by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

- Timing the market - The market’s best days almost always occur during the worst times.1 Missing them can seriously erode long-term performance.

- Diversification - A reasonable approach may be to diversify into parts of the market that don’t appear overpriced, like value, mid-cap, and European stocks.

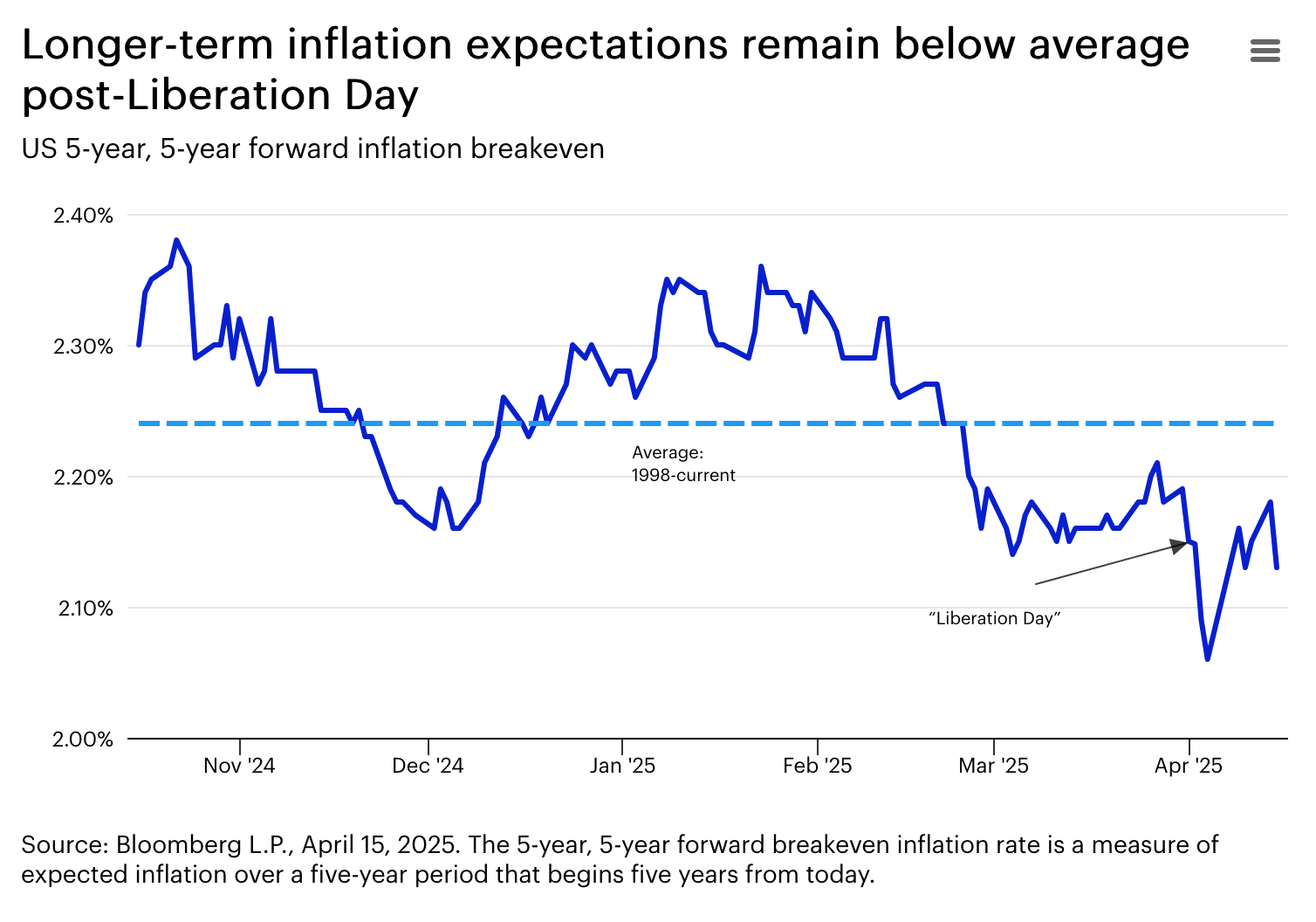

- Tariff impact - The Federal Reserve should be inclined to respond to economic weakness as long as long-term inflation expectations remain anchored.

Speaking of Springsteen, do investors still believe in The Promised Land? Being negative on the US has become the trendy (and easy) stance. Policy uncertainty persists, and the longer it takes to negotiate trade deals with much of the world, the bigger the hit to sentiment and investment. If I had a hard time planning for this month’s Above the Noise, then I can only imagine the challenges currently facing business leaders. Compounding the problem, markets have quickly priced for pain but may not be priced for recession.4

It doesn’t require advanced degrees in economics and international business to recognize the challenges facing the US economy. Tariffs and trade wars result in less optimal economic outcomes, plain and simple. Maybe then it’s more interesting to talk about what could go right. If a crisis is of your own making, then you can also act to provide relief, but is it coming? And could a wave of deregulation re-entice capital to flow into the US?

For now, the challenge is that we’re all operating under the whims of the White House. A reasonable approach could be to diversify portfolios into parts of the market that don’t appear overpriced, including value, mid-cap, and European stocks.5 They not only have the potential to outperform on a relative basis if market valuations adjust further but also could benefit from improved policy clarity.

Public service announcement

Timing the market is a fool’s errand. To better understand this, consider how you felt on the morning of Tuesday, March 24, 2020, 11 days after the COVID-19 shutdown began and following a 34% decline in the S&P 500 Index.6 Or think about the morning of Wednesday, April 9, 2025, a week after Trump’s “Liberation Day” and following a 19% decline from the S&P 500 Index peak.7

Those days were the fourth and third best return days, respectively, for the S&P 500 Index in the past 30 years, a period in which the market produced annualized returns of 10.0%.8 The best days almost always occur during the worst times. Missing those best days may seriously erode long-term performance.

If you’re thinking that I’m being too Pollyana this time, remember that the 30-year period referenced included the Tech Wreck, 9/11, the Global Financial Crisis, and COVID-19, to name a few.

It was said (part 1)

“…I have a trade deficit with my grocery store.” – Senator Rand Paul9

Senator Paul borrowed a line from Nobel laureate Robert Solow, who once quipped, “I have a chronic deficit with my barber, who doesn’t buy a darned thing from me.” Trade is not a zero-sum game where there must be a loser. It’s the opposite. Trade occurs because it’s mutually beneficial. For example, since China joined the World Trade Organization in 2001, the world's real gross domestic product has nearly doubled to over $93 trillion, with much of that growth attributed to China.10 The US accounted for 26% of the global economy then, and it still does now. The pie has grown, and the US share has grown proportionally.10

It was said (part 2)

“There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW,” – President Donald Trump speaking of US Fed Chair Jerome Powell

Market action on Monday, April 21 — a rare combination of US stocks, US Treasury bonds, and the US Dollar Index all declining11 — sent a clear signal that the risk to Federal Reserve independence negatively impacts all major asset classes. My concern is that if Trump were to fire Powell, the market could shift its focus from recession concerns to stagflation fears, likely resulting in a significantly worse outcome for US stocks. Hopefully, Trump doesn't intend to fire Powell but instead he’s preparing to blame him for the looming slowdown in economic growth.

It may be confirmation bias but…

…the market is not expecting stagflation. Rather, the market believes that the tariffs will result in a one-time price shock rather than broad inflation. In fact, the 5-year, 5-year forward inflation breakeven rate, which reflects the bond market’s expectations for inflation over a five-year period starting five years from now, initially declined following Liberation Day and remains below the long-term average.12 The Federal Reserve will be inclined to respond to any economic weakness as long as long-term inflation expectations remain anchored.

Views from across the pond

Welcome to a new segment where I reach out to my UK colleague Ben Jones, Director of Macro Research for Invesco, for his view from the other side of the Atlantic. Mr. Jones and me. We’re gonna be big stars.

Brian: Less than 10 years ago I was calling my British friends asking for their thinking behind Brexit. Now my phone is ringing. Is there a British equivalent term for schadenfreude?

Ben: I take no pleasure in your misfortune my friend. Unfortunately, the parallels with Brexit are clear, and I fear that, like our post-2016 experience, the US will now see a long period of capital outflows and currency weakness. But don’t worry, it’s not existential. The UK is still a great place to live. You might want to start thinking about increasing your UK equity exposure now.

Brian: Noted. I agree with the parallels to Brexit, which resulted in modest UK equity returns for a decade but not a disaster.13 What about the recent spike in US Treasury rates? Did that remind you of the 2022 “Liz Truss moment” in the UK?14

Ben: Cold sweats, Brian. The bond vigilantes hit the UK harder in 2022, but it’s clear that questions around US Treasury “safe haven” qualities are being asked. With greater inflation and growth uncertainty, I think the US Treasury term premium is likely to increase.

Brian: Do you believe that the era of US exceptionalism is over?

Ben: My view is that US asset outperformance is over. That seems a very consensus view on this side of the Atlantic, but the evidence I see is that investors are still only just starting to rotate their positions. I hold this view strongly, but I’m occasionally wrong. Do you have any reasons why I should reconsider underweighting US stocks, US Treasuries, and shorting the US dollar now?

Brian: I’m hard-pressed to bet long-term against the ingenuity of US businesses. That said, your point about investors being only at the start of rotating their positions is a good one. It does feel like a good time to diversify a portion of portfolios into non-dollar assets.

Ben: I agree. With the dollar under pressure, I’ll visit you this year instead of you coming here.

Brian: The first pint is on me.

Since you asked

Q: Was the recent spike in US Treasury rates the beginning of a massive flight from US assets? Is the US dollar in danger of losing its reserve currency status?

A: The spike in rates appears to have been more technical in nature, including the unwind of the so-called basis trade. In fact, the 10-year US Treasury rate is only modestly higher than the average of the past two years.15 As for the reserve currency, there doesn’t appear to be a viable alternative to the US dollar.

On the road again

My travels took me to Los Angeles to the Barron’s top teams conference. My flight was on Wednesday April 9, the day the reciprocal tariffs were paused. Thankfully, the flight had Wi-Fi, or I may have wasted effort on work, which would have immediately been out of date.

Footnotes:

1 Source: Bloomberg L.P., S&P 500 Index from Jan. 1, 1994–Dec. 31, 2024. ~15% of the best days were during the Tech Wreck (Feb. 28, 2000–Nov. 30, 2002; ~40% during the Great Financial Crisis (Oct. 30, 2007–March 31, 2009; –25% during COVID-19 (Jan. 31, 2020–Dec.31, 2002).

2 Source: Bloomberg L.P., April 17, 2025. The 10-year US Treasury rate climbed from 3.99% on April 4 to 4.49% on April 11.

3 Source: Bloomberg, L.P., April 17, 2025, based on the 9.5% return of the S&P 500 Index on April 9, 2025.

4 Source: Bloomberg L.P., April 17, 2025, based on the price-to-earnings ratio of the S&P 500 Index.

5 Source: Bloomberg L.P., April 17, 2025, based on the price-to-earnings ratios of the Russell 1000 Value Index (17.9x), the Russell Midcap Index (19.5x), and the MSCI Europe Index (14.2x). The current price to earnings ratio of the S&P 500 Index is 22.6x.

6 Source: Bloomberg L.P. The S&P 500 Index experienced a peak-to-trough decline of 34% from Feb. 19, 2020, to March 23, 2020.

7 Source: Bloomberg. The S&P 500 Index experienced a peak-to-trough decline of 19% from February 19, 2025, to April 8, 2025.

8 Source: Bloomberg L.P., April 21, 2025, based on the return of the S&P 500 Index from April 21, 1995, to April 21, 2025

9 Source: The Independent, April 9, 2025.

10 Source: World Bank, Dec.31, 2024.

11 Source: Bloomberg L.P., April 21, 2025, based on the one-day performance of the S&P 500 Index (-2.39%), Bloomberg US Treasury Index (-0.39%), and Bloomberg US Dollar Index (-0.70%).

12 Source: Bloomberg L.P., April 16, 2025.

13 Source: Bloomberg L.P, April 17, 2025, based on the return of the MSCI Europe US Dollar Hedged Index, is designed to replicate the performance of the MSCI Europe Index, but with the currency exposure hedged to US dollars. It returned an annualized 7.1% per year from the Brexit vote on June 23, 2016 to April 17, 2025. (The MSCI Europe Index captures large- and mid-cap representation across a universe of developed market countries in Europe.)

14 The term "Liz Truss moment" refers to a situation when bold political or economic decisions lead to significant market turmoil and loss of confidence. This phrase originates from the brief tenure of Liz Truss as the UK Prime Minister in 2022.

15 Source: Bloomberg L.P., 4/21/2025. The 10-year US Treasury rate closed at 4.38% on April 21, 2025, compared to a two-year average of 4.20%.