by Paul Eitelman, Russell Investments

Key takeaways

- President Trump pressed pause on reciprocal tariffs for 90 days with a 10% broad-based tariff remaining in place.

- China was the exception to the policy reversal as it was hit with a 125% tariff but the president has expressed optimism that he would negotiate with China.

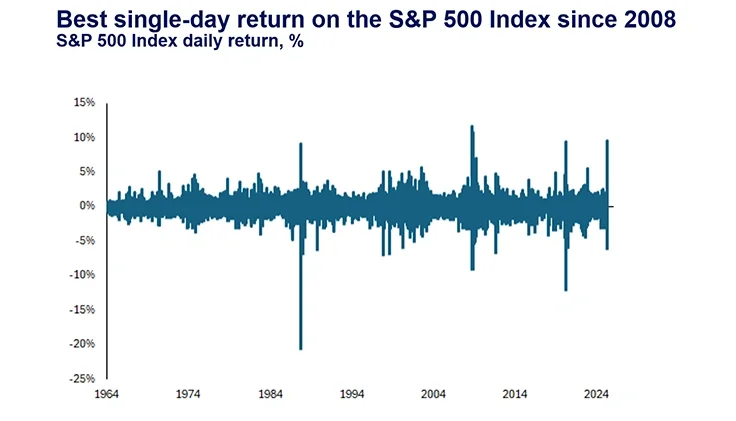

- The S&P 500 enjoyed its best one-day rally since 2008 after one of the steepest short-term market corrections in history.

The stock market finally got a pain reliever.

After several weeks of steep selloffs, the major averages roared back on Wednesday as the Trump administration announced a 90-day pause on its reciprocal tariffs. The move marked an important de-escalation and shift in U.S. trade policy toward negotiating deals while maintaining a hard line against China. The 9.5% single-day return for the S&P 500 Index was the largest ever outside of 2008.

Waitin’ on a sunny day

Tariff clouds finally cleared for the stock market—at least temporarily—as the S&P 500 posted its best single-day return since 2008

What we know

- 10% tariffs remain. The Trump administration will maintain a 10% baseline tariff on key trading partners while it pursues deals over the coming months.

- China was not spared. Instead, President Trump ratcheted up the tariff rate on China to a sky-high 125%.

- Coming to the table. U.S. tariffs were previously both large and broad-based. While they remain higher across the board, many countries are expected to negotiate a deal now that a pause is in place.

- All eyes on China. Importantly, Trump expressed openness to negotiate with China’s President Xi Jinping even though China has become the focal point of the tariff battle.

"Markets will eye upcoming trade negotiations and whether economic and earnings growth can continue to show resilience.”

—Paul Eitelman, CFA, Senior Director, Chief Investment Strategist

Reason to believe

Today’s policy off-ramp provided investors with much-needed clarity on the path forward. While a suspension of sweeping tariffs is a definitive step in the right direction, it’s important to note that we are not out of the woods yet. Markets will eye upcoming trade negotiations and whether economic and earnings growth can continue to show resilience.

At Russell Investments, we entered this period of volatility with defensive and well-diversified positioning. Our focus has been reminding our clients that spikes in volatility—even painful double-digit corrections like this one—are often short-lived. We continue to encourage clients to stay invested in this period of policy uncertainty and heightened risk aversion.

Copyright © Russell Investments