by Chris Fasciano, Chief Market Strategist, Commonwealth Financial Network

Last week, the S&P 500 was up 5.7%, the strongest week for the market since November 2023. The Nasdaq rose 7.3%, which was the best week for that index since November 2022. The rally was a result of President Trump’s announcement that he was pausing reciprocal tariffs for 90 days. And while there was no relief for China and the back-and-forth escalation between the two countries, markets latched onto the good news and rallied after a tough couple of months for equity investors.

Uncertainty about the path forward for the economy and corporate earnings still exists, but at least temporarily, the range of outcomes that had widened on April 2 has narrowed somewhat. Whether the economy has enough momentum to withstand the impacts of tariffs—or whether underlying inflation trends give the Fed leeway to cut rates later in the year—could be the key to corporate earnings and market performance in the second half of 2025. So, let’s look at where things stand currently.

The Economic Data: Still Telling a Positive Story?

The jobs market in March surprised to the upside despite concerns about the impact of tariffs and government worker layoffs. Non-farm payrolls increased by 228,000 during the month. And much of the surprise was in the government category, which saw growth in employment despite the previously mentioned layoffs. Even though the past two months showed revisions of 48,000 fewer jobs, net-net, this report was supportive of the consumer and further spending.

At the same time, both consumers and producers received good news on the inflation trend in March. Both the headline Consumer Price Index (CPI) and Producer Price Index (PPI) declined month over month. While core inflation rose slightly, it was still below expectations. These are positive trends on the inflation front; but with tariffs looming, we expect that inflation will tick higher over the coming months.

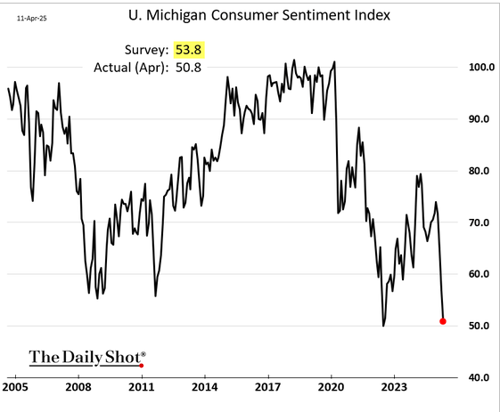

The concern, as it has been for several months now, is consumer confidence and the future path of inflation. As seen in the chart below, the preliminary reading for April dropped to its second-lowest level ever. The lowest level was in June 2022, when inflation was at 9%.

Source: The Daily Shot

All groups that were surveyed expressed concerns about their finances, the outlook on jobs, and inflation. The biggest concern for consumers was inflation, as year-ahead expectations for inflation surged to 6.7%, the highest reading seen since 1981. The worry is that this could become a self-fulfilling prophecy that leads companies to raise prices if they believe consumers are expecting them.

With the labor market showing strength and inflation data improving, the U.S. economy continues to show signs of expansion, which should provide a supportive backdrop. But with tariffs beginning to be implemented and consumers concerned about their future, it will be important to pay attention to the upcoming data to learn about any changes in the growth outlook.

What Is the Bond Market Telling Us?

Last week was an eventful one in the U.S. Treasury market. Yields on the 10-year bond rose 50 basis points from Monday through Friday. It was the biggest weekly gain in yields since 2001. Additionally, last week’s range on the 10-year Treasury yield was higher than any other week during the previous 35 years, outside of the Great Financial Crisis and the global pandemic, as seen below.

Source: Goldman Sachs Global Investment Research

When markets start acting abnormally, everyone has an opinion on why. And this week was no different. Reasons ranged from foreign governments selling their Treasury holdings to trade unwinds, with the basis trade being the most mentioned. Most likely, it was a combination of trade unwinds, portfolio de-risking, and an unsure macro environment around growth and inflation. At the same time, the House and Senate are negotiating a spending and tax budget bill package. The Bond Vigilantes* may also be sending a message.

No matter the reason, it doesn’t change the current market landscape as we begin the week. The 10-year yields traded as low as 3.9% on Monday and ended the week at 4.5%. To put that into perspective, yields were as high as 4.8% in January.

Fed speakers have tried to reassure investors, commenting that the Treasury market is functioning normally and liquidity has been maintained. The good news is that they are focused on what is going on and are watching it closely. Susan Collins, the Boston Fed president, stated that the Fed has the tools to intervene if necessary, and it is prepared to move if need be. That may not calm markets in the short term, but it is worth remembering if volatility continues or intensifies.

How to Think About the Equity and Bond Markets

On-again, off-again policy implementation makes it difficult for consumers to make spending decisions and for corporations to make investment and hiring decisions. The recent pause in reciprocal tariffs hasn’t changed that dynamic. But if the announcement of reciprocal tariffs on April 2 was the peak tariff rate and they are negotiated down or away over the next 90 days, then the rebuilding of confidence that investors and executives need will have begun. Volatility is likely to continue, but last week’s action in the equity markets is a good sign.

Much like the equity sell-offs on April 3 and 4, volatility and market declines in the fixed income markets could also create potential opportunities. While we anticipate more volatility in the bond market in the near term, fixed income investments could be attractive for the long term. High-quality intermediate-term bonds are, once again, offering historically attractive yields.

Any decisions made by investors should have the goal of helping achieve diversification within portfolios. We continue to believe that balance across asset classes is the best way to navigate uncertainty in the future.

*Investors who sell government bonds in response to fiscal policies they view as inflationary or irresponsible, driving up borrowing costs for the government.

Bonds are subject to availability and market conditions; some have call features that may affect income. Bond prices and yields are inversely related: when the price goes up, the yield goes down, and vice versa. Market risk is a consideration if sold or redeemed prior to maturity.

Copyright © Commonwealth Financial Network