply and demand may soon give many consumers a shock. Electricity generation is undergoing a change: older coal-burning plants are retiring as they cease to be cost-competitive with cheaper natural gas. However, replacement sources of supply are not coming online at a pace sufficient to replace them. Advancements in nuclear technology are promising, but mass deployment remains many years in the future.

The existing fleet of power plants will offer all they can, but demand will be tremendous. Artificial intelligence, along with every internet-enabled platform, depends on power-hungry data centers. Shifts away from fossil fuels for transportation and heating means a shift toward more electricity consumption. The push to restore domestic manufacturing of goods will only add to electricity demand from industrial facilities. Analysts forecast up to 80 new gas-fired plants will be built in the nation through 2030, a 20% gain in capacity. That won’t help in the short-term.

The disconnect between supply and demand for electricity became clear in last year's power capacity auction for PJM Interconnect, a regional electricity transmission organization covering 13 states in the country’s northeast quadrant. The auction sets a wholesale price for electricity generated within the network, priced to accommodate intervals of peak demand. The clearing price jumped an astounding 833% from the prior year; it is set to take effect this coming June and be effective for a year thereafter. While final bills may not increase by this magnitude, all electricity buyers should be braced for higher prices. And the PJM experience may be a cautionary tale for the nation's seven other regional interconnections.

So while we have been expecting a jolt to prices from tariffed products, one of the biggest may come from a domestic source. And there is no way for consumers to insulate themselves.

Copyright © Northern Trust