In a sweeping new report, Goldman Sachs’ US Economics Research team—led by Jan Hatzius, Jessica Rindels, Manuel Abecasis and David Mericle, and others—delivers a sobering yet analytically rich assessment of how a renewed wave of policy uncertainty is altering the trajectory of the US economy. Titled “The Impact of Uncertainty on Investment, Hiring, and Consumer Spending”,1 the report methodically quantifies how rising ambiguity across trade, fiscal, and immigration policies is now directly suppressing capital investment, stalling employment growth, and weighing on household consumption.

In a post-election environment shaped by the resurgence of protectionist rhetoric—most notably former President Trump’s “reciprocal” tariff plan—Goldman Sachs observes that “measures of policy uncertainty have far surpassed levels reached during the first Trump administration and could rise further”. In short, uncertainty is no longer a background risk. It has become the macro narrative.

Capital on the Sidelines: Investment on Pause

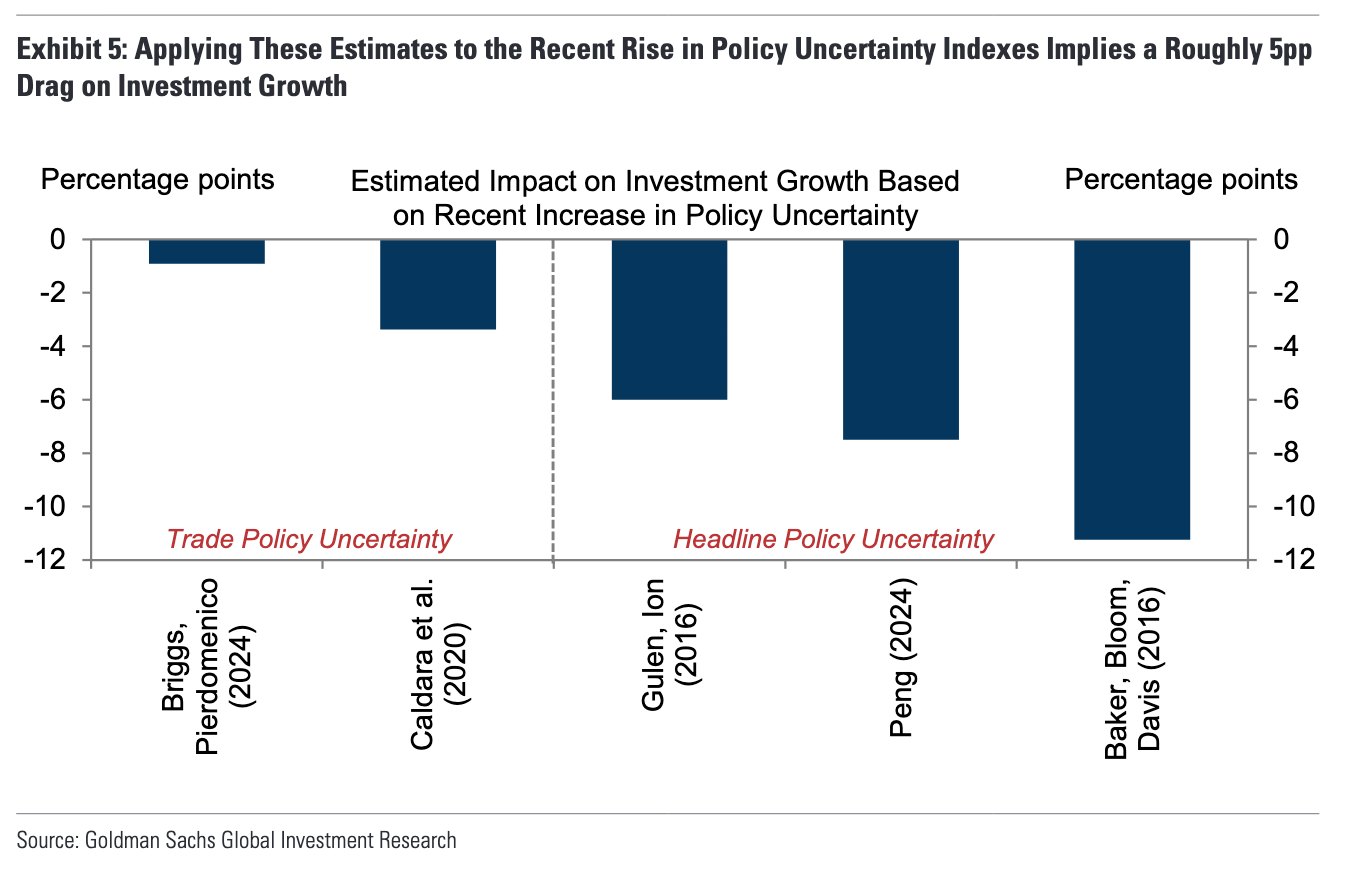

The report’s most immediate warning concerns business investment. Elevated uncertainty, particularly around trade, is “likely to exert a roughly 5pp drag on investment growth,” leading Goldman to project “roughly flat business investment over the next year”.

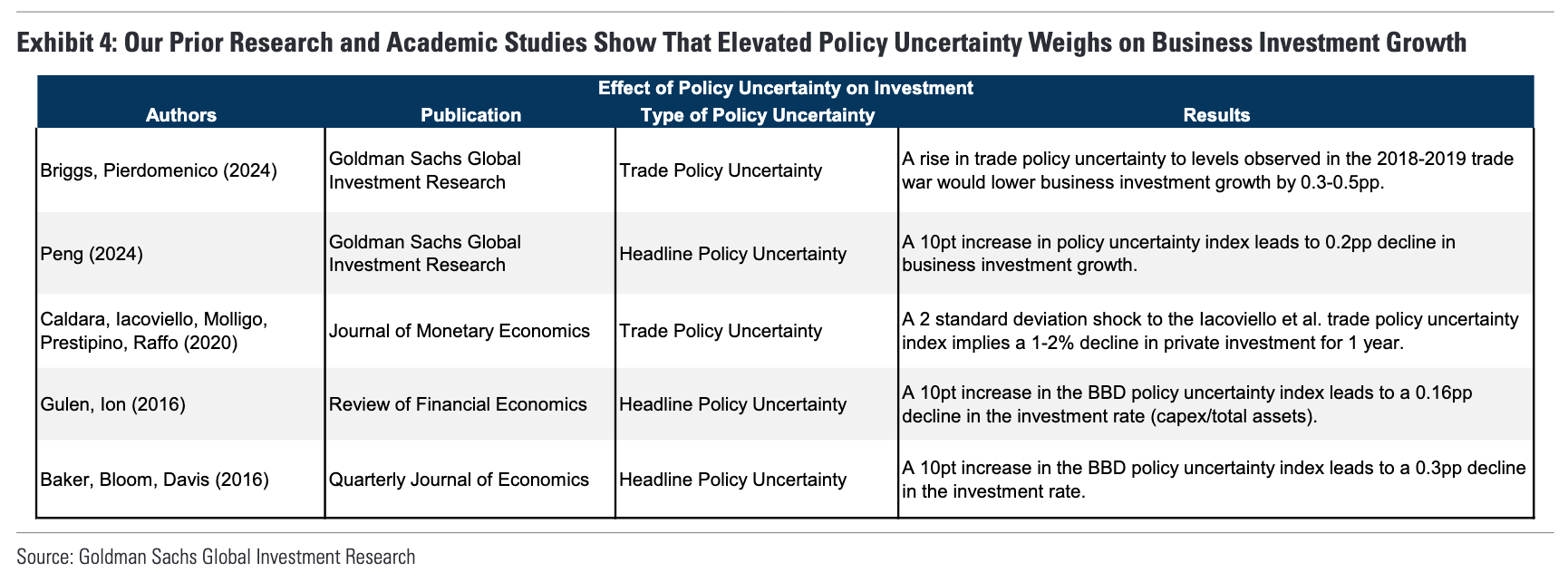

Why the dramatic shift? Goldman layers prior academic studies and its own proprietary modeling (Exhibit 4 and 5, page 5), concluding that even a 10-point increase in headline policy uncertainty translates into a 0.2 to 0.3 percentage point decline in investment growth. The recent surge in uncertainty implies a cumulative drag of up to five percentage points.

Goldman’s vector autoregression (VAR) models suggest that financial conditions will account for about three-fourths of this slowdown, with policy uncertainty supplying the rest. Together, they are expected to deliver a 4pp quarterly annualized drag on capital expenditures through 2025 (Exhibit 6, page 6).

Goldman’s vector autoregression (VAR) models suggest that financial conditions will account for about three-fourths of this slowdown, with policy uncertainty supplying the rest. Together, they are expected to deliver a 4pp quarterly annualized drag on capital expenditures through 2025 (Exhibit 6, page 6).

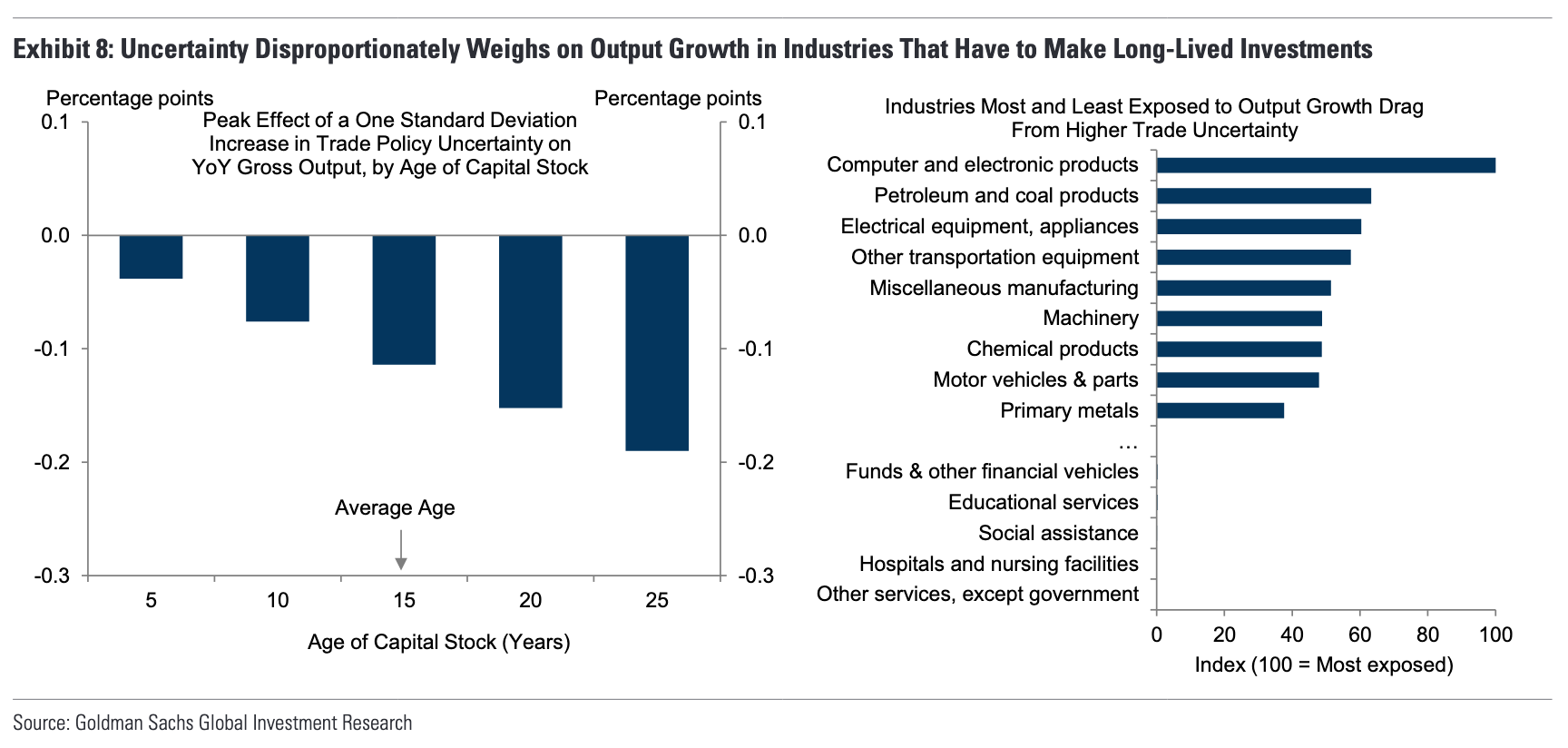

Even more concerning is the rising tail risk: the probability of a contraction in capex has jumped from 15% to 45%. The sectors most vulnerable? High-capex, long-cycle industries like computer electronics, heavy machinery, and chemical products manufacturing. These industries face not only tariff exposure but also the compounding effect of aging capital stock, making investment decisions even riskier under current conditions (Exhibit 8, page 8).

A Hiring Freeze in Motion

The same dynamics are expected to erode job creation. “We estimate that trade policy uncertainty will exert a roughly 20k drag on monthly employment growth,” Goldman writes. Add to that the direct impact of federal spending cuts—expected to reduce government payrolls by 25-30k jobs per month—and the knock-on effects of federal funding uncertainty on state and local hiring, particularly in healthcare and education. Goldman pegs the combined hiring drag at 35k in these federally supported sectors.

Catch-up hiring in these same sectors—understaffed during the pandemic—is also naturally fading, amplifying the overall deceleration. By year-end, Goldman expects overall job growth to slow to just 100k jobs/month, with the most acute pressure falling on healthcare, education, and state and local government (Exhibit 10, page 10).

Interestingly, Goldman does hedge against outright labor market pessimism. “If labor demand in these sectors slows gradually,” the team writes, “the combination of healthy labor demand in other sectors and slower labor supply growth would likely keep the unemployment rate from rising noticeably.” But the risk of an abrupt freeze remains a key wildcard.

Consumption: The Wealth Effect Reverses

Consumer spending, long the stabilizer of US GDP, is now expected to slow as well—caught in the pincers of policy-induced income erosion and evaporating wealth effects.

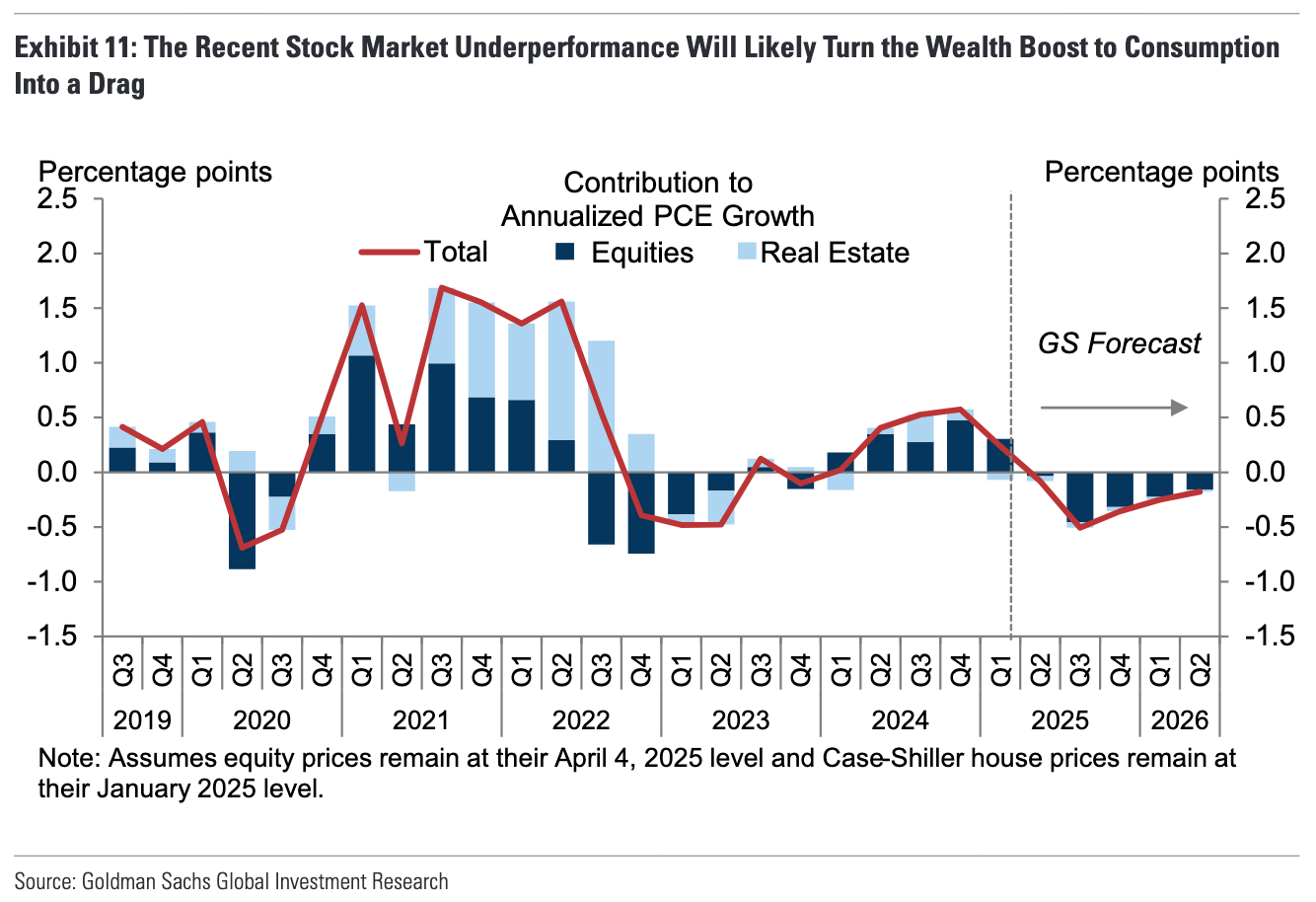

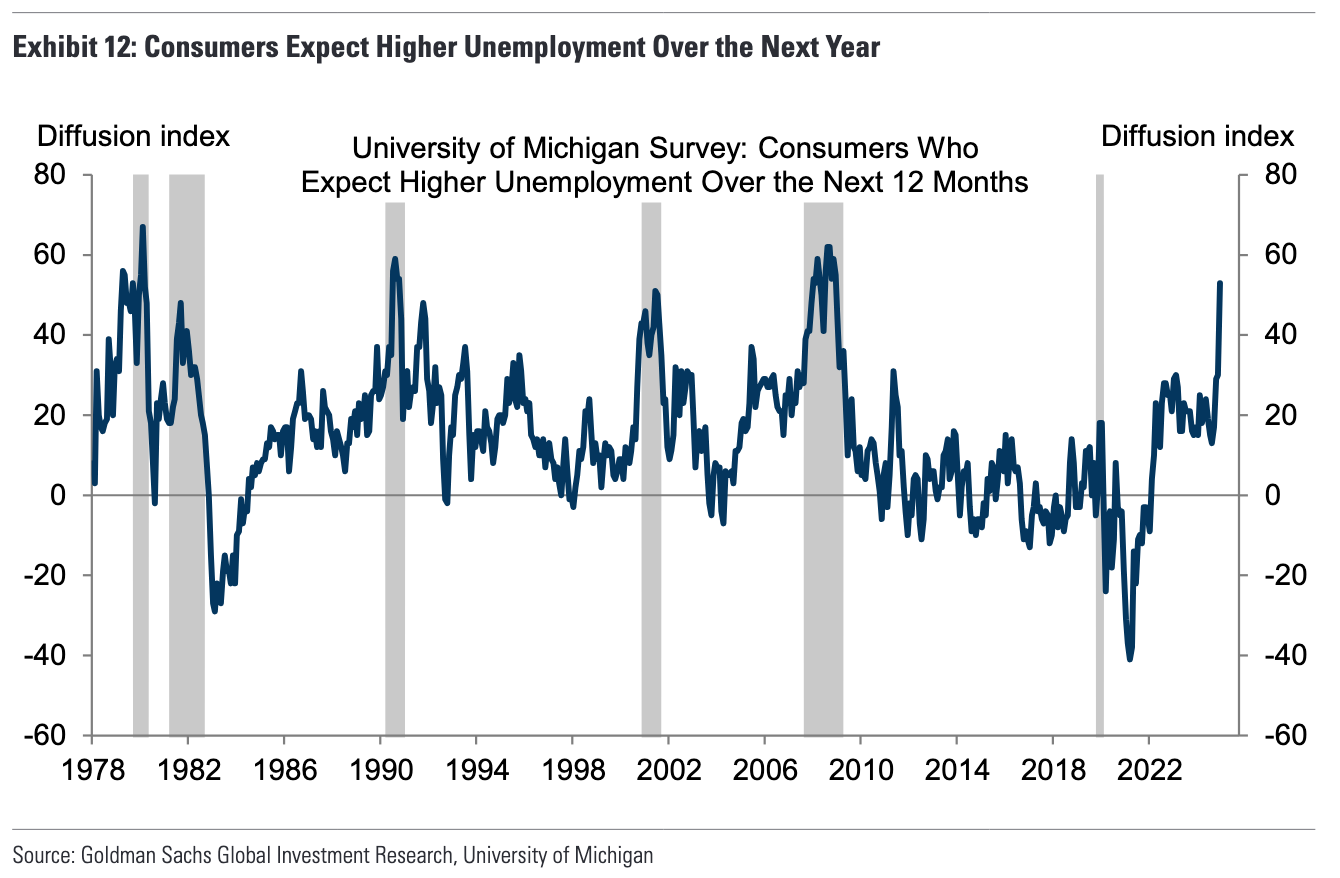

The mechanics are clear. Tariffs act as a tax on consumption, eroding real disposable income. Meanwhile, uncertainty itself is dragging down equity markets. “Wealth effects on spending will go from a ¼-½pp boost last year to a ¼pp drag,” Goldman notes (Exhibit 11, page 11). In addition, “weaker sentiment and rising fears about job loss could boost saving rates,” especially as layoff anxiety hits post-financial-crisis highs (Exhibit 12, page 11).

To date, these sentiment-driven channels haven’t had strong predictive power. But as confidence frays, their influence may deepen. Early indicators such as the University of Michigan’s unemployment expectations index and The Conference Board’s big-ticket spending data will be critical leading signals in the months ahead.

The Data to Watch: A Monitoring Roadmap

Goldman provides a roadmap for how to track this evolving uncertainty-driven slowdown:

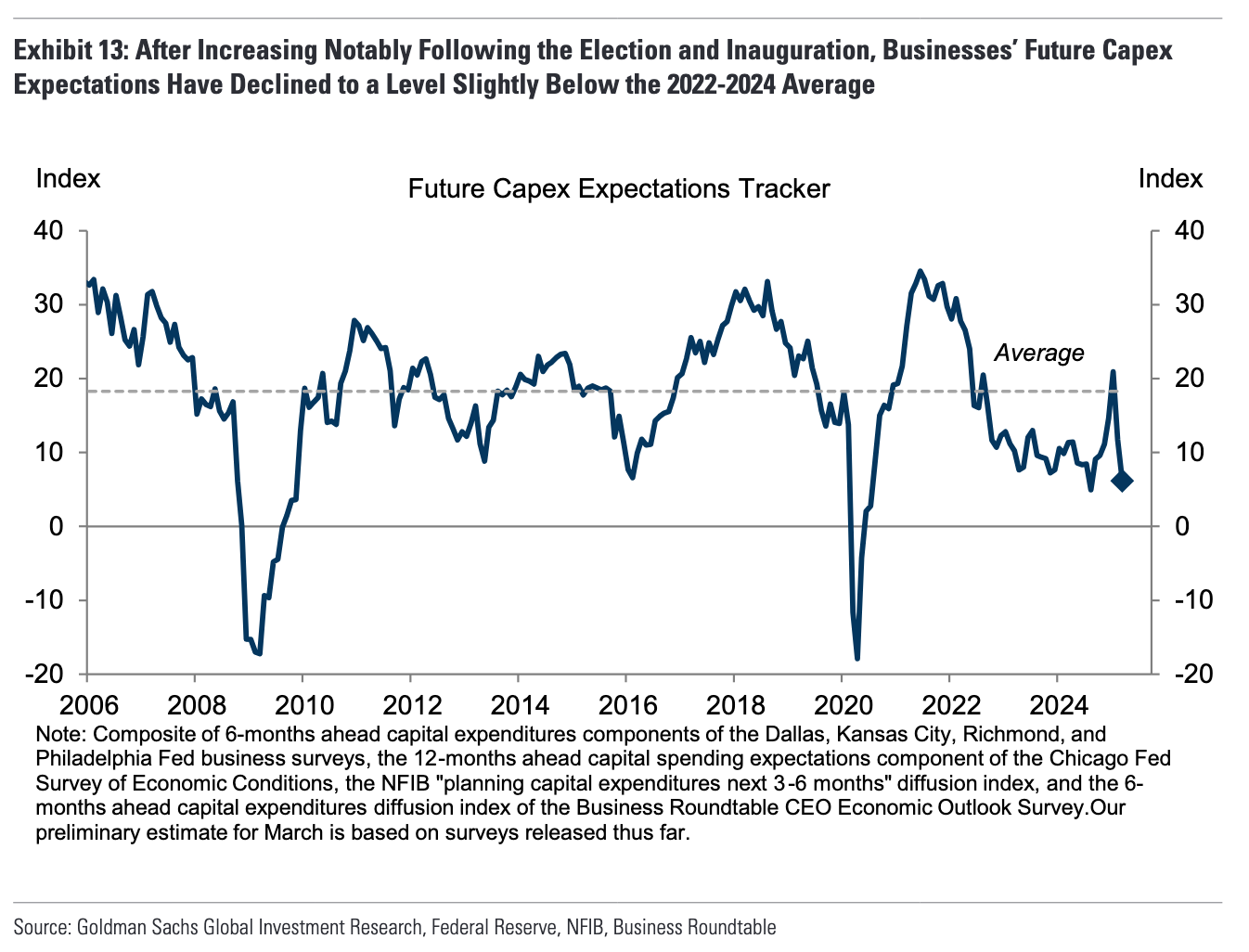

- For investment: Monitor the future capex expectations tracker (Exhibit 13, page 13), capital goods orders, and construction data on manufacturing structures.

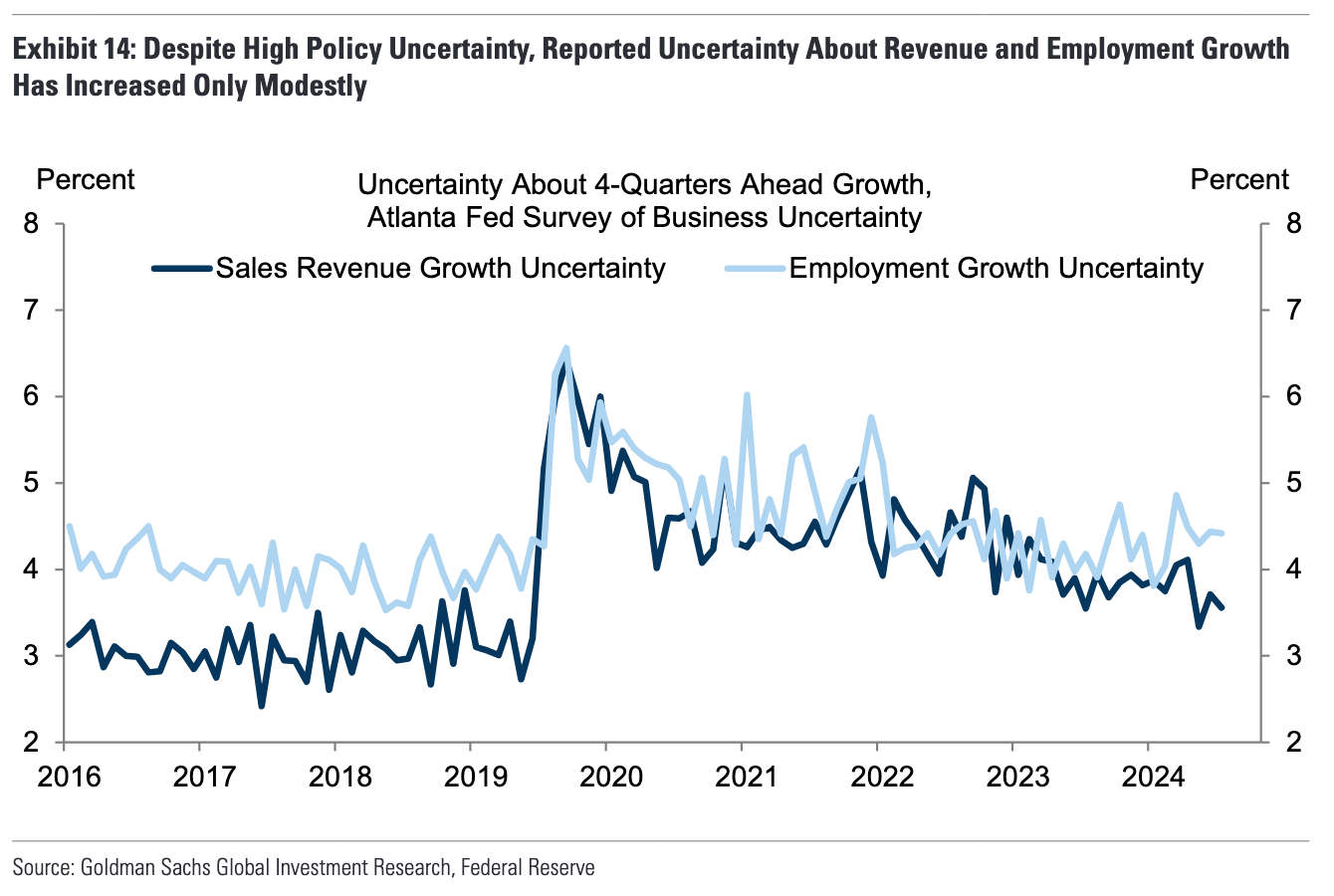

- For employment: Watch the Atlanta Fed’s employment uncertainty index (Exhibit 14, page 14), along with payrolls data in manufacturing, government, healthcare, and education.

- For consumption: Focus on real-time retail data (e.g., Adobe Analytics, Second Measure) and consumer expectations surveys for early signs of retrenchment.

Despite the rising headwinds, Goldman notes that the full impact has yet to materialize in hard economic data. “So far, government policy changes and associated uncertainty appear to have had only a modest impact on payroll growth,” they write. But the fuse is burning.

Policy Uncertainty as a Macroeconomic Shock

This report doesn’t just identify uncertainty as a risk. It treats it as a macroeconomic shock vector—on par with tightening monetary policy or global supply chain disruptions.

And while previous policy cycles have managed to ride out waves of ambiguity, Goldman warns that today’s iteration is “larger, broader, and more persistent” than in the past. The overlap of tariffs, immigration tightening, and fiscal austerity—combined with growing signals that the administration is willing to “tolerate near-term economic weakness in pursuit of its policies”—raises the stakes dramatically.

As capital sits idle, hiring slows, and households grow cautious, a central insight emerges from this report: policy clarity is no longer just a governance virtue. It is an economic necessity.

1 Goldman Sachs US Economics Analyst, The Impact of Uncertainty on Investment, Hiring, and Consumer Spending, April 6, 2025.