What You Need To Know

Coming off a wild ending to a disappointing first quarter, investors must navigate unsettled capital markets and decipher a wave of incoming policy news. The good news: opportunities are still there and are in many cases compelling.

Key Takeaways

- The direction of travel certainly seems to be toward higher trade barriers. In the US, we see growth slowing by more and inflation rising by more than they would have without tariffs.

- In equities, crowding has eased—a bit. Opportunities include classic quality value factors, certain AI and healthcare segments, and opportunities beyond the US.

- In fixed income, investment-grade credit spreads stayed largely put while high-yield widened. Overall yields are attractive—and have been a strong indicator of future returns.

- Municipal credit has done a good job of holding its value amid market turbulence. All-in yields remain historically high and offer compelling income.

A Difficult Quarter…and a Tariff Tempest

US equities booked their worst quarterly returns since the first quarter of 2022, and a flurry of tariff announcements just after quarter-end drove a major sell-off and a round of extreme market volatility. From about mid-February on, we’ve seen the downside of our “intersection of fear and hope” theme, with spreading uncertainty about the path of policies in Trump 2.0.

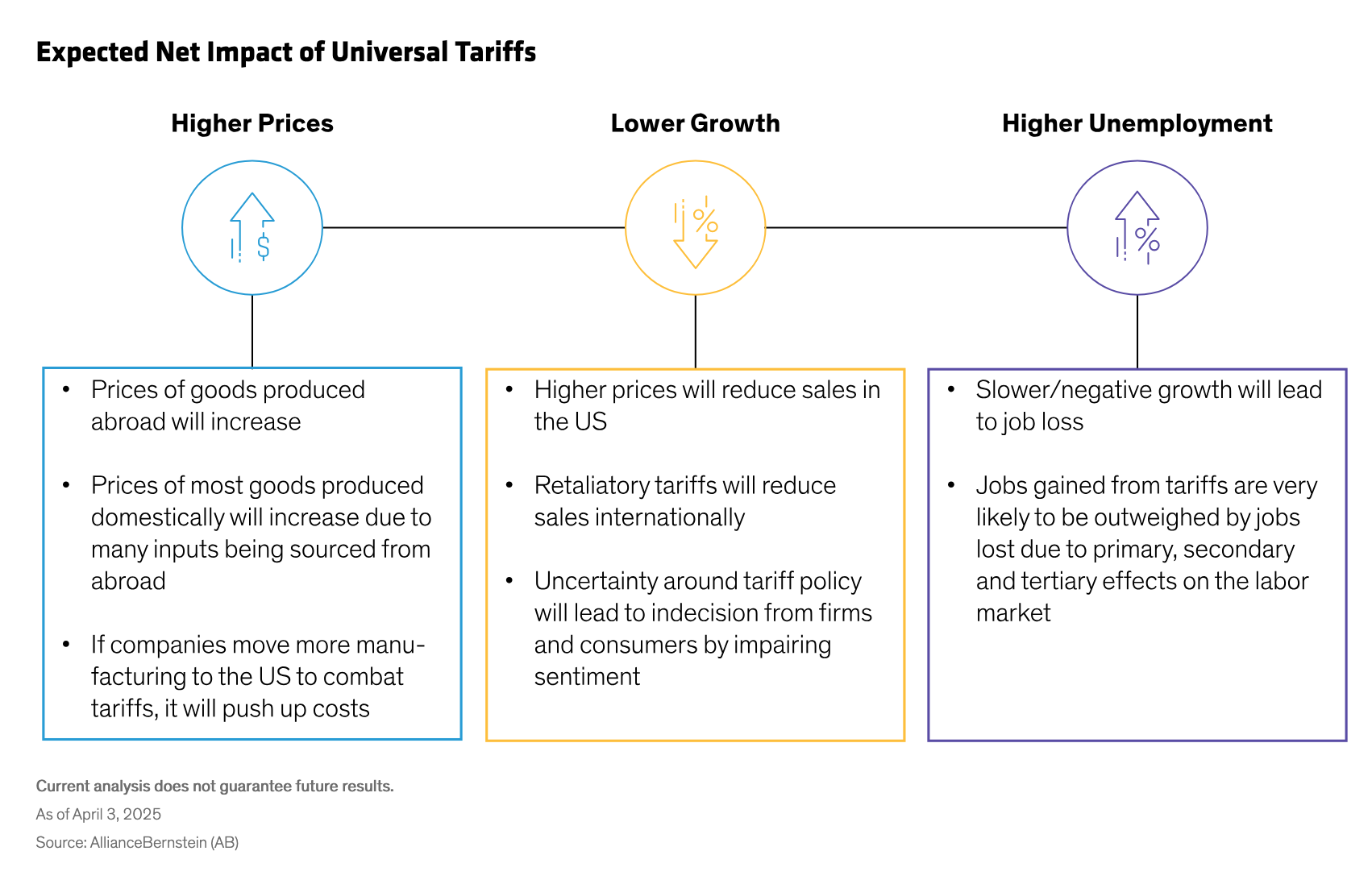

The direction of travel certainly seems to be toward higher trade barriers. This year, we see growth slowing by more and inflation rising by more in the US than they would have without tariffs (Display). Unemployment could rise, but because of our strong starting point, the US economy will likely avoid a meaningful recession. And if inflation expectations stay anchored, expect several Fed rate cuts this year.

In charting their course, investors must navigate challenges, including concentration risk, elevated valuations, abundant headline risk from policy uncertainty and pressures on corporate earnings. Here’s how we see things shaping up across the major asset classes:

Stocks: A Wild Ride Reshuffles Opportunities

On the equity side, S&P 500 valuations remain high despite the recent heavy sell-off and volatility. While we expect earnings growth to continue, investors should keep an eye on the direction of earnings revisions, which are generally trending lower and face pressure from international trade conflicts.

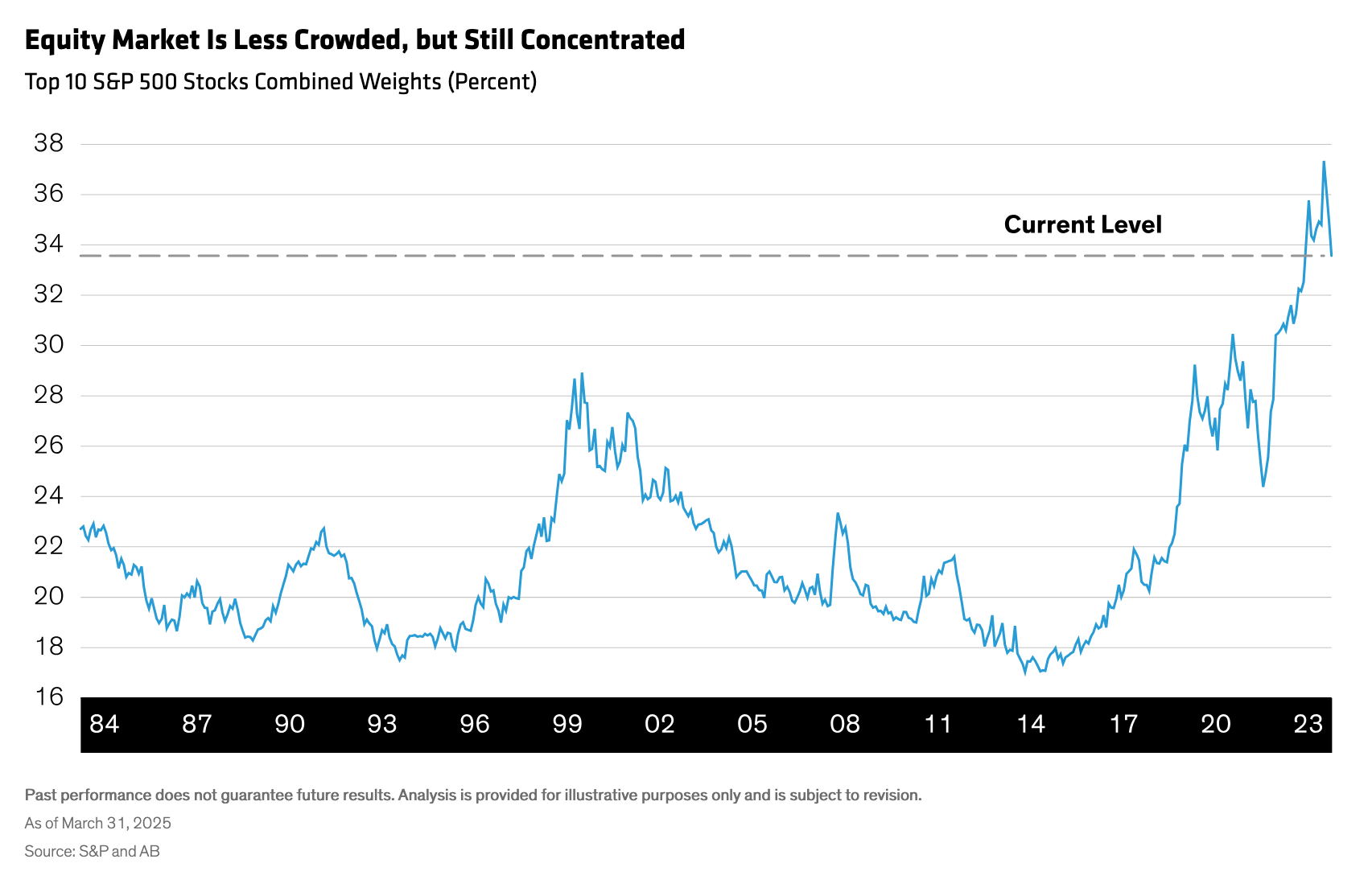

After an early extension of 2024’s strong return profile, index and factor results adopted a new look, with low volatility and value factors gaining at the expense of growth and momentum. Crowding has eased a bit (Display) but remains substantial. Historically, periods of mega-cap outperformance have been followed by a broadening of return potential across the market.

The value style has typically outperformed when stock returns broaden, and over time active managers have fared better than passive. Classic quality value factors still seem attractively priced, and we see many “shots on goal” still available, including “growth in value” and dividend equities with rising income. To play offense with defense, we think low-volatility equities offer a solid choice in a turbulent world where return patterns matter more.

Certain segments of AI and healthcare stocks seem better priced in the growth opportunity set, so we think it makes sense to explore well-positioned companies there. In the past, when healthcare stocks reached a low point in their share of the S&P 500, rewarding returns followed.

Deglobalization plays into equity opportunities, too. Reshoring brings concern over higher wage costs, so companies could embrace AI in manufacturing and automation more firmly, as the cost of industrial robots declines. Also, as trade frictions and earnings provide tailwinds for firms outside the US, the opportunity set should expand in other regions, too.

Amid the Angst, Bond Yields Still Appear Attractive

After a momentary flattening, the midsection and long end of the US yield curve suddenly steepened in a historic move, and as questions resurfaced over US Treasury demand, long-term yields were historically unsettled. As underlying Treasury yields fell, investment-grade credit spreads stayed largely put while high-yield credit spreads noticeably widened.

Technical conditions for high-yield bonds have weakened, but fundamentals continue to provide support, with both interest-coverage and leverage ratios starting from positions of strength. Defaults are low, though we expect them to rise to 2% or 3% in the US. Bear in mind that the high-yield index is of much higher quality today, with fewer CCC issuers than before the global financial crisis.

This could make high yield an option to reduce portfolio risk by replacing some equity exposure. While macro risks could cause more widening in spreads, high yield has historically held up better than equities in terms of peak-to-trough declines during large equity sell-offs. Overall yields today are attractive—and yield to worst has historically been a strong predictor of future returns.

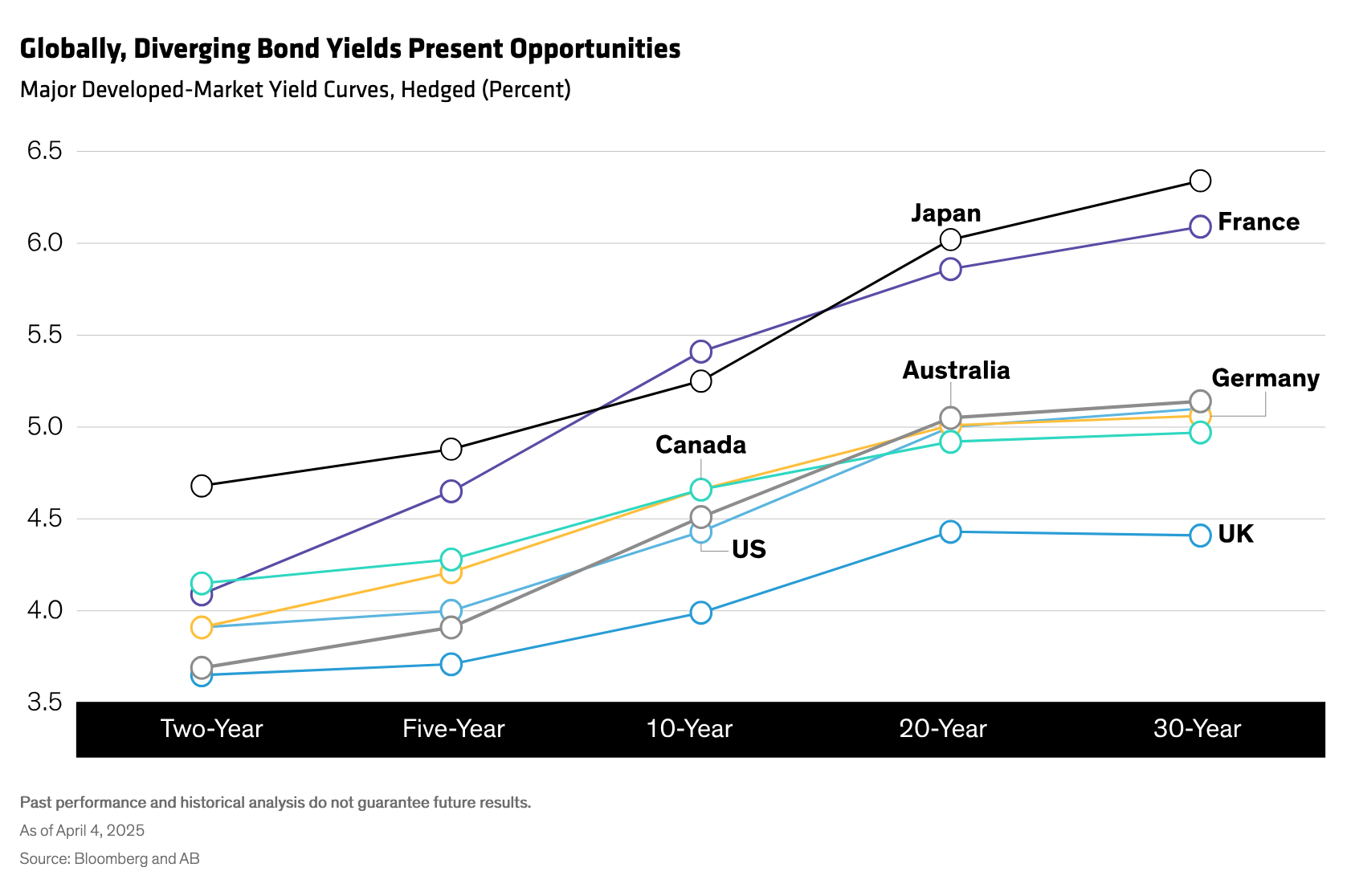

With yield curves diverging among major bond markets (Display), we also think it makes a lot of sense to take a global approach to scanning for opportunities. As we scan the market, global investment-grade credit and emerging-market local-currency debt are among the potential destinations for diversified fixed-income exposure.

Distill the Headline Noise and Tap the Income in Municipal Bonds

After a strong start in the first quarter, muni bond market performance was challenged in March as a higher supply of new issues and negative headlines created headwinds. The quarter’s supply was 18% higher than in 2024 and 45% above the five-year average, and demand waned as performance faded.

Municipals and treasuries have moved in opposite directions, and the municipal yield curve has become very steep. We think a barbell maturity structure of shorter and longer issues is a way to maximize yield and opportunities for roll, offering increased potential for total return.

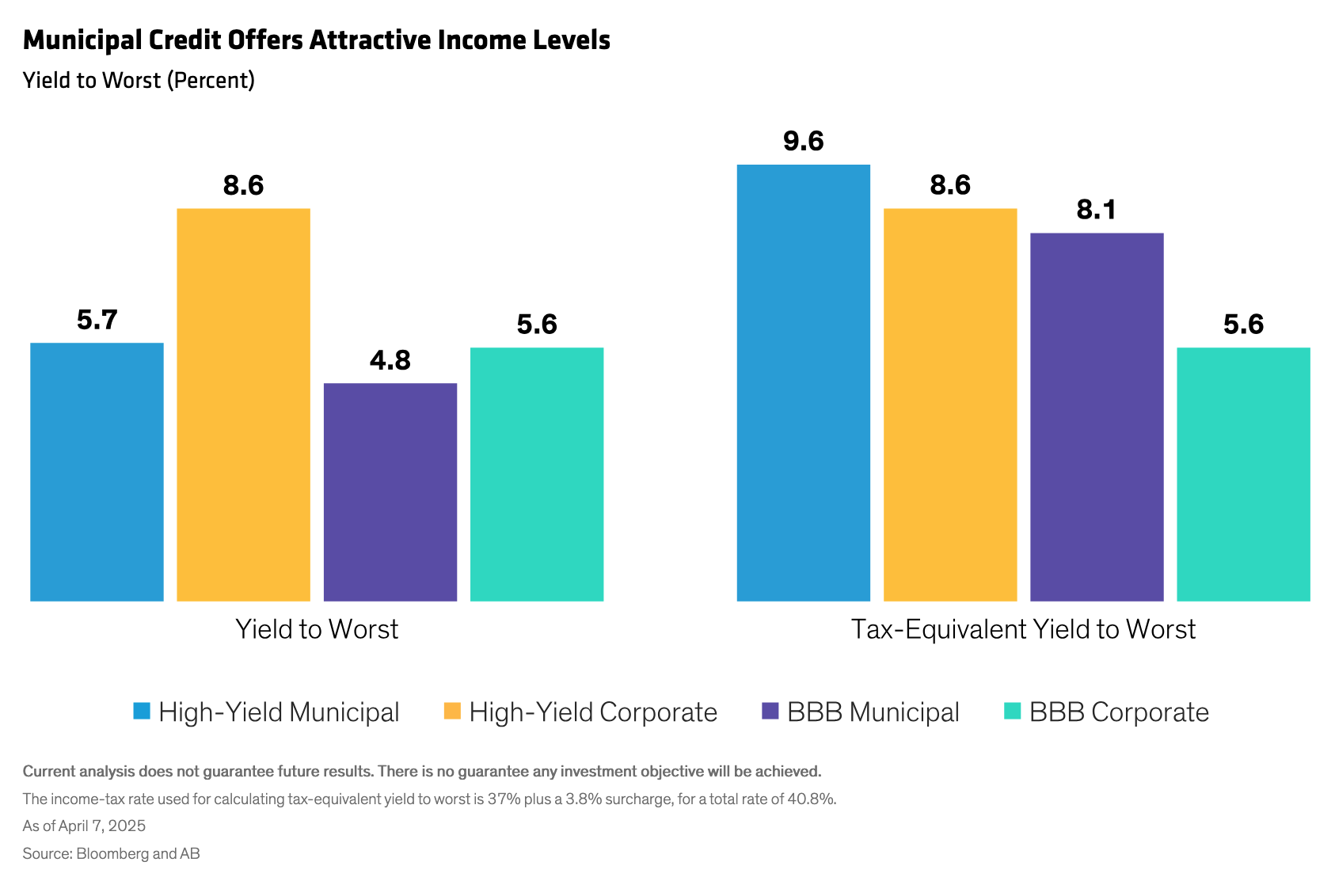

Municipal credit has done a good job of holding its value amid market turbulence, with firmer technical conditions providing support: issuance remains subdued and demand robust. Credit spreads are tight, but all-in yields remain historically high and offer compelling income relative to other asset classes (Display). Duration could also help boost performance if rates decline.

Muni investors must distill headline noise about the current administration’s policies and focus on issuer fundamentals. We think it’s unlikely that the entire market will lose its tax-exempt status, though some sectors may be impacted more. As for potential federal funding cuts, we believe most issuers will be able to manage them—though they could pose challenges for those already under credit stress.

Copyright © AllianceBernstein